Get Multiple Official Copies Of The Deceaseds Death Certificate

Obtain original death certificates from the county where the deceased lived. The funeral director who handled burial, cremation or other arrangements may also provide you with copies of the death certificate. Get more copies than you think you need its easier than going back for more later.

You probably will want to get one death certificate copy for each of the deceaseds credit cards, three for the three credit reporting bureaus, plus copies for other estate purposes. Some states have both long-form and short-form death certificates, and banks will differ on which they require.

You do not want to deal with identity theft of a loved one several years after they have passed away.

Recommended Reading: How To Remove Chapter 7 From Credit Report

Consider A Debt Management Plan

If you have the money to pay the debt and want to clear it up, you could talk with a not-for-profit credit counselling agency and arrange a debt management plan.

However, you must repay your debt in full, as this is a requirement with any payment plan through a credit counselling agency. A credit counsellor cannot settle your debt for less even if the collection agency is willing to accept less than the full amount.

A new note will be placed on your credit report when you enter into a debt management plan. This note will remain for two to three years from completion. However, some creditors continue to report your monthly payment made through a collection agency as regular transactions, refreshing the last activity date. So the debt can remain on your credit report for six years after you complete your debt management plan. Since a DMP can be anywhere from 1 year to 5 years, that one account could impact your credit history for a long time if you go through a credit counsellor.

Hiring A Collection Agency Or Credit Reporting Service

Don’t Miss: Does Paypal Credit Affect Credit

Is Simm Associates Inc Calling You*

Stop The Harassment

Is SIMM Associates, Inc calling you? Here’s what you need to know.

If youve ever had a debt collector call you about an overdue account, youre not alone. According to the Center for Responsible Lending, approximately one out of every seven Americans has an account in collections. While dealing with a persistent collector can be intimidating, remember that you have rights that prevent them from treating you in unprofessional and unethical ways.

Collection Accounts And Your Credit Report

If you have an account sent to a collection agency, your has already taken a hit. Every month your creditor has been reporting missed or late payments to the credit bureau. Once the account goes to a debt collector, the debt is marked as a collection account.

Collection accounts significantly hurt your credit score and will do so for several years whether you pay them or not. According to Equifax, Canadas largest credit reporting agency, a debt in collection wont be removed from your credit report until six years after your last payment date.

The problem with making a payment to the collection agency is that this new payment will reset how long that account will stay on your report.

To explain, here is an example:

You have an outstanding credit card bill that you havent made a payment on in two years based on credit reporting rules, it will automatically disappear from your credit report in four more years.

You have the money, so you decide to pay the debt collector. Since debt collectors report activity to the credit bureaus, doing so creates a new last payment date. Once you pay the collection agency, the debt will remain on your credit report for six more years, two years longer than not making a payment. Even if the collection agency agrees to accept less than the full amount owing, its still on your credit report for six more years.

In other words, paying a collection agency can mean the debt will affect your credit score longer than not paying.

Read Also: Does Zzounds Report To Credit Bureau

Creating And Using An Affirm Account

Before you can make purchases through Affirm, you will need to have an account with the lender. You can do this easily through their website.

You will need to be at least 18 years old and be a permanent resident or citizen of the U.S. to qualify. You must have a cell phone number and agree to receive texts from the company. It is also ideal to have a credit score of at least 550.

The company has also launched a mobile app that can be downloaded at the Apple store and Google Play Store to create an account.

Know Your Rights And How To Use Them Against Simm Associates Inc

When Simm Associates Inc comes knocking at your door, the first thing to do is to search for your rights in the Fair Debt Collection Practices Act 1977. This statute was specifically enacted to protect consumers from illegal actions, such as harassment, threatening to sue, threatening family members, coming to your home in disguise, etc.The key provisions of the FDCPA 1977 are:

- Protection against harassment: abusive phone calls, excessive phone calls, threats, violence.

- You have the right to sue either the whole agency or just the individual.

- You can ask Simm Associates Inc for proof of debt.

- You can ban debt collector from calling you at inconvenient times or at work. You can even ban them altogether.

- They CANNOT blab about your debt to other people. The information should remain between you and the debt collector.

When Simm Associates contacts you for the first time, they have to give you a mini-Miranda which is basically a full disclosure. In the mini-Miranda you must be told of your right to dispute the debt, the name of the company, the debt amount and the right of the consumer to ask for its verification. They have to send you all of this information in writing 5 days after the call.

If anyone from debt collection agency shows up to your home in the uniform of a police officer or claim to be an attorney of the creditor, that is completely illegal. Moreover any kinds of threats to seize your property or other assets or have them thrown to jail is also illegal.

You May Like: Does Carmax Do Credit Checks

How To Deal With Debt Collectors

Its a situation no one wants to be in. Multiple phone calls throughout the day, always demanding that you make a payment for bills you cant afford.

The constant messages left on your voicemail, the calls at your workplace or to friends and family, all of it quickly becomes both embarrassing and stressful.

No one likes dealing with debt collectors. But is there anything you can do about it? What are your legal rights when dealing with them?

This article will cover the rules that debt collectors have to follow and what you can do to stop the constant harassment. Knowing how to deal with debt collectors can save you a lot of time, money, and stress.

Filing A Complaint Against A Debt Collector

First, get proof of the actions that they are taking. You may be able to record telephone conversations without their knowledge, depending on your states wiretapping laws.

If you live in one of the following states, you cannot record the conversation without notifying the collection agent: California, Connecticut, Delaware, Florida, Illinois, Maryland, Massachusetts, Michigan, Montana, New Hampshire, Pennsylvania, and Washington.

If you live in one of the states listed above, have a witness to listen in during the conversations so you have someone who can corroborate what was said.

Also Check: What Credit Report Does Paypal Pull

Payment Firm Klarna Messed Up My Credit Score Says Student

“I was sitting with the girls talking about buying our first houses and how we would manage.

“I wasn’t too worried, because my credit score was quite good. The next time I checked, it had nearly halved,” Erin Phillips says.

The 21-year-old student prides herself on being organised, with monthly payments set up to pay off credit card bills and her car automatically.

But, she often used Klarna, a buy now pay later firm, to buy clothes online, try them on, and pay 30 days later.

She missed a few payments – not realising that it could affect her credit score, which banks and credit card companies use to decide whether or not to lend to people.

Klarna offers different ways to pay, including a deadline of up to 30 days or making three equal monthly instalments.

It says that it does a “soft” credit check, which doesn’t affect credit scores, for both options, to ensure customers have the ability to repay.

Klarna sent her a letter when her payments were overdue: “All they say is you’ve missed a payment, and you have one extra week. There’s not much information in them really.

“I was quite naive, and I didn’t think these little purchases would affect me so much, usually between £20 and £80. If I had known, I would have just used my credit card.”

Stop Calls From Mrs Associates Now

You could get as many as 15 calls per day, according to a Consumer Credit Card Market Report.

Thats way too many.

But you cant just call them and ask them to stop.

Follow these simple steps to stop the calls.

Make sure you follow these exact steps.

If you do, the National Consumer Law Center states, the collector can only acknowledge the letter and notify you about legal steps the collector may take.

When you stop the phone calls, you get some breathing room. Remember that you still owe the debt, and the collector can take legal action.

Then you can tackle the next step.

Recommended Reading: Does Cashnetusa Report To Credit Bureaus

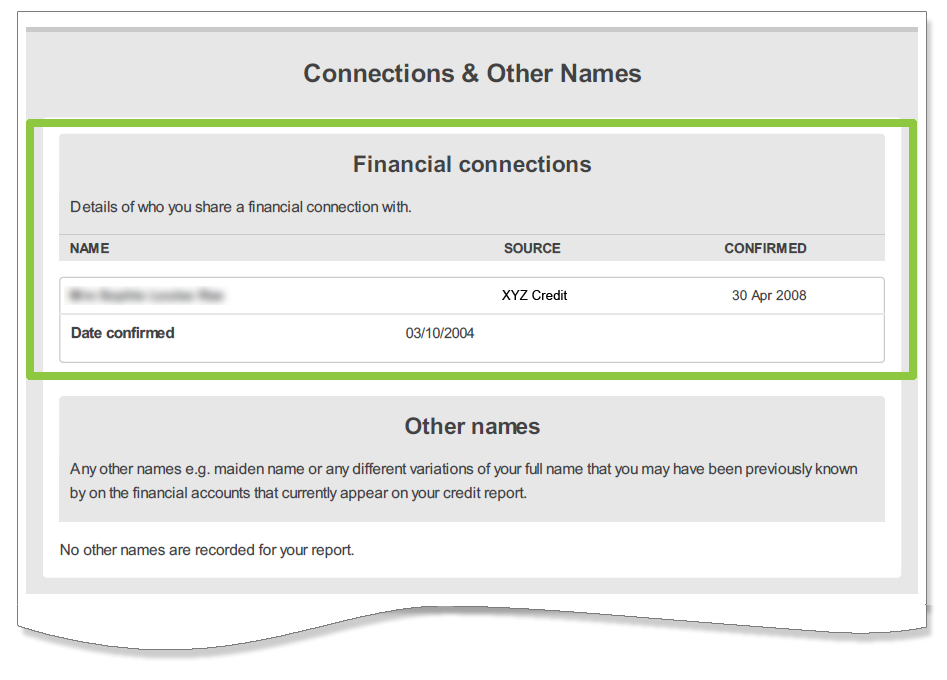

Request A Copy Of The Credit Report

Having a copy of the deceaseds most recent credit report on file will give you an accurate picture of the status of all of their accounts. If there are any outstanding accounts that need to be resolved, they will be reported here.

You can also check to make sure the account has been flagged. In order to request a copy of the credit report, you will need a copy of a government issued ID, such as a drivers license. Request a copy from all three bureaus to make sure you have complete information, since not all lenders and creditors report to all three bureaus.

What Can I Do

If youre hearing from MRS Associates or any collection agency there are things that you can do. There are also two things that you should not do:

- Dont Panic. It wont help.

- Dont ignore the situation. That wont help either. They wont go away.

Thats what you shouldnt do, but what should you do?

Heres where to start.

Don’t Miss: How To Get Credit Report With Itin Number

Applying For Buy Now Pay Later Financing

Making a loan application can affect your credit if the business pulls your credit information to approve your application. Some retailers that offer buy now, pay later financing may not require you to fill out a formal credit application. In that case, there wont be a on your credit report.

If youre asked to enter your social security number to applyeither your full social security number or the last four digitsthat signals your credit will be pulled to approve the application. The credit check results in a hard inquiry to your credit report and may cause your credit score to drop a few points. Inquiries are about 10% of your credit score and remain on your credit report for the next two years, though they only affect your score for 12 months.

Read Also: Does Zebit Report To Credit

Removing Simm Associates From Your Credit Report

Collections can hurt your credit score and remain on your credit report for up to 7 years regardless of whether you pay it or not. Unfortunately, paying the collection could even lower your credit score.

However, it is possible to have it removed before 7 years, and you may not even have to pay it.

Phone number: 864-6033

Recommended Reading: 626 Credit Score Good Or Bad

Withholding Information About A Debt

Debt collectors can not legally withhold information from you about a debt. They are required to notify you in writing within five days of their first contact with you that you have the right to dispute the debt. In addition, you have the right to request the name and address of the original creditor.

You also have the right to request verification of the debt that is, the name and address of the original creditor, along with how much money you owe. If the debt collector cant provide this information, they cannot legally pursue payment.

Buy Now Pay Later No Credit Check: How Does It Work

It sounds almost too good to be true, right? How can you buy now and pay later? Whats the catch?

Theres no catch.

Plus, many Buy Now Pay Later loans dont affect your credit. Many companies that offer BNPL like Affirm and Afterpay only do a soft credit check which doesnt hurt your credit . But if you dont make your payments on time, it could hurt your credit.

Here well explore the questions, what is a soft credit check and how do BNPL loans work?

Also Check: Does Speedy Cash Do Credit Checks

Request A Return Receipt For Your Records

When you mail off your request, you should do so via mail and request a return receipt.This will add a level of security to your letter and provide you notification of when the request has been received.

Be sure to keep a copy of your request, just in case. And keep track of the date you sent the request, as well as the date of the reply. This information will be helpful in the event you have to send a follow-up request.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: Which Business Credit Cards Do Not Report Personal Credit

Also Check: Does Capital One Report Authorized Users To Credit Bureaus

What Is A Debt Collection Agency

A debt collection agency, or debt collector, is a company that pursues debts on behalf of creditors.

Debt collectors employ many methods to get you to pay your debts, including collection calls and letters. And in some instances, lawsuits may lead to asset seizure or wage garnishments.

There are two main types of debt collectors third-party debt collectors and internal collection departments.

Hire A Creditor Harassment Attorney

The phone numbers for SIMM Associates, Inc are 1-800-864-6033 and 1-302-283-2800. If either number appears on your caller ID when the phone rings, it means that a debt collector is attempting to collect money from you. If they speak to you in an abusive manner, call you at work, and threaten legal action if you dont pay, hire a consumer attorney.

If you decide to sue SIMM Associates, Inc, you could potentially win $1,000 per FDCPA violation as well as attorney’s fees, court costs, and any actual damages. Collecting a debt is legal but abusing consumers is not, and debt collectors who forget that risk expensive penalties.

*Case taken from PACER . File number is1:13-cv-00184-JRH-BKE from United States District Court for the Southern District of Georgia, Augusta Division

Disclaimer: The content of this article serves only to provide information and should not be constructed as legal advice. If you file a claim against SIMM Associates, Inc,, or any other third-party collection agency, you may not be entitled to any compensation.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus