Transunion Smartmove Tenant Screening

Does Transunion Smartmove Tenant Screening offer additional features : No

How does Transunion Smartmove Tenant Screening work?

The method to request reports is as follows: You create an account and send your applicant an invitation. The applicant receives the invite and completes the online application. After their identity is verified, SmartMove sends the applicants reports to you.

How much does Transunion Smartmove Tenant Screening cost?

There are three plans available that range in price from $25 to $40 per applicant.

How To Write A Letter Explaining Bad Credit

Before you can write a detailed letter explaining your credit situation, you need to understand it thoroughly. Request a copy of your credit report from one of the three credit reporting agencies: TransUnion, Equifax, or Experian. You are entitled to one free copy from each per year. When youre actively working on your credit, it can help to space these out and review one report every four months so you always have an eye on the situation.

Review your credit report for red flags that will stand out to your prospective landlord, such as:

- Missed payments

- Accounts submitted to collection agencies

- High balances

You should address these warning signs openly in your letter and provide an honest explanation. Many landlords are sympathetic to tenants who have had a difficult history as long as theyre committed to making positive changes in the future. As you explain the situation surrounding late or missed payments, you should also explain how you plan to prevent these in the future.

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

Don’t Miss: How Long Does Debt Settlement Stay On Your Credit Report

Where To Get A Tenant’s Credit Report

Three credit bureaus have cornered the market on credit reports:

- Experian .

As linked above, each of these credit bureaus offers tenant screening services that include credit checks. You can order the reports online and receive them immediately. Fees for the services vary, but usually are no more than $40.

Another popular option is to have a service request a credit and screening report from your tenant. Doing so avoids your having to collect a credit check fee and potentially sensitive information . Most of the time, you simply register an account online with the service, and it will send the applicant instructions for how to order the report and allow you to receive it. The service notifies you when the report is complete and tells you how to access it. Many of the credit bureaus provide this option, as do other landlord-oriented websites such as Cozy and TurboTenant.

What Can I Do If I Believe The Information In My Credit Report Is Inaccurate

Write to the credit bureau immediately and describe the error in as much detail as possible. The agency must investigate your request and correct the error if one is found. If a correction is necessary, the agency must inform every business that has recently received your report that a correction has been made. If the dispute is not resolved, you have the right to file a brief statement describing the nature of the dispute with the credit reporting agency. This statement, or an accurate summary of the statement, must be included in any future credit report concerning you. Since the reports from the three major credit bureaus may contain different information about you, it is a good idea to obtain a report from each of them. Additionally, you should contact the company that provided the incorrect information. It may verify the mistake and write a letter on your behalf requesting that the credit reporting agency fix the error.

Don’t Miss: How To Check Credit Score For Free

How To Order Your Free Credit Reports

One of the best ways to protect yourself from identity theft is to monitor your credit history. Now you can do that for free. Thanks to a new federal law, consumers can get one free credit report a year from each of the three national credit bureaus. Those bureaus are Equifax, Experian, and TransUnion.1 You can also get your reports for free from “specialty” credit bureaus. These companies prepare reports on your employment, insurance claims, rental and other histories.

Checking your credit reports at least once a year is a good way to discover identity theft. And the sooner identity theft is discovered, the easier it is to clear up. You can also identify errors in your credit reports that could be raising your cost of credit

Experian Connect Tenant Screening

Does Experian Connect Tenant Screening offer additional features : No

How does Experian Connect Tenant Screening work?

The tenant is invited to fill out an online form to verify their identity. Applicants pay for their credit report and grant you access to it.

How much does Experian Connect Tenant Screening cost?

The applicant pays $14.95 for their credit report. Experian Connect does not include a criminal record search or dedicated eviction history reports.

Also Check: What Credit Score Do You Need For Paypal Credit

Experian Credit Report And Score For Tenant Screening

Request a;rental credit check;using only the applicant’s name and email address. Your applicants purchase their;tenant credit report;and grant you private access directly through Experian.

Shareable to trusted people like a;landlord, property manager or;real estate agent, for up to 30 days at no additional charge.

- , Credit Rating and Credit Score factors;

- Best Name,;AKAs, Addresses and Employers

- Public Record filings

Your Credit Report And Rating

If youre not sure what a prospective landlord will see on your credit report,;get a copy of your own credit report;from both Equifax and TransUnion Canada ahead of time. The link explains in detail how to get it for free in the mail, how to pay for it and get it right away, and how to get your credit score.

However, you dont in fact need to worry about your credit score. Take care of your credit history report and your score and credit rating overall will take care of itself.

If you have a bad credit report, for instance with items of public record, debts in collections, judgments against you, bankruptcies, repossessions, debt written off or settled, or even continuous late payments, you have your work cut out for you when it comes to proving to a landlord that you have what it takes to be an ideal renter. Be prepared to explain how your problems occurred and what you have done since to address the problem and resolve it.

You May Like: What Credit Score Is Needed To Buy A Mobile Home

What Information Is Needed For A Credit Check

Before you can run a credit check on rental applicants, each applicant over the age of 18 must submit a completed rental application and give the landlord permission to check their credit. As the landlord, you must follow all Fair Credit Reporting Act guidelines and be able to verify that youre the actual landlord. Heres what youll need to prepare for the rental credit check:

Corelogic Myrental Tenant Screening

Does Corelogic MyRental Tenant Screening offer additional features : No

How does Corelogic MyRental Tenant Screening work?

When you want to screen applicants, you can fill in the info about the applicant on the MyRental platform and then submit it for screening.

The applicant grants you access to their credit information and you receive the reports.

How much does Corelogic MyRental Tenant Screening cost?

There are three MyRental plans to choose from. Basic is $19.99 but does not include credit history information. It does have an eviction and criminal background check.

To get a credit report and score, youll have to pay $29.99 for Premium and $34.99 for statistics about how the applicant scored in comparison with other renters in the area. You decide who pays for the screening fee. CoreLogic MyRental is one of the top tenant screening companies but does not check references.

You May Like: How To Remove From Credit Report

Get What You Need From Rentpreps Screening Services

Here at RentPrep, we offer two different screening services. Both of these services include some type of credit report that can help you make a decision about whether or not to accept a tenants application for your property.

The first service that can be ordered via RentPrep is the SmartMove Full Credit Report. This report gives you the exact credit score of a tenant, and it must be ordered with the tenants involvement. The full report includes:

- Full credit report including ResidentScore

- SSN verification

- Option to have applicants pay

- Option judgments and liens search

With this report, you can easily see a lot of different information about all prospective tenants, and that information should be able to inform your decision.

Can a landlord order a credit report for the tenant without needing to be directly involved? You can if you use RentPreps Background Check service. This affordable service checks SSNs, addresses, evictions, bankruptcies, judgments, liens, and gives a pass/fail ranking for each screened tenant based on your guidelines.

Which of these services will work best for you is going to depend on your exact needs or the number of tenants that you want to screen.

Why Is A Credit Check Important For Landlords

A credit check is an essential part of the tenant review process. It provides an overview of an individuals financial status, including the amount of debt theyre carrying and their bill-paying history. A credit report is based on the assumption that people whove met their financial obligations in the past will do so in the future.

When landlords use credit information to make rental decisions, they must comply with the Fair Housing Act, a federal law that prohibits discrimination in the sale or rental of housing. Landlords must treat all tenants fairly and cant discriminate based on race, sex, religion, or other factors specified in the law.

While credit checks are useful for assessing applicants rent-paying ability, theyre just one part of the screening process. Landlords should consider using additional screening tools, like background checks and criminal histories.

You May Like: How To Read A Transunion Credit Report

How Do I Get Free Credit Reports When Screening Tenants

One of the reasons many landlords I have spoken with don’t do credit reports is because of the cost of running a credit report. What?! The cost of the credit report?? Well, yes. Believe it or not many people would rather spend thousands of dollars in lost rent and legal fees, renovation and aggravation than the cost of a $15.00 credit report because they feel lucky.

Then again, there are those of us who know the risks are heavily slanted against us and will not rent without a full credit and background check on the potential tenant. We know that it is better to spend a small amount of money on the screening process rather than wanting to kick ourselves in the rear when the tenant burns us.

You may be thinking, “yeah, I know all that, but the title of this article has the words “FREE CREDIT REPORTS” in it and that’s why I’m reading it.” Well that’s what I’ll talk about.

There are 2 types of “Free Credit Reports” for tenant screening I’d like to tell you about.

How To Run A Credit Check On A Prospective Tenant

Running a credit check on a prospective tenant can help you protect your investment property and the income it is supposed to generate for you. Since you cant always judge a book by its cover, this check allows you to dig deeper into the financial condition and habits of the prospective tenant. If they have a good credit history and pay their bills on time, chances are higher that they will pay their rent on time as well and keep the place in good order.

Don’t Miss: Is 643 A Good Credit Score

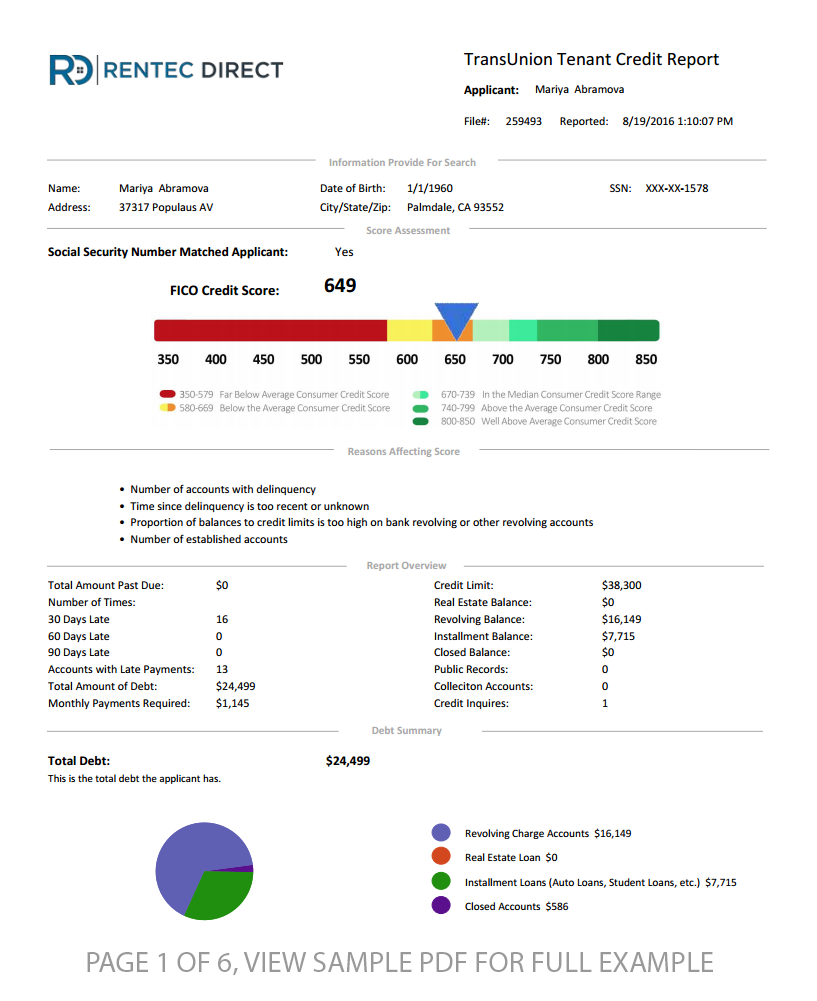

Know Your Tenants Rental Credit Report

With TransUnion SmartMoves renter credit report

With TransUnion SmartMove, landlords can run rental credit reports in minutes. As a property owner or landlord, youll be able to make better decisions for your rental property much faster and more efficiently.

TransUnion SmartMove offers a credit report for landlords like you that want to know more about their applicant’s credit history. After signing up for a free account, you can gain fast access to the same data thats used by large property management companies with TransUnion SmartMove’s comprehensive leasing recommendations. If you want a thorough background report on your renters, SmartMove will show you the whole picture in an easy to read format.

Doesnt impact the tenant’s credit score

A tenant from SmartMove is different than most resident screening services. A review of a SmartMove report results in a soft-inquiry on the applicants credit history, which has no effect on their overall credit score. Rental applicants can also be confident in the safety and security of their personal information throughout the process thanks to TransUnions experienced team. TransUnion SmartMove is the clear choice for helping you make the right decisions for your rental property.

Easy-to-read format

Available 24/7 online

Provided by a trusted company

Renter credit reports are provided by TransUnion, a company with more than 40 years of experience in the consumer reporting industry.

Landlords

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services.;These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Recommended Reading: When Will Chapter 7 Bankruptcy Be Removed From Credit Report

When It Comes Right Down To Convincing A Landlord To Rent To Youeven If You Have Bad Credit

First impressions for the ideal renter or great tenant and looking good on paper matter when it comes to getting a landlord to pick you. But being an attractive tenant also means communicating clearly and confidently; give straight forward answers when asked. And above all, be honest, even if you have bad credit. Landing the place is just the start. When it comes time to renew your lease or to ask you landlord to be a reference for the next place, you dont want them to feel like they didnt get what they saw in you before you moved in. People remember when they feel like they got duped, and you know what they say about karma.

How Can I Improve My Credit Score

If youre trying to rent a new apartment, first make sure that you look up your credit score before you fill out a rental application. You are allowed to get one free credit report from each of the three credit bureaus every year, thanks to the Fair Credit Reporting Act . Many credit cards or banks will also provide you with a free credit report if you have an account.

Tracking your credit report gives you the opportunity to fix any potential errors before a possible landlord sees it. You are able to dispute potential mistakes via the three main credit bureaus. Give yourself a couple of months to clear up any discrepancies, since the credit bureau has 30 days to respond to and correct erroneous information after you submit a claim by phone, email, or online.

If your credit score isnt great, there are several things you can do to improve it. Paying your bills on time, paying down your debts to reduce the amount of overall debt you owe, and managing your credit cards effectively will all help to improve your credit score. If you dont have a credit card, youll want to get one to establish a credit history, but dont overspend or open up lots of accounts in the hopes of improving your credit score.

Read Also: How To Remove Items From Your Credit Report Yourself

Does Paying Rent Build Credit

Simply paying your rent will not help you build credit. But reporting your rent payments can help you build credit especially if you are new to credit or do not have a lot of experience using it.

A 2017 TransUnion study followed 12,000 renters for a year as they reported their rent payments. Scores rose 16 points on average within six months after rent reporting began, according to the study. The largest increase was for scores below 620, which is considered bad credit.

Having rental payment information in your credit report can be useful if you rent again. Landlords prefer tenants who can show a history of paying on time.

But other strategies to build credit are more efficient than rent reporting because they influence all types of credit scores and usually report to all three credit bureaus. They also can cost less or, in the case of authorized usership, nothing.

-

You can become an on someones else credit card and benefit from their good credit history.

-

You can get a secured credit card, which requires a deposit and often serves as your credit limit.

-

;You can get a at many credit unions or community banks. Your loan payments are reported to the bureaus and you get access to the funds only after you have paid it off.