What Does A Credit Bureau Do

A credit bureau is a credit reporting agency that aggregates information about your credit history into a credit report. This typically includes payment history, number of credit accounts and length of credit history.

Information in your credit report is shared with financial institutions and other parties, such as real estate and auto companies, when you apply for , mortgages and auto loans. Credit bureaus do not make lending decisions; they only collect and provide information to lenders.;Lenders use this information to determine your eligibility for credit.

What Happens When An Account Is Closed

When you pay off or close an account its not available for purchases or payments.

An account can be closed for many reasons such as paying off the amount borrowed or closing an unwanted line.

Once the account is closed, its then settled and will appear on your credit report as such.

When an account is closed with a balance, the creditor will still;report the status and account details to the credit bureaus on a monthly basis.

The information that is reported is the balance, monthly payment history, and the date of your last payment.

Recommended Reading: Does Opensky Report To Credit Bureaus

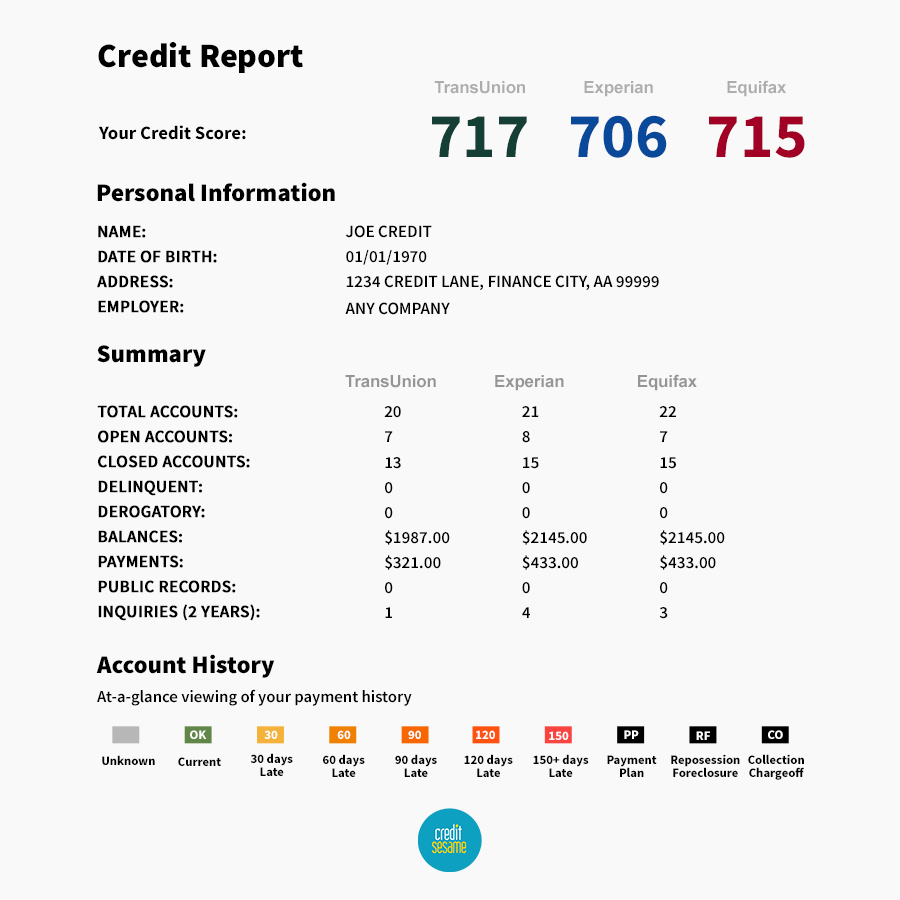

What Are The Differences Between The Credit Agencies

Each of the credit agencies offers slightly different services. For example, TransUnion is the only credit agency that offers Identity Lock, a service that helps you protect yourself against identity theft. Also, not all venders report to all three credit agencies. This means that the information on your credit report can vary from agency to agency, resulting in different scores.

Also Check: Does Klarna Build Credit

Who Reports To Credit Bureaus

- Banks, credit card issuers, lenders, collection agencies and peer-to-peer lending sites can furnish positive and negative payment information to credit bureaus.

- Utility companies, telecommunication providers and landlords or rental property managers can report negative information. However, they may not be able to report positive information, depending on state law and other regulations.

Note that Individuals such as friends, family members, business partners, etc., cant report any payment information.

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.;

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Don’t Miss: What Is Aargon Agency

How Do Credit Bureaus Get Information

If you’ve gotten a loan or credit card from a major issuer within the past seven years, there’s a good chance your information is in at least one of the major bureaus’ databases. Most of the credit bureaus’ information comes from other companies. In the credit world, these companies are called data furnishers. In everyday terms, they’re the same financial institutions that you regularly interact with, including banks, credit unions, credit card issuers, collection agencies and loan servicers.

These data furnishers send information about their customers’ accounts, such as their current balances and whether their bill was paid on time, to the credit bureaus at least once every month. They aren’t required to send information to the credit bureausit’s all voluntary. In fact, it costs money to maintain the staff and systems that allow companies to report to the bureaus.

However, the creditors also benefit from reporting. After all, borrowers may be more likely to make payments on time if they know a late payment will get reported to the credit bureaus and possibly hurt their credit scores.

Credit bureaus collect public records information, such as bankruptcy filings, and add these to consumers’ credit reports. Some types of public records, such as tax liens and civil judgments, are no longer collected by the bureaus. Everything else on your credit report is there because a data furnisher reported the information to a bureau.

Glocal Credit Bureau Score

A credit bureau score is a statistical indicator of the likelihood a customer will default over the next year on a payment, given that customers historical behavior as evidenced by the credit bureau data. Credit Bureau Scores are invaluable tools to improve the analytical powers of credit risk managers, and implement automated decision policies.

Scores can be either expert or customized.

The GLocal Credit Bureau Score is an expert score that comes integrated in the C2BS. It is useful as a start-up score in situation where no reliable historical data is available. The model was developed using data of different countries in which CRIF has Credit Bureau customers. In the period afert implementation of a new credit bureau solution as data is processed and stored by the bureau, it is possible to perform a validation which consists in testing the GLocal score forecasting capability and, if necessary, re-estimating it in order to fine-tune the scorecards weights.

Also Check: Is 584 A Good Credit Score

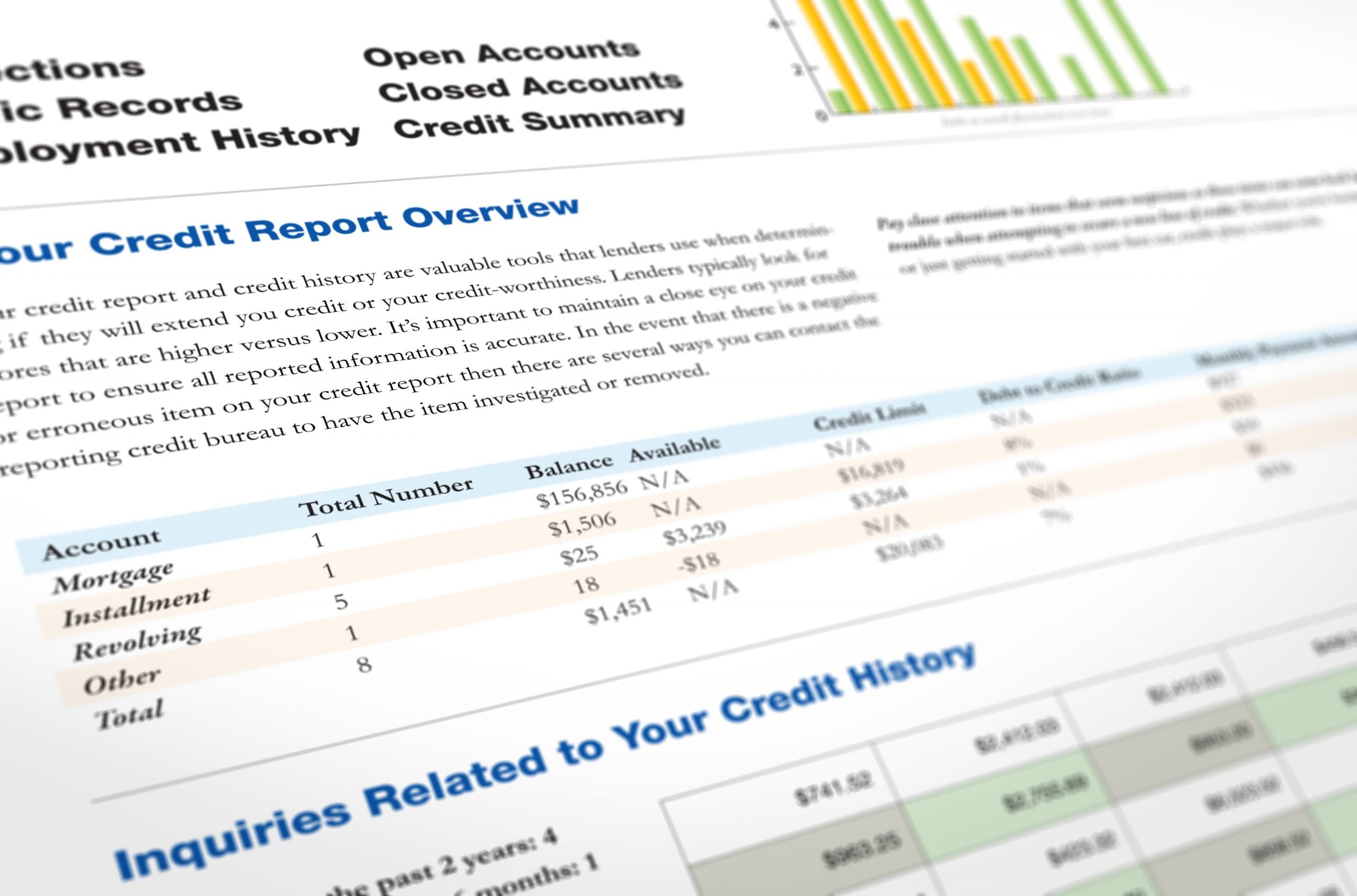

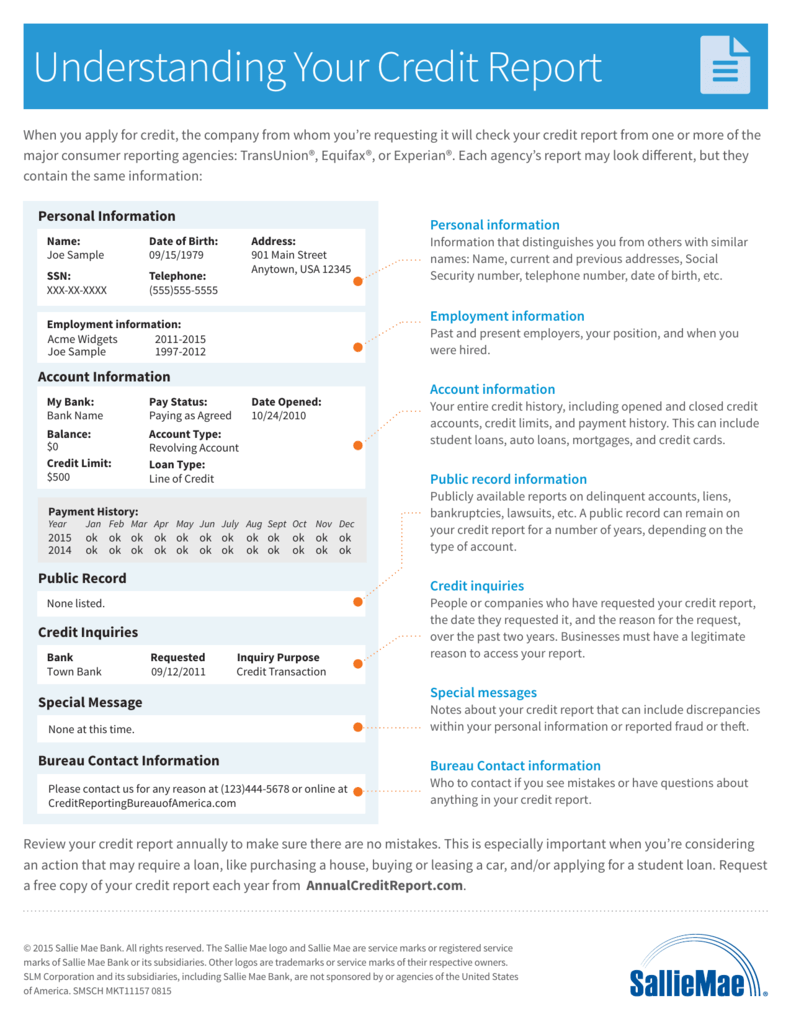

What Is A Credit Report

Most people have more than one credit report. Credit reporting companies, also known as credit bureaus or consumer reporting agencies, collect and store financial data about you that is submitted to them by creditors, such as lenders, credit card companies, and other financial companies. Creditors are not required to report to every credit reporting company.

Lenders use these reports to help them decide if they will loan you money, what interest rates they will offer you. Lenders also use your credit report to determine whether you continue to meet the terms of an existing credit account. Other businesses might use your credit reports to determine whether to offer you insurance; rent a house or apartment to you; provide you with cable TV, internet, utility, or cell phone service. If you agree to let an employer look at your credit report, it may also be used to make employment decisions about you.

Personal information

- Your name and any name you may have used in the past in connection with a credit account, including nicknames

- Current and former addresses

- Current and historical credit accounts, including the type of account

- The credit limit or amount

- Account balance

- The date the account was opened and closed

- The name of the creditor

Collection items

Wait A Few Months And Dispute The Account Again

If you failed to get the collection removed from your credit report by this step, dont lose hope. Let a couple of months pass by and try to dispute the account for another reason.You can dispute accounts for several diffident reasons, and the older the paid collection gets, the more likely the creditor will ignore the Credit Bureaus requests.

Donât Miss: Does Zzounds Report To Credit Bureau

Recommended Reading: Is 524 A Good Credit Score

How Often Is My Credit Report Updated

Your credit report is updated frequently, as new information is reported by lenders and older information is gradually removed per federal retention requirements.

However, it’s important to also know that most lenders report changes in account status, such as payments you’ve made or whether you’ve fallen behind, on a monthly basis. If you make a payment on one of your accounts, it’s possible that the payment won’t appear on your credit report for up to 30 days.

How To Dispute Inaccuracies

Any mistakes on your credit report need to be taken up with the agency that shows the error. Write a letter that lists each incorrect item you found and why youre disputing it.

Lets say you closed a credit card, but it still shows up as an open account on your credit report. Heres what you need to do: Gather up documents and any evidence you might have to prove its a mistake. Then, send all of this by certified mailand dont forget a return receipt! The agency has only 30 days to respond, so you should see some movement pretty quickly.

Don’t Miss: Aargon Agency

Financial Information On Your Credit Report

Your credit report may contain the following financial information:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a lien on a car that allows the lender to seize it if you dont make payments

- remarks, including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if you made your payments on time

- if you missed payments

- if your debt has been transferred to a collection agency

- if you went over your credit limit

- personal information thats available in public records, such as a bankruptcy

How To Get A Credit Report

Youre allowed;one free copy of your credit report every year;from each of the major credit-reporting agencies we just talked about. But the reports arent automatically mailed to youyou have to ask for them! And since each agency keeps different details on file, its worth checking with all three. If you play your cards right, you can even stagger them so youre getting a free report nearly every quarter.

Now that you know how to get your credit report, well walk you through the four major areas you need to check for any red flags. These could help you spot potential identity theft situations, so listen up!

You May Like: What Credit Report Does Paypal Pull

How Do A Consumer Disclosure And Credit Report Differ

Chip Stapleton is a Series 7 and Series 66 license holder, CFA Level 1 exam holder, and currently holds a Life, Accident, and Health License in Indiana. He has 8 years experience in finance, from financial planning and wealth management to corporate finance and FP&A.

Consumer disclosures and consumer credit reports are both regulated by the Fair Credit Reporting Act and the Fair and Accurate Credit Transactions amendments made to the FCRA. They;are both obtained from credit bureaus, and there is plenty of informational overlap between the two documents. Despite their similarities, they are used for different purposes and may also be requested by different parties in determining the creditworthiness of a borrower.

When you borrow money in any significant amount, the details of the lending arrangement and your subsequent payment history are usually submitted to the major to be filed under your name. This is how your credit profile is created, how your is calculated, and part of how lenders evaluate your creditworthiness whenever you ask for a loan.

Under the Fair Credit Reporting Act of 1970, you are entitled to know what is in your file, dispute incorrect information, and remove outdated information after a period of seven to 10 years, depending on the type of information.

Business Credit Reporting Agencies

Commercial credit reporting and scoring bureaus also exist and can be used to evaluate the likelihood of a business paying creditors. Examples of commercial credit reports are the Paydex score from Dun & Bradstreet, the Risk Rating from , the ExperianIntelliscore, the CPR Score from Cortera, the GCS score from Global Credit Services, SkyMinder service from CRIF and the CIC Score and NACM National Trade Credit Report from the National Association of Credit Management. TransUnion, Equifax, and Rapid Ratings International are also examples of commercial credit reporting agencies.

You May Like: Can You Remove Hard Inquiries Off Your Credit Report

What’s In Your Credit Report

Your credit report contains personal information, credit account history, credit inquiries and public records. This information is reported by your lenders and creditors to the credit bureaus. Much of it is used to calculate your FICO Scores to inform future lenders about your creditworthiness.

Although each of the credit bureausExperian, Equifax and TransUnionformat and report your information differently, all credit reports contain basically the same categories of information.These four categories are: identifying information, credit accounts, credit inquiries and public records.

How Do You Know If Your Creditor Or Lender Reports To A Credit Bureau

The best way to find out is to ask.;

Since reporting to the credit bureaus isnt required by law, not all creditors or lenders choose to do so. Oftentimes, smaller lenders may report to only 1 or 2 of the bureaus, or not at all.

Its best to work with lenders that report to all three business credit bureaus to ensure that your positive payment history is updated across the board. This can prevent discrepancies while ensuring that future creditors are getting the most accurate information about your business no matter which credit bureau they pull reports from.

You May Like: Ccb/mprcc On Credit Report

Send A Request For Goodwill Deletion

Like pay-for-delete, writing a goodwill letter seems like a long shot, but its an option for borrowers who want to exhaust every possible alternative. Write to the creditor and ask for a Goodwill Deletion. If you have taken appropriate steps to pay down your debts and have become a more responsible borrower, you might be able to convince the creditor to remove your mistake.

There is no guarantee that your plea will get a response, but it does get results for some. This strategy is most successful for one-off problems, such as a single missing payment, but it may be futile for borrowers with a history of missed payments and credit mismanagement.

When writing the letter:

- Assume responsibility for the issue that caused the account to be reported to begin with

- Explain why the account was not paid

- If you can, point out good payment history before the incident

What Does It Mean To Default On A Loan

Defaulting on a loan means youve stopped making payments as agreed. How delinquent an account must become to be considered in default depends on the lender and the type of account. While most lenders will not consider an account to be in default unless it is at least three to six months past due, a mortgage loan may be considered in default after only one missed payment. On the other hand, federal student loans may be allowed up to nine months of missed payments before being placed in default.

What happens when you default on a loan depends on the type of debt you were unable to pay. Defaulting on a personal loan or a credit card account will likely result in the account being written off as a loss and updated to reflect a status of charge-off on the credit report. The lender may then sell the debt to a collection agency. Once a collection agency purchases the debt, they can report it to the credit reporting companies as a separate account.

When you default on an auto loan, the lender can repossess your vehicle. This means that they take possession of your car and sell it to try to cover the outstanding loan amount. Your lenders policies and state laws determine how delinquent your payments must be before it considers your auto loan in default and begins the repossession process.

Read Also: Does Speedy Cash Report To Credit Bureaus

Read Also: Why Is There Aargon Agency On My Credit Report

What Is A Public Record

A public record is any municipal, provincial, or federal documentation that is accessible to the general public. Broadly speaking, public records refer to all legal and government matters which are too vast to discuss entirely in this article. In relation to credit reports, you can expect to see the following types of public records:;

- Bankruptcies

- Non-criminal rulings from court proceedings

- Liens against property

Non-financial public records will not be shown on your credit report. For example, a divorce is a public record, but it will not show on your credit report.;

Want to learn about how a credit score is calculated? Check out .;

Sample Letter To Remove Closed Accounts From Credit Report

Writing a sample letter to remove closed accounts from credit report is an important part of credit repair. Credit bureaus and reporting companies are not easy to deal with. Especially in the days of the internet many of these companies have shady operations. They can be very difficult to deal with and many times you will receive the run around. It is essential that if you have any dealings with these types of companies that you write a sample letter to remove closed accounts from credit report.

How to Send a Dispute Letter to Creditors 14 Steps from sample letter to remove closed accounts from credit report , source:wikihow.com

I think most of us would rather deal with the company our self, but what do we do when we get run over by the big credit bureaus? What do we do when they refuse to remove something even after we follow the process given to them? Well, we find another one. That is exactly what you will do when you write a letter to the credit bureaus describing your side of the story. You will detail the problem and how it was taken care of, hopefully leading them to remove the account from your credit record.

Sample letters like this are all over the place. They can be found on many credit repair websites or you can locate them in books found at your local library. All you need to do is search for a letter that explains the situation and how you have dealt with it and use that as a template for your own letter.

Also Check: Aragon Collection Agency