Alternative Credit Scoring Systems

FICO provides the most popular scoring models being used today, and weve already talked about VantageScores above. But there are a number of other credit scoring systems as well, with some being specific to certain credit reporting agencies.

These alternative credit scores are either less popular with lenders in general or used for niche purposes.

Eligibility To Check Your Equifax Credit Report

A consumer should fulfil certain basic eligibility criteria in order to receive a credit report, submitting the following documents along with an application form.

- Copy of self-attested ID proof. This can be either a Driving License, Voters ID card, Aadhar card, Passport or PAN card.

- Copy of valid address proof. This can be either a telephone bill, ration card, driving license, registered rent agreement, bank statement or electricity bill.

- An individual should ensure that the document in question is not more than 3 months old, with a clear picture and address details.

The amount to be paid in order to receive a report can be paid only through a Demand Draft, which should be crossed, containing the name and phone number of a consumer. This DD should be addressed to Equifax Credit Information Services Private Limited, Mumbai only and no other address can be mentioned. Cheques or cash cannot be used as mode of payment to receive a report.

How To Get Your Free Credit Report

You are entitled to a free credit report from each of the three major bureaus every 12 months. You can either request all three reports at once, or stagger each report, depending on your needs. By staggering your report, you can see if or how your report is changing throughout the year. Currently, the only authorized website for free annual credit reports is AnnualCreditReport.com. You can also call the toll free number 1-877-322-8228.

Also Check:

Also Check: Removing Hard Inquiries Increase Credit Score

Your Fico Score May Differ

On the customer review site ConsumerAffairs, some people have reported that their Credit Karma score is quite a bit higher than their FICO scores. Whether these posts are reliable is unknown, but it is worth noting.

If your Credit Karma score isn’t accurate, the problem is probably elsewhere. That is, one of the bureaus made an error or omitted information. Or, the information might have been reported to one bureau but not others.

Using Credit Karma won’t hurt your credit score. Your search is a self-initiated inquiry, which is a “soft” credit inquiry, not a “hard” inquiry.

What Makes A Good Credit Score

A good to excellent credit score makes it easy for you to qualify for loans at a competitive interest rate.

Various credit bureaus use proprietary models to compute your score, leading to differences in the score you get from TransUnion and Equifax.

In Canada, you can rank your credit score as follows:

- Poor credit score: 300-559

- Very good credit score: 725-759

- Excellent credit score: 760-900

The main factors influencing your credit score include your payment history, credit utilization, length of credit history, number of recent inquiries, etc.

Learn more about how your credit score is calculated.

Also Check: Carmax Financing With Bad Credit

Free Annual Credit Report

As a result of the FACT Act , each legal U.S. resident is entitled to a free copy of his or her from each credit reporting agency once every twelve months. The law requires all three agencies, Equifax, Experian, and Transunion, to provide reports. These credit reports do not contain credit scores from any of the three agencies. The three credit bureaus run Annualcreditreport.com, where users can get their free credit reports. Non-FICO credit scores are available as an add-on feature of the report for a fee. This fee is usually $7.95, as the FTC regulates this charge through the Fair Credit Reporting Act. The FTC tracks various scams and reports on other sites that provide fake credit reports or charge fees for their services. Instances of illegal behaviors by credit report services have been settled in court such as that of Experian Consumer Direct that was charged with deceptively signed people up for credit report monitoring services that charged them monthly fees.

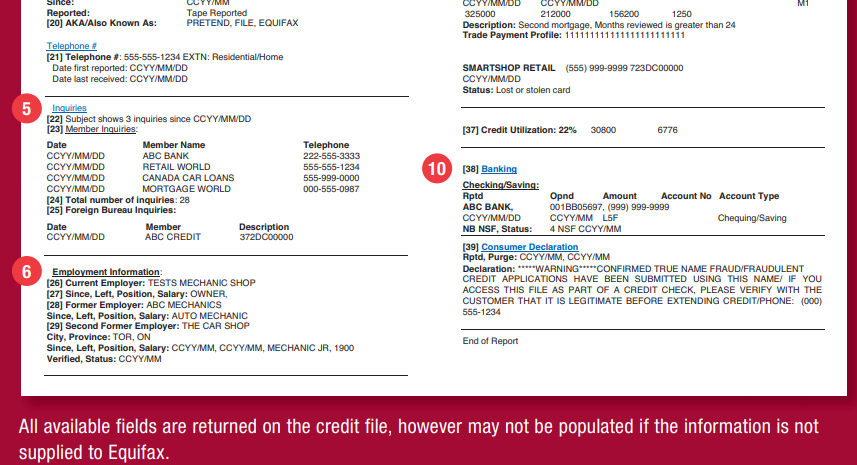

What To Look For On Your Credit Report

Lenders use codes to send information to the credit bureaus about how and when you make payments.

These codes have two parts:

- a letter shows the type of credit youre using

- a number shows when you make payments

You may see different codes on your credit report depending on how you make your payments for each account.

| Letter |

|---|

Read Also:

Don’t Miss: Report Death To Credit Bureaus

How To Apply For An Equifax Free Credit Report And Score

Here are two easy ways to get a free Equifax report and score:

Apply Directly to Equifax

You can get your Equifax credit information report and credit score directly from Equifax. For this, you will need to:

- Self-attest your identity and address proof

- Attach DD with requisite payment for Credit Information Report or credit score.

- Send the documents to the address mentioned on the Equifax website.

Apply through Creditmantri for a free Equifax score

If you choose to apply through the Creditmantri website, you will receive:

- Free and instant Equifax credit score.

- A free credit health check to help you identify how to become loan-eligible.

How To Get A Free Equifax Credit Report

While this credit bureau offers a paid service to access your credit report, you can actually request one free credit report every yearalthough, its a bit difficult to find the free credit report option on Equifaxs website.

Here are three ways to request it:

A. Reach them by phone at 1-800-465-7166. The automated phone service collects the information required including personal details such as your name and Social Insurance Number .

Your credit report is then processed and mailed to you via Canada Post within 5-10 days.

B. Visit their website to download the Request Form. After completing the form, mail it to: National Consumer Relations, P.O. Box 190, Station Jean-Talon, Montreal, Quebec, H1S 2Z2.

You will need to attach copies of at least two government-issued IDs . You can also fax the documents to 514-355-8502. Your credit report is sent via postal mail within 5-10 days.

C. Request your credit report in person at one of four Equifax locations in Canada Toronto, Montreal, Halifax, and Charlottetown.

Make sure to bring along at least one photo ID and proof of your address . The proof of address document must be less than 90 days old and should have been received by mail.

You can also request your free credit report from Borrowell and Mogo.

Unlike the Equifax-provided free credit report which is available once a year, Borrowell updates your report every month for free.

You May Like: How To Report Death To Credit Bureaus

Full Lowdown On What Mse Credit Club Offers:

- Our Credit Hit Rate. This shows your chances of success, as a percentage, of grabbing our top cards and loans.

- Eligibility tool. It reveals the likelihood of you getting top credit cards or loans .

- Your credit profile explained. It shows the key factors affecting your score and how to improve them.

Or alternatively

Experians CreditExpert free 30-day trial*. CreditExpert offers new customers a free 30-day trial, then £14.99 a month service. Its different from MSEs Credit Club in that it gives you real-time access to your credit report . It also offers an eligibility checker. You can only do the free-trial once. To cancel your subscription, log into your account and go to My Subscriptions.

Experians Credit Score free subscription to your score.If you dont want to pay a subscription to see your credit report, you can sign up for free to see your Experian Credit Score. You wont have to pay anything, but the information is limited to seeing your credit score, as opposed to credit report. The score updates every 30 days.

Why Is It Important To Check Your Credit Score

Checking your credit score can alert you to the possibility of credit card or identity theft. If your credit score seems much lower than it should be, it could be an indication that purchases are being made under your name or with your credit card information without your consent.

It is also important to know what lenders may see when you are planning on taking out a loan, applying for a new credit card or making a big purchase. Your credit score is a factor that can determine interest rates, so it is vital to ensure that your credit score is accurate and truly reflects your financial history and current standing. Your credit score also affects:

- Vehicle purchasing

- Paying for insurance

You May Like: Usaa Credit Score Free

Access To Equifax Credit Report

An Equifax Credit report contains personal financial information and is not open for public viewing. Only registered individuals have access to their report, with the report of an individual not provided to any other third person. On the other hand, institutions registered with Equifax as members have access to credit reports of individual members in order to gauge their creditworthiness and provide finance.

Whats The Best Site To Get A Free Credit Report

The best site for free credit reports depends on what you need.

If you want to take a look at your credit reports from Equifax and TransUnion, you can do so on Credit Karma.

The Fair Credit Reporting Act entitles you to one free copy of your credit report from each of the three major consumer credit bureaus every 12 months. You can order them online at annualcreditreport.com.

You May Like: What Fico Score Does Carmax Use

How To Get A Credit Report

Youre allowed one free copy of your credit report every year from each of the major credit-reporting agencies we just talked about. But the reports arent automatically mailed to youyou have to ask for them! And since each agency keeps different details on file, its worth checking with all three. If you play your cards right, you can even stagger them so youre getting a free report nearly every quarter.

Now that you know how to get your credit report, well walk you through the four major areas you need to check for any red flags. These could help you spot potential identity theft situations, so listen up!

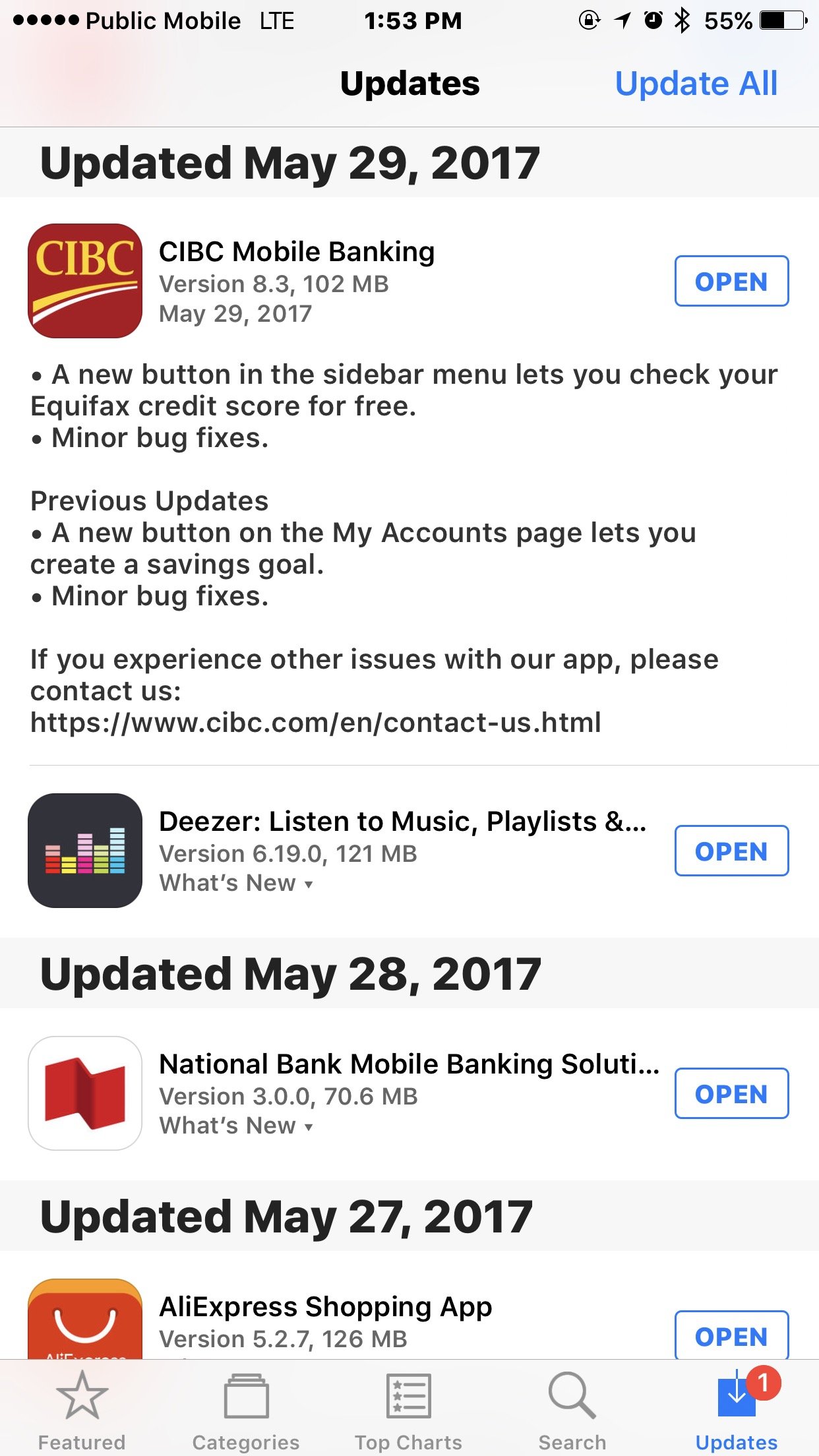

How To Check Your Credit Score In Canada For Free

A credit score is a three-digit number that helps lenders predict how well you pay bills on time. Having a

A is a three-digit number that helps lenders predict how well you pay bills on time. Having a high score can help you get lucrative rewards cards, lower insurance premiums, and even better mortgage rates.

In the past, Canadians had to pay a small fee, usually $20 to $30, to see what their score was. But recent legislation, as well as third-party services, are now allowing Canadians to check their credit scores for free. If you want to see your score for free, heres what you can do.

You May Like: How To Remove An Eviction From Your Credit Report

Clean Up Your Equifax Report With The Help Of Donotpay

DoNotPay is the perfect solution to cleaning up your Equifax report.

How to clean up your credit report using DoNotPay:

If you want to clean up your credit report but don’t know where to start, DoNotPay has you covered in 3 easy steps:

You can also check out our other credit products, including Credit Limit Increase, Get My Credit Report, Keep Unused Cards Active, and more! **

What Does A Credit Score Mean

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Credit Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

You May Like: When Does Paypal Report To Credit Bureau

What To Look For When You Review Your Credit Report

Monitoring your credit report is even more important during uncertain economic times since fraudsters like to take advantage of these situations.

You should keep an eye out for common credit report errors and signs of fraud when checking your credit report, such as:

- New accounts that you didn’t open

- Identity errors

- Incorrect reporting of account status

- Data management errors

- Balance errors

If you notice any errors, dispute them as soon as possible. Check out our step-by-step guide on how to dispute a credit report error.

Learn more:

Vantagescore 30 Credit Score Factors

Different credit scores can have a lot in common under the hood, but each individual scoring modeluses its own combination of factors to determine your score.

Here are the major factors that determine your VantageScore 3.0 credit scores.

Payment history The biggest factor in your scores is your history of paying bills on time. Late or missed payments in your credit history could affect your scores significantly.

Age and type of credit A longer credit history, particularly with the same accounts, shows lenders that youve been able to stick with your accounts over time. Lenders may also consider it a plus if you have a mix of credit accounts with positive use.

Your measures the amount of credit you use relative to the amount available to you. Most experts recommend shooting for a rate below 30%, meaning you use less than 30% of your available credit.

Balances Similar to credit utilization, this factor takes into account your total balances across your accounts but in terms of the dollar amount and not the percentage. If you already owe a fair amount elsewhere, lenders may be less inclined to extend more credit to you.

Don’t Miss: How To Unlock Experian Account

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

How To Get A Free Equifax Credit Score

Equifax does not provide your credit score free of charge. To access your score, the fee is $23.95 each time you check it.

You can also check your Equifax credit score by signing up for one of their monthly packages including:

- Equifax Complete Advantage: $16.95 per month

- Equifax Complete Premier: $19.95 per month

- Equifax Complete Friends and Family: $29.95 per month

So, how can you get your free Equifax score? These two financial technology companies below offer them for free:

You May Like: Ccb Mprcc

How To Read Your Business Credit Report

Small business owners rarely have downtime to handle every administrative task, but some matters shouldnt be ignored. One often overlooked area is your credit health. Business credit can impact your companys reputation, financial health and the ability to secure business financing.

Building and monitoring your businesss credit may be more important than you think. Learn how to read and interpret a business credit report with this guide.

How Do Your Debts Show Up On Your Credit Report

When your creditors and lenders send your information to the credit reporting agencies, each account comes with two identifiers, a number, and a letter. Heres what they are and what they mean:

Letters Stand for the Type of Account

Installment

You pay back your loan in fixed installments until the loan is paid back in full. Examples of this type of account are car loans or personal loans.

Open status

You can borrow money when you need to, up to a certain limit. A line of credit will show up as an open status account on your credit report.

Revolving

You can borrow specific amounts of money up until youve researched your limit your payments fluctuate depending on how much youve borrowed. A credit card is an example of revolving credit.

Mortgage

Mortgages do not always show up on credit reports, it depends on the credit reporting agency.

Numbers Represent a Rating

0 = Account is too new to rate, not yet used.

1 = Paid off within the agreed time limit.

2 = Late payment, 31-59 days late.

3 = Late payment, 6089 days late.

4= Late payment, 90119 days late.

5 = Late payment, more than 120 days late.

6 = Not used.

7 = Account is currently in consolidation, consumer proposal, debt management program.

8= Repossession.

9= Bad debt, accounts that have been sent to collections or are in bankruptcy.

Read Also: What Credit Bureau Does Carmax Use