Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your record.

The NFCC can provide financial counseling, help review your credit history, help you create a budget and even a debt management plan free of charge. It also offers counseling for homeownership, bankruptcy and foreclosure prevention.

As always, be wary of companies that overpromise, make claims that are too good to be true and ask for payment before rendering services.

When looking for a legitimate credit counselor, the FTC advises consumers to check if they have any complaints with:

- Your states Attorney General

- Local consumer protection agencies

- The United States Trustee program

What If I Decide To Not Paying Back My Debt

Of course, you can also decide not to pay off your debts and they will be removed from your credit report in about 6 or 7 years, depending on which province you live in. While this is an option, its not one what we would recommend. Its always in your best interest to pay back what you owe so that you know for sure you wont have any issues with that particular account in the future.

Want to know more about how long information stays on your credit report? .

Also, if the collections agency decides to pursue legal action against you because youre not repaying your debts, a judge could begin to garnish your wages to pay them off. Generally, it is a much better idea to simply pay the collections account and request that the demerit is taken off of your credit report before things get much worse than they need to. Even if you are unable to get them to wipe the account from your credit report instantly, paying it off is still a step in the right direction.

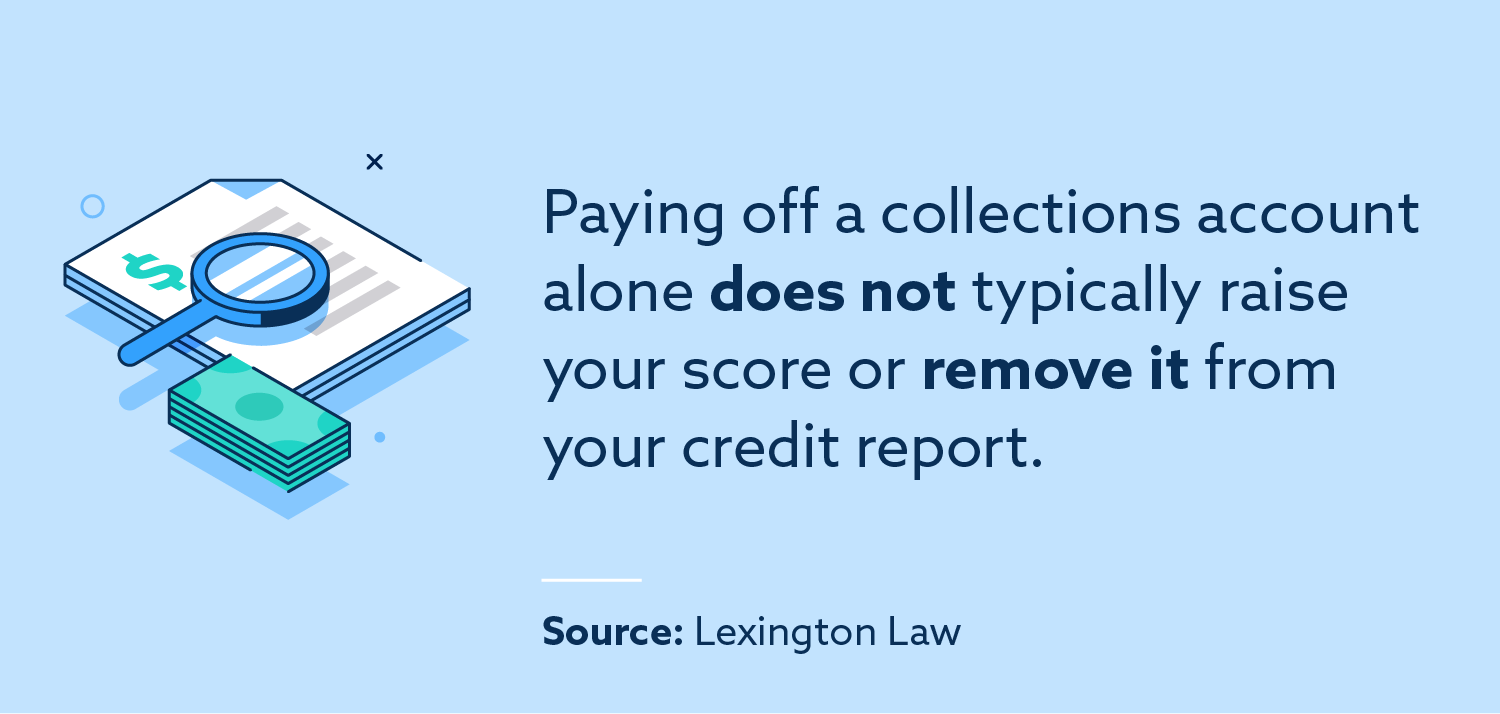

Also, while paying off these old debts that have gone to collections will help, dont expect them to completely turn your credit score and credit report from bad to great. Improving your credit as a whole takes a lot of time and effort in multiple areas, but paying off your collections accounts will at least ensure things dont get any worse for you.

When Your Credit Score Improves After Paying Off Debt

The impact can feel like it should be immediate, but thats not the case. Even if your balance becomes $0 today, it wont be reflected on your until your lender reports the payment.

It can take one to two billing cycles or one to two months. Lenders generally report activity monthly to credit-reporting agencies.

Lets take a more in-depth look at everything involved.

Read Also: Usaa Credit Score For Mortgage

What Are Other Ways To Improve Your Credit Score

You can build healthy credit over time by starting with these steps:

- Make on-time payments. This is one of the most important factors that impacts your credit scores. If you think you cant afford a payment, reach out to the lender right away. It may be willing to work out a payment plan and keep your account in good standing.

- Check your credit reports. This will help you understand and track your overall financial health. Also look for errors, such as incorrect credit card balances, trade lines that arent yours and accounts that are incorrectly marked as delinquent.

- Dispute and fix errors. About 20 percent of consumers have an error on at least one credit report, according to a Federal Trade Commission study. Getting an error removed may help your credit score improve.

- Consider a debt consolidation loan. A debt consolidation loan unites all your debts into a single balance, often at a lower interest rate that can save you money. A debt consolidation calculator can help you evaluate whether this type of loan is right for you, as debt consolidation can temporarily hurt your credit.

Sign up for a Bankrate account to analyze your debt and get custom product recommendations.

Next Steps: How Can I Keep Medical Collections From Ever Appearing On My Credit Report

These tips could help you keep medical bills off your consumer credit reports.

Read Also: Does Carmax Accept Itin Number

When Do Debt Collections Fall Off Your Credit Report

Any type of financial account can be sent to a collection agency if you become delinquent on the payments. When an account goes to collections, it will typically also be listed on your credit report and used to calculate your credit score. Unfortunately, debt collections bring down your credit score and can continue to affect it even after you pay off the balance.

Some newer versions of credit scoring calculations dont consider debt collections under $100 and dont ding you as much for medical debt collections. Even so, these blemishes can follow you around for years, hurting your ability to get approved for new credit cards, loans, and other credit-based services.

Thankfully, debt collections wont be on your credit report forever. The Fair Credit Reporting Act requires that debt collections fall off your credit report after seven years. In the past, court judgments against you for debt collection appeared on your credit report as long as an individual state’s statute of limitations. However, the major credit bureaus no longer include these civil judgments in your report.

Need Help Removing Collections From Your Credit Report

This is where hiring a credit repair company can really make a difference. They help most people to remove collections by disputing errors with the three credit bureaus for you. This means you dont have to contact any of the credit bureaus or collection agencies yourself directly.

If you arent sure where to start regarding disputing collections, talk to one of their credit repair professionals and get your questions answered. Of course, you can do it yourself, but youre likely to have more success by enlisting professional help.

They offer a no-obligation consultation to explain what they can do to help in your particular situation.

Recommended Reading: Can You Get A Repo Off Your Credit

Do Medical Bills Appear On Credit Reports

Medical bills usually only show up on your credit reports if theyre sent to collections.

As long as you pay your doctors bill or hospital bill on time, it shouldnt be reported to the credit bureaus. But if you miss the due date, and youre significantly late, the medical office might turn your debt over to a collections agency.

Experian, one of the three major consumer credit bureaus, notes that while each healthcare provider has its own practices, its typical for providers to wait 90 days before sending medical debt to collections. Some might even wait 180 days.

Regardless of when your unpaid bills are turned over to a collections agency, the three major consumer credit bureaus give you a six-month grace period. That means unpaid medical bills wont show up in your credit history until youre at least 180 days late. So, theoretically, even after your past-due medical bills are sent to collections, with the 180-day rule you might be able to pay them before they show up on your credit reports.

Have A Professional Remove Collections From Your Credit Report

If this all seems like too much for you to handle, and you are worried about trying to take on a collection agency on your own, theres an entire industry devoted to credit repair that is ready to help you.

A professional credit repair company like Lexington Law could help restore your credit usually within three or four months.

They wont take any action you couldnt take yourself. Since credit repair is all they do, itll work faster and more efficiently.

You would need to budget some money for the monthly payments, which average about $100 depending on the plan you choose.

Theres also a one-time set-up fee for most .

But if you want to get your personal finances back on track without spending your free time on the phone or writing letters, you should consider this kind of service provider.

Debt collections come in many forms.

Whether its an unpaid medical bill, a cell phone bill, or even an $18 library book you never returned, unpaid debt can lead to negative information on your credit report.

It looks especially bad when the negative item comes from a collection agency.

Collections accounts tell other creditors you let an old debt go three or maybe even six months without paying.

When you apply for new credit, lenders know your old lenders lost money on your accounts.

So a collection account will have a negative impact on your ability to apply for new credit whether its a mortgage, a major credit card, or a personal loan.

Read Also: Comenity Bank Credit Score

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

Common Credit Report Errors To Look Out For

According to the Consumer Financial Protection Bureau, these are the most common errors consumers find on their credit history:

Mistaken identity

- Wrong name, address or phone number

- Accounts from someone with a similar name

- New credit accounts opened by someone who stole your identity

Incorrect account status

- Accounts wrongfully labeled as open, past due or delinquent

- Accounts that wrongfully listed you as the owner instead of authorized user

- Wrong date for the last payment received, date the account was opened or delinquency status

- Same debt listed multiple times

Data management

- Information that is not removed, despite already being disputed and corrected

- Accounts that are listed multiple times, with different creditors

Balance

- Incorrect credit limit

Don’t Miss: Paypal Credit Hard Pull

What Happens After The Limitation Period Expires

Even though you owe the money until the debt is paid or settled, a debt collectors options are limited when the limitation period expires. At this point, calling and sending collection letters that demand payment before further action is taken are mostly just threats.

However, after the limitations period:

- Debt collectors can continue to call and ask for payment

- The debt will remain on your credit report for seven years from the date of last payment

If a debt collector does try to sue you after the limitation period, you can defend the action by notifying the court that the limitation period has expired. Failure to show up in court and plead this defense can result in a judgment favouring the collection agency.

Whether you choose to pay an old debt is up to you. It will fall off your credit after seven years, but collection agencies can still call. If you want to stop the calls, you can offer to settle. Only make this offer if that is what you intend to do. Otherwise, ignore the calls.

Whether the limitation period has passed or not, you have rights when dealing with a debt collector. Debt collectors can only contact your friends, relatives, neighbours, or employer to get your telephone number or address, but they arent allowed to suggest to them that you should pay your debts. They cant use threatening or intimidating language and apply unreasonable pressure to force you to repay the debt.

Offer To Sign Up For Automatic Payments

In some instances, a creditor may agree to delete a late payment if you agree to sign up for automatic payments.

This plan works well if youve had trouble making payments in the past but arent significantly delinquent on your account. Youll have better luck negotiating this deal if you can show that youre financially able to make your payments.

It also helps if youve overcome whatever financial hurdle held you back from making payments in the past. Like requesting a goodwill adjustment, this is also ideal for longer-term customers.

You May Like: Speedy Cash Collections

How To Keep Medical Debt Off Your Credit Report

As your doctor may say about your health, an ounce of prevention is worth a pound of cure. The same is true for medical debt.

To keep your medical bills off your credit report, make sure you:

- Read Your Explanation of Benefits: If you expect your insurance company to pay a medical bill, your explanation of benefits will show how much of the bill youre expected to pay. Reading EOBs prevents surprise past due balances.

- Communicate with Service Providers: The billing department at your hospital or doctors office may have grace periods or other ways to help keep your payment history on track. You may be able to negotiate a better payment plan to keep your account current.

- Communicate with Insurance Companies: You can avoid medical collections by communicating with your insurance company before a procedure to find out how much youll owe out of pocket.

- Stay In-Network: Finding service providers inside your insurance companys network can help keep medical costs lower and lower the chances of past due balances landing in collections.

- Use Public Insurance When Possible: If you qualify for Medicare or Medicaid, these public insurance programs could help you pay off medical bills and avoid collections. Medicare is income-based and income requirements vary by state.

Negotiate A Payment Plan

When your credit report shows valid and accurate data thats having a negative impact on your credit score, you still have one more option: You can negotiate a payment in exchange for removing the negative item.

A collections agency often buys medical debt from your healthcare provider. If you owed your doctors office $2,000, the collections agency may have paid only $500 for your past due debt.

In this case, the debt collector may be willing to accept less than the full $2,000 you owed. You could offer to pay $800 for example in exchange for closing the account and removing the negative items from your credit report.

When you use this strategy, always be sure to get the payment arrangements in writing before you send a payment. After you make your payment, check your credit report to make sure the agency kept its promise.

Some agencies may want a lump sum amount, but you could try to negotiate for monthly payments instead.

Don’t Miss: Zzounds Bad Credit

Three Ways To Remove Collections Accounts From Your Credit Report

The first step you need to take is to order from the three major bureaus: Experian, TransUnion and Equifax. Collections may be reported to only one or two bureaus. There are a few different ways you can try to remove collections from your account, some with more success than others. We review these options below.

Bear in mind that the results of these methods vary and not every consumer will have the same outcome. However, its always worth exploring and your credit score may improve as a result.

Discount For Family Members Couples And Active Military

Lexington Law is now offering $50 off the initial set-up fee when you and your spouse or family members sign up together. The one-time $50.00 discount will be automatically applied to both you and your spouses first payment.

Active military members also qualify for a one-time $50 discount off the initial fee.

Don’t Miss: Transunion Report Death

How To Improve Your Credit When You Have Collections

If you have legitimate collection accounts on your credit reports, there’s nothing you can do to get them removed before their expiration dates. But you can take steps immediately to start rebuilding your credit and reversing the damage those collections have done to your credit score:

When it comes to accurate collection entries on your credit reports, there’s nothing you can do to get rid of them except wait for their inevitable expiration date. So don’t fret over past mistakes instead, try to avoid future missteps, improve your credit habits and rebuild your credit in the process.

Lawsuit Or Judgment: Seven Years

Both paid and unpaid civil judgments used to remain on your credit report for seven years from the filing date in most cases. By April 2018, however, all three major credit agencies, Equifax, Experian, and TransUnion, had removed all civil judgments from credit reports.

Limit the damage: Check your credit report to make sure the public records section does not contain information about civil judgments, and if it does appear, ask to have it removed. Also, be sure to protect your assets.

You May Like: Paypal Credit Score