How Do Hard Credit Inquiries Affect Your Credit

Lenders and credit scoring models consider how many hard inquiries you have on your credit reports because applications for new credit increase the risk a borrower poses. One or two hard inquiries accrued during the normal course of applying for loans or credit cards can have an almost negligible effect on your credit. Lots of recent hard inquiries on your credit report, however, could elevate the level of risk you pose as a borrower and have a more noticeable impact on credit scores.

Hard inquiries can stay on your credit report for two years, but the degree to which they affect your credit diminishes over time. While they could initially reduce your FICO credit score by several points, your scores will likely recover after a few months. The credit score sting caused by many hard inquiries in a short period of time will take longer to go away. At any rate, both types of inquiries are automatically removed from credit reports after two years.

Again, your overall credit health is what matters most. If you have a consistent track record of making on-time payments and keeping your revolving credit balances low, it isn’t likely that a few hard inquiries will have enough of an impact on your credit scores that it affects your interest rates or credit approval.

How To Dispute Hard Credit Inquiries

We recommend checking your credit reports often. If you spot any errors, such as a hard inquiry that occurred without your permission, consider disputing it with the credit bureau. You may also contact the Consumer Financial Protection Bureau, or CFPB, for further assistance.

This could be a sign of identity theft, according to Experian, one of the three major credit bureaus. At the very least, youll want to look into it and understand whats going on.

Keep in mind, you can only dispute hard inquiries that occur without your permission. If youve authorized a hard inquiry, it generally takes two years to fall off your credit reports.

How To Dispute Hard Inquiries

Going through your credit reports from time to time is important because, among other things, it gives you the ability to find hard inquiries that you dont recognize. Finding these is important as such inquiries could be a sign of criminal activity.

Once you find a suspicious hard inquiry, use the information in your credit report to contact the lender in question. For all you know, the creditor might be associated with a business you received a store card or financed a purchase through, such as a car or a home appliance.

If, upon contacting the creditor, you still feel you might be a victim of fraud, contact the credit reporting agency and dispute the hard credit inquiry. You may also consider filing a complaint with the police and reporting the incident to the Federal Trade Commission.

Don’t Miss: When Does Citi Card Report To Credit Bureaus

Losing Points On Your Credit Score

To reiterate, hard inquiries can lower your FICO credit score anywhere from 5 to 10 points. While this seems like nothing, 5 to 10 points could end up being a deal breaker. Some companies look through thousands of loan and credit card applications every day. To make the process go by faster, they might only look at your credit score. They might have a threshold that if you are even one point under they wont lend to you. According to credit.org, a good credit score ranges from about 680-740 and the threshold of a good score usually is about 700 points and above. If youre trying to get a loan from a company that has a strict threshold of 700 points, a 5 or 10 point decrease could put you below that line and you could be denied an important loan.;

While many other things lower your credit score more than hard inquiries do, they still shouldnt be ignored. Hard inquiries arent exactly avoidable though, so try to only get them once in a while. If you have had 4 inquiries over the past year your score could be down as much as 40 points until it goes away!

Your Current Creditors Check Your Credit Reports

Creditors also regularly check current customers credit reports to monitor their creditworthiness and manage their accounts. For example, your credit card issuer might decide to increase your cards credit limit if you have a good payment history. Alternatively, the issuer can lower your credit limit if it sees youre falling behind on other bills.;

You May Like: How To Get Credit Report With Itin Number

What Is A Hard Credit Check

A hard credit check is when a lender pulls your credit report because youve applied for new credit, such as a credit card, a car loan, a home loan or an increase to an existing line of credit. Hard credit checks can affect your credit score because seeking new credit can make you seem like more of a risk to lenders, who may worry about your ability to pay back the debt.

How Long Does A Hard Inquiry Affect Your Credit Score

The Fair Credit Reporting Act requires credit bureaus to disclose all inquiries on your account from the last 2 years. This means that any hard inquiry within that period will show up.

However, your credit score is constantly changing. A large bill one month or missed credit card payment in the next can affect your score as well. While a hard inquiry will stay on your credit reports for 2 years, other factors related to your financial health will draw your score up or down.

You May Like: Does Opensky Report To Credit Bureaus

What Are Hard Credit Inquiries

Every time you apply for a loan or credit, the lender sends a formal inquiry to a credit bureau for your credit score. This type of inquiry is known as a hard pull inquiry, or just hard pulls. Hard inquiries can hurt your credit score by 5 or 10 points every time they are conducted. Now while 5 or 10 points may not seem like much, if youre not careful, this can quickly add up and make a dent in your credit score. Examples of hard inquiries include those that are made when you apply for a:

- Mortgage or home loan

- Auto, student or personal loan

These inquiries require your express authorisation, which is usually included in your application.;

How Rate Shopping Affects Your Credit Score

The FICO score ignores all mortgage and auto inquiries made in the 30 days before scoring. If you find a loan within 30 days, the inquiries wont affect your score while youre rate shopping.

The credit-scoring model recognizes that many consumers shop around for the best interest rates before purchasing a car or home, and that their searching may cause multiple lenders to request their credit report. To compensate for this, multiple auto or mortgage inquiries in any 14-day period are counted as just one inquiry.

In the newest formula used to calculate FICO scores, that 14-day period has been expanded to any 45-day period, Watt said.

This means consumers can shop around for an auto loan for up to 45 days without affecting their scores.

If youre wondering how to get the most bang for your buck while rate shopping, a nonprofit credit counselor can help walk you through the process. The advice is free and can save you from committing a costly error while perusing over various rates.

To sum things up, soft inquiries have no effect on your credit score. They happen all the time without your knowledge, so dont worry about them. A single hard inquiry will go mostly unnoticed by the credit bureaus. Any damage done will mend itself in a couple months.

However, if you make too many hard inquiries in a short enough period of time, your credit score will plummet.

Don’t Miss: What Is The Highest Credit Score You Can Get

Factors That Affect Your Credit Score

Even if youve done your research and decided which card you want to start with, you should not apply for it until you understand how your credit score is calculated.

Heres a breakdown of the factors involved:

- 35% payment history:;Its no surprise that the category that carries the most weight is your on-time payment history.

- 30% amounts owed:;Also referred to as utilization rate, this is the total balance on all your credit cards divided by your total credit limit.

- 15% length of credit history: Also known as the average age of accounts. The longer your credit history, the higher your score will be.

- 10% credit mix:;This refers to the various lines of credit you may have, including credit cards, student loans, a car loan, a mortgage, etc.

- 10% new credit: New inquiries on your credit report account for 10% of your score.

Related:How credit scores work

What Is A Soft Credit Check

A soft credit check is when your credit report is pulled but you havent applied for credit. For example: Insurance companies or potential landlords may look at your credit report to assess risk; potential employers may do background checks. Credit card companies can also pull a soft copy of your credit to service and manage any existing relationships you may have with them. Soft checks do not affect your credit score or show up on your credit report.

Don’t Miss: How To Get My Own Credit Report

What About Business Loan Inquiries

Business loan applications are subject to similar inquiries about the financial capability of the business, which can affect their credit score. Unfortunately, many small businesses in Australia either do not know about or neglect the importance of business credit scores. On the other hand, your business credit score is separate from your personal credit score. This means any inquiries you make as a business, as long as youve registered your business name with ASIC, wont impact your personal credit score.

Did you find this helpful? Why not share this article?

This article was reviewed by Personal Finance Editor before it was published as part of RateCity’s Fact Check process.

Jodie Humphries

Personal Finance Editor

An Editor for Personal & Home Finance working across the site, Jodie has worked for banks and comparison websites for a number of years, writing articles across Sharesight, Finder, and other places. Now, Jodie spends her time working on ways to make money make sense for everyone else.

By signing up, you agree to the RateCity Privacy Policy, Terms of Use and Disclaimer.

When Can Businesses Request Your Credit

The Fair Credit Reporting Act requires businesses to have an acceptable reason for accessing your credit report. Acceptable reasons include:

- To grant credit. If you’ve applied for a credit card, loan, or other credit-based services, the business has permission to access your credit report to determine whether you qualify.

- To collect a debt. Debt collectors can use your credit report to obtain information, like your address or place of employment, that would help them collect a debt.

- To underwrite insurance. Some insurance providers use your credit score to gauge the likelihood that you will file a claim.

- For employment. Current and prospective employers may check your credit report before hiring you for certain positions, especially financial and upper-level management positions.

- To issue certain government licenses.

- For legitimate business transactions.;

Companies that access your credit report under false pretenses or those who use it illegally are violating Federal law. You may be able to sue a company that violates your rights.

Recommended Reading: Does Closing A Credit Card Hurt Your Score

Practice Good Financial Habits

A good credit score starts with good financial habits. This will show lenders that you are a responsible borrower and can handle an additional credit account.

If you want to show lenders that you are a responsible borrower, commit to the following:

- Paying bills on time and in full

- Keeping track of balances

- Monitoring your credit score

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Don’t Miss: What Credit Score Do You Need For A Conventional Loan

Check Your Credit Report Regularly

Routinely checking your credit report gives you easy means to see how many hard inquiries youve had in the last two years. Doing so could mean spotting hard inquiries that might result from identity theft or fraudulent use of your information sooner rather than later.

Keep in mind that fraudulent use isnt just limited to hard inquiries. If someone takes credit on your name and doesnt repay it, it will reflect on your credit score. If you experience a sudden, unexplainable drop in your credit score, it could be a sign of identity theft or otherwise fraudulent activity.

How to Check Your Credit Score Without Lowering It

You are legally allowed to access your credit reports from each of the top three credit reporting agencies once every year for free. Doing this doesnt lower your credit score. You may request your free credit reports through annualcreditreport.com a website authorized by federal law online, over the phone or via mail.

Alternatively, you can get your free credit reports directly through:

How Does A Hard Inquiry Affect Your Credit Score

A single hard inquiry can shave;up to 5 points off your FICO;score. However, with the most-used FICO model, all inquiries within a 45-day period are considered as one inquiry when you are rate shopping, such as for mortgage, student and auto loans. Older FICO models and;VantageScore, FICO’s competitor, also group inquiries for rate shopping, but into a 14-day period. A VantageScore spokesman said a hard inquiry can shave up to 10 points off a VantageScore.

Most lenders or card issuers will pull a credit report from just one of the three major credit bureaus Equifax, Experian or TransUnion. So the inquiry will show up on only one of your credit reports. The exception is for a mortgage, when all three credit bureaus are usually checked.

It is smart to limit hard inquiries. Before you apply for credit, check to be as certain as you can that you are likely to be approved so you don’t lose score points without getting the approval you seek. Avoid applying for credit on impulse. Consider whether;a discount or bonus you are hoping to receive is worth the potential ding to your credit score. If you have excellent credit, a few points may not be a big deal. However, if you have borderline credit quality, think twice.

Don’t Miss: What Does Filing For Bankruptcy Do To Your Credit Score

Effect On Credit Score

When it comes to your credit score, the only type of inquiry you have to worry about is a hard inquiry. A soft inquiry does not affect a credit score at all, since its not an application for credit. Generally speaking, its a good idea to limit the number of hard inquiries you make. A typical hard inquiry could knock up to five points off a credit score.

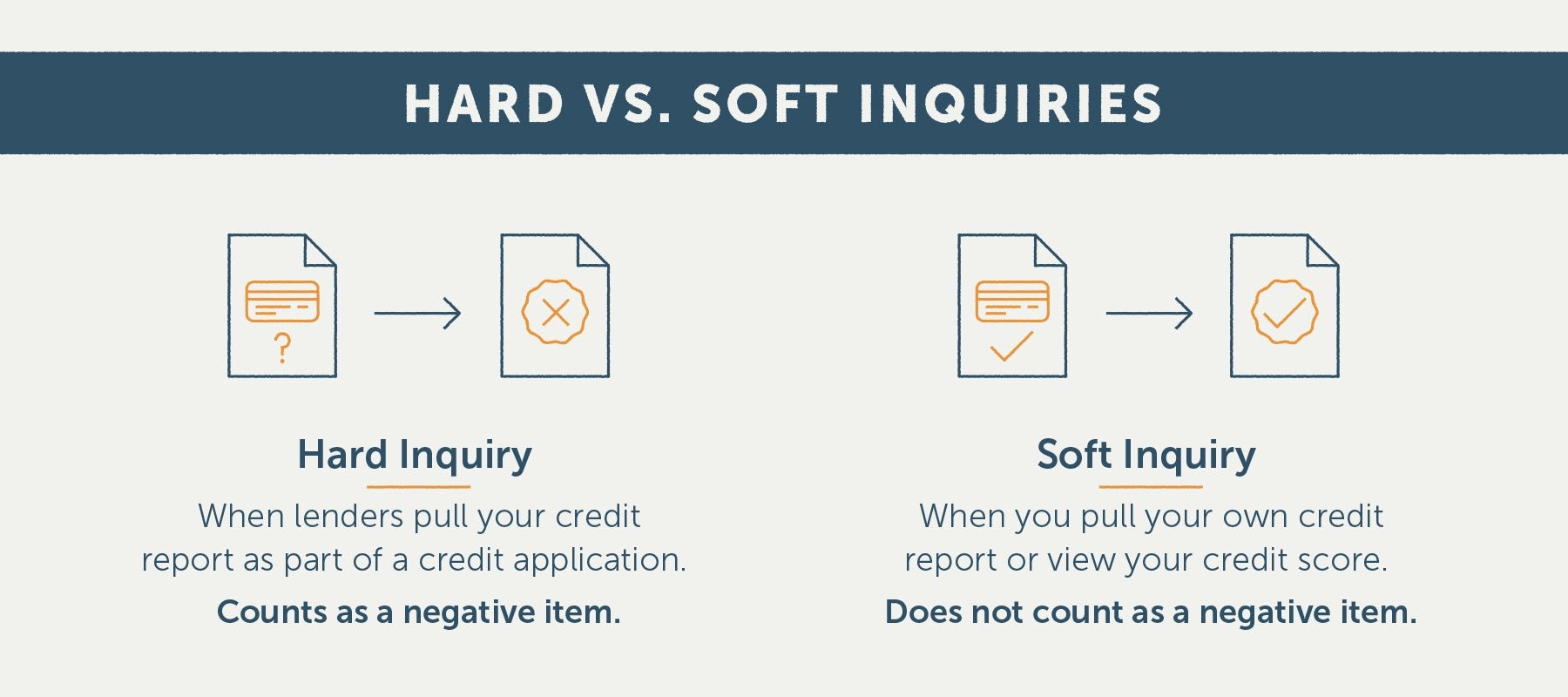

What Are Hard And Soft Credit Score Inquiries

There are two types of credit score inquiries lenders and others can make on your credit score: a “hard inquiry” and a “soft inquiry.” The difference between the two is that a soft inquiry won’t affect your score, but a hard inquiry can shave off some points.

Here’s what hard and soft inquiries are all about: why there’s a difference, and who makes them.

Don’t Miss: How Are Account Numbers Displayed In A Credit Report

Hard Inquiries Vs Soft Inquiries

The essential difference between a hard inquiry and a soft inquiry is whether or not you gave the lender permission to check your credit report.

Generally speaking, if you let a lender scrutinize your credit report, its a hard inquiry. If a lender or bank peers into your credit report without your knowledge or permission, its a soft inquiry.

As far as your credit score is concerned, soft inquiries are harmless and will mostly go unnoticed. Hard inquiries, however, can leave a mark on your credit report, especially for anyone rapidly applying for credit in a short time span.

Who Does A Hard Pull

Since a hard pull is most often used to tell if you’re a good lending risk, they are used by an entity considering you for a loan or credit card. Banks, credit unions, and credit card companies rely on hard inquiries to make sound lending decisions. They’ll look at the information listed on your report to see if you are likely to pay back the money. These decisions affect all kinds of loans, including mortgages, private student loans, and car loans.

Applying for many loans over time almost definitely brings your score down. Each pull can have an effect, depending on the timing. A flurry of credit pulls over the course of a year, for example, may signal to a bank that you are desperate for moneyâand not a solid credit risk. Make each pull an intentional action.

If you rent, your landlord can also run a hard pull, but they can sometimes just run a soft pull. The application will often ask permission to do a background or credit check, and they canât do one without your consent. If youâre not sure which one they will run, ask them.

Also Check: How To Read A Transunion Credit Report