What Is A Default How Bad Is It

A Default refers to failure to pay a debt, which is normally issued after three to six months of missed payments. The default notice will take the form of a formal letter warning you that you are behind on your debt repayments. The details included on the notice will include:

- Details of the original credit agreement

- Details of the default on this original credit agreement

- Early settlement figures

- What you can do to sort out your default

- Details on what may happen if you do not improve the situation

How Long Is A Default On Your Credit Rating

A credit score default will stay on your report for five years and can have a significant effect on your ability to access mortgages, credit cards, loans and other forms of borrowing.

Even if lenders look past your credit score, you wont get the best deals and are likely to face increased interest rates. Bad times.

Whats worse, defaults stay on your report for five years even if you pay off the original debt. That doesnt mean you should skip paying it though, as youll never begin the journey back to a good credit score with unpaid debts weighing you down.

You may receive the thumbs down from lenders if you have a credit default in your history.

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Read Also: What Is Cbcinnovis On My Credit Report

Complain To Your Current Credit Provider The Listing Creditor Or Credit Reporting Body

If you send a complaint to a credit reporting body, make sure you also send a copy to any relevant creditor. Remember to date, sign and keep a copy of your letter.

If a credit reporting body or credit provider refuses to correct your credit file, they must provide the reasons why and evidence proving the correctness of the information. If you are not happy with the result of step 1, you can take step 2.

What To Expect After A Loan Default

The impact of a default on your credit history, and by extension your credit scores, can be both catastrophic and long-lasting. A default will stay on your credit reports for up to seven years, and prospective lenders will be far more reluctant to extend credit to you.

You should make an effort to repay the defaulted loan or credit card debt whenever possible. However, if youre having extended financial difficulties for example, you or a partner becomes unemployed and has trouble finding a new job, or a family member faces an unexpected medical hurdle you may find yourself going months without touching the defaulted loan. In the immediate aftermath, youll likely receive a stream of communications from the lender as the account goes 30, 60 and 90 days past due. Then one day, the calls and letters may stop altogether. At that point, it can be tempting to think your lender has forgiven the debt, but dont be fooled. In reality, the lender has probably sold the debt to a collection agency that will soon come after you for the money.

Recommended Reading: What Day Does Opensky Report To Credit Bureaus

How Can I Avoid A Serious Credit Infringement Or Default

As defaults and serious credit infringements remain on your credit report for years, it’s best to avoid them in the first place. Here are some easy tips to remember to dodge a default or credit infringement:

- Update your contact details. If you move house, log in to your online account or contact your credit issuer as soon as possible to update your account details. That way you won’t miss any late payment notifications.

- Set up automatic repayments. You can create automatic payments from your debit account to your accounts so that you never miss a payment.

- Discuss financial hardship options. If you have overdue accounts because you’re struggling to pay your bills, you can contact your credit card issuer to discuss alternative payment options. This could include extended payment periods or instalments.

Can I Get Credit Like A Loan Or Mortgage If I Have A Default

A default negatively impacts your ability to borrow money. When you apply for credit, lenders check your credit information to decide if youâre likely to pay them back. A default looks like bad news to lenders, as it shows youâve struggled to repay credit in the past. So, you may find it hard to get approved, particularly for mortgages since lenders must meet strict rules to ensure you can afford one.

However, itâs still possible to borrow money with a default on your record. If you are looking for credit you could consider options designed for people with bad credit history, which usually have high interest rates and low limits. But make sure you can afford the monthly repayments first.

You might like to compare mortgages across the UK market, and see your eligibility for personal loans. Remember, weâre a credit broker, not a lender.

Recommended Reading: Does Paypal Credit Affect Your Credit

One Of My Defaulted Accounts Has Been Sold On To A Debt Collection Company This Debt Is Now Appearing Twice On My Credit File Is This Right

If it is clear from looking at the two entries that they relate to the same account, with the same default date and balances and the original debt is clearly showing as settled then it is likely that we would consider this to be fair in terms of the data protection law. However, if the entries are recorded on your credit file in a way that may look like they are two different debts, or that could make the debt remain on your credit file for longer than six years from the date of the original default it is unlikely that we would consider this to be fair.

There Is A Ccj On My Credit File That Has Nothing To Do With Me What Can I Do

Because information relating to county court judgments is often received from the courts without the individuals date of birth this can sometimes lead to mix ups particularly where people with the same name live at the same address.

If this has happened to you, you should raise this as a dispute with the CRA who you obtained your credit file from. They can, in the first instance, try and match you to the correct information. There are easy mistakes to identify such as an obvious mis-keying of a house number or misspelling of a name and in these cases the correct information can be merged, or separated as appropriate. The CRA should reply to let you know that they have resolved the issue or, if they are unable to, explaining why.

If, after raising a dispute with the CRA they have failed to resolve the issue you may want to make a complaint;to the ICO. You can find more information about how to make a complaint and the evidence we require can be found in Section 5 of our; guidance.

Recommended Reading: Does Lending Club Hurt Your Credit

What Are Credit Reference Agencies

The three main consumer CRAs in the UK are Equifax, Experian and TransUnion.

Most of the information held by the CRAs relates to how you have maintained your credit and service/utility accounts. It also includes details of your previous addresses and information from public sources such as the electoral roll, public records including county court judgments, and bankruptcy and insolvency data.

The information held by the CRAs is also used to verify the identity, age and residency of individuals, to identify and track fraud, to combat money laundering and to help recover payment of debts. Government bodies may also access this credit data to check that individuals are entitled to certain benefits and to recover unpaid taxes and similar debts.

CRAs are licensed by the Financial Conduct Authority.

My Partner And I Are Financially Linked Because We Have A Joint Account And Are Both Named On The Mortgage If He Applies For Credit Will The Lender Look At My Credit File As Well As His Will I Be Notified Of This

In short, yes, the lender can have full access to your credit file in the same way it could if it were you applying for credit. This is because your financial situation may have a bearing on whether your partner is offered credit or not. Because you are financially linked they are, effectively, looking at your credit history and ability to repay the loan as a couple rather than as an individual.

You should only be linked to someone who you have a joint account with or in some situations, have agreed to act as a guarantor for . You should not be linked to anyone just because you live at the same address.

When a joint account is closed you can write to the CRAs to request a disassociation from that individual.

If you find a financial link to someone you dont know, or you believe to be inaccurate you should raise this with the CRA and ask that they investigate this for you.

You May Like: What Credit Score Does Carmax Use

Can You Still Get A Mortgage With A Default

Receiving a default can be a stressful and worrying experience. However, a default;should not be looked at as being obstacle against acquiring a mortgage. Specialist lenders exist who work with applicants with bad credit history and indeed defaults present on their credit history to locate them the best deals for their mortgage needs.

Just Mortgage Brokers have access to over 12,000 mortgage products including specialist lenders so we can identify the right mortgage deal for your specific needs. Bad credit mortgages in the UK neednt be a minefield. Contact Just Mortgage Brokers today to discuss how we can help you acquire a bad credit mortgage.

How Do You Know If You Have A Default

Before a credit provider can report a consumer default, they must send at least two written notices to your last known address.

The first notice can be sent as soon as a payment is overdue, and must request that you pay the debt.

The second must be sent a minimum of 30 days after the first, and notifies you that the debt may be reported to a credit reporting body, like Equifax.

After a minimum of 14 days after this second notice, the creditor can inform a credit reporting body.;

Tip: Defaults can be recorded for debts in your name that you may not have applied for yourself, for example, in cases of fraud or legitimately as a guarantor to someone elses credit. If someone has incurred a default in your name, and you suspect that this is not legitimate, you may need to correct your credit report. Under the Privacy Act 1988 , you can have this investigated free of charge and amended if the information is incorrect. .

Read Also: Business Credit Cards That Don T Report To Personal Credit

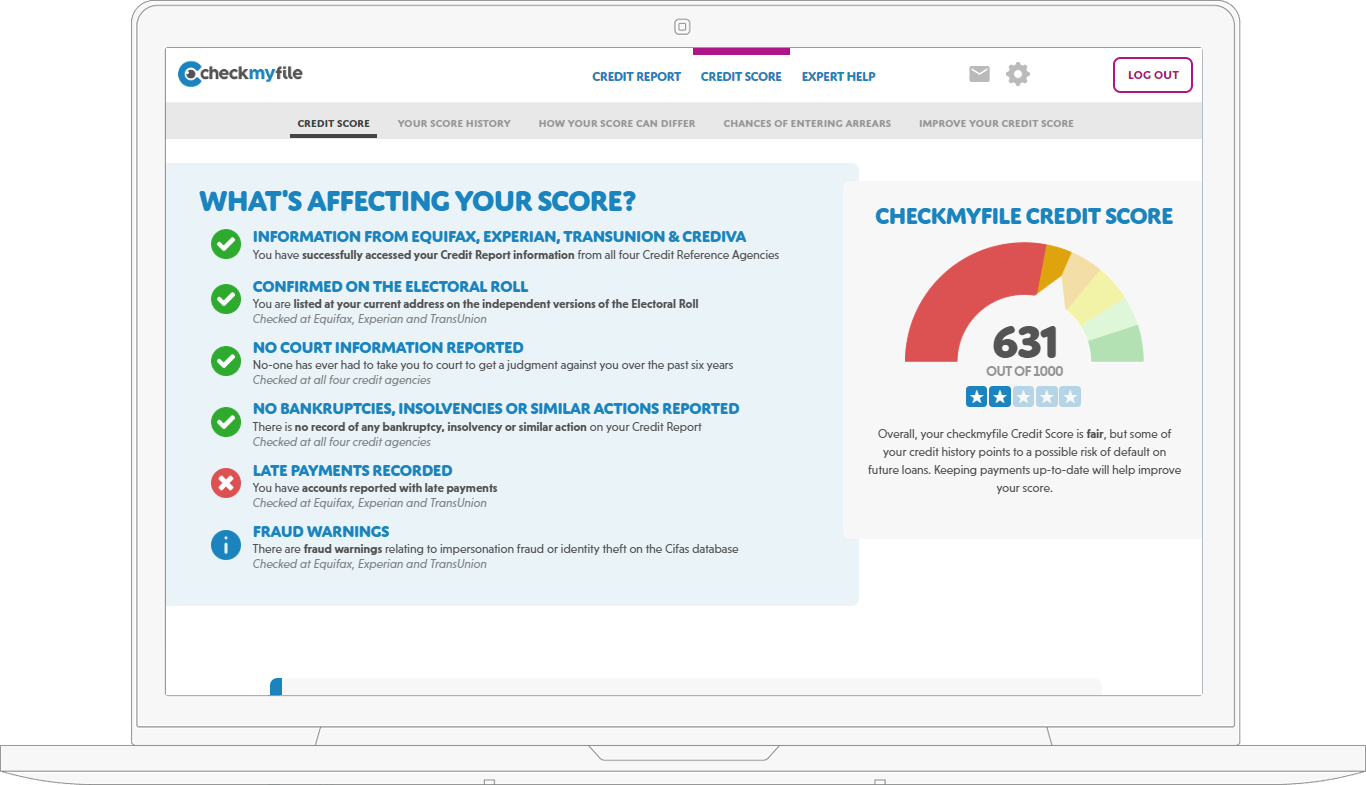

How Do I Check My Credit Rating

Everyone has a legal right to request information held about us by a credit reporter at no cost.

If you want the information quickly you may be required to pay a fee, but otherwise its free to check your credit rating.

To order a credit report, contact the credit reporters directly at the links above. Selecting the regular application option will take longer than an express service but theres no charge.

For a fee, some credit reporters, such as Equifax, will load a monitor on your credit file to alert you to applications for credit made using your identity.

Find out more about;rights;on the Privacy Commissioner’s website.

Correcting wrong information

Spotted a mistake? Ask the credit reporter to correct it and they will sort it out.

Understanding Defaults On Your Credit Rating

A default on credit will occur if you fail to pay an expected debt, such as a utility charge, mobile phone bill, credit card repayment or loan.

But missed or late payments dont always turn into defaults. You have to be at least 30 days overdue on a payment of $100 or more and the credit provider must have taken steps to recover the money .

If your debts remain unpaid, the provider is likely to get in touch with a credit rating agency to report the default, which will then show up on your credit file.

You May Like: Does Klarna Report To Credit

How Can I Offset The Effect Of A Default Notice

Until six years have gone by, a default will continue to have a detrimental effect on your credit file.

While you canât change or completely eradicate the impact during this time, you can try to offset it by improving your credit score in other ways.

- Make sure youâre on the electoral roll. If you havenât yet registered to vote at your current address, make this a priority. Itâs a really easy way to boost your credit score, and the longer youâre on the electoral register at one address, the better it looks to lenders.

- Donât apply for credit. Avoid applying for further credit for at least six months. This will help give your credit score a boost â and also stop you getting any further into debt.

- Be timely with repayments. If you have any other forms of credit, pay them off in a timely manner. It can help if you automate your payments by setting everything up on direct debit.

- Choose to pay upfront. Some payment methods are viewed more favourable than others by creditors. For example, if you choose to pay your car insurance annually, rather than monthly, this avoids the insurer carrying out an unnecessary search on your credit file and will be less likely to have a negative impact on your score.

What Can A Creditor Do After I Receive A Default Notice

It varies. If you pay the default or comply with the terms detailed in it for repayment within the time limit, the debt will be satisfied, and theyâll take no further action.

If you donât respond to the default, the company you owe money to will prevent you from using any more credit and cancel your account with them.

Things could escalate if your creditor decides to take further action to recover the debt. This can include:

- Starting court proceedings against you â which could result in a County Court Judgement .

- Passing on the debt to a debt collection agency.

- Starting proceedings to repossess any goods that are included in the agreement â for example, a TV that was bought via a monthly payment agreement, or a car that was bought through finance.

Read Also: Which Business Credit Cards Do Not Report Personal Credit

Can I Reduce The Negative Impact Of A Default

Once a default is recorded on your credit profile, you canât have it removed before the six years are up . However, there are several things that can reduce its negative impact:

- Repayment. Try and pay off what you owe as soon as possible. Once youâve achieved this, the default will be marked as âsatisfiedâ on your credit report, which looks better to lenders

- Explanation. Consider asking us to add a note to your credit report to help lenders understand why you got into debt

- Time. As your default ages, it may become less important to lenders. So, after a few years, you may find it easier to get approved for credit again

You can also take steps to improve your credit score, which can help balance out the negative impact of a default. In the long-term, you get more control over your finances with a paid CreditExpert subscription.

Defaulting On A Student Loan

Student loans are another type of unsecured debt. If you fail to pay your loan, you probably won’t find a team of armed;U.S. Marshals at your front door, as one Texas man did in 2016, as reported by CNN Money. But its still a very bad idea to ignore that debt.

In most respects, defaulting on a student loan has the same consequences as failing to pay off a credit card. However, in one key respect, it can be much worse. The federal government guarantees most student loans, and debt collectors dream of having the powers the Feds employ. It probably wont be as bad as armed marshals at your door, but it could get very unpleasant.

Don’t Miss: Speedy Cash Late Payment

How Do Defaults Work

A default is a financial term, used when a credit agreement has been broken. If youre unable to make payments or you don’t pay the right amount, your creditor may send you a default notice. If the default is applied, it could affect your credit file. Even if you have a default on your file, you can reduce the impact it has on your credit by working with Lowell on an affordable and reasonable payment plan. Find out more about defaults, including how long a default stays on your credit file, how to have a default removed and how working with Lowell can help with a default.

In this guide:

- What is a default on a credit file?

- How to get a default removed from your credit file

- Can I reduce the negative impact of a default?