Is Credit Karma Safe

Based on the information available, Credit Karma is safe to use. The service is absolutely not a scam to steal your information or charge your credit card.

The only piece of information that might be difficult for you to pass along to Credit Karma is the last four digits of your Social Security number. Although it is likely engrained that you should never give out your Social Security number, Credit Karma will need this in order to find your credit report. Unfortunately, there is no other effective way to accurately obtain your credit reports.

Personally, Ive been using Credit Karma for the past two years without any issues. Of course, there is always the threat of a data breach on any website that you work with. However, Credit Karma seems to have a good record of keeping its users data safe.

In my experience, the only negative part of Credit Karma is the number of emails they send to you about your credit score. At first, they send you a barrage of emails. However, you can go in and adjust your email preferences to avoid that in the long term.

If they do notice that your credit score has changed, they will send you an email to let you know. That is a helpful feature because most of us dont make time to check out our credit score every single month.

How Accurate Are Credit Karma Credit Scores

A lot of people rely on Credit Karma to monitor their credit score to make sure everything stays up to par. Its a very easy and free to use tool so it is very understandable that it is one of the most popular ways to keep track of your credit score. But exactly how accurate is Credit Karma?

In this article, I will talk about whether or not Credit Karma is accurate and some of its potential shortcomings as well as its strengths. Ill also show you how to find a more accurate credit score that can better predict your credit approval odds.

Why Is Credit Karma So Inaccurate

Not everyone who checks their score through Credit Karma gets a higher number through the service, though. As many people discovered, Credit Karma does not use the same scoring system as major lenders. Its not so much that Credit Karmas score is wrong, its just that they use a different measurement system.

Also Check: What Is The Highest Credit Score You Can Get

Differences Between Fico And Vantagescore

In addition to the base FICO Score, of which the newest versions are FICO Score 9 and 10, FICO offers industry-specific credit scoring models designed for creditors such as auto and mortgage lenders. VantageScore does not have industry-specific credit scoring models.

There are also different FICO Score models for each of the three major consumer credit bureaus . Each of the four VantageScore models can be used by any credit bureau.

To have a FICO Score, your credit report must show at least one credit account at least six months old and activity on at least one credit account during the last six months. To have a VantageScore, all you need is one credit account on your credit report, no matter how new the account is.

The two credit scoring models weigh the data in your credit report somewhat differently. For instance, payment history is more important to your FICO Score than to your VantageScore; credit usage and credit mix are more important to your VantageScore than to your FICO Score.

Faq About Credit Karma

Still have questions about Credit Karma? Keep reading.

Is Credit Karma really free?Does Credit Karma hurt your credit?

Checking your own credit score and credit report on Credit Karma will not hurt your credit. Your credit score may see a temporary dip when you apply for credit and the lender checks your credit report . Checking your own credit score is known as a soft inquiry, which does not affect your credit score.Credit Karma could boost your credit if its educational tools and credit monitoring services help you improve your credit score. On the other hand, if the site inspires you to take on excessive debt and you fall behind on the payments, your credit could suffer.

Can you get my FICO score from Credit Karma?

Credit Karma does not provide a FICO Score; it provides your VantageScore 3.0. You can get a free FICO Score and free credit report from Experian. You may also be able to get your credit score from your bank or credit card company, but youll need to clarify whether it is the FICO Score or the VantageScore.

Is Credit Karma score lower than FICO?Is FICO the most accurate credit score?

Also Check: Do Hard Inquiries Affect Credit Score

Fico Vs Vantagescore: The Differences

FICO Score and VantageScore are the two major credit scoring models and have both similarities and differences.;

VantageScores are generic scores, designed to be used by a variety of different creditors. The base FICO Score is generic, but FICO also creates specialized credit scoring models for specific industries such as credit card issuers, mortgage lenders, and auto lenders.;

Both FICO and VantageScore release new versions of their credit scoring models from time to time, with updates intended to improve accuracy. The latest versions of VantageScore are 3.0 and 4.0. The latest versions of FICO Score are 9 and the 10 Suite; however, FICO Score 8 is still the version most creditors use.;

FICO creates different versions of each of its credit scoring models for each of the three major consumer credit bureaus . VantageScores credit models can be used by any of the three bureaus.

Both base FICO Scores and the latest versions of VantageScore range from 300 to 850. FICO Scores and VantageScores consider the same basic factors when calculating your credit score:

- Payment history: Whether you pay bills on time;

- The percentage of your available credit you actually use;

- Length of credit history: How long youve had credit;

- The variety of credit types you have ;

- How often and how recently youve applied for credit;

Errors To Watch Out For On Your Credit Report

Once you get your report, check for:

- mistakes in your personal information, such as a wrong mailing address or incorrect date of birth

- errors in credit card and loan accounts, such as a payment you made on time that is shown as late

- negative information about your accounts that is still listed after the maximum number of years it’s allowed to stay on your report

- accounts listed that you never opened, which could be a sign of identity theft

A credit bureau cant change accurate information related to a credit account on your report. For example, if you missed payments on a credit card, paying the debt in full or closing the account won’t remove the negative history.

Negative information such as late payments or defaults only stays on your credit report for a certain period of time.

Also Check: How To Remove Items From Your Credit Report Yourself

What Are The Equifax Credit Score/ Ratings

| Equifax credit score | ||

| You are likely to be rejected for credit products | ||

| 439-530 | Fair | You may be accepted for some credit products, but may have to pay a higher rate or have a lower credit limit |

| 531-670 | You are likely to be accepted, but could have a lower credit limit | |

| 671-810 | You’re likely to be accepted for most credit products | |

| 811-1000 | You’re very likely to be approved for the most competitive credit products |

What Affects Your Credit Scores

Common factors can affect all your credit scores, and these are often split into five categories:

- Payment history: Making on-time payments on your credit accounts can help your scores. But missing payments, having an account sent to collections or filing bankruptcy could hurt your scores.

- : How many of your accounts have balances, how much you owe and the portion of your credit limit that you’re using on revolving accounts all come into play here.

- Length of credit history: This category includes the average age of all your credit accounts, along with the age of your oldest and newest accounts.

- Types of accounts: Also called “credit mix,” this considers whether you’re managing both installment accounts and revolving accounts . Showing that you can manage both types of accounts responsibly generally helps your scores.

- Recent activity: This considers whether you’ve recently applied for or opened new accounts.

FICO® and VantageScore take different approaches to explaining the relative importance of the categories.

Read Also: Which Credit Score Is Correct

Why Is It Important To Monitor Your Credit Score

A good credit score can make your financial life easier. Youll have easier access to large loans such as a mortgage or auto loan with better terms. These terms can save you money over the long term and allow you to work towards your other financial goals such as retirement or building a safety net before deciding to work for yourself.

On the flip side, a bad credit score can lead to difficulty obtaining large loans with favorable terms. If you are able to secure a loan with bad credit, then you will likely be paying higher rates. Your higher payments can add up and make it more difficult to save for your other financial goals.

If you have plans to make a major purchase with the help of a loan, then you will want a good credit score. Consider whether or not you see a home purchase or auto loan in your future. If you do plan on making a major purchase with the help of a lender, then you will likely need a good credit score to make that transaction flow as smoothly as possible.

With that, is incredibly important to monitor your credit score. Not only can your actions have a big impact on your , but also mistakes on your credit report can lead to a misleading score. For example, if a creditor accidentally reports a defaulted loan on your credit report, it could lead to a big drop in your credit score through no fault of your own. That could lead to problems securing a mortgage or auto loan down the line.

Other Places To Check Your Credit Score

Although other scores arent used as often by lenders, they are still useful for tracking changes to your credit and are offered for free.

If you dont have a credit card or other product that provides free access to your score, it doesnt hurt to track one of the other scores, even though it isnt a FICO score.

You can also use these scores to check if you are making progress on your credit, and if there is a major decline or suspicious activity on your credit report, you can catch it right away. Then, you can at least investigate the activity and fix any issues.

Some of the other credit scores you might want to keep an eye on include the following:

Recommended Reading: How To Check Credit Score For Free

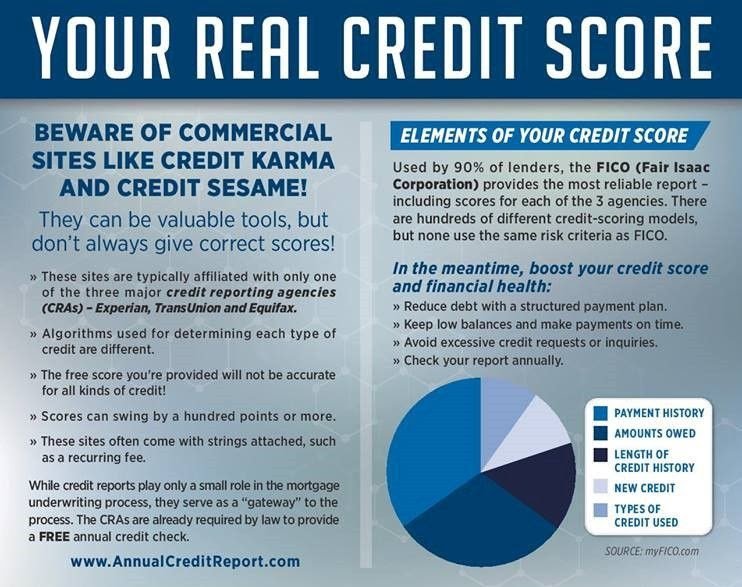

How Credit Scores And Fico Scores Are Calculated

All credit scores, including FICO and VantageScore, are based on similar . They assess factors like your credit history, payment history, credit mix, and credit utilization ratio.

Heres the FICO scoring model:

FICO;score breakdown from MyFico.

If youve never used credit before, or have used it irresponsibly, your credit scores will be low or non-existent. A great way to build your credit;from the ground up is with responsible use of a credit card, secured credit card, or .

For those of you simply looking for a boost, here are a few easy ways to improve your credit:

- Make on-time payments: Above all else, pay your bills on time. Late payments are incredibly detrimental to your credit scores. To avoid them, we recommend setting up automatic bill payments.

- Reduce your : You can do this by spending less, paying off a credit card with a personal loan, or even asking to raise the credit limit;on your current cards. Just make sure youre responsible with these changes, and avoid spending more money than you did before.

- Keep your credit cards open:;Closing a card will increase your credit utilization, and eventually reduce the length of your credit history both of which will reduce your scores. Unless youre paying an annual fee, we advise keeping old cards open;.

Your Credit Scores Dont Update Immediately

Once you sign up for Credit Karma, youll get emails prompting you to check your scores every so often. Youll also get notified if theres been a major change to your credit score. But you wont see changes on a daily basis, since Credit Karma updates your scores once a week.

It also might not always have the most up-to-date information from lenders, a fact that personal finance reporter J.R. Duren learned the hard way. I transferred a $5,000 balance from one card to another, said Duren. The transfer was a success, but ended up dropping my Credit Karma scores by nearly 30 points.

Why did his credit score take such a big hit? The card that used to have the balance hadnt sent updated information to Credit Karma yet, so my credit report showed the $5,000 on the card I transferred from and the card I transferred to, Duren said. The double balance pushed my credit utilization over 30 percent, which dropped my scores around 30 points.

In other words, it looked like Duren had gone over his credit utilization limit because his information wasnt updated immediately. Although this kind of temporary issue might not impact your ability to take out a loan, it can be frustrating if youre trying to build your credit scores. Plus, it makes your scores seem like a less accurate picture of your financial health.

Don’t Miss: Does Annual Credit Report Affect Score

Which Credit Report Do Lenders Look At

It may be difficult to know which credit report and score a lender is using to evaluate your credit. You can ask, but the lender isnt obligated to tell you.

But if a lender denies your credit application, federal law requires the lender to

- Tell you the main reasons why you were denied.

- Tell you the numerical credit score it based its decision on.

- Give you the name, address and phone number of the credit-reporting agency that provided your credit report.

- Inform you of your right to get a free copy of that report from the credit-reporting company .

- Explain how you can fix mistakes on your report or add information to it.

The reporting agency is required to provide you with a copy of the report used for the decision to deny your credit application. If you spot any errors in your report, you can dispute them and the agency is required to investigate and correct any errors it finds.

What Is A Good Fico Score

FICO® creates different types of consumer credit scores. There are “base” FICO® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card issuers and auto lenders.

The base FICO® Scores range from 300 to 850, and FICO defines the “good” range as 670 to 739. FICO®’s industry-specific credit scores have a different range250 to 900. However, the middle categories have the same groupings and a “good” industry-specific FICO® Score is still 670 to 739.

You May Like: How To Get My Own Credit Report

Is 719 A Good Credit Score

A 719 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

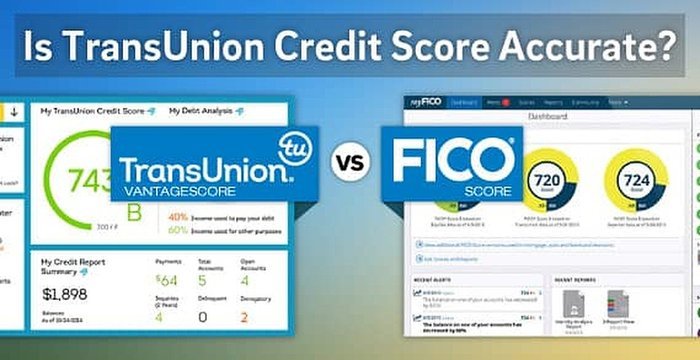

Why Are My Transunion And Equifax Credit Scores Different

When you log into your Credit Karma account, you can access your free credit reports and scores from both TransUnion and Equifax. Theyll likely be slightly different, and its possible they could be very different.

Multiple factors could account for why your scores are different.

- Like all credit-reporting agencies, TransUnion and Equifax use proprietary scoring models. And while credit scores are typically based on the same or similar factors including your payment history and number of accounts in good standing each credit-scoring model can weigh those factors differently.

- The credit bureaus may have different information. Not every credit-reporting company will have every bit of information about you. Some lenders may report information to all three big credit bureaus, while others might report to only one or two. And a lender may report updates to different bureaus at different times. So, its possible that Equifax and TransUnion could have different credit information on your reports, which could lead to your TransUnion score differing from your Equifax score.

- You may be seeing scores from different dates. A credit score is a snapshot of your credit profile at a specific point in time. Since credit scores can change over time, its important to compare scores from the same time period when comparing them across credit bureaus.

What factors determine my credit scores?

Recommended Reading: How To Get Fico Credit Score

How To Check Your Credit Score: A Summary

There we go, hopefully, this helps explain why theres a difference between the Equifax and Transunion credit scores and why you may want to check both of these scores to monitor the health of your credit scores on a periodic basis.

Heres a recap of why there is a difference between your Transunion and Equifax credit scores:

- There are different algorithms that the credit bureaus Transunion and Equifax use

- Equifax separates your credit inquiries to open and closed referrals

- The credit score most used by lenders is a difficult answer because credit agencies use different credit bureaus.; Which is more accurate Transunion or Equifax?; Actually, Transunion is not more important than Equifax

- Knowing both Transunion and Equifax scores is beneficial

- You can check your credit scores for free with Borrowell and .

As mentioned, I think it is great to do a periodic check up of your personal finance health, especially if youre thinking of applying for credit any time soon .; You want to have an excellent credit score to buy a house and an excellent credit score to buy a car.

The last thing you want is to be denied a loan because your credit score isnt up to par.

To get your free Equifax credit score, I like to use Borrowell.

To get your free Transunion score, I like to use .

Readers, do you check your credit score with both Equifax vs Transunion?;

If so, have you found a large discrepancy between Transunion vs Equifax?

How often do you check your credit score?