What Credit Score Is Needed To Buy A House

Ah, the dreaded . Its one of the biggest criteria considered by lenders in the mortgage application process three tiny little digits that can mean the difference between yes and no, between moving into the house of your dreams and finding yet another overpriced rental. But despite its massive importance, in many ways the credit score remains mysterious. If you dont know your number, the uncertainty can hang over you like a dark cloud. Even if you do know it, the implications can still be unclear.

Is my score good enough to get me a loan? Whats the best credit score to buy a house? What’s the average credit score needed to buy a house? Whats the minimum credit score to buy a house? Does a high score guarantee I get the best deal out there? And is there a direct relationship between credit score and interest rate or is it more complicated than that? These are all common questions, but for the most part they remain unanswered. Until now.

Today, the mysteries of the credit score will be revealed.

How To Earn A Good Credit Score:

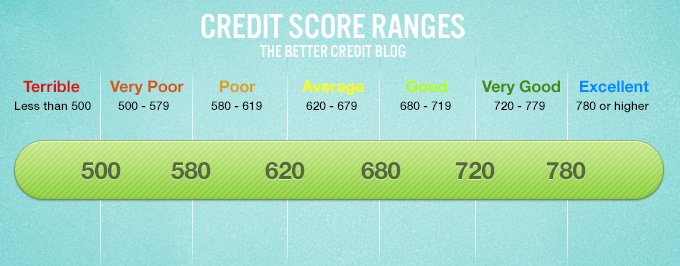

If you currently have a credit score below the “good” rating, you may be labeled as a subprime borrower, which can significantly limit your ability to find attractive loans or lines of credit. If you want to get into the “good” range, start by requesting your credit report to see if there are any errors. Going over your report will reveal what’s hurting your score, and guide you on what you need to do to build it.

Pay All Your Bills On

If your credit score is over 700, youre probably doing this faithfully. At the same time, you should be aware that a single late payment could have a serious negative effect on your credit score.

Set up automatic debits for any recurring payments you have. You should do this even with rent and utility payments. Though they wont report to credit bureaus in the normal course, they will report unpaid balances. Automatic debits will eliminate that possibility.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

How Long Does It Take To Get A 717 Credit Score

It depends where you started out.

If you had fair credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

Summary: Financing A Car With A 717 Fico Score

It is when applying for loans that the distinction between an excellent and good credit score truly comes to fore. For example, when applying for a loan that is more than how much you earn, then you will need a credit score of at least 680 and it is not different when it comes to an auto loan.

It is practically impossible to secure some loans without a very good credit score. Imagine the interest on a $200,000, 30-year, settled rate contract. If you have a credit score of 760 to 850, you will have to pay an interest rate of 3.083 percent according to FICOs interest number cruncher as of October 2012.

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

What Is The Average Credit Score In Canada And How Do You Compare

What is the average credit score in Canada, and how do you rank among average Canadian credit scores? More so, what is a good credit score in Canada?

Often, Canadians want to know how they measure up to other people when it comes to their credit score. Is your credit score better than the average credit score? Maybe its worse?

First, let’s answer the question you are here to find out:

+ Credit Scores By Income

700+ Credit Scores by Income

People who make at least $50,000 per year are significantly more likely to have a credit score of at least 700. And people who pull in $75,000 to $99,999 per year are in the sweet spot for a score that begins with a 7 or an 8. But note that it is possible to get into the 700-plus club if you earn less or wind up with a way lower score even if you make a lot more. Its all about spending within your means.

Don’t Miss: How Long Does A Repossession Stay On Your Credit Report

How To Solve Common Credit Issues When Buying Ahouse

If your credit score orcredit history is standing in the way of your home buying plans, youll need totake steps to improve them.

Some issues like errorson your credit report can be a relatively quick fix and have an immediateimpact on your score. Other issues can take much longer to resolve.

You should start checking your credit early on, ideally 6-12 months before you want to buy a house. This will give you time to identify issues with your score or report and work on solving them before you apply for mortgage pre-approval.

Here are tips on solvingsome of the most common credit issues faced by home buyers.

Can I Get A Mortgage & Home Loan W/ A 717 Credit Score

Getting a mortgage and home loan with a 717 credit score shouldn’t be very difficult. Your current score is a mid-to-high credit rating.

The #1 way to get a home loan with a 717 score is to complete minimal credit repair, and simply apply and wait for approval.

After a few short months of repairing your credit , youâll be in a much better position to get your ideal home loan terms.

Don’t Miss: How To Get Credit Report Without Social Security Number

Average Credit Score By State In 2020

| Average credit score by state in 2020 | |

| Alabama: 687 | Montana: 727 |

| Alaska: 714 | Nebraska: 728 |

| Arizona: 706 | Nevada: 696 |

| Arkansas: 690 | New Hampshire: 730 |

| California: 717 | New Jersey: 721 |

| Colorado: 725 | New Mexico: 694 |

| Connecticut: 723 | New York: 719 |

| Delaware: 710 | North Carolina: 704 |

| District of Columbia: 713 | North Dakota: 730 |

| Florida: 702 | Ohio: 712 |

| Georgia: 689 | Oklahoma: 690 |

| Hawaii: 727 | Oregon: 727 |

| Idaho: 721 | Pennsylvania: 720 |

| Illinois: 716 | Rhode Island: 720 |

| Indiana: 708 | South Carolina: 690 |

| Iowa: 726 | South Dakota: 731 |

| Kansas: 718 | Tennessee: 697 |

| Kentucky: 699 | Texas: 688 |

| Louisiana: 685 | Utah: 723 |

| Maine: 722 | Vermont: 732 |

| Virginia: 718 | |

| Massachusetts: 729 | Washington: 731 |

| Michigan: 715 | West Virginia: 695 |

| Minnesota: 739 | Wisconsin: 732 |

| Mississippi: 675 | Wyoming: 719 |

| Missouri: 707 |

What To Do Before Applying For A Credit Card If Your Fico Score Is 700 To 749

Even if youve been in the 700 to 749 credit score range for a long time, never assume thats still the case. Credit scores are a moving target! The score you have today will be different a month from now, and again a year from now.

For that reason, there are a few steps you should take before you even make application for a credit card.

Read Also: How To Report A Death To Credit Bureaus

Very Poor Credit Score: 0 549

This score spells rookie. Clearly, youre a newbie in the credit bidness and dont have enough credit history, to begin with. Not to panic though, everybody starts somewhere. This can easily be fixed, apply for a loan and credit card and set up a repayment schedule, this will ensure a good record and aid in maintaining a future credit history. Although if your score falls to this range, you might need to take some drastic measures to bring it back up.

Perfection is overrated but aiming for it isnt. Our score doesnt be perfect to get the best terms but our effort should be to achieve an excellent credit score. But if your credit is bad, how do you get there?

Rewards Should Match Your Spending Patterns

If youre not a frequent traveler, it will make little sense to get a card that provides generous travel rewards. As you probably wont take advantage of them, itll be just another credit card.

Also, look very carefully at any qualifications for the rewards. Many credit cards in this credit range make their most generous rewards offers on select categories. If you use those categories normally, it will make sense to take the card. But if you dont, you wont earn the rewards.

Recommended Reading: What Is Syncb Ntwk On Credit Report

What Is A Good Credit Score To Buy A House

If only it were that simple. When trying to answer the question, What credit score is needed to buy a house? there is no hard-and-fast-rule. Heres what we can say: if your score is good, lets say higher than a 660, then youll probably qualify. Of course, that assumes youre buying a house you can afford and applying for a mortgage that makes sense for you. Assuming thats all true, and youre within the realm of financial reason, a 660 should be enough to get you a loan.

Anything lower than 660 and all bets are off. Thats not to say that you definitely wont qualify, but the situation will be decidedly murkier. In fact, the term subprime mortgage refers to mortgages made to borrowers with credit scores below 660 . In these cases, lenders rely on other criteria reliable source of income, solid assets to override the low credit score.

If we had to name the absolute lowest credit score to buy a house, it would likely be somewhere around a 500 FICO score. It is very rare for borrowers with that kind of credit history to receive mortgages. So, while it may be technically possible for you to get a loan with a score of, say, 470, you would probably be better off focusing your financial energy on shoring up your credit report first, and then trying to get your loan. In fact, when using SmartAsset tools to answer the question, What credit score is needed to buy a house?, we will tell anyone who has a score below 620 to wait to get a home loan.

Mortgage Rates For Good Credit

Your credit scores are just one factor to consider when youre looking to get a great mortgage rate. Having good credit can help you get a better rate, but so can factors such as

- The type of mortgage loan youre looking for

- The total cost of your home

- Your debt-to-income ratio

- The size of your down payment

The average credit score it takes to buy a house can also vary greatly by location.

Once you have a general picture of your overall credit as well as how much house you can afford and the type of loan you want its a good idea to shop around. This can give you a better idea of what different lenders could offer you.

Compare your current mortgage rates on Credit Karma to learn more.

Also Check: 698 Credit Score Auto Loan

Can You Get A Personal Loan With A Credit Score Of 717

Most lenders will approve you for a personal loan with a 717 credit score. However, your interest rate may be somewhat higher than someone who has Very Good or Excellent credit.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

See Also:12 Best Personal Loans for Good Credit

What Is A Good Credit Score

What is considered a good credit score? :59

Reading time: 3 minutes

-

Theres no magic number to reach when it comes to receiving better loan rates and terms

Its an age-old question we get, and to answer it requires that we start with the basics: What is a, anyway?

A credit score is a number, generally between 300 and 900, that helps determine your creditworthiness. Credit scores are calculated using information in your , including your payment history the amount of debt you have and the length of your credit history.

Its also important to remember that everyones financial and credit situation is different, and theres no magic number to reach when it comes to receiving better loan rates and terms.

There are many different credit score models used today by lenders and other organizations. These scores all have the same goal: to predict a consumers likelihood to pay their bills. There are some differences around how the various data elements on a credit report factor into the score calculations.

Although credit scoring models vary, generally, credit scores from 660 to 724 are considered good 725 to 759 are considered very good and 760 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behaviour in the past, which may make potential lenders and creditors more confident about your ability to repay a debt when evaluating your request for credit.

How Do Your Actions Impact Credit Scores?

Recommended Reading: Paypal Credit Required Score

Chief Factors That Affect Your Credit Score

The following factors may make or break your credit score:

- Payment history: learn from this history, repeat it. Timely payments go a long way. Payments are considered late when theyre 30-60 days past the due date. Timely payments go a long way. This might just be the best thing you can do for your credit score.

- the runner-up to payment history. This is the second most important factor to keeping an envious credit score. This is basically the amount of credit available that is being used by you. Financial advisors commend that each card you own should have a balance of below 30% according to your credit limit. Say if your limit $7000, the balance should be under or equal to $2100.

- Length of credit history: patience is a virtue and time is money. Both these things are the MVPs when it comes to building a rock-hard credit score. The longer the mean age of our account, the better.

- The type of credit in use: An assortment of different credit account types donates to a healthy credit score. A blend of debt and credit cards with a pinch of installment debt i.e. loans on automobiles or mortgages keep the credit score running in a smooth way.

- New credit: new credits or loans you apply for. This may simple but isnt so. Each new credit will help in eventually racketing up a good score, but the duration of our credit length is key here. The longer the length of our credit history, the less the new credit applications will harm our score.

Can I Get A Car / Auto Loan W/ A 717 Credit Score

Trying to qualify for an auto loan with a 717 credit score is relatively cheap. There isn’t as much risk for a car lender . Taking out an auto loan out with a 717 credit score, shouldn’t be very difficult.

It gets even better.

You can improve your loan terms with a few simple steps to repair your credit.

An ideal option at this stage is reaching out to a credit repair company to evaluate your score and see how they can increase it.

Read Also: Does Loan Me Report To Credit Bureaus

Getting A Mortgage With A Thin Credit History

One option to boost yourcredit score is to become a credit card authorized user on someone elsesaccount. You can be added tohealthy credit card accounts, and that can boost your score.

This strategy can help you if youre new to managing credit and dont have many open lines of credit or tradelines.

Tradelines arecredit-lingo for accounts with creditors. When youre short on tradelines, itcan be hard for the credit bureaus to assign to you a credit score and hardfor lenders to know whether youre a good borrower.

Getting yourselfauthorized to use a family members credit card can be a terrific way toboost your own credit rating andqualify to buy a house sooner.

Auto Loans For Good Credit

The best rates for auto loans are typically available to people with good-to-excellent credit, but what good credit means to auto lenders can vary. Beyond the base credit-scoring models like FICO and VantageScore, there are also industry-specific scores that lenders could check, such as FICO® Auto Scores.

Even though you may not know which specific score a lender will use, its still a good idea to have an understanding of your overall credit health when shopping around. You can check your credit from Equifax and TransUnion for free on . You can also periodically get a free credit report from each of the three main consumer credit bureaus from annualcreditreport.com.

And yes, its important to shop around! Take some time to compare offers to find the best terms that could be available to you. In particular, the rates offered at car dealerships may be higher than rates you might be able to find at a bank or credit union, or with an online lender.

If youre shopping around for auto loan rates, consider getting preapproved to boost your negotiating power when youre at the dealership. A preapproval letter can be a great way to show car dealers youve done your homework and wont accept a subpar financing offer. Just be aware that it can result in a hard inquiry, which can temporarily ding your credit.

And if you already have a car loan but youve improved your credit since you first got it, you might be able to find a better rate by refinancing.

Don’t Miss: How To Unlock My Experian Credit Report