How Accurate Is Discover Credit Score Tracker

The Discover FICO score is a real FICO score.

It uses FICO 8 and TransUnion.

So _the score presented is 100% accurate with any FICO 8 score generated from the same TransUnion report_.

That Fico score in not 100% in reality but the secret is that lenders, creditors and banks do take it as a determinant factor.

Your Credit Karma Score May Be Insufficient

Credit Karma updates its scores once per week. For most people that’s plenty, but if youre planning to apply for in the near future, you may need a more timely update.

Although VantageScore’s system is accurate, its not the industry standard. Credit Karma works fine for the average consumer, but the companies that will approve or deny your application are more likely to look at your FICO score.

Redeem Any Amount At Any Time

No need to wait until you have $100 of cash-back in your account before you can redeem your rewards, like some other cards require.

Discover allows you to redeem any amount you want, any time you want.

- Cash You can elect to have your cash-back deposited into your bank account or applied as a statement credit.

- Amazon When checking out on Amazon.com, you can pay with your Discover rewards.

- Gift Cards Use your rewards to purchase gift cards and receive $5 free added. Gift cards start at $20.

- Charity Use your rewards to donate to charity.

Bottom Line:

Also Check: What Is Credit Bureau Report

How Does A Discover Credit Card Work

Discover credit cards operate just as you would expect. The issuer offers credit cards for every type of credit and allows you to prequalify with no harm to your credit. You can apply online, over the phone, or by responding to a prescreened offer in the mail.

The application process is quick and should provide you with a decision instantly. If you are accepted, Discover will expedite the shipment of your new rewards card so it arrives within five days.

The credit limit on most Discover unsecured credit cards is determined by your credit history, but the secured cards limit depends on the amount of your security deposit. The two student credit cards do not require you to have any credit history. Your credit limit establishes how much you can charge on your card, withdraw in cash advances, and allocate to balance transfer offers.

As with virtually all credit cards, Discover cards have a grace period of at least 23 days between the statement closing date and payment due date. Pay your full balance before the end of the grace period to avoid interest charges.

If you prefer, you can finance your purchases over multiple billing periods. Just be sure to pay at least the minimum amount by the due date to avoid late fees . The APRs charged by Discover for carrying a balance across billing periods are very competitive with those of rival credit card companies.

Whats In My Credit Reports

Your are records of your past dealings with creditors and other credit history. They include information such as your name, addresses, employers, the history and status of various credit accounts, and inquiries from companies checking your reports. If applicable, youll also find information from public records, such as bankruptcies, tax liens and civil judgments.

Read Also: How To Get Credit Report Without Social Security Number

How Does Credit Karma Work With Real Estate

Home buying power and credit score are two things that go hand in hand, especially when it comes to the mortgage interest rate you will receive. If you have a better credit score, theoretically that should improve your home buying power. The best thing about the Credit Karma service is that it can teach you how to improve your credit score over time with simple tips and tricks that allow you to increase your home buying power over time. When it does come time to buy a home you will be well prepared to do so thanks to the Credit Karma service.

When searching for great applications to use to monitor your credit score look no further than Credit Karma!

The 5 Best Credit Monitoring Apps Of 2021 According To Experts

Select is editorially independent. Our editors selected these deals and items because we think you will enjoy them at these prices. If you purchase something through our links, we may earn a commission. Pricing and availability are accurate as of publish time.

Continuously monitoring your credit now can save you a lot of headaches in the future, especially if youre suddenly plagued by fraudulent abuses of your personal information. In 2020, the Federal Trade Commission received more than 1.4 million reports of identity theft in the U.S., double the previous year, with the top three reports listed as credit card fraud, government documents or benefits fraud and loan or lease fraud.

While credit monitoring services dont prevent fraud from showing up on your credit report or affecting your credit score, experts say they can help detect major changes to inform necessary action. But credit monitoring sites and apps vary when it comes to cost and services understanding what they do and whats best for you are important before investing in a specific plan. To figure out the best approach to finding the best credit monitoring apps, we consulted financial experts.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

What Credit Score Do Lenders Use

The two main companies that produce and maintain are FICO® and VantageScore. Lenders most commonly use the FICO® Score to make lending decisions, and in particular, the FICO® Score 8 is the most popular version for general use. If you’ve taken an interest in the health of your credit and how lenders will view it, checking your FICO® Score 8 is a smart place to start.

There are, however, many types of FICO® Scores. FICO® has released updates to its basic score over the years, and the FICO® Score 10 is the most recent. Mortgage lenders most often use older versions to assess applicants: the FICO® Score 2, 4 or 5.

There is also the FICO® Bankcard Score and the FICO® Auto Score . If you know you’re interested in a certain type of credit, it could be worthwhile to check beforehand the specific score type you know a lender will look at.

How Many Discover Cards Can You Have

You may be qualified for multiple Discover credit cards, but the card issuer sets a limit of two cards per individual. You need to own your first Discover card for at least 12 months before you can apply for a second.

While strict, at least this ownership cap is easy to understand. Its less complicated than Chases 5/24 Rule, which withholds a new Chase card when youve opened any five or more new credit accounts within the past two years.

Recommended Reading: When Does Opensky Report To Credit Bureaus

Simple Tips For Improving Your Credit Scores

For anyone looking to improve their credit scores, I have put together some simple tips you can do on your own:

Pay all of your bills on time- This one ties into the previous tip and is just as important for improving credit scores. If you cant keep up with payments consistently, its going to hurt any kind of potential progress that might have been made.

Dont ask for a credit limit increase- This is another tip thats easy to understand, yet people often forget about it when theyre trying to improve their FICO scores. The more you open new accounts and raise your limits with them, the lower your score will be because of potential risk factors involved in this behavior.

Cancel unused cards- This tip is great for people who have a lot of credit card accounts open. Having an account open and not using it increases the risk associated with those accounts, so I recommend canceling as many as possible if youre trying to increase your FICO scores.

Monitor your credit report- The final tip I have for you is to monitor your credit reports. If there are problems, its better if you can find out about them before lenders do!

How Can I Increase My Discover Credit Limit

If you feel constrained by your current credit limit, you can apply for a higher credit limit on your unsecured Discover credit card. This may be worthwhile if you are contemplating some big-ticket purchases that you plan to finance over multiple billing periods.

A higher credit limit can also translate into larger cash advance and balance transfer limits.

Discover offers several options when you want a higher credit limit:

- Ask for an increase: Log in to your account at the Discover website and complete the request form. Or, call 1-800-347-2683 and speak to a customer representative.

- Get a new card: Your credit history may allow you to acquire another card if your current card saddles you with a low credit limit.

- Be patient: Discover may reward your creditworthy behavior by offering you an unsolicited credit limit increase.

When negotiating a credit limit increase with a customer rep, explain how you earned it rather than why you need it. Points in your favor include having a history of on-time payments, a second job, a higher salary, and lower expenses.

Keep the following negotiating tips in mind:

A higher credit limit need not be an automatic invitation to spend more. If you drive your credit utilization ratio above 30%, youll hurt your credit score and your chances for another credit limit increase.

Recommended Reading: Does Opensky Report To Credit Bureaus

Here’s How To Check Your Fico Score For Free

Checking your credit score is free and easy to do. And doing so won’t lower your score, though that’s a common myth.

The easiest way you can access your free credit score is through your credit card issuer. Many banks and issuers offer cardholders free access to their FICO Score, including the companies listed below:

Re: Discover Fico Is Wildly Incorrect

I just got my Discover IT card about 6 weeks ago. The FICO score they have is 8 weeks old and 50 points below what it was when I applied. Now I’m actually pretty suprised I got a 4K starting limit with them, but will this affect CLI’s? Or will they catch up to what my actual score is? Just a side note, I got the Amex BCE card the same day, and they have the correct FICO on file

Discover provides you with a TU FICO 8 score, where Amex provides you with an EX FICO 8 score. Looking at these two scores, neither is “incorrect.” They are scores drawn using different bureau data, that’s all. Trying to compare them would be like comparing apples to oranges.

Read Also: What Is Syncb Ntwk On Credit Report

How To Increase Your Chances Of Getting Approved For A Discover Card

Getting approved for a credit card requires a little planning. Most credit card offers require very good credit. When applying for new credit, its important to know your credit scores and whats on your credit reports.

Discover wants to see a strong credit history, steady income, and low credit utilization. If youre using too much of your existing revolving credit, its a sign that you may not pay them back. Its also important to make sure that you havent applied for too much credit in the recent past. Having too many credit inquiries can lessen your chances of getting approved.

Why Your Credit Karma Credit Score Differs

There are multiple reasons why your credit score differs between what a personal finance website tells you and what your credit card company or a prospective lender find.

This is mainly because of two reasons: For one, lenders may pull your credit from different , whether it is Experian, Equifax or TransUnion. Your score can then differ based on what bureau your t is pulled from since they don’t all receive the same information about your credit accounts. Secondly, different credit score models exist across the board.

As it states on its website, Credit Karma uses the VantageScore® 3.0 model. VantageScore may look at the same factors that the other popular FICO scoring model does, such as your payment history, your amounts owed, your length of credit history, your new credit and your credit mix, but each scoring model weighs these factors differently.

For this reason, VantageScore and FICO Scores tend to vary from one another. Your VantageScore® 3.0 on Credit Karma will likely be different from your FICO Score that lenders often use.

If you plan on applying for credit, make sure to check your FICO Score since there’s a good chance lenders will use it to determine your creditworthiness. FICO Scores are used in over 90% of U.S. lending decisions.

Editorial Note:

Read Also: How To Get Credit Report Without Social Security Number

Qualify For A Discover Card With Less Than Perfect Credit

If you have bad credit or no credit history, you wont qualify for most credit cards.

Secured credit cards like the Discover It Secured Credit Card can be a viable solution for building a credit history or re-building one that is less than perfect.

Finding a secured credit card is not difficult, but finding one that earns cash-back rewards is rare. Heres what you can expect from the Discover It Secured Credit Card:

- 2% cash-back at restaurants and gas stations

- 1% cash-back on all other purchases

- Cash-back match at first card anniversary

Youll also have the same redeem any amount/any time redemption privileges, zero fraud liability, and security options allowing you to freeze your account and get custom alerts.

Bottom Line: While secured credit cards require a security deposit, theyre an excellent solution for rebuilding credit. Earning rewards and not having to pay an annual fee are huge positives for a secured credit card.

Is It Bad To Check Your Credit Score

Checking your credit score doesnt hurt your credit, and even if youre not applying for credit, its smart to get into the habit of checking it regularly. In fact, the simple act of checking your credit score is one way you can improve your credit. If you notice a dip in your score, it may alert you to potential fraud or errors on your report.

Read Also: Who Is Syncb/ppc

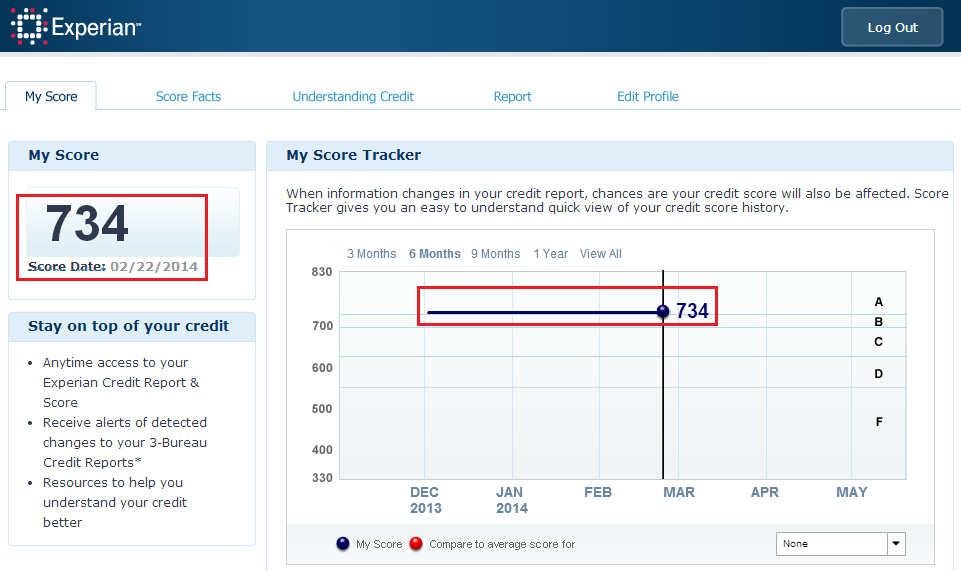

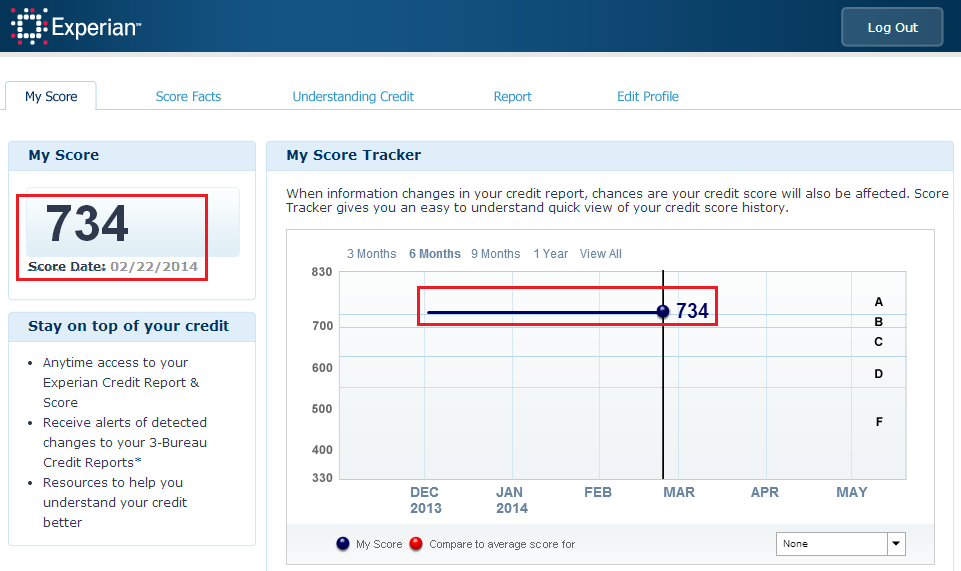

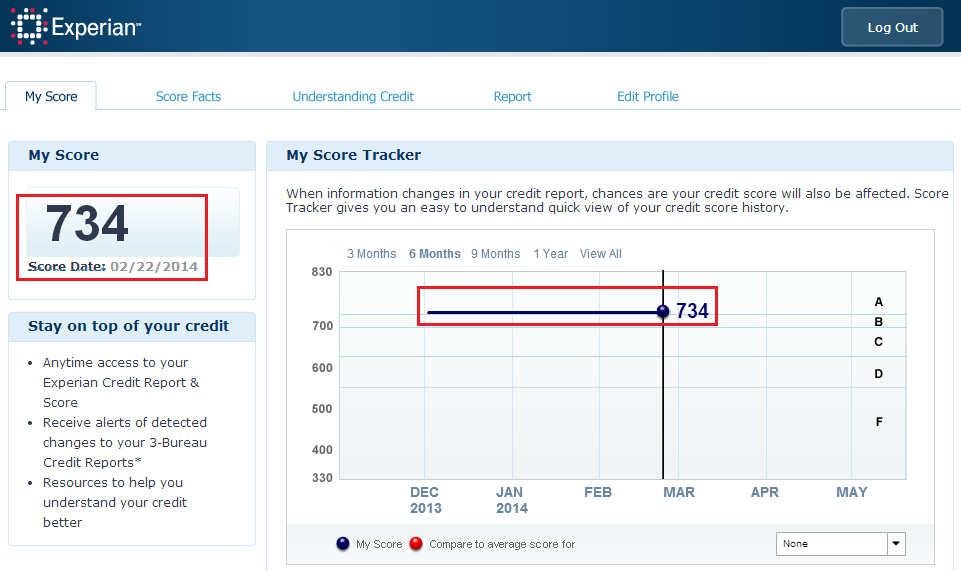

Why Discover Credit Scorecard

Discover credit scoreboard provides free FICO credit score from Experian. Experian is one of the three major consumer credit bureaus. FICO credit score is very important because most of the financial institutes and lenders use FICO credit score. There are many free credit score providers available like Credit Karma, Credit Sesame, etc. and they only provide a VantageScore credit score. VantageScore and FICO credit scores are not the same and FICO is the most important credit score therefore Discover credit scorecard is more significant. In the Discover credit scoreboard, your free credit score will update monthly. The Discover credit scorecard will be a good option if you

1. Want to check your FICO score more frequently

2. Want to check the FICO score than the VantageScore

3. Want free credit monitoring and free SSN monitoring

What Credit Monitoring Services Dont Do

Credit monitoring services are informational: They dont prevent identity theft, nor do they stop people from opening new accounts or making unauthorized payments in your name. They also dont report identity theft people will need to contact the FTC if they suspect someone is using their personal information. Credit monitoring services dont prevent your information from being stolen in data breaches, fix errors found in your credit report, freeze your credit in case of fraud or warn you if anyone filed a tax return in your name.

Don’t Miss: How To Get A Repo Removed From Your Credit

Your Fico Score May Differ

On the customer review site ConsumerAffairs.com, some people have reported that their Credit Karma score is quite a bit higher than their FICO scores. Whether these posts are reliable is unknown, but it is worth noting.

If your Credit Karma score isn’t accurate, the problem is probably elsewhere. That is, one of the bureaus made an error or omitted information. Or, the information might have been reported to one bureau but not others.

Using Credit Karma won’t hurt your credit score. Your search is a self-initiated inquiry, which is a “soft” credit inquiry, not a “hard” inquiry.

How Accurate Is Credit Karma

Is Credit Karma Accurate? A common question from people who are using the free credit monitoring service. In this article we will dive into everything you need to know about Credit Karma’s accuracy, how often Credit Karma updates, how the service works, as well as what to be aware of:

Many people looking to buy a home will need to know their credit score and how accurate is Credit Karma? is one of the more common questions we receive.

Below we will give you an in-depth overview of what is, how accurate Credit Karma is and how often Credit Karma updates.

Lets dive in so we can understand how accurate Credit Karma is:

Also Check: What Is Syncb Ntwk On Credit Report

Does A Fico Credit Score Accurately Predict A Borrower’s Future Ability To Repay Debt

FICO did a study on how well its credit scores mirrored borrowers’ risks for defaulting on their debt, and according to an analysis for the Federal Reserve, it looks like its credit score does correlate with a borrower’s ability to repay debt in the future. It looked at the actual performance of borrowers between 2008 and 2010, relative to their credit scores and found this:

|

FICO® Score |

|---|