How Can I Improve My Chances Of Getting Accepted For Credit

Here are some simple things you can do to improve your credit report:

- Pay your bills and credit agreements on time. Lenders look for evidence you’re able to repay existing credit on time. If you forgot a payment one month, you can use a Notice of Correction. These are notes you add to your credit report to explain why you were late with a particular payment.

- Provide accurate, truthful and complete information on your application form. If you leave anything out or don’t give the true picture, it could affect your ability to get credit in the future.

- Check your credit report regularly so you can close any accounts of financial products youre not using, and check youre registered on the electoral register at your current address.

Check Your Credit History For Accuracy

Anthony Battle is a CERTIFIED FINANCIAL PLANNER professional. He earned the Chartered Financial Consultant® designation for advanced financial planning, the Chartered Life Underwriter® designation for advanced insurance specialization, the Accredited Financial Counselor® for Financial Counseling and both the Retirement Income Certified Professional®, and Certified Retirement Counselor designations for advance retirement planning.

Your credit report contains a wealth of information about your financial history and actions. If you have , those accounts and how you pay them, are included in your credit report. Its important to review your credit report at least once a year so you know what your creditors are saying about you.

Understanding your can be confusing, especially if youre reading your credit report for the first time. Here is a breakdown of the types of information contained in your report.

How Can Other Peoples Credit Histories Affect Mine

Your financial associates are just one more contributing factor to the lenders decision whether or not to give you credit. Before youre accepted for a loan or a mortgage, lenders want to make sure you can afford to pay it back. This involves assessing your other financial ties and commitments.

For example, if you and your spouse share a mortgage and your spouse loses their job, youre likely to have to pick up their half of the payments. This could affect your ability to pay off other debts, and potential creditors will take that into account when deciding whether to give you credit.

Also Check: Sync/ppc On Credit Report

How To Check Your Financial Associates

Checking who your financial associates are is as simple as checking your credit report.

For more information about how to obtain your credit report please see our guidance.

In the connections section of your report, youll be able to see the names of everyone you have financial links with and if any of them are incorrect, you can issue a notice of disassociation.

Initial Advance At Closing

You have chosen our funds transfer option to reduce your interest rate. Please verify that the account information is correct. If you maintain at least this $25,000 balance for the first three consecutive billing cycles the account is open, you will receive .25% off your approved rate for the life of the line.

Recommended Reading: Does Les Schwab Report To Credit

Understanding Your Equifax Credit Report And Credit History

Reading time: 3 minutes

- Learn what information is on your Equifax credit report

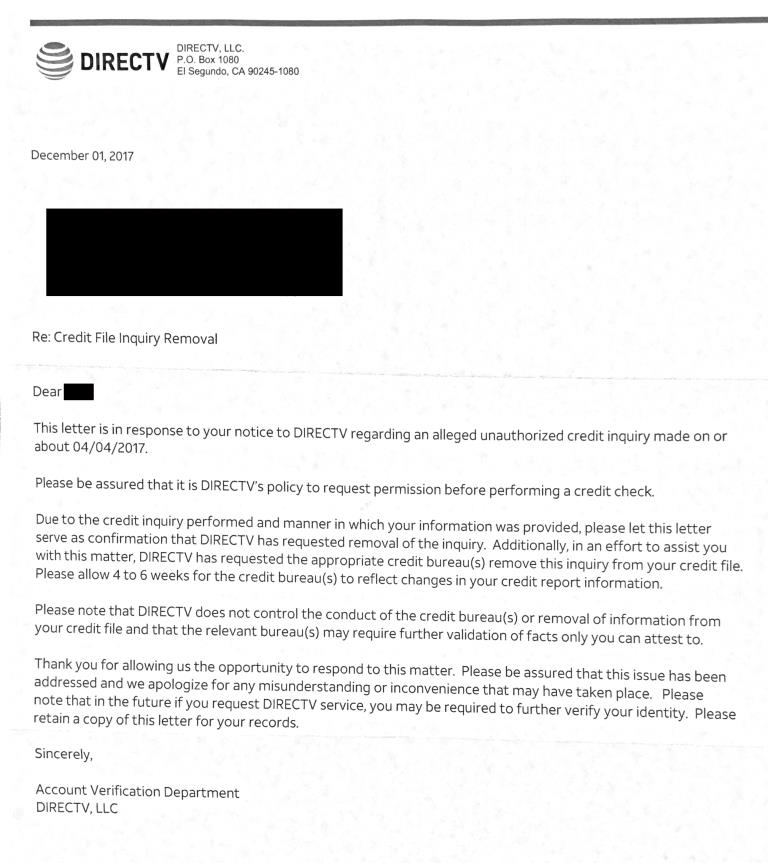

- Hard inquiries on credit reports can impact credit scores

- What to consider before shopping around for a loan

School report cards contain numbers or letters summarizing and evaluating students performance. As they get older, these report cards may be used to help determine students eligibility and acceptance into colleges or other programs.

Your relationship with your Equifax credit report isnt much different. It contains information summarizing how you have handled credit accounts, including the types of accounts and your payment history.

Simply stated, your Equifax credit report is made up of:

-

Personal information such as your full name, address, and Social Security number.

-

as reported to Equifax by your lenders and creditors. This information includes the types of accounts, the date those accounts were opened, your credit limit or loan amount, current balances on the accounts and payment history.

-

Inquiry information. There are two types of inquiries: hard and soft. Read more about inquiries below.

-

Bankruptcies and related details about them, such as the filing date and chapter .

-

Collections accounts. This includes past-due accounts that have been turned over to a collection agency. These can include your credit accounts as well as accounts with doctors, hospitals, banks, retail stores, cable companies or mobile phone providers.

Why inquiries are important

Do your credit homework

Contractual Payment: First Mortgage

For a mortgage, the contractual payment is the required monthly payment amount for your home loan as described and determined by your loan contract. The contractual payment may include principal and interest due and may include a portion of funds due to cover homeowners insurance, mortgage insurance , and property taxes associated with your home.

Here’s how it works:

Principal + interest + mortgage insurance + homeowners insurance and tax = full contractual payment.

You May Like: Is Paypal Credit Reported To The Credit Bureaus

Some Of My Credit Agreements Dont Appear On My Statutory Credit Report Why Not

There are a few reasons why this may happen:

- Recently opened opened and information has not yet been shared with TU

- Information from this provider is not shared with TU at all,

- this is a really old account and at the time of signing it was not as common for users to be notified inforamtion would be shared to CRAs and in this instance the user will need to contact their lender to share their data for CRA purposes.

Although we hold millions of accounts on our database, some lenders dont contribute information about their credit agreements to TransUnion. They may supply data to all three CRAs or only to one or two agencies.

Do Credit Reference Agencies Make Lending Decisions

No. Credit Reference Agencies will not decide whether youre given credit. That is the lenders decision. Credit Reference Agencies are independent organisations holding the information that lenders use to decide whether you should get credit. They play no part in the actual decision-making process and the information they hold is entirely factual.

You May Like: What Does Public Record Mean On Your Credit Report

Dont Worry About The Rest

Legitimate hard inquiries can ding your credit score, but not by much and not for long. Hard inquiries … represent potential new debt that doesnt yet appear in the credit report as an account, says Rod Griffin, Experians director of public education.

Typically, any impact drops off dramatically after a month or two, Griffin says, either because you did not add the debt, so theres no risk, or you did open an account and its now wrapped into other credit factors.

Some companies say they can remove even legitimate inquiries from your report for a fee but NerdWallet advises against using them. As long as youre not continuing to pile up applications, time will repair any damage to your credit.

Griffin advises keeping perspective because other things influence your credit score more .

Hard inquiries alone will never be the reason a person is declined for credit, he says. Inquiries may be the proverbial straw that broke the camels back, but they will not be the entire bale of hay.

About the author:Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

What Does Dt Stand For On Credit Report

| Account in early arrears | |

|---|---|

| DM | Debt management programme in force |

| DT |

. Moreover, what is DT on credit report?

ST Account settled / Closed. SF Satisfied after a defaulting. QY Customer has queried the status. DT Dormant, inactive account.

Also Know, what does AT stand for on a credit report? “C” is used to indicate who the co-signer of an account is, while “S” means that you’re a co-signer and will become liable if the maker defaults. ” T” indicates that your relationship to this account has been terminated.

Subsequently, question is, what does AA mean on Noddle?

AA: Early arrears PS: Partially Satisfied DA: Debt assigned to external collection company.

What does AR mean on Noddle report?

arrangement to pay = not good

You May Like: What Is Syncb Ntwk On Credit Report

What Are Debits And Credits

In a nutshell: debits record all of the money flowing into an account, while credits record all of the money flowing out of an account.

What does that mean?

Most businesses these days use the double-entry method for their accounting. Under this system, your entire business is organized into individual accounts. Think of these as individual buckets full of money representing each aspect of your company.

For example:

-

One bucket might represent all of the cash you have in your business bank account

-

Another bucket might represent the total value of all the furniture your business has in its office

-

Another bucket might represent a bank loan you recently took out

When your business does anythingâbuy furniture, take out a loan, spend money on research and developmentâthe amount of money in the buckets changes.

Recording what happens to each of these buckets using full English sentences would be tedious, so we need a shorthand. Thatâs where debits and credits come in.

When money flows into a bucket, we record that as a debit

For example, if you deposited $300 in cash into your business bank account:

An accountant would say we are âdebitingâ the cash bucket by $300, and would enter the following line into your accounting system:

| Account |

|---|

| $600 |

Real World Example Of The Dti Ratio

Wells Fargo Corporation is one of the largest lenders in the U.S. The bank provides banking and lending products that include mortgages and credit cards to consumers. Below is an outline of their guidelines of the debt-to-income ratios that they consider creditworthy or needs improving.

- 35% or less is generally viewed as favorable, and your debt is manageable. You likely have money remaining after paying monthly bills.

- 36% to 49% means your DTI ratio is adequate, but you have room for improvement. Lenders might ask for other eligibility requirements.

- 50% or higher DTI ratio means you have limited money to save or spend. As a result, you won’t likely have money to handle an unforeseen event and will have limited borrowing options.

Recommended Reading: Paypal Credit Reporting To Credit Bureaus 2019

Changing The Status Of The Application

You can use underwriting screens Applications master screento change the status and sub status of the application.

To change the status of the application

The system checks the information on the Underwriting form using guidelinesestablished during implementation.

The system finds an error based on these guidelines, a Warning messageappears stating Validation Error exist, Unable to Change the status.Please check the Edits.

During status change:

- If there is an error in the edit, system displays an error messageas Errors exist. Cannot change status. Please Verify Edits.and previous status is retained.

- If there is an edit which requires override, the system displaysan override message as Override Required. Do you want to continue?

- If you select Yes, the system will continue with OVERRIDE_REQUIREDprocessing by changing the status.

- If you select No, the system will change the statusback to old status.

During status change, if there is a warning in the edit, the systemdisplays an error message as Warning Exists. Do you want to continue?.

- If you select Yes, the system will continue processingby changing the status.

- If you select No, the system will change the statusback to old status.

Why Does My Credit Score Differ Across Different Credit Reference Agencies

Your TransUnion, Experian and Equifax scores are likely to be different as each of these companies use their own credit scoring system with different maximum scores .

Each CRA assembles your report from information sent to them by lenders, credit card issuers and courts and local authorities. Lenders will have their own scoring criteria like CRAs, and will calculate a credit score based on their perception and interpretation of the information they hold.

Recommended Reading: What Bank Does Carmax Use

Could I Be Turned Down For Credit Because Of A Previous Occupant At My Address

When someone leaves a property, their financial details stay attached to them rather than the address. Someone else can affect your chances of getting credit but only if you have a financial association with them like a joint bank account or joint mortgage, not because you lived at the same address.

What Is A Credit Score

A credit score is a number calculated based on the information in your credit report. It represents your creditworthiness and the likelihood of you making repayments. Each credit reference agency has a different version of a credit score and most lenders generate their own score based on the information in your credit report. A high score means youre more likely to be accepted for credit.

Read Also: When Does Open Sky Report To Credit Bureau

What Is The Meaning Of Debit And Credit

There are a few theories on the origin of the abbreviations used for debit and in accounting. To explain these theories, here is a brief introduction to the use of debits and credits, and how the technique of double-entry accounting, came to be.

A Franciscan monk by the name of Luca Pacioli developed the technique of double-entry accounting. Pacioli is now known as the “Father of Accounting” because the approach he devised became the basis for modern-day accounting. Pacioli warned that you should not end a workday until your debits equal your credits.

Debit Cards And Credit Cards

Debit cards and credit cards are creative terms used by the banking industry to market and identify each card. From the cardholder’s point of view, a credit card account normally contains a credit balance, a debit card account normally contains a debit balance. A debit card is used to make a purchase with one’s own money. A credit card is used to make a purchase by borrowing money.

From the bank’s point of view, when a debit card is used to pay a merchant, the payment causes a decrease in the amount of money the bank owes to the cardholder. From the bank’s point of view, your debit card account is the bank’s liability. A decrease to the bank’s liability account is a debit. From the bank’s point of view, when a credit card is used to pay a merchant, the payment causes an increase in the amount of money the bank is owed by the cardholder. From the bank’s point of view, your credit card account is the bank’s asset. An increase to the bank’s asset account is a debit. Hence, using a debit card or credit card causes a debit to the cardholder’s account in either situation when viewed from the bank’s perspective.

Also Check: Centurylink Collections Agency

Rens Annual Letter To Shareholders

As part of our tradition to offer candid insights on the banking industry and the communities where we operate, were pleased to share our Annual Letter to Shareholders.

This years letter explores the impact of the pandemic, the rise of unregulated financial companies and our continued commitment to driving positive change across our growing footprint.

Artist: Robert Szpak, part of ARISE. M& T is a proud supporter of the arts and organizations like ARISE who share our sense of responsibility in advocating for community engagement, education, inclusivity and empowerment.

My Details On The Electoral Register Are Incorrect How Do I Update Them

Each local authority updates Credit Reference Agencies at different times. If the information on your credit report regarding your electoral registration is incorrect, youll need to raise a dispute against it on your credit report and supply us with evidence from your local authority in order to update your credit file.

Once youve raised a dispute, please email your supporting documentation to or send it to Consumer Services Team, PO Box 491, Leeds LS3 1WZ.

You May Like: Aargon Agency Inc Collections

How Do I Get Judgments Removed From My Credit Report

Most judgments are automatically removed six years after the original judgment date, with a few exceptions:

- The courts will also allow a judgment to be removed entirely when it is paid within one month and is therefore set aside by the court.

- If the judgment is not yours, in the sense that its not in your name at an address you have been financially known at, you should raise a dispute against it. If its in your name and at an address youve been known at, please contact the issuing court for further information.

- Judgments issued by a Sheriff Court will require you to supply them with evidence from the plaintiff that the debt has been paid before it will be marked as satisfied.

- Judgments included in an insolvency or bankruptcy are not automatically marked as satisfied when the insolvency or bankruptcy ends. Youll need to contact the issuing court with evidence of the insolvency or bankruptcy ending and ask them to update their records.

Understanding Debit And Credit

Let’s review the basics of Pacioli’s method of bookkeeping or double-entry accounting. On a balance sheet or in a ledger, assets equal liabilities plus shareholders’ equity. An increase in the value of assets is a debit to the account, and a decrease is a credit. On the flip side, an increase in liabilities or shareholders’ equity is a credit to the account, notated as “CR,” and a decrease is a debit, notated as “DR.” Using the double-entry method, bookkeepers enter each debit and credit in two places on a company’s balance sheet.

For example, Company XYZ issues an invoice to Client A. The company’s accountant records the invoice amount as a debit in the accounts receivables section of the balance sheet and records that same amount again as a credit in the revenue section. When Client A pays the invoice to Company XYZ, the accountant records the amount as a credit in the accounts receivables section and a debit in the cash section. This method is also known as “balancing the books.”

Read Also: Syncb Verizon