Top 10 Cities With The Highest And Lowest Credit Scores To Rent Apartments

According to data from the top 50 largest cities, credit scores of apartment renters range from more than 700 in some of the most competitive markets like San Francisco, Boston, New York, Seattle and Oakland, CA to less than 600 in Arlington, TX, Memphis, TN, Las Vegas, Indianapolis and Baltimore.

More precisely, San Francisco is the most competitive city to rent in. Renters here boast credit scores of no less than 719. Its followed by cities of the same caliber, such as Boston , New York and Seattle . In this way, Minneapolis, MN is the surprise among the top 10, with this citys average credit score sitting at 688 higher than Los Angeles renters credit score of 682 and San Diegos 680, and similar to Washington D.C.s 689.

How To Read Your Credit Report

Your credit report contains both personal information and financial information. Your credit report illustrates who you are as a borrower, both the good and the bad. Checking it allows you to keep an eye on your accounts, make sure there are no errors, and even potentially prevent the damaging effects of fraud. Your credit report is the report card of your financial life and understanding how to read it can help you take control of your finances and be prepared for any of your future credit needs.;

Your Credit Scores Are An Important Aspect Of Your Financial Profile

They may be;used to determine;some of the most important financial factors in your life, such as whether or not youll be able to lease a vehicle, qualify for a mortgage or even land that cool new job.

And considering;71 percent of Canadian families;carry debt in some form , good credit health should be a part of your current and future plans.

High, low, positive, negative theres more to your scores than you might think. And depending on where your numbers fall, your lending and credit options will vary. So what is a good credit score? What about a great one? Lets take a look at the numbers.

Don’t Miss: Will Increasing Credit Limit Hurt Score

How To Qualify For A Loan With Fair Credit

To improve your chances of obtaining a personal loan with fair credit, try taking the following steps before you apply:

- Use a co-signer: While a co-signer adopts some responsibility for your loan and therefore some risk they may also make it easier for you to qualify. Choosing a co-signer with good credit will improve your overall creditworthiness.

- Prequalify: If you’re unsure if you’ll qualify for a loan with a particular lender, see if it offers prequalification. That way, you’ll avoid harming your credit score even further before applying.

- Pay down debt: Many lenders consider your debt-to-income ratio in addition to your credit score. By paying down credit card debt before applying for a loan, you’ll look better to potential lenders.

- Use a local bank or credit union: Your existing bank or a local credit union may be more lenient when it comes to your credit score, especially if you have a history of timely payments on your accounts.

More About Secured Credit Cards

A secured credit cardnot to be confused with a prepaid cardis a good way to build your credit if you dont qualify for any of the options listed above. With this type of card, you give the card issuer a deposit. They hold that deposit for you and take money from it if you miss a payment. If you make your payments on time, the deposit just stays in an account for you.

The best secured credit cards will eventually convert to regular credit cards, which give you a higher limit and more flexibility.

Youll want to look at a few different credit card options in this category.

Overall, applying for a credit card with fair credit means you should do your research. Its best to only apply for a card if you are fairly sure you qualify. Theres always a chance that youll get turned down, of course. Thats not the end of the world, though it will take a few more points off of your credit score.

But armed with this list of the best credit cards for fair credit, you should be able to find one that works for your needs.

Related:Most Exclusive Credit Cards

Read Also: Do Hard Inquiries Affect Credit Score

Keep Your Balances Low

Keeping your balances low on your credit cards can help your credit utilization rate, or how much of your available credit youre using at any given time.

The usual advice is to keep your balance below 30% of your limit. Thats a good rule of thumb and a nice round number to commit to memory. But if you can manage to keep your utilization rate lower than 30%, thats even better.

Theres no credit-building benefit to carrying a balance on your cards if you can afford to pay off the full balance each billing cycle. When it comes to credit-building strategies, its best to make consistent charges to the account while keeping the total amount owed under 30% of your credit limit. If you can, pay your statement balance off in full and on time each month so you arent charged interest on those purchases.

Pay Down All Installment Loans

I was surprised by this one. I always assumed my credit score wouldnt be affected by the balances on my installment loans.

But I noticed that once I paid off my auto loans and student loans, my credit score jumped more than 20 points.

The key here is that you should pay off as much of the loan as possible, if not all of it. The closer the remaining balance is to zero, the more it will benefit your credit score.

For a little bit of perspective, I paid off a $30,000 auto loan, another $20,000 auto loan, and student loans totaling $11,000. Almost immediately after I did this, my credit score improved.

Read Also: How To Up Credit Score

Shopping For Credit Cards With A 586 Credit Score

When shopping for credit cards, make sure you explore all of your options. In other words, dont just sit down with one potential creditor and decide to accept their deal or not. Sit down with multiple potential creditors and compare and contrast them to find out what works best for you.

If you already have a credit card, but have been shopping for one that is cheaper, you can then go to your existing creditor and request them to either match or beat an offer from another credit card company. Tell them that you believe you are paying too much money in fees and interest, and ask them if they are willing to lower their rates and fees down to the other credit card company that you are thinking about switching to.

If they refuse, then you can switch accounts, but dont close your existing account immediately. You still want to make the minimum payment on. it while you are waiting for your balance to transfer to your new account. You only want to close a credit account when your balance is at zero.

Factors That Can Affect A Credit Score

There are 5 main factors that can affect the calculation of a credit score. If youre interested in improving your credit these are the areas that you should focus on.

History of Payments

This is determined by the payments you have made to lenders or creditors. This ultimately reflects on how frequently you pay your loans or bills on time. Anyone looking to improve their credit scores should always make their payments on time, without fail.

Debt/ Credit Utilization

This shows the amount of outstanding debt a consumer has compared to the amount of available credit they have. For example, if you have a total credit limit of $5,000 and consistently carry a high balance, your credit score may be negatively affected. To help improve your credit scores, pay down your debt and make sure you need your balance to lower than 35% of your available credit.

This factor is straightforward, the longer a credit account has been open, the better it is for your credit scores. If youre considering cancelling a credit card, make sure you cancel a new one and keep the older ones open.

New Inquiries

Every time a potential lender or creditor pulls your credit, your credit score may take a small and temporary hit. If you apply for a lot of new credit within a short period of time, your credit score may drop and other creditors will be able to see that youve recently applied for a lot of credit which they may consider to be a red flag.

Diversity

Loans Canada Lookout

Recommended Reading: What Is A Fair Credit Score Number

How To Improve Your 686 Credit Score

A FICO® Score of 686 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 686 FICO® Score is on the lower end of the Good range, you’ll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range .

35% of consumers have FICO® Scores lower than 686.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll find some good general score-improvement tips here.

Can I Get A Car / Auto Loan W/ A 586 Credit Score

Trying to qualify for an auto loan with a 586 credit score is expensive. Thereâs too much risk for a car lender without charging very high interest rates.

Even if you could take out an auto loan with a 586 credit score, you probably don’t want to with such high interest.

There is good news though.

This is completely avoidable with a few simple steps to repair your credit.

Your best option at this stage is reaching out to a credit repair company to evaluate your score and see how they can fix it.

Don’t Miss: Is 739 A Good Credit Score

Understanding The Scoring Models

FICO and VantageScore arent the only scoring models on the market. Lenders use a multitude of scoring methods to determine your creditworthiness and make decisions about whether or not to give you credit. Despite the numerous options, FICO scores and VantageScores are likely the only scores youll ever see yourself.

Heres what FICO uses to determine your credit score:

- Payment history. Whether or not you pay your bills in a timely manner is critical, as this factor makes up around 35% of your score.

- . How much of your open credit you have usedwhich is called credit utilizationaccounts for 30% of your score. Keeping your utilization below 30% can help you keep your credits core healthy.

- Length of credit. The average age of your creditand how long youve had your oldest accountis a factor. Credit age accounts for around 15% of your score.

- Types of credit. Your credit mix, which refers to having multiple types of accounts, makes up around 10% of your score.

- Recent inquiries. How many entities have hit your credit history with a hard inquiry for the purpose of evaluating you for credit is a factor for your score. It accounts for about 10% of your credit score.

VantageScore uses the same factors, but weighs them a little differently. Your VantageScore 4.0 will be most influenced by your credit usage, followed by your credit mix. Payment history is only moderately influential, while credit age and recent inquiries are less influential.

Pay Down Your Credit Card Balances

Your is the amount of available credit youre using and it accounts for 30% of your overall fico score. The lower your balances are, the higher your score will be. Only your payment history has a bigger impact .; If youre carrying a lot of credit card debt then your credit rating is suffering. Try to pay your card balances down to less than 25% of their credit limits.;

Get a secured credit card if you dont have one

If you dont have a credit card, you will need to get one or two to help improve your score. ; A secured credit card works similarly to an unsecured credit card only they require a deposit equal to the credit limit.

Wait to get a secured card until after you have followed these steps and have waited 30 days. Your credit scores could improve enough for you to be approved for an unsecured credit card.

Read Also: How To Remove From Credit Report

What Credit Score Do You Need To Buya House

You dont need perfect or even good credit to buy a house. In fact, the minimum credit score to get a mortgage is 580 which is considered only fair.

Remember, mortgage lenders dont look at your credit score in a vacuum.

They also look at your credit report, debts, and down payment. The stronger you are in these areas, the more likely you are to get away with a low credit score.

The downside to lower credit is that youll pay a higher interest rate. But many buyers with low scores choose to buy now and refinance for a better rate when their credit improves later on.

What We Love About Honda Financial Services

Honda Financial Services offers very reasonable rates if you want to lease a Honda or borrow money to purchase one. You can work with the company to get financing for new or certified pre-owned vehicles. There are also deals available that can help you save money, such as discounts for college graduates, military members, and people who recently finished a lease of another Honda.

Also Check: How To Check Credit Rating

Capital One Platinum Credit Card

DisclosureThe information regarding the Capital One Platinum Credit Card was collected independently by DoughRoller and was not reviewed or approved by Capital One.

Heres another Capital One card option for those with low to average credit, especially with a limited credit history. The Capital One Platinum Credit Card has a $0 annual fee, which is a great selling point. Like the QuicksilverOne, though, it has a 26.99% APR, so youll definitely want to pay it off in full each month.

The;Capital One Platinum Credit Card is a straight up credit card with no frills and no rewards. It could be a good fit it you dont see yourself using a credit card often enough to out-earn the QuicksilverOnes annual fee. But if you do plan to run some of your everyday expenses through a credit card, the other card would give you more bang for your buck.

Can I Get A Personal Loan With Fair Credit

Not all lenders offer loans to borrowers with fair credit since it’s seen as a greater risk to the lender. However, many lenders will consider credit scores in the low 600s, though they’ll likely charge higher interest rates.

Explore lenders that advertise fair credit scores before you apply. Additionally, check out lenders that offer prequalification. Prequalification lets you share some information with the lender but doesnt result in a hard credit check, which would temporarily cause your credit score to dip. It also lets you see if youre eligible for a loan from a particular lender.

You May Like: What Is The Highest Credit Score A Person Can Have

Think Carefully Before Closing Old Credit Card Accounts

If you dont use an old credit card much anymore, you might be tempted to close it.

To this we say: Not so fast. Keeping an old credit card account open can increase your age of credit history as well as your credit mix, which could help you build credit.

You might be better off keeping that old account open, assuming you dont have to pay an annual fee. You may even consider putting a small recurring charge like a monthly subscription on the card to ensure the account stays active and the credit card company doesnt close it for you.

Five Levels Of Credit Scores

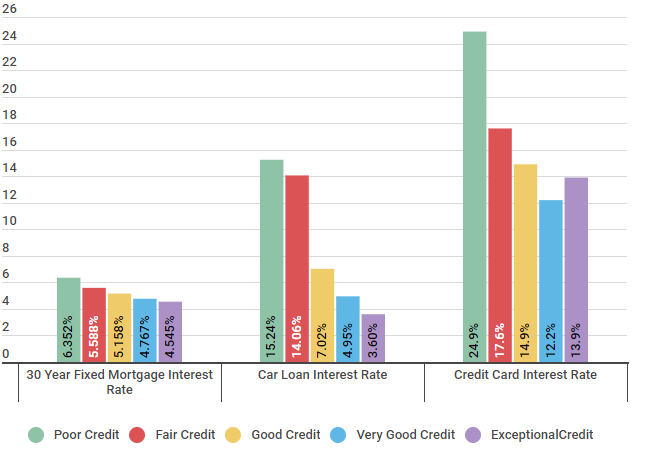

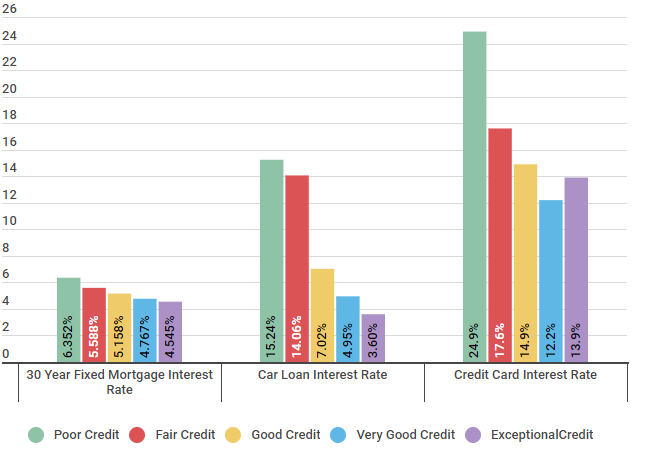

Now that you know what goes into your score, lets take a look at what lenders consider a good score and a bad score. The FICO scoring ranges are as follows:;

- Very poor: 300-500 points. Obtaining a credit card or loan with bad credit is more challenging.;

- Fair: 580-669 points. Lenders consider borrowers with a fair score to be higher risk. You may be able to find a loan or credit card with a fair score, but youll pay more in interest.

- Good: 670-739 points. Youre a much more appealing candidate for loans and cards if you have a credit score in this range.

- Very good: 740-799 points. Youll get better rates from lenders If you have a very good score.

- Exceptional: 800-850 points. Lenders see people with exceptional credit scores as very dependable borrowers. An exceptional score means youll get the best interest rates available and exclusive credit card offers.

The maximum credit score that you can have is 850. Perfect scores are very rare but with patience and a plan, its not impossible to make it into the perfect credit club with time.

Read Also: Is 524 A Good Credit Score

Mortgage Overlays: Credit Requirements Vary Bylender

A mortgage overlay isan additional mortgage guideline imposed by a lender, which goes beyond theloans official minimum standard.

For example, FHA allows FICO scores as low as 500, but some lenders set their minimums at 620.

According to FannieMae, the majority of mortgage lenders apply mortgage overlays. The most commonoverlay relates to credit scores.

About half of lenderssurveyed apply overlays to the minimum credit score requirements of a mortgageloan. Your 500 FICO score, therefore, may not get you FHA-approved, even if theFHA allows it.

This is why its smartto re-apply for a mortgage if youve recently been denied. Your loan may havebeen turned down, but that could be because of an overlay. Theres a chance you could be approved by a lenderwith looser guidelines.

Apply at a differentbank, you may get better results.

How mortgage lenders pull credit

When you apply for amortgage, lenders pull a credit report from all three credit bureaus on you.Their decisions to lend, and the terms of your loan,;depend;on theresult of those reports.

Lenders qualify youbased on your middle credit score.

For example, if your scores are 720, 740, and 750, thelender will use 740 as your FICO. If your scores are 630, 690, and 690, thelender will use 690 as your FICO.

When you apply with aspouse or co-borrower, the lender will use the lower of the two applicantsmiddle credit scores.