The Negative: Reporting Late Payments

If you do rental payment reporting and a tenant pays late or doesnt pay at all, this information will make it onto their credit report in various ways. You might get upset that a tenant keeps paying late and want to report a tenant to the credit bureau.

Most tenants will not want this to happen, so the knowledge that you report to credit bureaus monthly can help to keep tenants focused on making their payments on time. You may want to remind tenants that consistently paying late in the ways of this can affect them.

Even if late payments may not actually lower their credit score, every late payment issue will show up in the full report. If they plan to rent again in the future, this could be a problem for them. Ensuring that they know this can help encourage tenants to be more reliable while also protecting you and their future landlords.

Does Applying For An Apartment Or Home Hurt My Credit

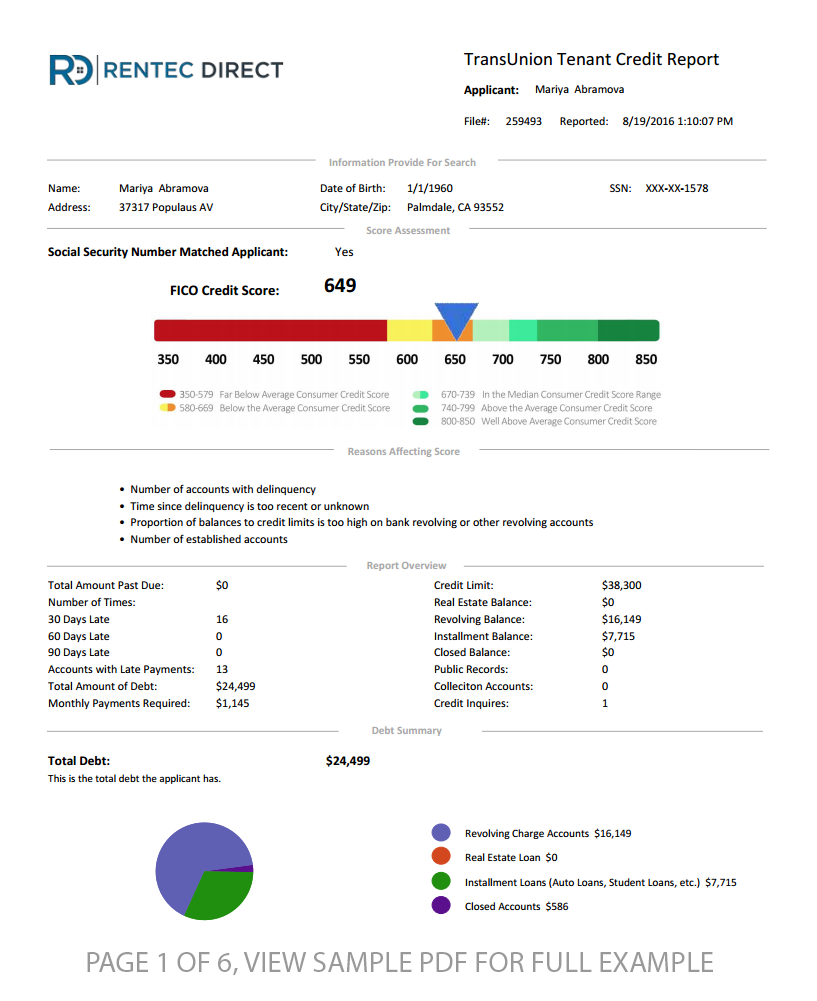

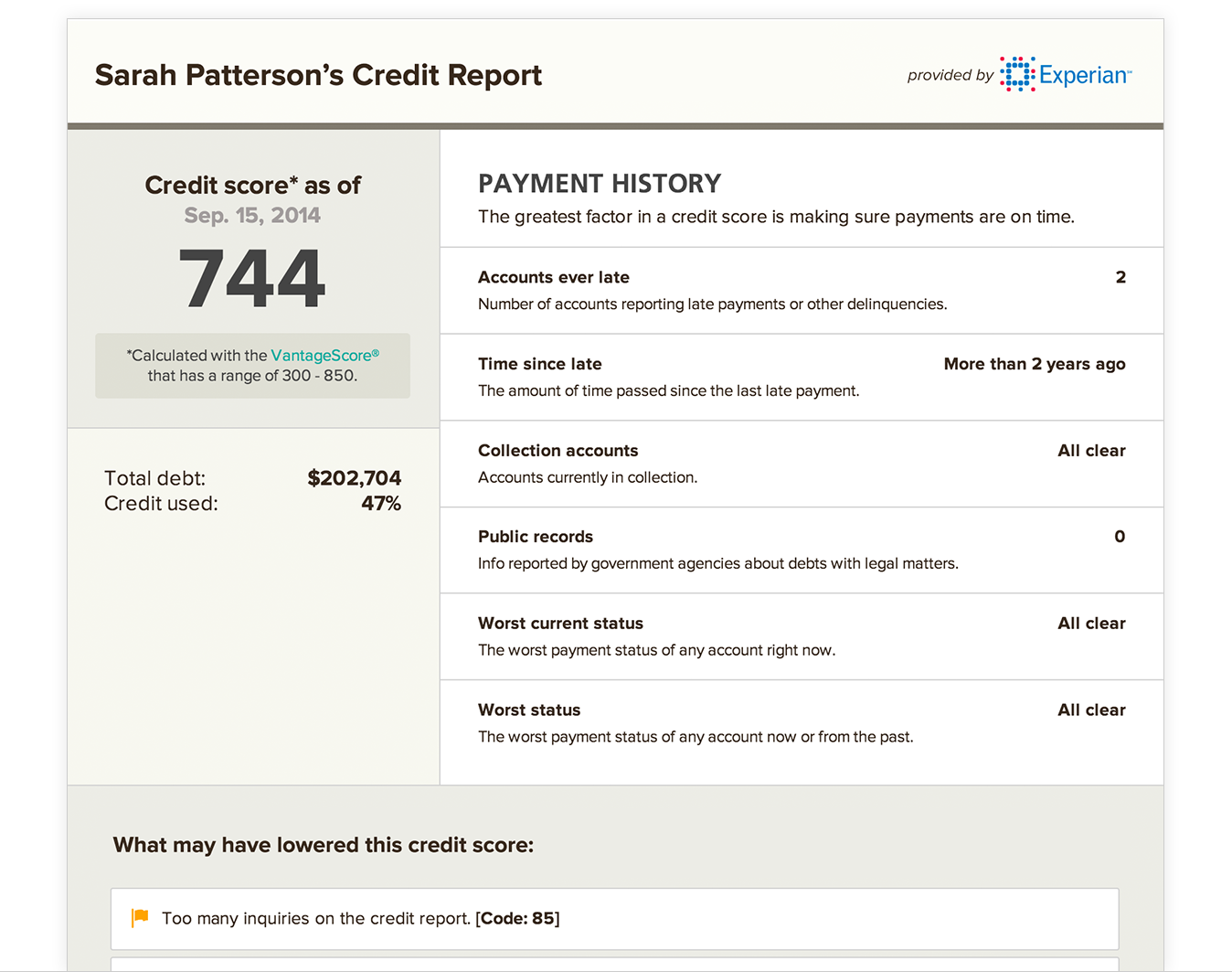

When you apply for a new apartment, the landlord requests a copy of your credit report. This request initiates a hard inquiry credit pull that does affect your credit score. The good news is that a single hard inquiry doesnt impact it much and will no longer affect your credit after 12 months. Your credit score will take a hit if too many hard credit inquiry requests come in over a short period of time.

How To Run A Credit Check On A Tenant

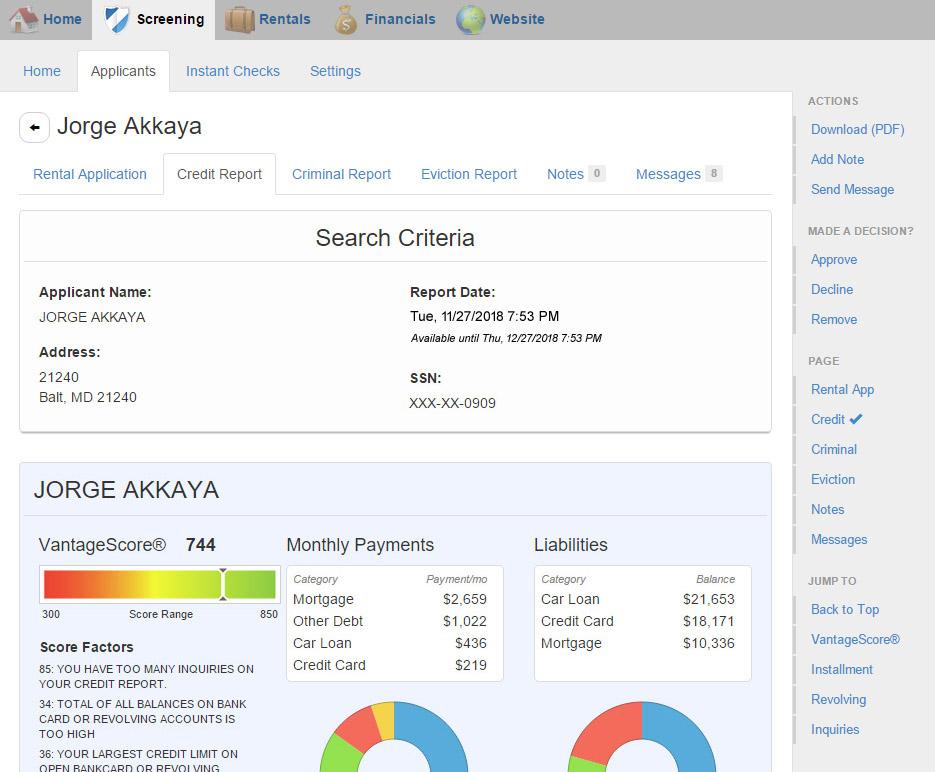

A tenant credit report is tailored to fit the demands of landlords. Working with a company specializing in online credit checks for landlords guarantees that you have all of the information you need to make the best decision possible for your property. The first step in how to run a credit check is to go to the American Apartment Owners Associations page and get a free rental application form, as well as purchase a tenant screening package. Enter your tenant information and gain instant access to various reports including evictions, background checks, and other screening services. Your tenants will then receive an email with a unique link that they must click to authenticate their identity and permit you to view their rental credit reports. Youll get an email with a link to their credit report and score when they give you permission. This does not necessitate any additional documents or underwriting.

Don’t Miss: How Long Until Closed Accounts Fall Off Credit Report

Tenants Want To Know How To Report Rent Payments To Credit Bureaus

On average, tenants spend about 40% of their income on rent, and they want credit for it literally. Tenants realize that paying rent on time every month can raise their credit scores, and they are looking for landlords who report rent payments.

What is surprising about this trend is that tenants appear to have caught on to the benefits of reporting rent payments before landlords and property managers.

Reporting rent payments is a highly effective property management tool that dramatically increases on-time rent payments, and landlords should be the ones pushing for it. More on-time rent means less time spent chasing down tenants, collecting late fees, or filing evictions. Its what tenants want. By offering to report rent payments to credit bureaus Landlords and Property Managers can attract responsible tenants looking for this added benefit while rewarding their great tenants who consistently pay rent on-time.

Which Bureaus Account For Rent Payments

All three credit bureaus will include rent payment information in your credit report if they receive it.

However, credit bureaus dont automatically receive your rental payment history. And despite services that simplify rent payment data reporting, that information wont automatically translate into changes in the credit score potential lenders see when you apply for a loan or new credit card.

Commonly-used versions of FICOs scoring model do not include rental payment data when calculating your credit score, though VantageScore models do consider rent payments when calculating your credit score.

You May Like: 698 Credit Score Mortgage

Use A Rent Reporting Service

There are several companies that will report rent payments on your behalf. Monthly fees vary between services, and some charge an initial enrollment fee to get started. In some cases, your landlord may have to verify your rent payments for them to be included in your credit report. Note that even when rent payments are included in your credit report, they may not be included in your credit score calculation.

Tenants Are Willing To Move

According to a study conducted last year by Freddie Mac, 44% of tenants who were struggling with rent were forced to move to find something cheaper. In numerous studies, tenants rank increased rent as the top reason for moving out.

Data from John Burns Real Estate Consulting indicates that tenants are willing to give up on amenities for affordability.

Investors who are looking to add value with new amenities and then spike the rent and landlords who go over market may be surprised to find that tenants are willing to bolt, even in a tight rental market.

Increased turnaround also increases a landlords costs and liabilities. Landlords will need to find new tenants, orient those new tenants, and spend more time restoring units. One Midwest property manager says that frequent turnover isnt worth a spike in rent. Routine but reasonable rent increases are her secret to holding on to good tenants and avoiding the cost of vacancies.

Inexperienced landlords suffer from the misconception that the best tenants are the ones who will pay the highest price those with the most income. But savvy landlords have learned that the tenants who can most afford an expensive unit are out chasing better deals. Its the tenants who cant qualify for anything else who are willing to go for overpriced properties. Keeping rent at slightly below the market rate is the best strategy for attracting good tenants and avoiding rental income loss from property damage, defaults and prolonged vacancies.

Recommended Reading: When Do Things Fall Off Your Credit Report

How To Choose A Rent Reporting Service

Not all rent reporting services are created equal. Many of them only report to one of the three major credit agencies.

This means that your credit score will improve only at that one credit bureau. Credit bureaus do not share information.

Quick Tip:To get the maximum benefit from rent reporting, choose a service that reports to more than one credit bureau.

What To Keep In Mind When Reporting Your Rent

Adding on-time rent payments to your report almost always results in positive changes to your credit, but be aware that its possible you may see a slight drop in your score initially. This is because whenever you add a new account whether its rent, a car loan, or a credit card it takes time for the bureaus to process this information.

I always tell people to not look at their scores immediately, Griffin says. Give it a billing cycle or two, so that the information can stabilize, and then youll see that your scores will go back up to where they were, or improve in the case of rent reporting, he adds.

Experian, TransUnion and Equifax also dont exchange information with one another and use different credit scoring criteria. This means that you may get a different score from each bureau, even if they receive the same information.

Besides that, some rent reporting services only share your data with certain agencies. For example, PayYourRent reports your payments to all three credit bureaus, while Rock the Score only reports them to TransUnion and Equifax. So, make sure to check this information before you enroll.

Finally, if youre using your credit card to pay your rent, Minor recommends looking into your credit limit first, to make sure this transaction wont max it out, as this could temporarily impact your credit utilization and hurt your score.

- Categories

Don’t Miss: How To Remove A Repossession From Credit Report

One: Data Furnisher Setup

Your first step is submitting an application to the credit bureau to become a data furnisher. We will help you complete the following requirements to verify your companys:

- Identity: one copy of a valid form of ID for property owner or manager

- Ownership: one copy of an acceptable form of proof of ownership for each property to be rented

- Contract: one copy of standard rental contract used by property owner and/or manager

- signed Service and Support Agreement with Datalinx

If you have questions about any of these requirements for setting up your company as a data furnisher, dont worry. Your Datalinx rep will be on hand to help.

Who Can Benefit The Most From This

For people who never miss a rent payment, adding it to a credit report might seem like a great idea at first. But in reality, people who have little to no credit, or a rock-bottom score, will benefit the most from reporting their payment history to credit bureaus.

TransUnion states that out of a sample of 300,000 residents, 8% of the population with no credit score achieved an average score of 635 after reporting their rental payments on time. Additionally, 23% of the population who were in the subprime and near prime credit score range saw a gain of 13 points and 4 points, respectively.

If youre someone who doesnt consistently pay your rent on time, adding this reporting to your credit score could be of risk. TransUnion states that negative rental payment data can be reported immediately to the bureau, whereas other negative payment data usually isnt reported for 30-90 days. Proceed with caution.

Overall, the lower your score is, the bigger the benefit that comes with reporting rental payments to credit bureaus as long as you pay your rent on time.

Read Also: Zzounds Paypal

What To Look For In A Rent

First, check to see if your landlord/property manager already has a service in place for free. If you need to find your own service, make sure to evaluate the following:

- Fees: Cost to join, monthly fee, and look back fees

- How easy it is to cancel

- How they protect your data

- How long it will take before payments appear on your credit report

- Which credit bureaus they report to

- What happens in the case of a dispute with your landlord. Is this reported as nonpayment, even if you live in a state that allows renters the right to withhold payment when the landlord fails to maintain habitable living conditions?

Services You Can Use If Your Landlord Does

-

ClearNow: This service debits your rent from your checking or savings account. Theres no cost to tenants, but your landlord must be signed up. If you opt in, payments are reported to Experian via its RentBureau.

-

PayYourRent: Fees are typically paid by management. It reports to all three credit bureaus.

Recommended Reading: How To Get Credit Report Without Social Security Number

The Benefits Of The Increase To Your Credit Score

Remember there are multiple sources of credit scores that show up on your credit history, including the FICO Score and the VantageScore.

So what does a 40-point increase to your credit score mean in real-life terms?

- For some, it means having a credit score for the first time, giving them the origin point to build a positive credit history.

- Having a credit history opens up the ability to pay for security deposits, set up utilities, or get a cellphone account.For some they can qualify for credit cards and loans, including a student loan.

- For others who had lower scores the boost can lower the interest rate on many loans, giving them an affordable payment option.

- And bringing this back around, landlords check so this boost can affect residents who are renewing their rental agreements.

Reporting Good Payment History For Renters Can Instantly Boost Their Credit Score

Did you know that if youve been making your rent payments on time that your by more than 40 points if that was reflected on your credit history?

Your landlord likely knows this, as do the credit bureaus.

A credit rent boost is fast becoming a trend. But it has yet to really catch on with the ones who need it most: Renters.

Does paying rent increase your credit score? Yes.

Greg Knotts, Continental Finance Blog

Most people know that building a strong credit history involves showing that they are a good candidate for credit or a loan.

One of the keys to showing this is to make payments on a credit card balance on time.

Other big payments like a mortgage or a car loan are also big indicators on a persons credit report.

But an on-time payment history of your rent is something many people never considered to be an indicator of good credit history.

Thats the thing though, paying rent on time is a great example of what a credit report from all three credit bureaus is looking for.

You can build credit history with rent payments. Ongoing reporting of your on-time payments helps establish your good record.

Chris Parker, executive director of Giv Development, told that rent reporting is a very useful indicator of a persons credit history.

They were the epitome of good credit risks, Parker told Herron.

Also Check: Does Zzounds Report To Credit Bureau

How To Start Reporting Rent Payments On Credit Report

You can improve your credit score up to 26 points over 12 months when you report your monthly, on-time rent payments to the TransUnion credit bureau.

Needless To Say I Was Thrilled

03/28/2019

I have been trying different ways of raising my credit score. Unsecured credit cards, Secured credit cards. Secured loans, you name it. Every option I look at or tried would raise my score but I would have to wait two month or even four months I was told by one place. Paid the fee that Credit Rent Boost charged, they contacted my landlord I think the next day. By the end of the next week my credit score went up 66 points. Needless to say, I was thrilled!!! I highly recommend Cred Rent Boost if your looking to raised you credit score and you want it raised NOW!!!

You May Like: Does Rent A Center Report To The Credit Bureau

Pay Rent With Your Credit Card

Outside of directly reporting rent payments to a credit bureau, some renters overlook simple payment options that can help them improve their credit score like paying rent with a credit card.

Online rent payment platforms like Avail allow renters to pay their rent with a credit card, which can help strengthen credit and, in some cases, help renters get reward points or cash back on rent payments.

While these payments wont be listed as a separate tradeline on a credit report, they can still help boost a renters credit score if theyre consistently paying off full balances as they would a regular rent payment.

What Is A Rent Reporting Service

Individuals cant report their own rental payments and landlords seldom do. Instead, independent reporting agencies gather information and report it to the credit bureaus on your behalf.

Another benefit of using a rent reporting agency is for securing a future rental property. All landlords much prefer candidates with a history of on-time rental payments, and this is an easy way to document your success.

In fact, Experian RentBureau and TransUnion SmartMove are designed specifically for landlords performing background checks during the application process.

You May Like: Is Speedy Net Loan Legit

Ask Your Landlord To Use Clearnow

It is a no brainer for you as a tenant to have your rent reported to a credit bureau for free! Will your landlord be willing to sign up for ClearNow so that this can happen? If you ask, most landlords are willing to pay the small service fee ClearNow charges when they realize that rent will be automatically debited from your bank account and sent to their bank account, reducing the work for both of you. So text them a link to www.ClearNow.com and ask if they can debit you for rent automatically!

Why Landlord Credit Bureau

All a tenant needs to do is continue to pay rent on time each month. At the end of the lease, the tenant can access the rental history as a Tenant Record to share with prospective landlords. The tenant not only has an opportunity to earn better credit, but to improve their rental history at the same time. In a tight rental market, that can make it easier to compete with other applicants for the best rental properties.

Focusing solely on landlords and tenants, LCB can offer valuable education and assistance, such as providing sample disclosures that landlords may provide to tenants to explain the benefits of rent reporting. LCB also provides sample lease provisions that allow tenants to better understand their responsibilities under the lease agreement and to maximize the value of rent reporting to build credit.

Once landlords learn how to report rent payments to a credit bureau, they can enjoy enhanced tenant screening abilities like access to the Tenant Records database, the ability to register on tenant credit reports and to report delinquencies to support collection efforts.

Tenants can build credit and rental histories to gain a competitive edge when applying for rental properties, monitor credit reports, and rate their landlords.

Ready to make renting easier?

Also Check: Does Square Capital Report To Credit Bureaus

How To Report Rent Payments To Credit Bureau

RentRedi is excited to announce that tenants can now report their rent payments to credit bureaus when they pay rent via their RentRedi tenant app!

When you pay rent through the RentRedi mobile app, you can report all on-time rent payments to TransUnion to boost your credit score by up to 26 points!

60% of renters even see improvements after 1 month!