Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

Your Bankruptcy Fell Off Your Credit Report

When bankruptcy falls off your credit report after seven years , you’ll likely move to a new credit scorecard, similar to what happens when a collection drops off your credit score. You could see a drop in your credit score because now your credit performance is being compared to other people who haven’t filed bankruptcy.

Poor Credit Scores From Vantagescore

Like FICO, VantageScore credit scores range from 300 to 850. But how it judges scores is a little different. For example, VantageScore makes a distinction between poor and very poor credit scores. The company says a credit score is poor if itâs between 500 and 600, while a score from 300 to 499 is called very poor.

âIn general, people with higher scores can get more credit at better rates,â VantageScore says. So you could have trouble getting approved for higher-limit, low-interest cards if your credit score falls at 600 or below.

Don’t Miss: Do Klarna Report To Credit Bureaus

Don’t Let Your Partner Or Flatmate’s Score Wreck Yours

It’s not usually whether you kiss, hold hands, live together or even being married that links your finances, it’s simply whether you have a joint financial product.

If you are financially linked to someone on any product, that means their files can be accessed and looked at as part of assessing whether to accept you. Even just a joint bills account with flatmates can mean you are co-scored.

Therefore if your partner/flatmate has a poor history, keep your finances rigidly separate, and it should maintain access to good credit for you. If your finances are already linked and you’ve split up with your partner or moved out of your flat-share, make sure you take the time to financially de-link and ask the credit reference agencies for a notice of disassociation .

There are currently only four products that can infer financial linking a joint mortgage, a joint loan, a joint bank account , and in certain circumstances, your utility bills. Being jointly named on a bill with a flatmate shouldn’t mean you are financially linked this should only happen when the energy firm is confident you’re a couple .

It’s worth noting that while many people think they have a “joint” credit card, these technically don’t exist. It’s one person’s account, the other just has a second card to access it.

The Us Department Of Education

Direct Subsidized Loans are offered to undergraduates demonstrating financial need. Your school will decide how much you can borrow based upon your FAFSA, but the amount cannot exceed your financial need.

The U.S. Department of Education pays the interest on the loan during the following periods:

- While you are enrolled in school at least half-time.

- The six-month grace period following the date you graduate or otherwise leave school.

- During a period of deferment in which your loan payments are postponed for an acceptable reason.

Direct Unsubsidized Loans are available to both undergraduates and graduates. They are not based on financial need.

Your school determines the loan amount according to the cost of attendance and whatever other financial aid you will receive. Borrowers are responsible for loan interest repayments during all periods.

You may postpone loan interest payments during periods of attendance, the grace period, or period of deferment, but doing so will add the interest to the principal amount of the loan.

Recommended Reading: How Long Is A Repossession On Your Credit

What Are The Penalties

Having bad credit often indicates that you are a more risky borrower, which can make it harder to get approved for new credit cards, a mortgage, or other loans. If you are approved, you may be offered only a high interest rate or other unfavorable terms.

Bad credit can impact other areas of your life as well. If you have bad credit, landlords may not accept you as a renter, or may only agree if you have a co-signer. It can even make it harder for you to get a job if your potential employer checks your credit score as part of your job application.

A good credit score shows youre a dependable borrower, which makes lenders more willing to have a relationship with you and give you funds. Consumers with very good and exceptional credit scores have better odds of loan, rental, and mortgage approval. They can choose from a wider selection of credit cards and loans with more favorable interest rates.

Most businesses that check credit scores are easier to work with when you have a good credit score.

Identity Theft Or A Mixed Credit File Is Dragging You Down

A much lower score than you expected might mean that someone elses credit activity is being reported as yours. This could be because a criminal is using your credit card number or opening new accounts in your name.

It could also happen if you have the same name as someone else and your credit files have become mixed with theirs. Both should be disputed with the credit bureaus.

You May Like: Syncb/ppc Credit Inquiry

‘i Am Not A Number I’m A Free Man’ Er Not With Credit Scoring

We don’t have a right to be lent money. While the Government pushes lenders to offer more credit, especially in the small business and mortgage worlds, ultimately it’s still a commercial decision from firms about whether they want to lend.

This is done with a massive system of automated impersonal credit checks. It’s often far cheaper for a lender to reject some people who it should be lending to than it is to accept some it shouldn’t be lending to.

You may feel it’s unjust, but The Prisoner‘s call “I am not a number, I am a free man” doesn’t work in credit scoring. Here you are just a number, and you have to understand that, as frustrating as it may seem.

How To Fix A Bad Credit Score

To fix a bad credit score, understand the basic contributors to creditincluding whether you pay your bills on time and whether you carry balances on credit cardsand identify the factors that are making a negative impact. Checking for errors on your credit report is also an important step.

Your is a three-digit number, usually between 300 and 850, that’s based on the information in your credit report. It’s valuable for lenders, who need to understand how likely you are to repay money you borrow.

While there are several credit scoring models with different score ranges, 700 or higher is generally considered a good credit score, while 800 or higher is excellent. If your score isn’t quite in that range, here’s how to get it back in shape.

Also Check: Check Credit Score With Itin

Increase The Length Of Your Credit History

The longer you have a credit account open and in use, the better it is for your score. Your credit score may be lower if you have credit accounts that are relatively new.

If you transfer an older account to a new account, the new account is considered new credit.

For example, some credit card offers come with a low introductory interest rate for balance transfers. This means you can transfer your current balance to this new product. The new product is considered new credit.

Consider keeping an older account open even if you don’t need it. Use it from time to time to keep it active. Make sure there is no fee if the account is open but you don’t use it. Check your credit agreement to find out if there is a fee.

Is A 600 A Bad Credit Score

Scores, from 580 to 669, reflect fair grades because they are within your range.As you can see, credit scores are lower when you have a 600 FICO Score.A lender who rates a Fair range consumer as having unfavorable credit, as well as declining his or her application, may consider the consumer to be a liability.

Also Check: Paypal Credit Score Check

Use ‘soft Searches’ For New Credit

When you apply for credit a lender will perform a hard credit search to check if you are eligible. This will leave a ‘footprint’ on your credit file, which will be visible to other lenders.

So it’s worth asking lenders to perform a soft search’ rather than a hard credit search when you’re looking to get new credit. This should give you an idea of whether your application would be accepted, as well as what interest rate you’d be charged, but won’t be visible to other lenders on your credit report.

More and more lenders are offering soft searches, including on loans, credit cards and mortgages.

How long will this take to boost my score?

Using soft searches won’t boost your score, but it can help protect it. By not using hard searches, your score will remain in tact while you’re shopping around for a new mortgage, loan or credit card.

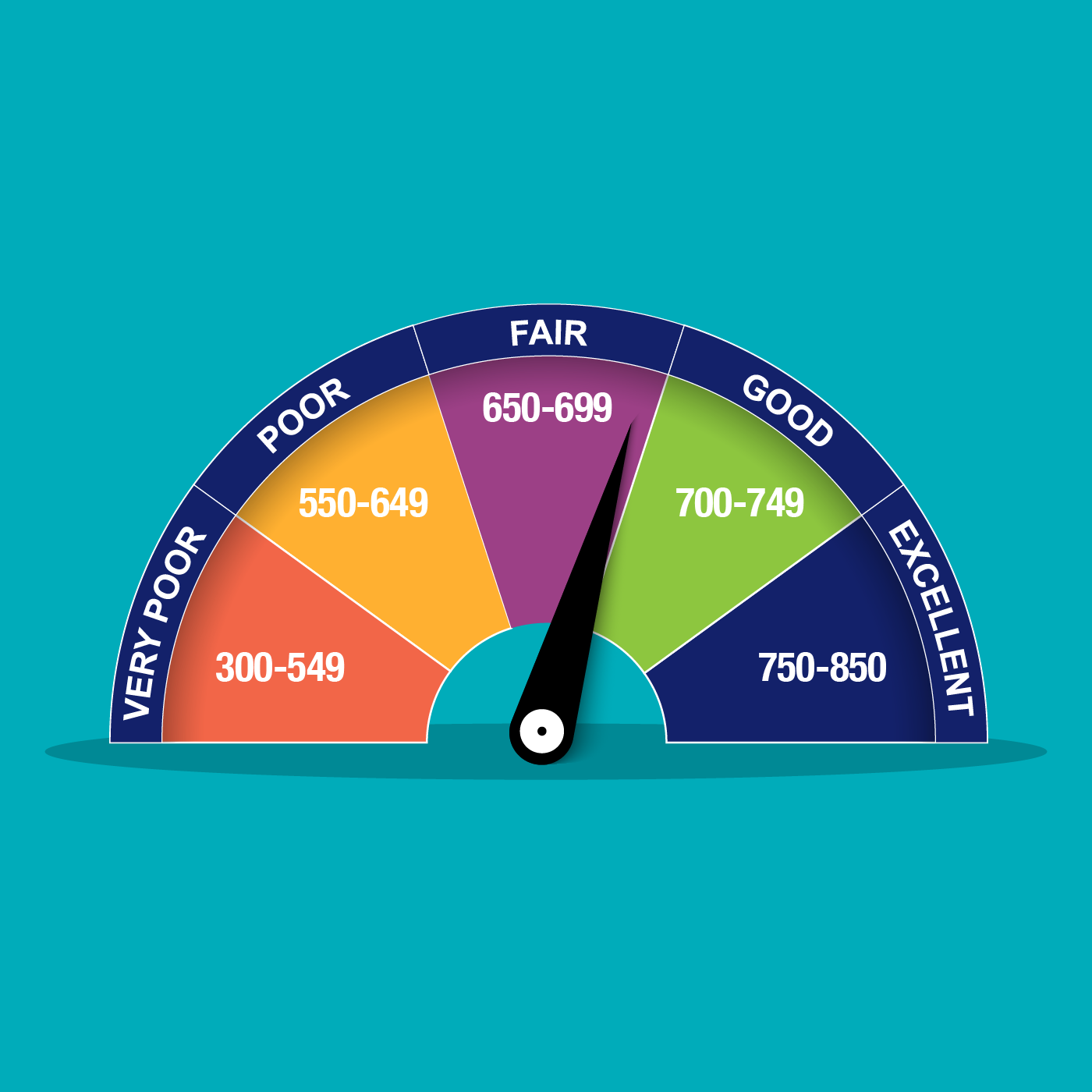

What Are The Credit Categories

Each credit checking agency uses a different numerical range to determine your credit score. This means youll have a different credit score depending on which credit checker you look at. Although different credit agencies have different ranges, they usually have five categories for credit scores. The categories for credit scores are: excellent, good, fair, poor, and very poor.

In the UK, there are three main credit reference agencies. They all have different ranges for working out your credit score:

-

Trans Union 0-710

You May Like: Navy Fed Car Buying Program

Sign Up To Mse’s Credit Club Which Includes Your Experian Credit Report

Our totally free MoneySavingExpert.com Credit Club helps you keep a track of your credit record. You can here’s what it does:

You can get your full Experian Credit Report for FREE through Credit Club. See our full details on how this will work.

You’ll get a free Experian Credit Score. This will give you an indicator of how lenders see you when assessing you for credit applications.

Our unique affordability score. This clever tool will help you work out how much you can afford to borrow, using calculations based on your income and estimated spending.

Our unique Credit Hit Rate this will show you your chances of success, expressed as a percentage, of grabbing our top cards and loans.

Eligibility tool to show your best credit deals. It reveals the likelihood of you getting top credit cards or loans.

Wallet workout tool to check if youre on the best credit products for YOU.

Your credit profile explained. It shows the key factors affecting your score and how to improve them.

Do Business Loans Look At Personal Credit

The three business loan providers we have reviewed here all offer business loans despite low credit scores for the business itself and/or for its owners. Very often, small businesses dont have their own credit scores, so lenders may turn to the personal scores of owners when underwriting these loans.

As we point out above, Kabbage, Fundbox, and BlueVine take into account other factors, such as time in business and annual revenues, to offer loans to businesses lacking good credit.

If you qualify, you might want to check out loans facilitated by the Small Business Administration. The SBA offers guarantees for loans made to small businesses that meet the agencys eligibility requirements.

Business owners can expect that derogatory information in their personal credit histories may hurt their approval chances. Its not likely a lender will overlook an owners recent delinquency, bankruptcy, or collection.

But the opposite also applies creditworthy behavior on the part of owners can help rehabilitate their credit scores and improve their chance of approval for a business loan.

If you have trouble qualifying for a small business loan, you may have better luck applying for a business credit card. These cards are often easier to obtain than business loans and may offer rewards such as cash back, miles, or points. Furthermore, many business credit cards allow owners to get free extra cards for employees, thereby multiplying the rewards the owner can earn.

Read Also: Does Comenity Bank Report To Credit Bureaus

Why Is My Credit Score Low Even Though I Pay My Bills On Time

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If your credit score is lower than you thought it would be, you probably want to know why and what it will take to fix it.

It can be especially perplexing if you thought you always paid on time and expected to have a good credit score. Here are five reasons you may be in a lower credit score range than expected.

Bad Or Poor Credit Score Ranges

A credit score represents âa snapshot of a personâs creditworthiness,â the Consumer Financial Protection Bureau says. And thatâs why the CFPB says potential lenders might use your credit score to make decisions about things like approving loans and extending credit.

Credit-scoring companies use different formulas, or models, to calculate credit scores. There are many different credit scores and scoring models. That means people have more than one score out there. Most range from 300 to 850, according to the CFPB. And the CFPB says some of the most commonly used credit scores come from FICO® and VantageScore®.

But how they determine scores and their definitions of what constitutes poor credit differ. Itâs important to remember that credit decisionsâand whatâs considered a bad scoreâare determined by potential lenders. But here are some more details about how FICO and VantageScore generally view credit scores.

You May Like: Does Overdraft Affect Credit Score

What Factors Influence Your Credit Score

FICO Score

VantageScore

‘soft Searches’ Incl If You’ve Checked Your Own File

Some lenders will do a soft search of your credit report, to tell you both whether you qualify to borrow from them, and what rate they are willing to give you. This isn’t passed on to other lenders when they credit-check you.

When you check your own file, it does appear on your credit report. It’s not always clear, but the words “administration check” or “quotation search” should indicate something, but lenders can’t see this so it doesn’t play any role in any assessment of you.

You May Like: How Many Years Does An Eviction Stay On Your Record

Can I Get A Home Loan With A Low Credit Score

As exemplified by the home loan providers reviewed in this article, your low credit score doesnt necessarily disqualify you from this type of loan.

Remember, it is a collateralized loan secured by your home. Lenders know that, as a last resort, they can foreclose on your home and resell it to recoup their loans.

Some of the best home loan sources are peer-to-peer marketplaces, such as LendingTree, where up to five lenders may offer mortgages, home equity loans, home refinance loans, and reverse mortgages to a borrower. If you prefer dealing directly with a bank, Wells Fargo, Citi, and Bank of America offer low-credit-score home loans with little or no down payments and closing costs rolled into the loan.

Home equity lines of credit may be the most versatile home loans because you can use and reuse the same credit line without applying for a separate loan each time. Another time-tested way to get money from your home is to perform a cash-out refinancing.

You can extract some or all of the equity youve built over time by paying down your mortgage principal. On a cash-out refi, you convert your home equity into cash by taking out a new mortgage for a larger amount than the existing loan.

Your new loan repays your old one plus puts cash in your pocket. Some lenders charge reduced closing fees for refinancing versus the fees for first mortgages.

Does A Bad Credit Score Mean You Cant Get A Mortgage

No. Having a bad credit rating doesnt mean you cant get a mortgage. A lower credit score can make things harder, but it doesnt make homeownership impossible.

For example, if your Experian credit score is in the Poor category, there is still a chance of being approved for credit. Experians Poor category ranges from 561-720, which has a bit of a flex in it.

Its likely that most mortgage lenders wont want to lend to you if you have a Poor or Very Poor rating, but theres still lenders who will.

You could be asked to pay a high-interest rate and have a low credit limit. Or, you could be able to get a mortgage offer from a specialist lender who is willing to look at mortgage applications on a case-by-case basis, rather than just a simple Computer says no. To get in touch with specialist lenders, you need a specialist mortgage broker. Get in touch and we will match you to the perfect mortgage broker for you.

Go to our page Bad Credit Mortgages to find out what options you have if you have a bad credit score or have had credit issues in the past.

Read Also: Affirm Credit Score Needed