How Can Loan Applications Affect My Chances Of Securing Credit In The Future

If you make multiple applications for credit in a short space of time, not only will you affect your credit score but its possible that a potential lender might see this as an indicator of severe financial difficulties. While the lender cant be certain whether youve had applications rejected without asking you, it may draw conclusions from your credit file for example if you made a number of applications for credit, but these were not followed by any repayments.

Because of this, its a smart idea to take a little time to research what loans you are likely to be approved for, and only apply for one of those itll save you from wasting your own time as well.

If you havent already, you can check your credit report. This is free with companies such as Experian, TransUnion or Equifax. It has no impact on your credit score, and will give valuable information about the products you are likely to be eligible for.

Its also a good idea to check to see if you meet a lenders minimum eligibility criteria before applying for a loan. Many lenders will even let you run a soft search to test your eligibility. This gives you a pretty good idea of whether or not youll get approved, without affecting your credit score so theres no downside.

The Credit Dip From New Loans

New loans generally create a slight dip in your credit scores.

Every time you apply for a new loan, lenders check your credit. When they do so, an inquiry is created, showing that somebody pulled your credit.

Inquiries can be a sign that youre in financial trouble and you need money, so they pull your credit score down slightly. One or two inquiries arent a big deal, but numerous inquiries can damage your score.

Shopping among lenders is a smart way to get a good deal. To minimize the impact of the credit dip, do all of your shopping within a relatively short time frame.

- If youre buying a home and comparing mortgage lenders, complete all of your applications within 45 days or less.

- If you’re comparing auto loans, complete your inquiries in two weeks or less.

If you have strong credit, any dip in your credit score will probably be short-lived and insignificant. If you have poor credit , that dip could last a little longer, generally until you start making enough payments to improve your payment history.

To avoid the negative impact of this dip, don’t take on new debt before you apply for a major loan like a home loan.

Using A Personal Loan To Build Credit

Its possible to use a personal loan solely for the purpose of building up your credfit history and , though it isnt always advisable.

If your credit isnt great, you may have a hard time getting a loan with a good rate. And, if you arent sure of your ability to repay the loan, you could end up making your situation worse if you find yourself unable to fulfill your monthly payments.

And if you want to work on building your credit, getting a credit-builder loan from a credit union or opening a secured credit card might be a better option.

Also Check: What Credit Score Does Carmax Use

Find Out More About How National Hunter Works

It works by looking for inconsistencies between your current application form and any past applications you’ve made, trying to spot factual errors. While it can’t block your application itself, it triggers a red warning flag to lenders, and this happens roughly 7% of the time. Lenders can then check the info, and ignore it or do further checks. They’re not allowed to reject you based on the National Hunter red flag alone.

Factors such as a number of applications in a few days can also trigger warnings, though generally that’s more acceptable with mortgages, where it’s more common, than with credit cards.

What to watch for

It’s crucial to be consistent, even over long periods, when you fill in application forms. If you have a number of job titles or phone numbers, try to use the same one on every application. Changes to guidance introduced in 2009 mean lenders are supposed to tell you if National Hunter has been a contributing reason for your rejection.

How to check your National Hunter file

To check the info it holds on you, you’ll need to make a subject access request, which is free thanks to the introduction of the General Data Protection Regulation in May 2018. This can also be a useful thing to do if you think you’re a victim of ID fraud.

How Do Student Loans Affect Credit Score

There are many different types of credit scoring models, the most common one is the FICO scoring system created by the Fair Isaac Corporation. It uses a standard evaluating and quantifying method to determine someones creditworthiness. Your credit score ranges from 300 850 . Five things determine your score:

- Payment History: 35% of the score

- Amounts Owed: 30% of the score

- Length of : 15% of the score

- New : 10% of the score

- Mix: 10% of the score

When it comes to student loans and credit score, the above-mentioned categories are applied in the following ways:

Payment History

When it is time to start paying off your student loans to lenders, you have to stick to payment schedules. Late payments can have a negative effect on your FICO score. Neglecting to meet payment deadlines can place you under defaulting or delinquent status.

When you are regularly late with payments, this is reported to the three major . This will ultimately have a negative effect on your credit score. Depending on the student loan companies terms and conditions, you might be subject to paying a late payment fee as well.

Amounts Owed

One of the other ways student loans affect credit score is by the total amount owed on them. When youve decided to continue your studies and you need to apply for an additional student loan or student loan refinancing, then the total amount you owe on your loan will add up.

Length of Credit History

New Credit

Federal Student Loans

Private Student Loans

Don’t Miss: Does Barclaycard Report To Credit Bureaus

Carrying A Balance On My Credit Card Boosts My Credit Score

False. Carrying a balance on your credit card doesn’t help your credit score, it only has the potential to hurt it and it will end up becoming expensive over time paying interest. Not to mention, it’s a waste of money to pay interest on your balance if you can afford to pay off your credit card bill in full each month.

Lingering balances on your account directly affect your . The higher your credit card balance, the higher your utilization rate, which can in turn hurt your credit score.

If you’re already carrying a balance on a credit card, consider transferring it to a balance transfer credit card, such as the Discover it® Balance Transfer. This can help you save money in the long run, if you commit to paying off your balance during the introductory 0% APR period .

Modification Is Almost Always Preferable To Foreclosure

Foreclosure will very negatively impact your credit score. Foreclosure also stays on your credit report for seven years. Over time, the effects of a foreclosure will fade, but the foreclosure itself is considered a very negative credit event. Only under specific circumstances should you simply allow a property to go to foreclosure auction. Instead, contact an experienced foreclosure defense attorney to discuss your options.

Read Also: How To Remove Inquiries Off Credit

Costa Coffee To Shake

3 September 2021

Everyone should take time to manage their credit score, especially during this time of coronavirus uncertainty. It’s no longer just about whether you can get a mortgage, credit card or a loan, it can also affect mobile phone contracts, monthly car insurance, bank accounts and more. Here’s what you need to know about credit checks and how to boost your credit score.

What Credit Score Do I Need To Get A 20000 Loan

670Personal loan applicants with a FICO credit score of 670 or higher, you may have a good shot at getting a $20,000 personal loan with a favorable rate and loan term. While its possible to get approved with a credit score lower than that, it could get expensive. Many mainstream lenders charge as high as 36 percent.

Don’t Miss: Zzounds Payment Plan Denied

‘soft Searches’ Incl If You’ve Checked Your Own File

Some lenders will do a soft search of your credit report, to tell you both whether you qualify to borrow from them, and what rate they are willing to give you. This isn’t passed on to other lenders when they credit-check you.

When you check your own file, it does appear on your credit report. It’s not always clear, but the words “administration check” or “quotation search” should indicate something, but lenders can’t see this so it doesn’t play any role in any assessment of you.

Don’t Withdraw Cash On Credit Cards

This is both expensive to do, as interest is higher and you’re charged it even if you repay in full each month. Crucially, many lenders see it as evidence of poor money management.

The one exception is withdrawing cash on a specialist card abroad. See Overseas Credit Card ATM Withdrawals for full info and why they’re not too bad.

Also Check: What Is Cbcinnovis On My Credit Report

How A Mortgage Can Benefit Your Credit Score

These early dips in your credit score are minor compared with the potential upside a mortgage can have for your credit. To understand this more clearly, consider the factors that go into calculating your FICO® Score:

- Payment history: A typical mortgage provides the opportunity to make 30 years’ worth of on-time, credit-building payments.

- : By managing a mix of installment loans like mortgages and auto loans as well as revolving credit card accounts, you show your ability to handle different types of credit.

- Length of credit history: Although a new mortgage works against this metric, over the life of the loan, your mortgage becomes a long-term account that shows longevity.

The sheer size of a typical mortgage can also play in your favor. Make on-time payments over the life of the loan, and the positive influence your mortgage has on your credit will be long-lasting.

Things To Consider Before Taking Out A Personal Loan

Before taking on debt, its important to consider your overall financial situation and whether your budget can handle the structured, monthly payments on the new loan.

Do your research, evaluate your situation and make sure that taking out a personal loan is the best option for you. The more confident you feel financially when taking on the debt, the more likely youll be able to avoid the personal loan negatively affecting your credit.

Ready To Improve Your Financial Life?

You May Like: Does Opensky Report To Credit Bureaus

Factors To Consider About Student Loans

Looking at debt statistics regarding student loans, it is evident that US college graduates have billions of dollars of debt collectively. Even though this is a sad statistic, you can manage your student loan in a way that doesnt affect your credit score negatively.

Here are a few things you need to consider if you have a student loan:

Paying Off Your Loan

When you are approved for a student loan, you should be wholly aware that you are going to have to pay it back in the future. Its important that you have a repayment plan and not live beyond your means. Failing to stick to repayment agreements and installment plans will have a negative effect on your credit score.

Paying off your student loan earlier than the loan period might incur some additional penalties. Make sure you fully understand the terms and conditions of your loan. Missing payments is one of the most common reasons why student loans can affect your credit score negatively.

Applying for a Private Student Loan

When you apply for a private student loan to cover your college education, you can consider getting a cosigner. Cosigners, usually parents or guardians, can help students get better interest or variable rates. Especially if the cosigner has a good , the student loan rates will be much better.

Such an arrangement shouldnt be taken lightly though. If the student is unable to repay the loan, the cosigner will be responsible for the outstanding amount.

Impact of Debt

Student Loan Default

How Your Credit Score Impacts Your Financial Future

Many people do not know about the credit scoring systemmuch less their credit scoreuntil they attempt to buy a home, take out a loan to start a business or make a major purchase. A credit score is usually a three-digit number that lenders use to help them decide whether you get a mortgage, a credit card or some other line of credit, and the interest rate you are charged for this credit. The score is a picture of you as a credit risk to the lender at the time of your application.

Each individual has his or her own credit score. If you’re married, both you and your spouse will have an individual score, and if you are co-signers on a loan, both scores will be scrutinized. The riskier you appear to the lender, the less likely you will be to get credit or, if you are approved, the more that credit will cost you. In other words, you will pay more to borrow money.

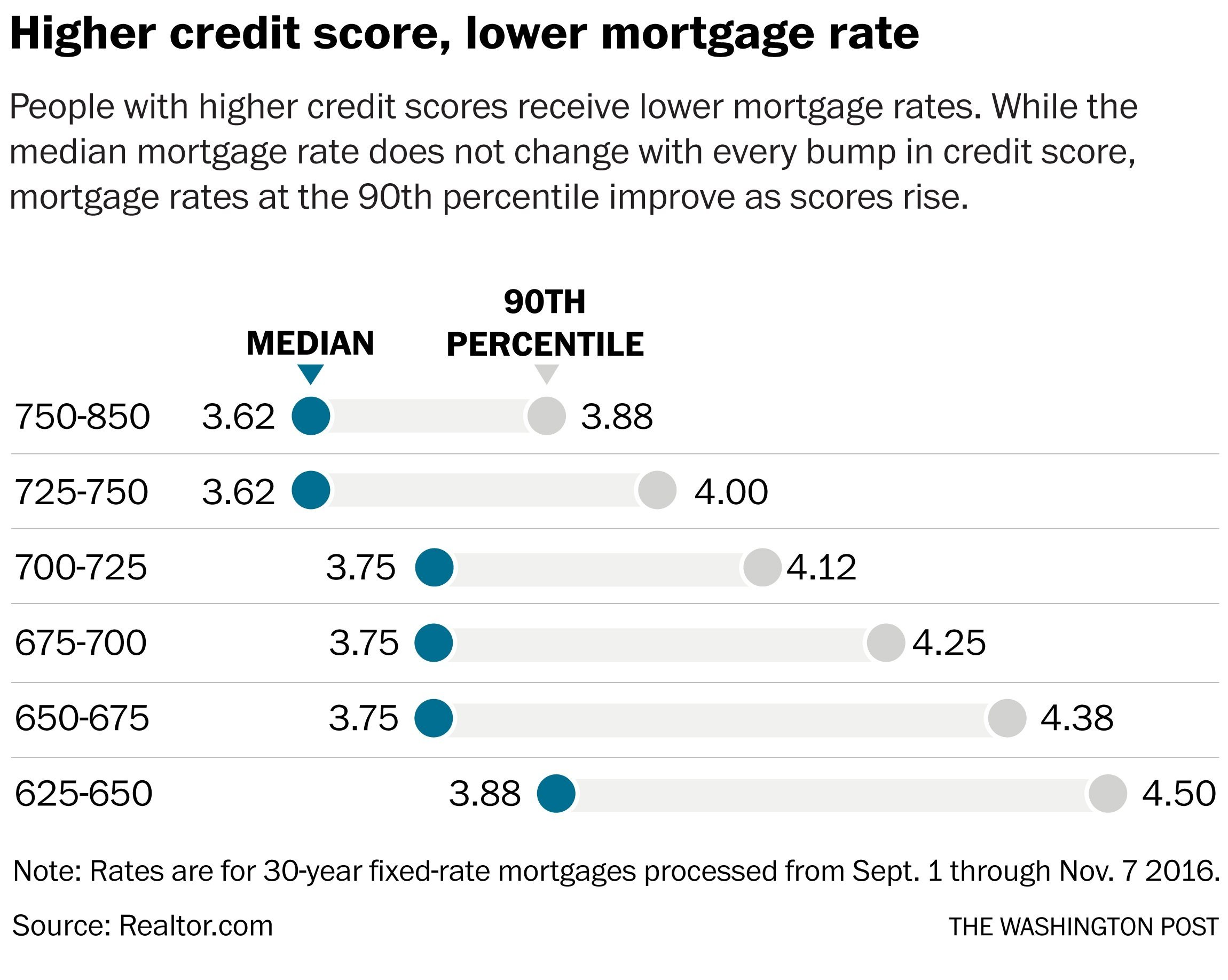

Scores range from approximately 300 to 850. When it comes to locking in an interest rate, the higher your score, the better the terms of credit you are likely to receive.

Now, you probably are wondering “Where do I stand?” To answer this question, you can request your credit score or free credit report from 322-8228 or www.annualcreditreport.com.

Because different lenders have different criteria for making a loan, where you stand depends on which credit bureau your lender turns to for credit scores.

Read Also: Does Klarna Affect Your Credit Score

Can Personal Loans Help Your Credit

Under the correct circumstances and when used responsibly, a personal loan can absolutely improve your credit health. Here are a few ways in which a personal loan can positively affect your credit score:

- Debt consolidation: If you use a personal loan to consolidate debt, you can generally take advantage of lower interest rates than youd get with credit cards. With a lower interest, you may be able to pay down outstanding debt faster, which will improve your credit score.

- Payment history: When payments are made in full and on time, a personal loan can help establish a positive payment history. A positive payment history makes up 35 percent of your FICO score, the largest category in determining your score.

Shopping For A Personal Loan

Most online lenders allow you to pre-qualify for a personal loan with a soft credit check, which is a routine check of your creditworthiness. A soft inquiry wont affect your credit score, and it allows you to shop around for the best rates and terms.

NerdWallets personal loan marketplace lets you compare multiple lenders with one pre-qualification.

Some lenders, including many banks and credit unions, do not offer a soft check with pre-qualification. If youre just comparing rates, opt for lenders that offer the soft check.

» MORE:Personal loans with the best interest rates

Also Check: Is 524 A Bad Credit Score

Will My Credit Score Increase If I Pay Off A Personal Loan

Yes – paying off a personal loan in full is one of the best things you can do to boost your credit score. The whole reason lenders perform credit checks is to find out whether youre a borrower who can be relied upon to pay the money back. So, from the lenders point of view, if youre the sort of person who has paid off money in full before then youre an attractive potential borrower.

In fact, if we dig into the Experian statement a little more, we have the line:

Companies often like to see a track record of timely payments and sensible borrowing

What this means is that some lenders would prefer to lend to a borrower who has taken out new credit in the past and repaid it, rather than someone who has never taken out a loan and therefore has no track record.

Of course, a borrower who has never taken out a loan has never missed a payment, but thats only true in the same way that the Queen has never lost a fight to Mike Tyson – theres no track record to base a decision on.

Thats not to say that you should take out a personal loan just to boost your credit score – youd be paying fees and interest – but it does explain why some borrowers who have never missed a payment might want to consider a lender like Koyo, which relies on Open Banking data rather than a credit score.

Top 5 Credit Score Factors

While the exact criteria used by each scoring model varies, here are the most common factors that affect your credit scores.

Also Check: How Does Carmax Work With Bad Credit