Why Having A Good Credit Score Is Important

Your credit score is one of the most important factors lenders look at when determining your creditworthiness, but your credit score can affect you in ways beyond taking out loans. Here are some reasons why having a good credit score is important:

- It can affect whether you qualify for a loan. Whether youre applying for a home loan, auto loan, personal loan, or credit card, most lenders will look at your credit score to determine whether to approve you. The higher your credit score, the better your chances of getting approved.

- It can affect what interest rates and terms you get. Even if youre approved for a loan, you may not qualify for the lowest interest rates if you have a bad credit score. The more lenders feel youre a credit risk, the more theyre likely to charge you to lend to you. Having a bad credit score can also limit the loan amount or the length of the loan you qualify for.

- It can affect your insurance premiums. Although not the primary factor, your credit score can affect your insurance premiums. According to , people with excellent credit scores have 24% lower premiums than those with median scores.

- It can affect how employers see you. Even if your job has nothing to do with lending or finance, some employers may look at your credit score as part of a background check. Employers may see a good credit score as a sign of high personal responsibility and evaluate you accordingly.

What Is Your Credit Score

The most common credit score range is 300 to 850. In other words, 850 is the best credit score you can have, while 300 is the worst. And a good credit score is anything from 700 to 749. All of the most popular credit-scoring models, including those from VantageScore and FICO, now use that 300-to-850 credit score scale. Thats good because knowing the possibilities for what a credit score could be is the first step toward truly understanding what your credit score means.

To help you better understand the significance of your score, whichever it happens to be, WalletHub analyzed every single credit score from 300 to 850. Below, you can take a closer look at the different tiers in the credit score range, learn everything you need to know about your particular score, and see what steps you can take to improve.

What Does A 720 Credit Score Get You

| Type of Credit |

|---|

| 31.08% |

*Based on WalletHub data as of Oct. 7, 2016

As you can see, the majority of us are in the top two tiers of the credit-score range. A lot of people dont know where they stand, though, considering that 44% of consumers havent checked their credit score in the past 12 months, according to the National Foundation for Credit Counseling. If youre one of them, you can change that by checking your credit score on WalletHub.

Don’t Miss: What Is A Public Record On Your Credit Report

What Is A Good Credit Score For A Credit Card

Like other lenders, credit card issuers will consult your credit score to determine the risk of doing business with you before approving you for a new credit card. If you want to open a premium travel rewards credit card, you may need good and perhaps even excellent credit scores to qualify. For other types of credit cards, even some with 0% introductory APR offers, a good credit score may be sufficient to be approved for the card.

Beyond qualifying for a credit card, your score can also have a significant impact on the APR and other terms of your account. Credit card issuers not only rely on credit scores to help them determine whether or not to approve applications, but they also use scores to set the pricing on the accounts they approve.

Take this list of top credit cards, for example. Youll notice that every credit card offer features not a specific rate, but rather an APR range. A card issuer might advertise an APR of 13.49% to 24.49%. The reason for that range is because the card issuer will base the final rate it offers you on the condition of your credit.

Defining a specific number that a credit card issuer defines as a good score is tough for two reasons:

How A 680 Credit Score Affects Your Mortgage

For quite some time, mortgage rates have held near historic lows.

This boosts the amount of home a home buyer can purchase and has increased the monthly savings available via a home loan refinance.

However, as many borrowers have learned the hard way, not everyone can access ultra-low rates.

For borrowers with conventional loans, the ability to access these best mortgage rates is directly linked to their credit score.

But certain loan programs specifically tailored to those with lower credit can be more cost-effective. Heres what you should know.

Recommended Reading: Where Does Your Credit Score Start

Equifax Credit Score Ratings

- B: 720-780

- A: 800-850

Remember, these ratings are just a guide, and lenders will often use other criteria to decide whether youre a safe investment.

If your score is lower than 660, you should take steps to improve it before you make any major financial decisions, like applying for a mortgage. When it comes to big loans, even a slightly better interest rate can save you thousands.

How Much Will I Be Able To Increase My Credit Score In 6 Months

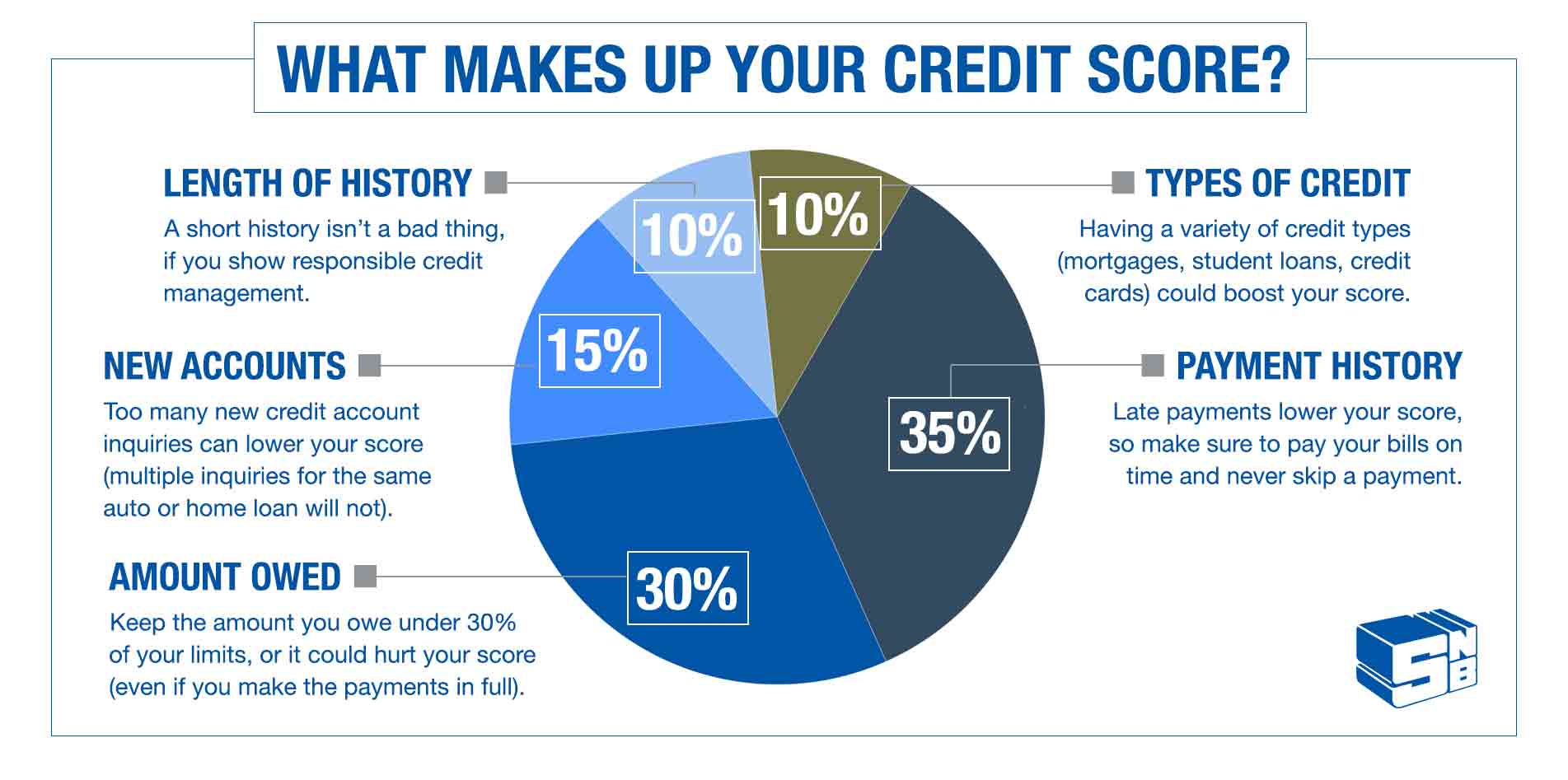

- Payment History

- Amounts Owed

- Length of Credit History

- New Credit

- Types of Credit

Its not possible to make a blanket prediction about how much you can increase your credit score in a six-month time frame. One person might be capable of earning a 25-point credit score increase. The next person might be able to earn far more or far fewer points. That being said, many people can see meaningful credit score jumps in six months or less.

If youd like to see your own credit scores potential for improvement, FICO provides an online tool you might find useful. The Free Credit Score Estimator asks you ten simple questions about your credit report and estimates your FICO® Score based on your answers. You can then take the quiz a second time and give different answers to gauge your scores potential trajectory as the information on your credit report changes.

You May Like: Does Moneylion Report To Credit

How Does A 720 Credit Score Rate

Most authentic credit scoring models like FICO and VantageScore use credit score range from 300-850. Even though the range seems broad but let me tell you that there are different categories within this range that starts from Very Poor to Excellent. If your score is near to the higher limit then it indicates the lower credit risk as well, likewise the lower credit score point to higher credit risk.

To help you in better understanding the ranges and the relative categories they fall in are explained below:

- Excellent Credit: 750 850

- Very Poor: 549 & Below

Still Have A Backup Plan

As it is something that usually may not depend only on “the number,” and multiple factors will actually define the outcome, it is not a bad Idea to have a backup plan. A backup plan can be as simple as having someone you trust and that trusts in you, to co-sign the agreements while granting his/her credit history as a creditor of trust.

In this case, your partner or tutor is the ideal person to come up with a more robust financial status to back up your request. But remember, it doesn’t mean that this person will pay, by default. In fact, when you sign a loan with someone else, you both are responsible for the contract. You primarily and then they, if you fail to do it yourself.

It is normal, either because you are starting, you just landed in Canada, you are young, or just your credit history is not reliable enough, that you can co-sign a contract for getting acceptable rates on a Loan.

So, in the previous example , Person A signed the Credit Check and pre-set the possibility of having his/her partner to call the Dealership Financial Advisor in the eventuality that the primary financing company required more warranties or intended to offer a higher interest rate. Of course, it wasn’t needed, but the backup plan was ready to go at a reasonable rate, just in case.

Also Check: When Do Credit Cards Report Late Payments

Dont Apply For Loans Or Credit Cards For At Least A Year

Once youve paid down your installment loans, I suggest you stop applying for loans and credit cards altogether. By this point, you should have a few credit cards in your wallet, a couple of paid off cars, and a mortgage.

When youre in this position, there is really no need to apply for more credit.

By not applying for credit, you wont get any hard inquiries on your credit report and this helps your credit score. If you need to apply for credit, just keep in mind the hard inquiries will stay on your credit for about a year.

Again, you should be in a situation by this point where you dont need anymore credit.

Have At Least One Gas Or Store Credit Card

For the longest time, I resisted getting a store card, such as a Macys credit card, because I saw no point in opening a new credit account just for one store.

But, now I know better. If you shop at one store a lot, and that store offers its own credit card, consider applying. These cards have some nice perks such as cash back or coupons.

More importantly, a store credit card can boost your credit. I cant document this, but I know getting a Macys card and keeping its balance at $0 each billing cycle boosted my FICO score by 20 points.

Just be sure you dont buy too much and run up a balance you cant clear each month. If you do that, youll be cutting into your available credit which will hurt your credit score.

Read Also: How Long Does A Dispute Take On Credit Report

Lower Your Credit Utilization Rate

A significant portion of your credit score is based on a factor called your . Credit utilization is the link between your and balances. If you have a credit card with a $1,000 limit and a $750 credit card balance on your credit report, your credit utilization ratio is 75%.

Reducing your credit utilization rate can be good for your credit score. The best way to accomplish this reduction is to pay down your credit card balances. This approach can save you money on interest fees as an added bonus.

If you need time to pay off your credit card debt, you may also be able to lower your utilization rate by requesting a credit limit increase. Still, your ultimate goal should be to eliminate your credit card debt altogether and only use cards for purchases you can afford to pay in full each month.

How To Improve Your 720 Credit Score

A FICO® Score of 720 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 720 FICO® Score is on the lower end of the Good range, you’ll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range .

46% of consumers have FICO® Scores lower than 720.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll find some good general score-improvement tips here.

Recommended Reading: Does Experian Boost Report To All 3 Credit Bureaus

Poor Credit Score: 550 649

This grand score is on account of several late or pending payments, numerous defaults on products from different lenders. This score can also be due to bankruptcy which is a scar that will remain on your record for a whole decade. Getting a new credit is near to a miracle for such individuals. It would be advisable for them to look up a professional finical advisor that will aid them in repairing their credit.

Recommended Article:

Make Sure You Use Your Credit Card To Maintain Your Good Credit

While a credit card can be a valuable tool when it comes to building credit or maintaining good credit, the opposite is also true. If you use your credit card irresponsibly, you can cause damage to your credit and see your score drop in a hurry.

To make the most of your credit card, you should keep in mind the factors used to determine your credit score. For example, your payment history makes up 35% of your FICO score and is the biggest determinant as to whether you have a good or bad score. Thats why its so important to pay your credit card bill and all your other bills on time each month.

Another factor that affects your credit score is the amount you owe in relation to your credit limits, which is known as your . Experts suggest keeping the amount you owe on your credit cards at 30% or lower for the best results. This would mean owing $3,000 or less on total credit limits of $10,000.

Finally, you should also check your credit reports for errors that could be harming your credit, such as accounts that arent yours or incorrectly noted late payments. If you find any problems, you should take steps to dispute the errors with the credit bureaus so they can be fixed right away. Fortunately, you can check your credit reports for free using the website AnnualCreditReport.com.

Don’t Miss: Does Klarna Affect Your Credit Score

How To Get A 750+ Credit Score

If you want to know how to improve your credit score, look no further than the Credit Analysis section of your free WalletHub account. Youll find grades for each component of your credit score, along with an explanation of where you stand and tips to improve. Getting your credit score to 700 is kind of like making the honor roll in school. You need mainly As and Bs to pull it off.

For example, heres a common credit scorecard for someone with a 750 credit score:

- Payment History: A = 100% on-time payments

- A = 1% – 10%

- Debt Load: A = < 0.28 debt-to-income ratio

- Account Age: B = Average account is less than 9 years old

- Account Diversity: A = 4+ account types or 21+ total accounts

- Hard Credit Inquiries: A = Fewer than 3 in past 24 months

- Collections Accounts & Public Records: A = 0 collections accounts and public records

You dont need to match this scorecard exactly to build a credit score of 700 or even higher. Different profiles can get the job done. For example, you might have an A in Credit Utilization but a B, or even a C, in Account Age. Its the complete picture that matters.

Was this article helpful?

Related Scores

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Do Student Loans Affect Your Credit Score

Learn More About Your Credit Score

A 720 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.

What Kind Of Credit Cards Can I Qualify For With Good Credit

Most people with good credit can qualify for many of the top credit card offers available, such as cards that let you earn exceptional rewards or ones that come with top-notch benefits, and even cards with low interest offers on purchases and balance transfers. However, you may not get instant approval when you apply.

CNN Underscoreds favorite credit cards in each of these categories can be found in our guides below. If you have good credit, you have a decent chance of being approved for any of the cards on these lists:

Having good credit can also help you qualify for premium credit cards that come with unique perks, including VIP travel benefits. However, youre more likely to be eligible for one of these premium cards if your credit score is on the high end of the good range, or at least 720.

With a good credit score of 720 or more, you may be able to qualify for a credit card that comes with an airport lounge membership, automatic elite status with hotel brands or rental car companies, or annual travel credits worth hundreds of dollars. While these benefits typically come with credit cards that carry high annual fees, the perks can help you get more than enough value in return.

Related: 9 of our favorite credit card perks that you wont want to miss out on.

Recommended Reading: Does Your Credit Score Change Daily