Income Age & Credit Scores

Income is another age-related factor that could indirectly affect credit decisions. Lenders use income to determine whether a person can afford a new debt obligation, but income isnt factored into credit scores. However, income does affect a persons ability to afford their financial obligations.

Having a history of on-time payments can give your credit score a huge lift since payment history is 35% of your credit score.

Average salary also tends to increase with age, which means consumers are better able to afford their bills as they get older and their salary increases.

What Is The Average Credit Score For A 25 Year Old

Learn what the average credit score is for a 25 yr old. Find out how you can start building better credit w/help from a pro like Credit Glory.

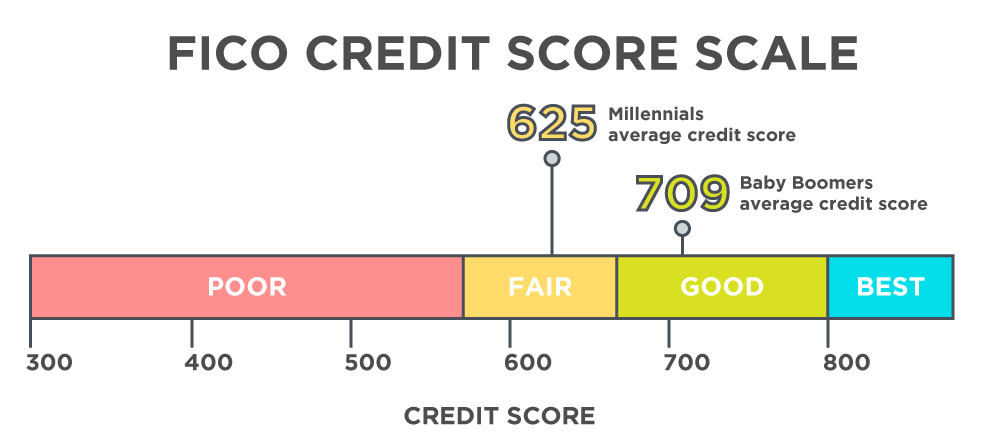

The average 25 yr old has a credit score around 660. According to the FICO model this is considered “fair.” Looking to improve your credit ? The easiest way is by finding & disputing errors on your credit report. DIY credit repair is a headache. Partnering w/a pro like Credit Glory makes it a breeze.

Start Building Your Credit W/help From Credit Glory

Disputing negative items on your credit report is hard work! It takes a lot of time, effort, organization, and follow up. The good news? Our team of credit repair professionals is here to simplify everything! Let your dedicated credit repair expert relieve you of the stress, hassle, and time needed to fight your inaccuracies and boost your credit score

Call us at or set up a consultation to get started, today!

Don’t Miss: 611 Credit Score

Does Age Typically Influence Credit Scores

Interestingly enough, there is a correlation between age and credit score. Data from both Borrowell and Equifax shows that the average credit score increases by age group. Borrowell members between 20 to 29 years old have an average credit score of 649, while members between 70 to 79 years old have an average credit score of 721.

Equifax surveyed individuals from various age ranges and monitored their credit scores for a full decade. According to their most recent Generational Study, here are the average credit scores by age group.

-

Age 18-25:692

-

Age 56-65: 737

-

Age 65+: 750

There are some high-level reasons why credit scores seem to increase with age. Two factors that impact your credit score are your credit history and your credit mix. As you grow older, you might make bigger purchases to reach major milestones. Buying a car or a house involves adding different forms of credit to your credit mix. When you take out a car loan or a mortgage, your credit mix becomes more diverse. As you pay these off, your credit history grows. These two factors both help in increasing your credit score.

A word of caution, though: growing older doesnât guarantee that your credit score will increase. Building good credit requires strong financial habits, like paying your bills on time and in full.

Does The Average Credit Score In Canada Vary By Age

Generally speaking, yes it does. Unfortunately, a good credit score and the actual average score in Canada are two different numbers. This average score can be somewhat difficult to measure, as it varies from province to province. Plus, our country is always growing in population.

However, according to financial experts, the average credit score Canada wide is somewhere between 600-650. A score of 650 or above is where potential borrowers should aim to be, so it may look like our country has a problem maintaining a healthy credit score. But remember, we are talking about a cumulative average here and Canadian credit scores do indeed fluctuate according to many different factors, including age, debt load, etc.

According to Equifax Canada, one of Canadas major credit bureaus, the average credit score amongst Canadians from 10 years ago to today has fallen in every age bracket but Generation Z . On average, Canadians within the youngest age bracket have a credit score of 692 while the oldest have a credit score of a little over 740. Data also shows that as age increases so does the average credit score number.

Source: Equifax Canada consumer credit database

Also Check: Does Speedy Cash Report To Credit Bureaus

How The Average Credit Score Relates To Income

The average credit score is directly correlated to income, according to research insights from ValuePenguin. To determine the average credit score by income, they looked at the income brackets and research from the Minneapolis Federal Reserve Bank.

People in the low-income bracket earning less than 50% of the median family income have an average credit score of 664. Moderate income earners earning 50-75% of the MFI have an average score of 716. Middle-income folks earning 80-119% of MFI have an average credit score of 753. Upper-income individuals who earn more than 120% of the MFI have an average credit score of 775.

To summarize, the average credit score by income is as follows:

-

Low income: 664

-

Upper income: 775

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

You May Like: Does Paypal Credit Report To Credit Bureaus

How Do You Get A 800 Credit Score

5 Habits To Get 800+ Credit ScorePay Your Bills on Time All of Them.

Paying your bills on time can improve your credit score and get you closer to an 800+ credit score.

Dont Hit Your Credit Limit.

Only Spend What You Can Afford.

Dont Apply for Every Credit Card.

What an 800+ Credit Score Can Mean..

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.

That could be a reason peopleâs credit scores tend to increase as they get older. Their accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just your age.

Don’t Miss: Capital One Reporting Date

What City Has The Highest Credit Score

We dug deep into our data of over 1.6 million Borrowell members to find the average credit score of major Canadian cities. The data below show 20 selected Canadian cities with Borrowell members. See how your cityâs average credit score compares with other Canadian cities.

According to Borrowellâs data, the Canadian city with the highest credit score isâ¦

-

Edmonton, AB: 645

-

Moncton, NB: 632

Out of the 20 cities listed above, 11 cities are above Borrowellâs average credit score of 667, while 9 are below the average credit score. Depending on where you live, the average credit score of your city may skew lower or higher than the average.

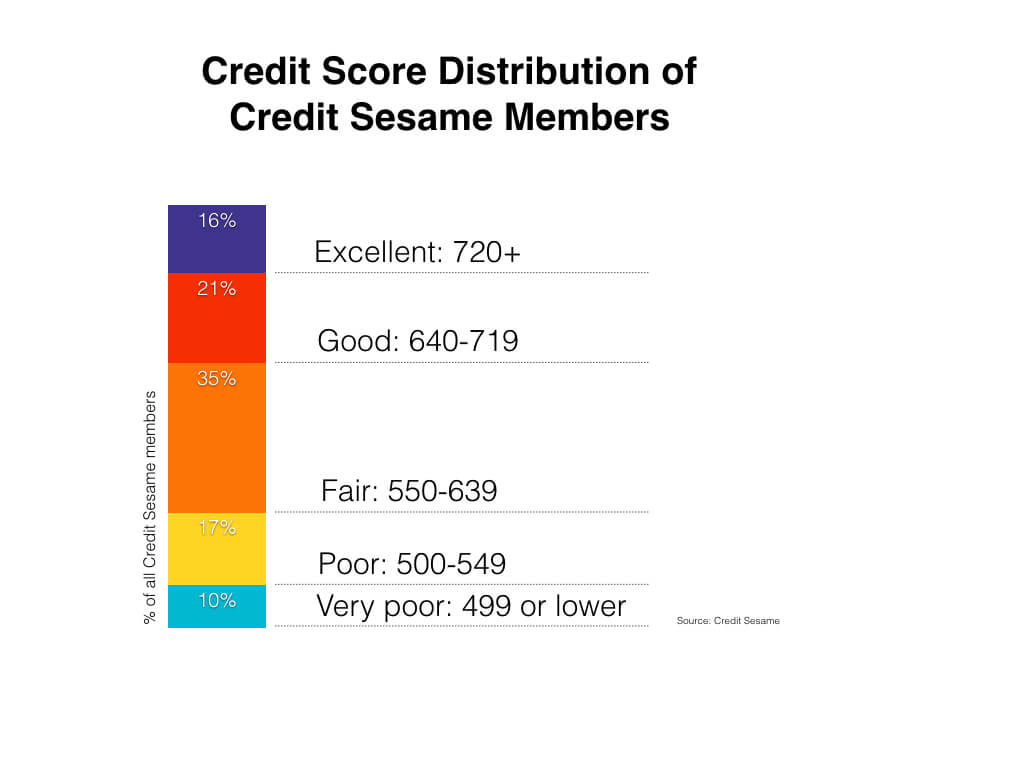

What Is The Average Credit Score Tier By Age

I have to say that this is the part that I found the most interesting.

And its because it seems to fly in the face of the rest of the data.

That is, the other information above indicates that the older you are, the more likely it is that youll have a good credit score.

But then take a look at the average credit score tier by age :

- Excellent Credit: 41 years old

- Good Credit: 45 years old

- Fair Credit: 47 years old

- Bad Credit: 52 years old

These results may be partly because many younger people dont have a credit score yet, so the average age for each credit score tier skews higher than youd expect.

Whatever the reason, it shows that, for example, just because youre in the average group of people in their early 30s who have a Poor credit score, it doesnt necessarily mean that youre behind on getting your credit score sorted out.

After all, the best time to work on your finances was yesterday. The second best time is today!

Also Check: Does Paypal Credit Report To The Credit Bureau

Consumers’ Fico Scores Increase Most From Their 50s To 60s

The largest jump in FICO® Scores happens from consumers’ 50s to 60s. The average FICO® Score for those ages 50 to 59 is 703 as of Q2 2019, compared with 733 among those ages 60 to 69.

Average estimated household income also peaks when consumers are in their 50s, reaching a high of $83,467 in Q2 2019up from $79,390 in Q2 2015. That may make it more possible for those with debt to pay it off, contributing to an increase in average FICO® Scores during this time. , or the amount of credit a consumer uses relative to their overall credit limit, has the second-largest impact on , just after payment history.

Why Is A Good Credit Score Important

Lets be real, your credit score can seem pretty arbitrary. But its nonetheless important when it comes to getting your first apartment or applying for your first credit card.

Why is this? Because your credit score can make or break whether you get approved for an apartment. It can also determine whether you get approved or denied for a credit card. It can even affect the interest rate you get. This is crucial to understand because, if you take out a loan, interest can cost you a lot of money over time. Even the difference between a few percentage points can potentially cost you hundreds or thousands of dollars in interest.

So, having a good credit score can help you save money, and help you get better interest rates.

Also Check: Why Is There Aargon Agency On My Credit Report

Tips To Maintain A Good Credit Score

So now youve established your credit history and youve got a good score, you may be wondering how you keep it there. Fortunately, following a few simple steps can help ensure that your credit score stays where you want it.

Make sure you make all of your payments on time, keep your credit utilization low, carry a mix of different credit types, hold on to your oldest accounts, and keep your hard credit inquiries to a minimum.

Also be sure to check your credit on a regular basis, as this will help you spot any inaccuracies or outdated information and you can take care of it before the error does too much damage. You can do this for free through Credit Sesame.

We talked to Credit Sesame member, Keilani, about how shes already working to build her credit at 18. Heres her story.

Keilani at 18 is already building her credit

Member Since: 9/1/2018

Keilanis story is important because it shows the clear benefits of having a plan to establish and build credit early on.

How Is Your Credit Score Calculated

Your credit score is calculated using five factors:

Most of the information is automatically removed after 6-7 years so that student loan payment you missed 20 years ago wont be haunting your score today.

1. Whats your payment history?

This is obviously the most important factor affecting your credit score. Prospective creditors want to know that you are going to pay them back. Your payment history covers all of your consumer debt: credit cards, lines of credit, student loans, car loans, cell phone payments on contract, etc.

- Do you pay your bills on time?

- How frequently do you miss a payment?

- How many times have you missed a payment?

- How old are your missed payments?

2. How much do you currently owe?

When creditors look at how much you owe, theyre trying to determine whether or not you are able to take on more debt. Can you manage with more?

Besides looking at the amount of debt that you currently have, lenders will look at whats called debt utilization ratio: thats the amount of credit youre using compared to the amount thats available to you.

For example, if you have a credit card limit of $5,000 and youre constantly hovering at $3,600, then youre using 75% your available credit on an ongoing basis. To a creditor, that indicates that youre struggling to pay off your existing debt.

- How much in total do you currently owe?

- How much are your payments?

- How much of your available credit do you use on an ongoing basis?

Also Check: Does Zzounds Report To Credit Bureau

Whats A Good Credit Score For My Age

The average credit score in the U.S. is 680 based on the VantageScore model and 703 based on the FICO score model. That means the average American has a fair-to-good credit score.Average Credit Score by Age.Age GroupAverage Credit Score30 3967340 4968450 5970660 and above7491 more rowMay 6, 2020

Help Your Teenager Build A Good Credit Score

Good parents want the best for their children, and that includes having a good credit score when the time is right. It’s important that you set a good financial foundation, teaching your child good money management, rather than try to build their credit history for them. It’s like doing all their homework for them.

When it’s time for your child to take the test, they’ll fail because they haven’t been doing the work themselves. The basic steps are to instill a solid financial foundation including a steady income and good checking account history, teach your child how credit works, and then help them get hands-on experience with a of their own.

You May Like: Does Lending Club Show On Credit Report

How Long Does It Take To Establish Credit

Your credit file is established as soon as your first account gets reported to the credit bureaus. However, building good and useful credit can take some time. For example, FICO can’t score a credit report that doesn’t have an account that’s at least six months old. In addition, if you have fewer than five credit accounts, also known as having a thin file, lenders may not be able to assess your creditworthiness.

Because the age of your accounts is a , the longer you’ve had open and active accounts, the better . While this takes time, you’re making a long-term investment in your financial future and establishing credit while you’re youngwhich is better than waiting until you need to apply for a rental apartment or loan.

What’s The Best Way For A Young Person To Build Credit

There are many ways to build credit, and they all involve creditors reporting your bill payment information to the major credit bureaus: Experian, Equifax and TransUnion. To begin establishing credit if you have none, try one or more of these options:

- Become an authorized user on a parent’s credit card.

If one or both of your parents have a good credit history and keep their credit card balance low, you could ask them to add you to the account as an . As an authorized user, you may or may not have your own credit card for purchases, depending on your agreement with the primary cardholder, but assuming they continue to pay the bill on time and keep their balance low, your credit could benefit. Make sure the card issuer reports authorized-user activity to the credit bureaus, because not all do.

- Open a student or secured credit card.

College students can apply for a student credit card, which is often easier to get approved for than a non-student card. Whether or not you’re in school, you could also consider getting a secured credit card. Secured cards require a security deposit, which typically becomes your credit limit. This makes secured credit cards easier to obtain than regular unsecured cards because the deposit limits the issuer’s risk. Some card issuers will transition you to a regular unsecured credit card once you’ve shown responsible use of your secured card.

- Pay your student loans on time.

- Take out a credit-builder loan.

You May Like: Does Les Schwab Report To Credit Bureaus

How Do You Check Your Credit Score In Canada

Nearly half of Canadians dont know where to check their credit scores.

In Canada, your credit score is calculated by two different credit bureaus: Equifax and TransUnion. You can request a free copy of your credit report by mail at any time though your credit score is not included on the reports.

Both of these bureaus can provide you with your credit score for a fee, and also offer credit monitoring services. For more information visit TransUnion or Equifax.How do you improve your credit score?

When you understand how your credit score is calculated, its easier to see how you can improve it. Thats the good news: no matter how bruised your score is, there are a few relatively easy ways that you can change your behaviours and improve it.

1. Make regular payments

One of the easiest ways to improve your credit score or to build it from the ground up is to make consistent, regular payments on time over time. These are things that potential lenders love to see: consistency, dependability, regularity and history.

When it comes to credit cards, the best financial advice is always to pay it off every month so youre never running a balance. Making regular payments is one of the best habits to get into because youre always paying down your debt.

2. Close your newer accounts

3. Accept an increase on your credit limit

Just be careful you’re not getting into more debt in an attempt to improve your credit score.

4. Use different kinds of credit when possible