How Long You’ve Been Trying To Improve Your Credit Score

Although time is of the essence to improve payment history, there are some very powerful moves you can make to see noticeable signs of improvement within weeks:

- Checking your credit report for errors and disputing them

- Paying down a balance on a credit card to zero

- Improving your utilization ratio by paying all balances down to less than 30% of credit limit

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

How Do I Force My Credit Score To Update

4 tips to boost your credit score fast

Read Also: How To Check Your Real Credit Score

Ways To Help Maintain And Improve Your Credit Scores

Remember: Itâs normal for your credit scores to fluctuate a little. And credit scores can change significantly over time. But you can maintain good credit scores and even improve your scores by regularly practicing responsible financial habits.

Here are some ways you can maintain and improve your credit scores:

Speaking of applying for credit: Want a better idea of whether you might be approved? Pre-approval or pre-qualification can help you find out whether you might be eligible for a credit card or a loan before you even apply.

With Capital Oneâs pre-approval tool, for example, you can find out whether youâre pre-approved for some of Capital Oneâs credit cards before you submit an application. Itâs quick and only requires some basic information. And checking to see whether youâre pre-approved wonât impact your credit scores, since it requires only a soft inquiry.

What Can Lenders See On Your Credit Report

Your creditreport provides a detailed summary of your credit history. It includes your personal information and lists details on your past and current credit accounts. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too.

You May Like: How Does Credit Utilization Affect Your Credit Score

Article Contributed By Rentspree

Disclaimer: This article is not legal advice. Any legal information is not the same as legal advice, where an attorney applies the law to your specific circumstances, so you should consult an attorney if you would like advice on your interpretation of this information or its accuracy. You may not rely on this article as legal advice, nor as an endorsement of any particular legal understanding.

TransUnion is one of the three major, national credit reporting agencies. This agency creates one of the credit reports that lenders, renters, and home buyers rely on to provide a report of good credit and help them obtain a loan or property. Most people who have good credit spend little time thinking about their credit report unless one day something bad happens. A negative mark on ones credit can have significant financial impacts, which is why many people ask: how long does it take for my TransUnion credit report to update? This question actually requires a rather detailed answer, as this is typically asking both how often the agency updates, and how long a negative remark will stay on a report before it is removed.

How Often Are Credit Scores Updated

Your credit scores typically update at least once a month. However, this may vary depending on your unique financial situation.

based on the information included in your credit reports. So, for your credit scores to update, the information in your credit reports must first change.

A credit report is a summary of your financial behavior over time. It may include information about the number and types of credit accounts you have, your payment history, the total credit available to you and other information such as recent requests for credit.

Lenders that choose to report, typically do so monthly. Credit card companies, for example, usually report by a recurring date known as the billing cycle or statement date. But the exact day of the month may be different for each provider.

In short, there’s no set day that all lenders deliver information to the CRAs. Additionally, not every lender or creditor will share information with every CRA. Some may report to only one or two, or none at all.

So, when it comes to your , updates usually occur at least once a month but could be more frequent depending on how many lenders you have and when each of those lenders reports new information.

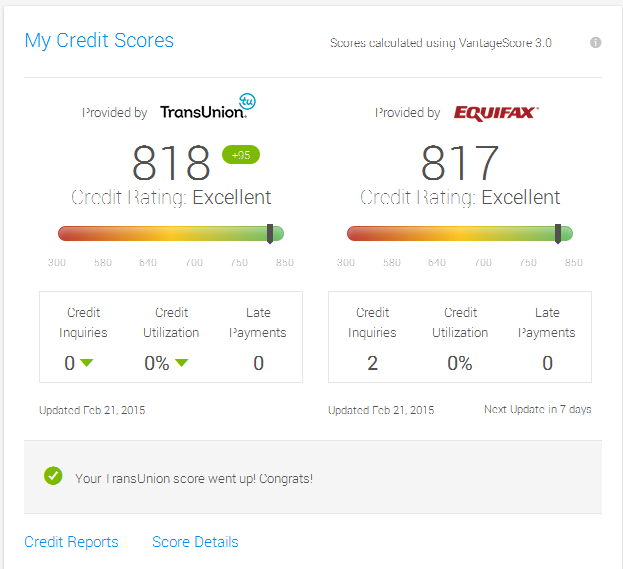

You will need to request a new copy of your credit score in order to see any changes. A free monthly VantageScore® 3.0 credit score and Equifax credit report are available when you sign up for Equifax Core Credit. A VantageScore is one of many types of credit scores.

Also Check: How Long Hard Inquiries Stay On Credit Report

What Is A Credit Score

A credit score is a three-digit number that ranges from 300 to 850. The number reflects how well you pay your bills on time.

A good to excellent credit score is essential when applying for a loan to buy a car, a house or when you sign up for a credit card. Your score can even make a difference when renting an apartment or qualifying for the best interest rates.

Exact Answer: After Every 45 Days

Maintaining a proper credit score and taking a balanced eye on every market is a must for a businessman to carry on the market. There are several markets available at this present time, and it becomes quite a tough job to keep a hawk-eye on every market. Hence, there are some reporting agencies, who step up forward and create an educational credit score for the provided consumers.

By studying this credit market deeply, one can easily take a brief knowledge about the estimated general credit position one can generate. In the same way, it also works with Transunion and they report millions of consumer credit over several countries. Hence, it all aggregates the and provides it to the consumer.

Also Check: How Many People Have An 850 Credit Score

Contact The Credit Bureaus

Both Equifax Canada and TransUnion Canada have forms for correcting errors and updating information. Fill out the form to correct errors:

Before the credit bureau can change the information on your credit report, it will need to investigate your claim. It will check your claim with the lender that reported the information.

If the lender agrees there is an error, the credit bureau will update your credit report.

If the lender confirms that the information is correct, the credit bureau will leave your report unchanged.

In some provinces, the credit bureau is required to send a revised copy of your credit report to anyone who recently requested it.

What Should I Do If The Information On My Credit Report Is Incorrect

Most lenders update their account information with the credit bureaus once a month. Even if you pay your credit card balance off before you get your statement, the balance reported by the lender is typically what is listed on the billing statement at the end of the billing cycle. Depending on when you make the next purchase on your card, you may still see a balance reflected.

If you are seeing an account on your report that has not been updated in several months, you should dispute the account directly with Experian using the online Dispute Center. If you have documentation showing that the balance has changed, you can submit a copy online along with your dispute. Experian will contact your lender and ask them to verify the information they have reported.

You may also wish to contact your lender to verify that they have been reporting your account information to the credit reporting companies and request that they send updated balance information. For more information, see How to Dispute Credit Report Information.

Don’t Miss: How To Get Rid Of Collections On Credit Report Canada

Vantagescore Or Fico: Does It Matter

VantageScore is not FICO. FICO stands for Fair Isaac Corporation, the biggest competitor in the business of creating scoring models that are used to rate the creditworthiness of consumers. To complicate matters, both update their models occasionally, and lenders use different versions with slightly different results.

Your score should be roughly the same on either model. One model may put slightly more weight on unpaid medical debt. One may take longer to record a loan application. But if your credit is “good” or “very good” according to one system, it should be the same in the other.

VantageScore and FICO are both software programs that calculate credit ratings based on consumers’ spending and payment history. FICO is the older and better-known model, having been introduced in 1989. VantageScore, released in 2006, was developed by the three leading consumer , Experian, Equifax, and TransUnion.

Because they are different models, your VantageScore will inevitably be a little different from your FICO score. For that matter, you may get a different FICO score from various sources at any given time, depending on whether the source uses a specialized variety of FICO or the most frequently used base model and which of its many versions is used.

The key point is that your score should be in the same range on any or all of those models. You should not have a “good” VantageScore and only a “fair” FICO score.

Why Does Transunion Update Slower Than Equifax

The credit bureaus may have different information. And a lender may report updates to different bureaus at different times. So, it’s possible that Equifax and TransUnion could have different credit information on your reports, which could lead to your TransUnion score differing from your Equifax score.

You May Like: How To Report A Lost Victoria Secret Credit Card

How To Remove Wrong Employer Information From Your Credit Report

You can remove incorrect employer information from your credit report by filing a dispute with the credit reporting bureau to have your employer information removed. Your employer information will only be removed from your credit report if it is inaccurate or incorrect.

So, you might be wondering, where does your employer information come from since youve probably never provided it to the credit bureaus? Your employer information comes from credit applications and financial institutions that you have credit cards and loans with. Usually, your employer information is furnished by them to the credit bureaus.

- Can you remove employer information from your credit report?

- What should I do if my employers information is outdated on my credit report?

- Does employment information show up on the credit report?

How Often Do Credit Scores Update Heres How To Track Your Progress

Your is a three-digit numerical representation of your financial health. Banks and other lenders consider this value as part of loan and credit card applications, so it must be updated frequently.

The credit reporting agencies update your file â and by extension, your credit score â whenever they receive new information from lenders. This usually occurs monthly.

Read on to learn more about how credit scores are updated, how often this happens, and what the related process of rapid credit rescoring encompasses.

Don’t Miss: Who Uses Transunion Credit Report

Whether You Have Recent Missed Payments Or Defaults On Your Report

Missed payments can stay on your credit report for seven years and bankruptcies for 10. You will more than likely need to re-establish a history of making payments on time, as well as reducing your principle debt every month, by paying more than the minimum payment due. Although missed payments stay on your report for seven years, their impact fades over time. All may not be lost if you’ve missed your payment by a few days. If the missed payment is an exception rather than the rule, then pay the bill as soon as you can and ask the lender if they could refrain from reporting the late payment to the bureaus this one time. There’s no guarantee this will work, but it mightyou could set up automatic payments in return, as a goodwill gesture. Just be sure that you catch that missed payment as soon as possible, because its impact on your credit score will get worse with every day it’s in default.

How To Check Your Credit Reports

It’s wise to periodically check your credit reports to make sure they’re accurate. Consumers have free weekly access to their reports from all three bureaus through the end of 2022 request them by using AnnualCreditReport.com.

While waiting for improvement can seem like watching paint dry, there are habits aside from checking credit that will help you build good credit and maintain it.

-

Pay on time every time.

-

Use credit cards lightly, keeping balances no higher than 30%.

-

Keep cards open unless you have a compelling reason to close them.

-

Space credit applications at least 6 months apart if you can.

-

Consider using both loans and credit cards.

Recommended Reading: Does Car Insurance Check Credit Report

How Do Transunion Credit Scores Work

The exact algorithm used to generate TransUnion credit scores isnt publicly known. However, TransUnion credit scores utilize a range of data points from credit reports to determine each consumer score. Court judgments, mortgages, and credit account age are just a few of the additional factors influencing TransUnion credit scores.

Big Credit Score Swings

Most changes to your credit scores happen incrementally, but there are exceptions. The biggest factors in your score are paying on time and how much of your available credit you use. Big, sudden drops in your score are likely to come from:

-

A late payment: Falling behind on a bill payment by 30 days or more could cause your score to take a big hit. Late payments stay on your credit report for seven years and have a powerful effect on your score. If you’ve fallen behind with one of your accounts, do your best to get current as soon as you can. A 60-day delinquency is worse than a 30-day delinquency, and a 90-day delinquency is worse still, so it pays to get back into good standing quickly.

-

Using more of your credit limit: Another major influence on your score is your , or how much of your credit limits you’re using. A spike in credit card debt will push up your utilization, which can drop your score. But the opposite is also true. If you use a big windfall to pay down credit card debt, your score can benefit. Opening a new credit card can also be a useful strategy for increasing lowering your overall credit utilization, but it’s important to research eligibility requirements before you commit to a hard credit pull. Your score will change once the new balance is reported to the credit bureaus.

About the author:Bev O’Shea is a former credit writer at NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Don’t Miss: How To Help Your Credit Score

Does Credit Karma Use Fico

No. However, the credit score Credit Karma provides will be similar to your FICO score. The scores and credit report information on Credit Karma come from TransUnion and Equifax, two of the three major credit bureaus. Your scores can be refreshed as often as daily for TransUnion and weekly for Equifax, with a limited number of members getting daily Equifax score checks at this time.

Re: How Long To Wait For Update On Transunion

Your scores can only change once your report data changes, meaning that the updated balances need to report. This could happen anywhere from 1 day to 30 days from now, depending on when your creditor typically report. Just look at your report and see the “last reported” date. If the creditor typically reports on the 17th of the month, for example, you’d expect to see the update on or about the 17th of the next month, +/- a day or two. Hopefully that helps.

Also Check: Do Medical Bills Affect Your Credit Score

When Do Creditors Report To Bureaus

So even though creditors arent required to report to credit bureaus, the majority of lenders will report information to the three main credit bureaus. So, when do they report this information?

Each credit provider has its own schedule of when they report to credit bureaus. Credit bureaus dont require the information to be reported at a specific date. But you can expect it to happen every 30 to 45 days. The exact dates will vary from lender to lender. Also, remember, the same information might not reach all credit bureaus at the same time. So, a lender could report your information to TransUnion this week, but it only reaches Equifax next week.

As a result, it is very typical for your credit score to be in constant flux. It can change within days or even hours as different lenders send information to the credit bureaus. Your credit score will also not be the same with each credit bureaus. Every new report a creditor makes to the bureaus could mean adjustments to your credit report and credit score.