Which Credit Score Is Used For A Mortgage

When a mortgage lender pulls your FICO score, they are actually pulling several variations of your score . They concentrate on FICO scores 2, 4, and 5. Together they make up the Residential Mortgage Credit Score . In addition to your credit report, the RMCS also pulls employment and resident history, as well as legal records. This score is tailored to mortgage lenders because its specifically focused on your ability to repay a home loan, versus an auto loan or credit card.

Since your FICO score is comprised of scores from each of the three credit bureaus, your lender will use the scores in this way:

- If all three scores are different, they will use the middle score.

- If two of the scores are the same, they will use that score regardless if the third score is higher or lower.

If there are two borrowers who are applying for a mortgage, the lender will take the steps above for both individuals. The lender will then use the lower of the two credit scores for the loan approval process.

What Is The Difference Between Credit Scores From Equifax And Credit Scores From Fico

The Equifax credit score is an educational credit score developed by Equifax. Equifax credit scores are provided to consumers for their own use to help them estimate their general credit position. Equifax credit scores are not used by lenders and creditors to assess consumers’ creditworthiness.

FICO scores are general purpose credit scores developed by the Fair Isaac Corporation, which are used by lenders and creditors to help assess consumers’ creditworthiness.

Equifax credit scores and FICO scores can be calculated using information in your credit reports at any of the three nationwide credit bureaus — Equifax, Experian and TransUnion. Since the information on your credit reports at each bureau can differ, your Equifax credit score and FICO score can differ depending on which credit report is used to calculate the score.

The Equifax credit score model uses a numerical range between 280 and 850, and FICO score models use a range between 300 and 850. In both cases, higher credit scores indicate lower credit risk.

Who We Are

More Credit Karma Services

But, besides this free service, Credit Karma has other related services, including a security monitoring service and alerts for new credit checks on you. Outside of Credit Karma, many of the best credit monitoring services provide similar alerts and services.

And, once it has your personal information, you can search for personalized offers for a credit card, a car loan, or a home loan, and your search won’t pop up in your credit report on Credit Karma or anywhere else. A standard section of credit reports is “inquiries,” which lists requests for your report from lenders you’ve applied to for a loan.

Read Also: Cbcinnovis Inquiry

How Payment History Affects Your Fico And Credit Scores

Your payment history has a significant impact on your FICO and credit scores.

If you pay your bills on time, you may get a higher score since this shows that you are financially responsible. Your payment history is essential because it shows that you’ve always paid your bills on time or made partial payments when necessary.

Suppose instead, though, that you tend to pay only the minimum due on your credit card bill each month. Assuming this becomes a habit of not paying off your entire balance, your credit score may suffer, limiting your access to credit finance.

Fico 8 Vs Fico : What Are The Differences

FICO 9 is similar to FICO 8 but differs when it comes to collections and rent payments. FICO 9 counts medical collections less harshly than other accounts in collections, so a surgery bill in collections will have less of an impact on your than a credit card bill in collections.

Additionally, FICO 9 ignores accounts in collections that have a zero dollar balance. If you had a credit card account go to collections but later paid it off, FICO 9 will no longer use said collections account against your score. This is different than FICO 8, which factors all collections amounts of $100 or more into your FICO scoreeven if theyre completely paid off.

Just because collections with a zero balance are ignored by FICO 9 does not mean that lenders will ignore them. Credit bureaus will still show these collections on your full credit report, and lenders will see them when they reviews your full credit history.

Finally, FICO 9 factors rental history into your credit score. This makes it easier for people with no credit to build a high credit score with their monthly on-time rent payments. Unfortunately, this is dependent on your landlord actually reporting rent payments to credit bureaussomething not yet seen on a large scale.

Read Also: Does Snap Finance Report To The Credit Bureaus

Lets Start With Your Fico Credit Scores

In the old days, banks and other lenders developed their own score cards to assess the risk of lending to a particular person. But the scores could vary drastically from one lender to the next, based on an individual loan officers ability to judge risk.

To solve this issue, the Fair Isaac Corporation introduced the first general-purpose credit score in 1989. Known as the FICO Score, it filters through information in your credit reports to calculate your score.

Since then, the company has expanded to offer 28 unique scores that are optimized for various credit card, mortgage and auto lending decisions.

Why Isnt My Score The Same Everywhere

You may have a different score with each of the three nationwide credit reporting agencies . Dont be worried if thats the case. We all collect similar information, and a lot of it overlaps, but scores can vary for a number of reasons. For example, lenders can choose to report to one, two or all three agencies. Because of this, the information in your reports can vary, which is partly why your scores can differ too.

There are also many scoring models, and they may weigh certain information in your reports more heavily than other factors. For example, one scoring model may put more emphasis on total credit usage than others. Because there are varied scoring models, youll likely have different scores from different providers. Lenders use many different types of credit scores to make lending decisions. The score you see when you check it may not be the same as the one used by your lender.

Read Also: Does Opensky Report To Credit Bureaus

What Are Inquiries And How Do They Impact Fico Scores

Inquiries may or may not affect FICO® Scores. Credit inquiries are classified as either hard inquiries or soft inquiriesonly hard inquiries have an effect on FICO® Scores.

Soft inquiries are all credit inquiries where your credit is NOT being reviewed by a prospective lender. FICO® Scores do not take into account any involuntary inquiries made by businesses with which you did not apply for credit, inquiries from employers, or your own requests to see your credit report. Soft inquiries also include inquiries from businesses checking your credit to offer you goods or services and credit checks from businesses with which you already have a credit account. If you are receiving FICO® Scores for free from a business with which you already have a credit account, there is no additional inquiry made on your credit report. FICO® Scores take into account only voluntary inquiries that result from your application for credit. Hard inquiries include credit checks when youve applied for an auto loan, mortgage, credit card or other types of loans. Each of these types of credit checks count as a single inquiry. Inquiries may have a greater impact if you have few accounts or a short credit history. Large numbers of inquiries also mean greater risk.

How Do Public Records And Judgments Impact Fico Scores

Public records are legal documents created and maintained by Federal and local governments, which are usually accessible to the public. Some public records, such as divorces, are not considered by FICO® Scores, but adverse public records, which include bankruptcies, are considered by FICO® Scores. FICO® Scores may be affected by the mere presence of an adverse public record, whether paid or not. Adverse public records will have less effect on a FICO® Score as time passes, but they can remain in your credit reports for up to ten years based on what type of public record it is.

Don’t Miss: Aargon Collection Agency Scam

How Often Is Fico Score Updated

every 45 daysHow often do credit reports update? Your credit reports are updated when lenders provide new information to the nationwide credit reporting agencies for your accounts. This usually happens once a month, or at least every 45 days. However, some lenders may update more frequently than this.

Why Is My Fico Score Lower Than My Credit Score

Your credit score can impact many things in life. Besides affecting your ability to get a loan, buy a house, or buy a vehicle, your can affect what you pay for insurance and if you can get a cell phone.

If youre wondering why your FICO score is lower than your credit score, the answer depends on what credit scoring model is being used and what factors that scoring model looks at.

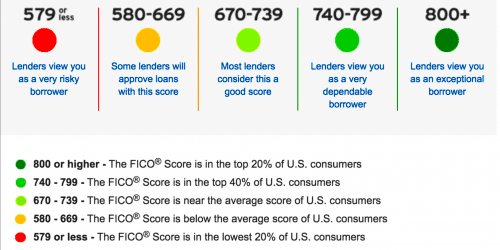

Credit scores are used to give lenders an idea of your , or, in other words, how likely you are to pay your bills on time. Credit scores range from 300 to 850, with 300 being the lowest and 850 the highest.

Youll have better luck getting a loan with a than 500. If you’re able to get a loan with a low score, that loan will probably come with a higher interest rate.

Also Check: Paypal Credit Soft Pull

Can You And Should You Do Anything About It

The decentralized nature of credit reporting will always introduce some differences. Those reporting information to credit bureaus are not required to send information to all three bureaus. Nor are they required to report simultaneously to the bureaus.

For their part, the credit bureaus make updates on their own schedules. They dont have to update their files so they match up with each other. Fortunately, most major card and loan issuers report to all three bureaus every month, though not necessarily at the same time.

Those types of variations arent worth bothering with. Others are.

For example, if you have paid off a big chunk of debt, you want that positive information included on all three bureaus reports. If it isnt, dispute the inaccuracy with the credit bureau thats not showing that.

If you have a mortgage pending, you may even be able to speed up the dispute process by having your mortgage broker or lender submit a rapid rescore request that can update your report in just a few days.

Finally, some discrepancies can work in your favor. For instance, a collection or public record item may appear on one or two, but not all three, of your credit reports. Rather than bring it to the attention of the bureau not reporting it, you may want to leave well enough alone. That will result in a higher score at that bureau. Then if youre lucky, the next time you apply for credit or rent an apartment the creditor or landlord might use that bureau with the higher score.

How Can I Raise My Fico Score Fast

Reduce the amount of debt you oweKeep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score.Pay off debt rather than moving it around: the most effective way to improve your credit scores in this area is by paying down your revolving debt.More items.

Read Also: Will Paypal Credit Report To Credit Bureaus

Vantagescore Or Fico: Does It Matter

VantageScore is not FICO, for Fair Isaac Corp. They are the two biggest competitors in the business of creating scoring models that are used to rate the creditworthiness of consumers. To complicate matters, both update their models occasionally, and lenders use different versions with slightly different results.

You don’t have a credit score. You have many credit scores, each calculated by a lender based on one of many models or versions of models. The important thing is, they should all be in the same range, such as “good” or “very good.”

Your score should be roughly the same on either model. One model may put slightly more weight on unpaid medical debt. One may take longer to record a loan application. But if your credit is “good” or “very good” according to one system, it should be the same in the other.

Number And Type Of Accounts

In order to build a credit history and good credit score, you need to actually use credit. Most young people start out with a retail credit card, student loan, or another type of loan that a parent co-signed for.

Its good to have at least a few accounts and variety is also important. Lenders want to see that youve used different types of credit without problems. If youre looking for your first credit card, check out our 2019 recommendations.

Also Check: Does Speedy Cash Report To Credit Bureaus

What Consumers Have To Say

If you want to know what people really think check social media. Some people have been pretty vocal regarding Credit Karma. Here are a few Tweets from Twitter:

Credit Karma always says my credit score is like 750. But then we just refinanced, and the bank sent out the credit disclosure letter and said my score was 825.

is wrong 99% of the time. They can be anywhere from 100 points higher to like 80 less than the actual score.

If you think your credit score on is right, you wrong, lol.

And for the last one a bit more colorful!

Credit Karma: your credit score is 800.

Car dealerships: maam. your shit is 325.

Fico Scores Vary By Credit Bureau

Each credit reporting agency has different information on file, which can affect a FICO score.

For example, Experian knows about your payment history and late payments, which affect your FICO score. TransUnion may have more in-depth information about other debts you’ve had to pay back in the past.

In contrast, credit scores do not. While there are a few different companies that offer credit scores, they all use the same three major factors:

- Payment history

- Length of credit history

FICO Scores Are Higher

Lenders tend to look more favorably at a FICO score of 720 or higher, while some may not accept a credit score that is below 600.

A credit score of 680 or higher is typically considered a good credit score. In contrast, anything below 579 is deemed to be poor.

Also Check: Opensky Locked Account

The Other Side Of The Coin

While the continued improvement in U.S. consumer credit profiles in aggregate is encouraging, it is important to note that there are millions of consumers for whom the financial strain of the last year has been observable in their credit files. In fact, some 17% of the FICO scorable population experienced a score decrease of 20 or more points between April 2020 and April 2021 . For many, this decrease has been driven by the inverse of the aggregate credit trends that are driving the national average FICO® Score upwards: the impacts of COVID-19-related income disruptions has led to missed payments and/or ramped up debt levels, as personal loans and credit cards are used as a lifeline to cover life necessities.

Figure 4. 37% of FICO Scorable Population Experienced Year-Over-Year Score Decrease

To learn more about FICO® Scores, check out these resources:

Why Fico Scores And Credit Scores Matter

A bad credit score can haunt you by making it difficult to rent an apartment, get an affordable mortgage, or land a job. Even if youre able to qualify for a loan, your interest rates will be higher than if you had good credit scores.

And that has costly ramifications: On a $150,000 mortgage, for example, a 1% higher interest rate could cost you $31,000 over 30 years.

On the other hand, good credit scores open all kinds of doors. Not only will you find it easier to borrow money when you need it, theyll also qualify you for lucrative credit card offers.

Yes, irresponsible credit card use can lead to a damaging debt spiral but responsible credit card use can reward you immensely for your everyday spending.

If you have high credit scores, you could get cards like the Chase Sapphire Reserve® , which offers a signup bonus worth hundreds in travel, or the Citi® Double Cash Card 18 month BT offer , which offers 2% cash back on every purchase .

Not there yet? Dont worry. Focus on building credit slowly and strategically. The best credit cards will be waiting for you when youre ready.

Also Check: Why Is There Aargon Agency On My Credit Report

What Is A Vantagescore

VantageScore was created by the three major credit reporting agenciesExperian, Equifax, and TransUnion. It uses similar scoring methods to FICO but yields slightly different results.

Featured Topics

One of the primary goals of VantageScore is to provide a model that is used the same way by all three credit bureaus. That would limit some of the disparity between your three major credit scores. In contrast, FICO models provide a slightly different calculation for each credit bureau, which can create more differences in your scores.

How Many Points Off Is Credit Karma

The only possible answer is, a few if any. Your credit score can vary every time it is calculated depending on whether the VantageScore or FICO model is used, or another scoring model, and even on which version of a model is used. The important thing is, the number should be in the same slice of the pie chart that ranks a consumer as “bad,””fair,””good,””very good,” or “exceptional.”

Also Check: Does Paypal Credit Report To Credit Bureaus