What Is A Perfect Credit Score

What does it mean to have perfect credit? If your credit score is 850, you have the highest credit score possible in both the FICO and the VantageScore credit scoring systems.

However, the FICO credit scoring system considers all credit scores over 800 to be exceptional. While trying to get a perfect credit score might be a fun game, you can get all of the advantages associated with perfect credit simply by getting your credit score over 800. Once your credit score passes 800, theres little you can do to actually make your credit score even higher, besides keeping your credit utilization low and waiting for the length of your credit history to improve.

What Does It Mean If Your Credit Score Is High

Lenders tend to look at your credit score when you apply for credit, such as a credit card. Theyâre looking for someone who will be able to meet the repayments – someone who is low risk.

A higher credit score means your credit report contains information that shows youâre low risk, so youâre more likely to appeal to lenders. For example, if your report shows that you always pay your bills on time, youâll be considered a reliable borrower.

If you have a high credit score, your application is more likely to be accepted. Youâre also more likely to be offered the best interest rates and higher credit limits.

Check your eligibility: See what offers you’re eligible for with your credit score.

What Is A Bad Credit Score Range

Bad credit score = 300 549: It is generally accepted that credit scores below 550 are going to result in a rejection of credit every time. If your score has fallen into this range, improving your score is going to take some work.

Filing for bankruptcy can bring a score down to this level. Statistically, borrowers with scores this low are delinquent approximately 75% of the time. But if you continue to make your payments on time, your score should improve. There are certain types of loans, like home loans, that are hard to get with a score in this range, but there are still options for getting a mortgage with bad credit.

Recommended Reading: Does Paypal Report To Credit Bureaus

Do You Need An 850 Credit Score

Nothing magical will happen if your credit score of 850 ticks up to 850. And most importantly, you probably wont save more money. You dont need to take our word for it, though. We consulted a panel of financial experts, all of whom said the same thing.

Disclaimer: Editorial and user-generated content is not provided or commissioned by financial institutions. Opinions expressed here are the authors alone and have not been approved or otherwise endorsed by any financial institution, including those that are WalletHub advertising partners. Our content is intended for informational purposes only, and we encourage everyone to respect our content guidelines. Please keep in mind that it is not a financial institutions responsibility to ensure all posts and questions are answered.

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Related Scores

What Is An Excellent Credit Score

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

An excellent credit score is a FICO® Score of 800 to 850 or a VantageScore of 781 to 850.

To clarify what these different scores mean, FICO is the credit scoring system that’s most widely used by lenders. VantageScore isn’t as popular, but it’s often the score provided by free credit score tools.

Having a credit score in this range is great for your personal finances. With excellent credit, you’re likely to qualify for the top credit cards and the lowest interest rate on loans. Whether you have excellent credit and you want to take advantage of it or you’re trying to get there, here’s everything you need to know.

Recommended Reading: Does Paypal Credit Help Credit Score

How To Earn A Good Credit Score:

If you currently have a credit score below the “good” rating, you may be labeled as a subprime borrower, which can significantly limit your ability to find attractive loans or lines of credit. If you want to get into the “good” range, start by requesting your credit report to see if there are any errors. Going over your report will reveal what’s hurting your score, and guide you on what you need to do to build it.

Other Credit Scores Or Fico Scores

While FICO Scores are used by 90% of top lenders, there are other credit scores made available to consumers. Other credit scores may evaluate your credit report differently than FICO Scores. When purchasing a credit score for yourself, most experts recommend getting a FICO Score, as FICO Scores are used in 90% of lending decisions.

Also Check: How To Remove A Repo From Your Credit

What Information Credit Scores Do Not Consider

FICO® and VantageScore do not consider the following information when calculating credit scores:

- Your race, color, religion, national origin, sex or marital status.

- Your age.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Soft inquiries. Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use from companies like Experian. These inquiries do not impact your credit scores.

How Can I Check And Monitor My Credit

You can check your own credit it doesn’t hurt your score and know what the lender is likely to see.

You can get a free credit score from a personal finance website such as NerdWallet, which offers a TransUnion VantageScore 3.0.

It’s important to use the same score every time you check. Doing otherwise is like trying to monitor your weight on different scales or possibly switching between pounds and kilograms. So, pick a score and get a game plan to monitor your credit. Changes measured by one score will likely be reflected in the others.

Remember that, like weight, scores fluctuate. As long as you keep it in a healthy range, those variations wont have an impact on your financial well-being.

Also Check: Can I Get A Repo Off My Credit

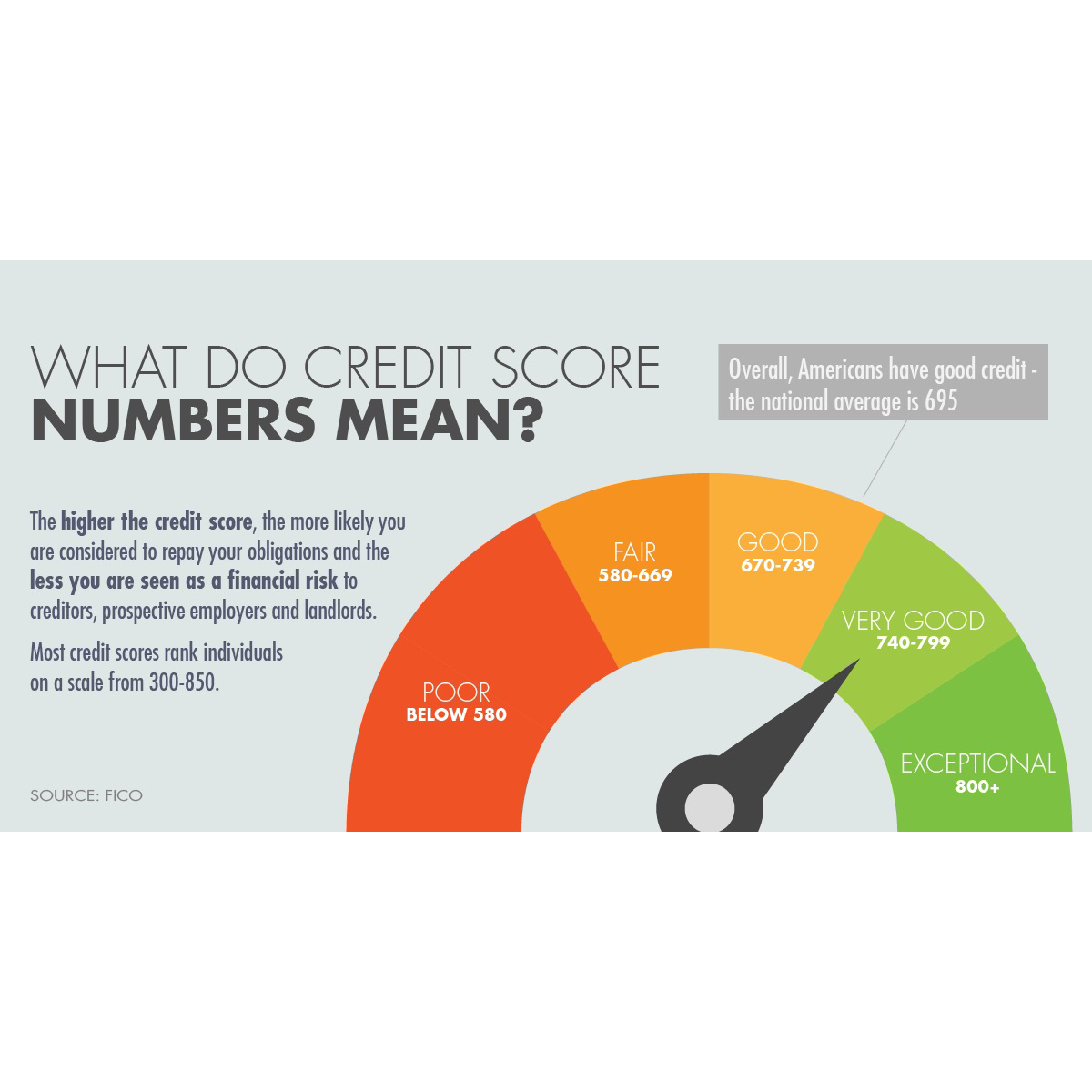

What Does My Credit Score Mean

Your credit score is a three-digit number that sums up all the information on your credit report into one tidy number. It follows you around for your entire life, its value moving up and down depending on whats happening in your financial life.

This three-digit score goes by two different names, FICO or VantageScore. The FICO score is named after the company who invented this three-digit scoring system in the mid-1980s, Fair Isaac, Inc. Many lenders use the FICO scoring system.

More recently, the three major credit reporting agencies created their own scoring system, called the VantageScore, designed to produce a more consistent score across all three credit reporting agencies.

So what does a score mean? Whats a good credit score? Or a bad one?

Your Score Range: 300

Your score falls between 300 and 549, which is the lowest credit score range. About 16 percent of Americans are in this category.

It will take time to counteract your financial problems and win back the trust of creditors. However, with patience and dedication, you can improve your credit score. A higher score can grant you access to loans when you need them and help you live better.

Recommended Reading: What Credit Bureau Does Target Pull From

How To Get A Good Credit Score

Good credit habits, practiced consistently, will build your score. Heres what you need to do:

-

Pay bills on time. This is important because payment history has the largest impact of all the factors in your score. A missed or late payment can do tremendous damage to a credit score and it can stay on your credit report for up to 7 years.

-

Try to keep your credit card balances well below your credit limits aim for, and lower is better. High utilization dings your score, but the damage will fade when you’re able to reduce your balances and the lower utilization shows up on your credit reports. You also may be able to lower utilization by getting a higher credit limit or becoming an authorized user on a lightly used card with a large limit.

-

Keep credit accounts open unless there is a compelling reason, such as high fees or poor service, to close them. Keeping older accounts open helps your average age of accounts, which has a small influence on your score. Also, closing an account cuts into your overall credit limit, driving up your credit utilization.

-

Avoid making several credit applications in a short time frame. Credit checks for the purpose of credit decisions can cause a small, temporary dip in your score, and several in a short time can add up.

-

Monitor your credit reports and dispute information you believe is incorrect or too old to be included .

Personal Loan Growth Slowed From Last Year’s Record High

- 22% of U.S. adults have a personal loan.

- The average FICO® Score for someone with a personal loan in 2020 was 689.

- The percentage of consumers’ personal loan accounts 30 or more DPD decreased by 27% in 2020.

Despite growing by 12% in 2019, personal loan balances saw the least growth in 2020, at just 1%. Personal loan balances rank near the bottom compared with other debt types, with consumers owing an average of $16,458 in Q3 2020. Across the nation, nearly one-quarter of adults have a personal loan.

Personal loan accounts also saw a dramatic decrease in delinquencies, with the percentage of loans 30 or more DPD falling by 27% in 2020. Though personal loan delinquencies in 2019 also decreased from the prior year, this drop was 25 percentage points higher in 2020.

Recommended Reading: How To Raise Credit Score 100 Points

What Is A Good Fico Score

FICO® creates different types of consumer credit scores. There are “base” FICO® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card issuers and auto lenders.

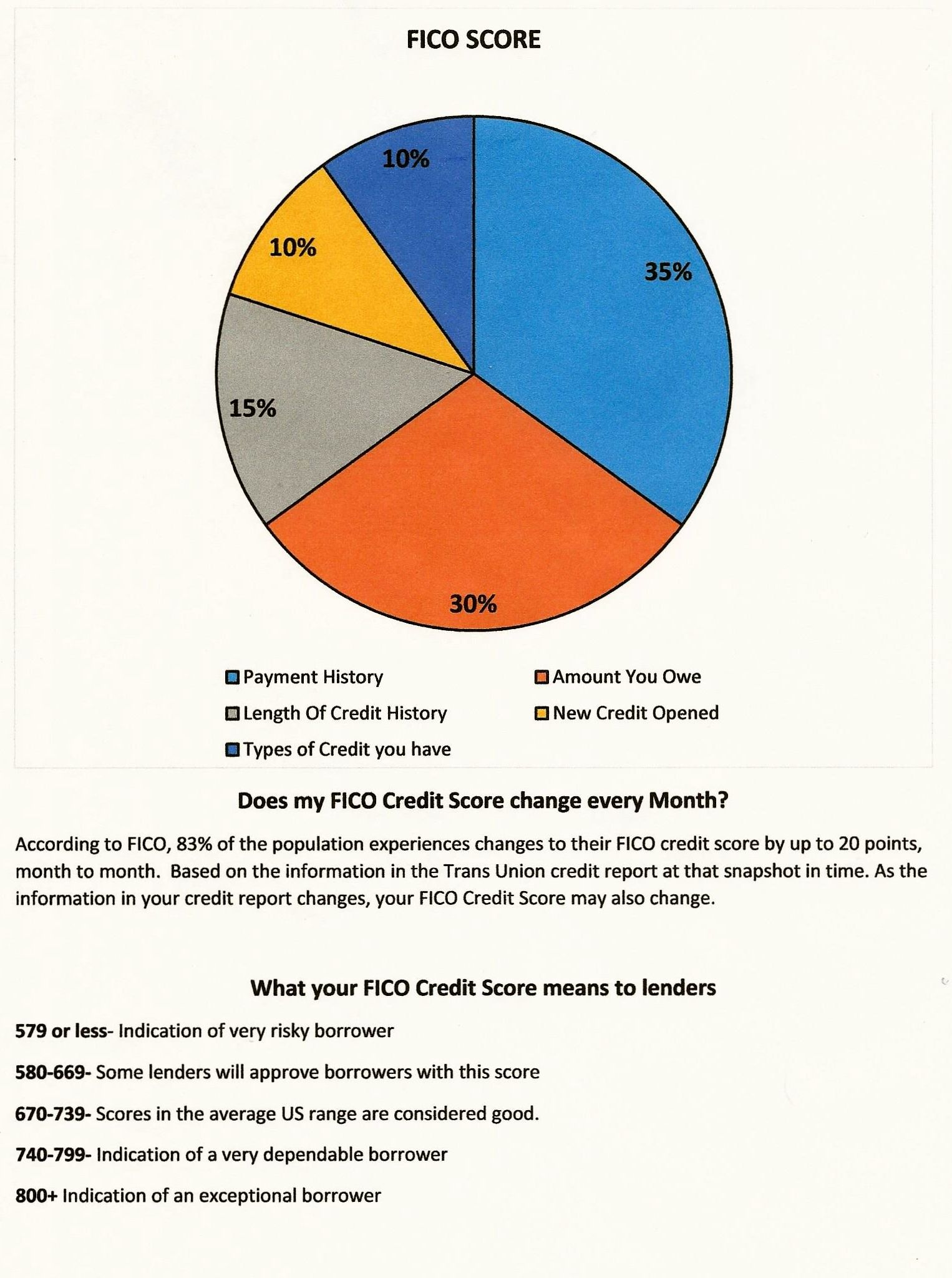

The base FICO® Scores range from 300 to 850, and FICO defines the “good” range as 670 to 739. FICO®’s industry-specific credit scores have a different range250 to 900. However, the middle categories have the same groupings and a “good” industry-specific FICO® Score is still 670 to 739.

Monitor Your Credit Report And Score

Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable termsbut checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest. Experian offers free credit monitoring for your Experian report, which in addition to a free score and report, includes alerts if there’s a suspicious change in your report.

Keeping track of your score can help you take measures to improve it so you’ll increase your odds of qualifying for a loan, credit card, apartment or insurance policyall while improving your financial health.

Recommended Reading: How To Get Credit Report Without Social Security Number

How Is A Credit Score Calculated

Whenever you apply for credit, lenders will look at information from your credit report, application form, plus any information they hold on you . All this data is then used to calculate your credit score. Every lender has a different way of calculating it, largely because they all have access to different information but they also have different lending criteria.

Generally, the higher your score, the better your chances of being accepted for credit, at the best rates.

like ourselves, calculate a version of your credit score. How each CRA calculates this varies but there are certain factors they all consider, including – how much you owe, how often you apply for credit, and whether your payments are made on time. You can read more about the factors that influence your score in our guide to what affects your score.

How Is Fico Different From Vantagescore

Aside from FICO, there’s an entirely separate credit scoring model, called the VantageScore®, which the three major credit reporting agencies released together in 2006. The average VantageScore, according to recent Experian data, is 680.

There are several differences between the FICO and VantageScore models. You could have a VantageScore with just one line of credit to your name, even if it’s less than six months old, for instance. But you won’t have a FICO® Score if you don’t. Plus, a good VantageScore starts at 700, as opposed to 670 on the FICO® Score range.

The two scoring models also differ in the ways they weight certain financial behaviors. The latest VantageScore version is more similar to FICO® Score 9 than FICO® Score 8, which is still most widely used: It doesn’t factor in paid collection accounts and reduces the impact of medical collections on credit scores. VantageScore also considers your historical credit utilization, such as how frequently you pay off your balances in full, rather than capturing it only as a snapshot like a FICO® Score does.

Also Check: How Personal Responsibility Can Affect Your Credit Report

Get Approved For Higher Limits

Your borrowing capacity is based on your income and your credit score. One of the benefits of having a good credit score is that banks are willing to let you borrow more money because youve demonstrated that you pay back what you borrow on time. You may still get approved for some loans with a bad credit score, but the amount will be more limited.

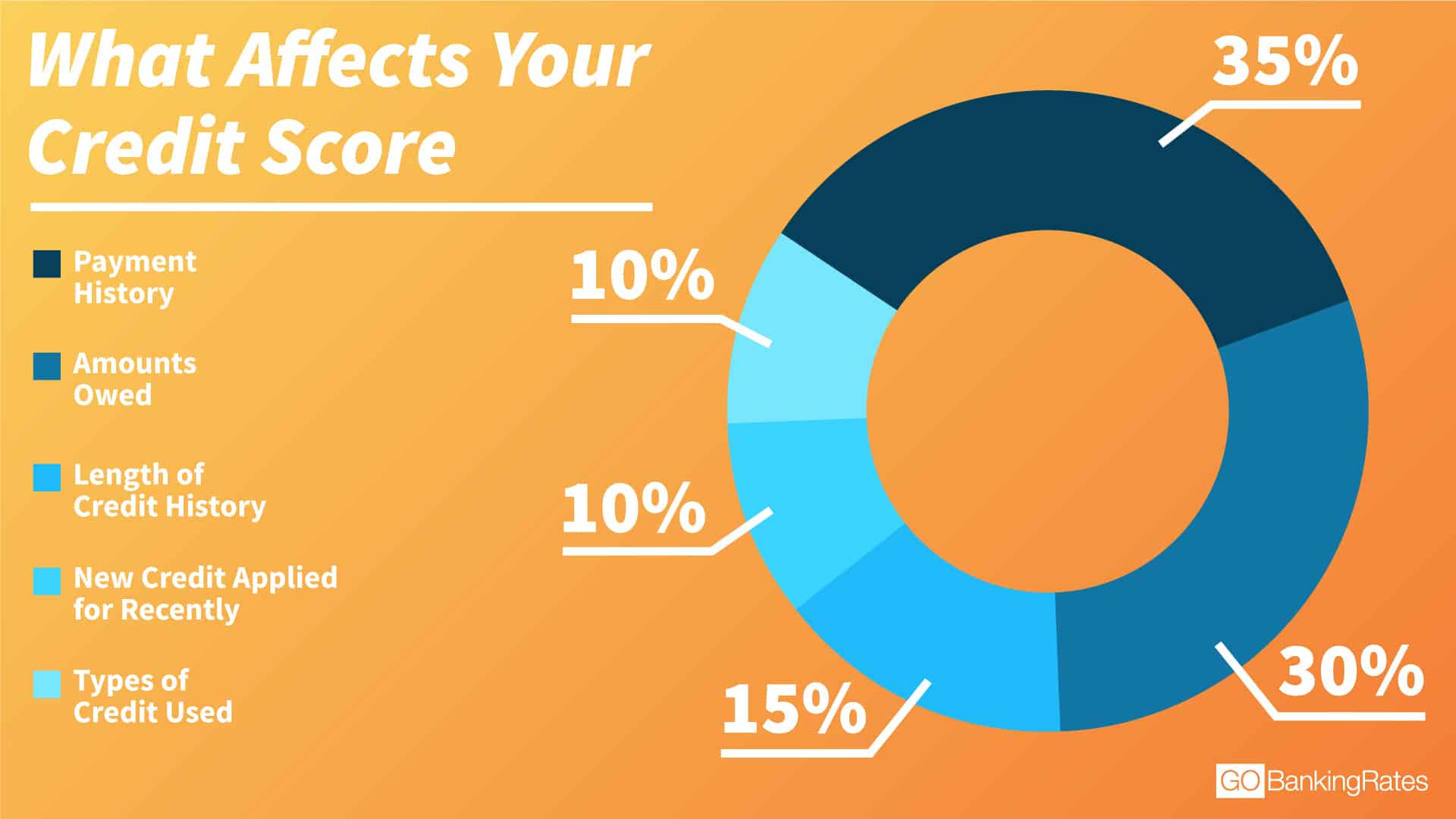

What Affects Your Credit Scores

Common factors can affect all your credit scores, and these are often split into five categories:

- Payment history: Making on-time payments on your credit accounts can help your scores. But missing payments, having an account sent to collections or filing bankruptcy could hurt your scores.

- : How many of your accounts have balances, how much you owe and the portion of your credit limit that you’re using on revolving accounts all come into play here.

- Length of credit history: This category includes the average age of all your credit accounts, along with the age of your oldest and newest accounts.

- Types of accounts: Also called “credit mix,” this considers whether you’re managing both installment accounts and revolving accounts . Showing that you can manage both types of accounts responsibly generally helps your scores.

- Recent activity: This considers whether you’ve recently applied for or opened new accounts.

FICO® and VantageScore take different approaches to explaining the relative importance of the categories.

Don’t Miss: Does Lending Club Show On Credit Report

What Affects Your Credit Score

Whether you have a good credit score on its way to very good or excellent, or have a less-than-good score that youd like to improve, the factors that affect your credit score are generally the same.

Since your credit score depends in part on the credit scoring model used to generate it, how these factors are used can vary. But Equifax offers some useful guidance on what factors are considered and how important they are.

How A Good Credit Score Can Help You

A credit score is a numeric representation, based on the information in your , of how risky you are as a borrower. In other words, it tells lenders how likely you are to pay back the amount you take on as debt.

In general, the higher your scores, the better your chances of getting approved for loans with more-favorable terms, including lower interest rates and fees. And this can mean significant savings over the life of the loan.

Having a good score doesnt necessarily mean youll be approved for credit or get the lowest interest rates though, as lenders consider other factors, too. But understanding your credit scores could help you decide which offers to apply for or how to work on your credit before applying.

Recommended Reading: How To Get Credit Report With Itin Number

What Are The Benefits Of A Good Credit Score

The benefits of good credit can include everything from lower credit card interest rates to lower car insurance premiums.

Since credit scores are based on information in your credit reports, a higher score is a sign of healthy creditâand that can be the key to enjoying these eight benefits:

1. Get Better Rates on Car Insurance

First up: car insurance. Some insurance companies may use your credit scores to make all kinds of decisions when you apply for coverage.

According to the CFPB, insurance carriers can use your credit reports to help decide whether to approve your application and how much to charge you. Once youâre a customer, they may check your credit to help decide whether to raise your premiums or even deny you the chance to renew your policy.

2. Save on Other Types of Insurance

Companies offering other kinds of insuranceâhome insurance, for exampleâmay also look at your credit history.

Thatâs because insurance companies may want the same information that other lenders look for. That could include your history of on-time bill payments as well as how much debt you owe. What insurance companies learn about your credit may help them determine how much youâll pay in premiums.

3. Qualify for Lower Credit Card Interest

When you apply for a credit card, the card issuer will likely check your credit. If youâre approved, a good credit score may make you eligible for things like a lower annual percentage rate .

4. Get Approved for Higher Credit Limits