Heads Up: What To Consider When Applying For An Amazon Credit Card

Although all four cards are credit cards, its important to know that two of these cards dont function like traditional credit cards specifically, the Amazon.com Store Card and the Amazon Prime Store Card.

Most credit cards including the Visa Signature cards will let you charge a purchase anywhere that particular card is accepted. But the Amazon.com Store Card and Amazon Prime Store Card can only be used to make purchases at Amazon and nowhere else.

With these two cards, you can select from three levels of interest-free financing: six months for purchases of $150 or more, 12 months for purchases of $600 or more, and 24 months for certain purchases of $800 or more.

John Ganotis, credit card expert and founder of Credit Card Insider, gives a warning to unwary consumers who take advantage of the special financing offers. He says to watch out for deferred interest financing offers. Theyre not the same as 0% introductory APRs on most credit cards.

While youre paying off these financed charges, the bank will be adding up all the interest charges. If you pay off your balance in full before the financing period ends, you dont have to pay any interest.

But if you dont pay off the full balance in time, youll be charged retroactively for all of that accrued interest. So make sure youre able to pay off the balance in time before signing up for the interest-free financing.

What We Know For Sure

There are certain requirements that are critical to getting approved for a Chase credit card:

- A Good to Excellent Credit Score While the terminology can vary by credit bureau, you will generally need to have a good to excellent to secure a Chase credit card. Experian, one of the top credit bureaus, states that a score of 700 or above is generally considered good and a score of 800 or above is considered to be excellent.

- Sufficient Income Chase will want to verify sufficient income to determine your ability to pay and to calculate the amount of your credit card limit.

- A U.S. Address and Social Security Number You will need a U.S. address and a social security number or EIN number to be approved for a Chase credit card.

Secured Mastercard From Capital One

The;Secured Mastercard® from Capital One;has a few of the most appealing terms in the industry.

Depending on your credit, you might get a card with a $200 limit for just a $49, $99, or $200 deposit.

The majority of secured cards require anywhere between $300 and $500, so this is a bargain. Theres no annual fee, youll get a credit review after only six months, and you can use it pretty much anywhere.

Also Check: Does Klarna Affect Your Credit Score

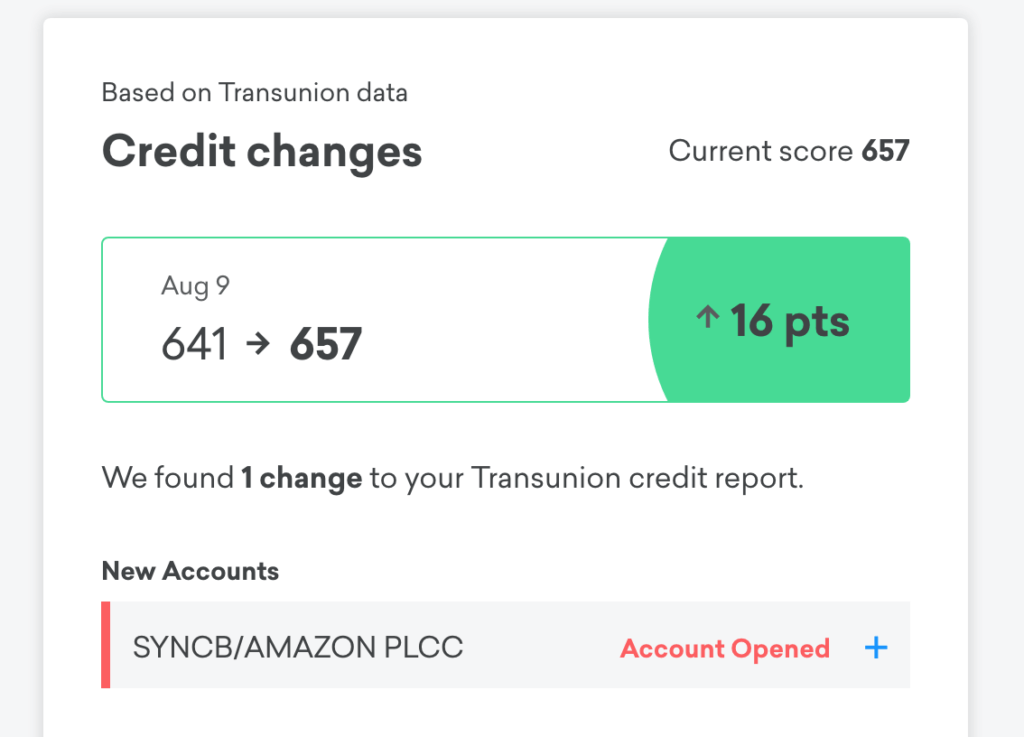

Does Amazon Use Equifax Or Transunion

Amazon checks credit scores through the main credit bureaus, including Equifax, Experian and TransUnion.

According to former customers, they go through Chase when checking credit scores through these sub-bureaus.

Additionally, when Chase goes through these companies, they use the FICO 8 score for all customers credit score checks and decisions.

After Amazon processes the check, they decide whether or not the customer is eligible for a Prime Visa based on their overall score.

Customers should note that Amazon will generally only check credit scores if their contact and personal information warrants an identity check.

Therefore, customers are recommended to keep their Amazon account as up-to-date as possible to avoid a delay for Prime Visa approval.

Our Thoughts On The American Express Gold Card

The American Express® Gold Card lets you earn Membership Rewards points on every purchase, with a rewards rate and offerings heavily catered to foodies. Youll earn Earn 4X Membership Rewards® Points at Restaurants, including takeout and delivery, and earn 4X Membership Rewards® points at U.S. supermarkets , and 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com. Terms apply. Earn 1X points on all other eligible purchases. Youll even enjoy monthly dining statement credits when using your Amex Gold at select partners, including Grubhub, Seamless, The Cheesecake Factory, Ruths Chris Steak House, Boxes and participating Shake Shack locations for annual savings of up to $120 . A new benefit is up to $10 monthly in Uber Cash , good for U.S. Uber rides or U.S. Uber Eats. Your American Express® Gold Card needs to be added to your Uber app in order to receive this monthly Uber Cash benefit.

Read Also: Experian Boost Paypal

Best Amazon Credit Card For 2021

Advertiser Disclosure

Advertiser Disclosure: ValuePenguin is an advertising-supported comparison service which receives compensation from some of the financial providers whose offers appear on our site. This compensation from our advertising partners may impact how and where products appear on our site . To provide more complete comparisons, the site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Hands down, the best credit card for Amazon is the . You won’t find a card that offers a higher rewards rate on all your Amazon purchases.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.

Amazon shoppers have a number of credit cards to choose from, both from the e-commerce giant itself and from other credit card companies that incentivize spending online and in supermarkets. We’ve broken down the rewards rates and bonuses below, so you can maximize your money while shopping.

Unlimited 2% Cash Back On Common Business Expenses

Heres a handy reward for business owners that isnt specific to Amazon purchases. Youll be earning an unlimited 2% back on common business expenses, including:

- US restaurants

- US gas stations

- Wireless telephone services purchased directly from US service providers

Because these are common business expenses, the Amazon Business Prime card might be more useful for your business.

Also Check: How To Get Credit Report Without Social Security Number

Looking For A Credit Card With Poor Credit

If you currently have only limited, poor, or average credit, and are looking for a real;credit card, we currently recommend theMilestone® Gold Mastercard®instead of the Amazon.com Card.

This is because the Milestone® Gold Mastercard® allows you to see if you’re pre-qualified before you apply for the card – so you don’t have to risk having your credit pulled, only to be denied a card.

The Milestone® card is a Mastercard® which means that it can still be used on Amazon and at millions of merchants around the world.And your application will be considered even if you have a prior bankruptcy.

Amazon Prime Store Card Vs Amazon Prime Visa Card: At A Glance

Synchrony and Chase each offer two versions of their Amazon cards one for Prime members and one for nonmembers and youre automatically assigned one or the other when you apply.

Whether you opt for an Amazon store card from Synchrony or an Amazon Visa from Chase, being a Prime member is key if you want to maximize your .

While youll earn 5% back on Amazon purchases with either the Amazon Prime Store Card or the Amazon Prime Visa card, the two cards vary considerably in other areas, including their sign-up bonuses, approval odds and cardholder benefits.

| Amazon Prime Store Card |

| $401 |

You May Like: Innovis Consumer Assistance Letter

Best For Earning Rewards: Amazon Prime Rewards Visa Signature Card

Whether youre a Prime member or not, Chases Amazon cards win out easily on the rewards front. These cards offer many more opportunities to earn rewards on everyday spending and are much more flexible.

Indeed, even with its lower rewards rate on Amazon purchases, the Amazon Rewards Visa Signature Card beats out the Amazon Prime Store Card thanks to rewards flexibility and a higher average rewards rate across purchases outside of Amazon.com.

Theres also a stark contrast when it comes to sign-up bonuses. On either Amazon store card, new members get a $100 Amazon.com gift card upon approval, compared to a $150 and $50 gift card with the Amazon Prime Rewards Visa and Amazon Rewards Visa, respectively.

Tip: The Amazon credit cards arent your only options for earning rewards on Amazon or other online shopping. The Discover it® Cash Back is one good alternative, as it frequently features Amazon.com in its cash back calendar. This year, the card is offering 5% back on Amazon.com purchases from October through December .

What’s To Like About The Amazon Secured Card

This card offers a way to rebuild your credit with no annual fee and few other fees. And although it’s a store card that’s not part of a larger payment network, Amazon is one of the largest stores in the world, with a selection of over 100 million items.

Better yet, Prime members are able to receive 5% back by using an Amazon Prime Store Card, including this secured card version. Prime members can choose a promotional financing option instead of receiving 5% back on their purchases.

Most important, you can qualify for this card with bad credit, and balance and payment information will be reported to the major consumer credit bureaus to help get your credit score back on track. This option helps customers rebuild their credit when they aren’t able to qualify for a standard, unsecured credit card.

Also Check: Fingerhut Guitars

What Is The Difference Between The Amazon Store Card And Amazon Visa

The Amazon store cards can be used only for Amazon purchases, whereas the Amazon Visa cards can be used anywhere Visa cards are accepted. In addition, the Amazon Visa cards have more benefits than the Amazon store cards, including different types of travel insurance and purchase protections. However, its likely easier to qualify for the Amazon store cards because they have less strict requirements.

Is It Worth Signing Up For Amazon Prime

Amazon Prime costs $119 per year, comparable to the cost of many credit cards with annual fees. Since the Amazon Prime Rewards Visa Signature Card is only open to existing Prime members, you may wonder if it’s worth opening a membership if you don’t own one already. Here is the list of the ongoing benefits you’ll enjoy with Amazon Prime:

- Free two-day shipping on millions of eligible products, with free same-day or 2-hour delivery in select cities

- Extra 10% discount on sale items at Whole Foods

- Prime Video, offering access to thousands of movies and TV shows for free

- Prime Music, offering over two million songs ad-free with the opportunity to upgrade to Amazon Music Unlimited at a Prime member rate

- Amazon Photos, with free unlimited photo storage shareable to up to five family members or friends

- 30-minute early access to Amazon Lightning Deals

- Borrow one e-book for free on any Kindle device

If you live in a metropolitan area, Whole Foods offers free two-hour delivery or one-hour same-day pickup, which can be helpful to grocery shoppers who need items in a pinch. While the shipping benefit alone is why millions of people subscribe to Amazon Prime, there are many entertainment and shopping perks with this subscription.

Amazon Prime also offers a free six-month trial exclusively for college students. After that, you’ll enjoy a 50% discount on membership while you’re still a student.

You May Like: Paypal Credit Soft Or Hard Pull

Business Lines Of Credit

Rather than choosing Amazon’s credit lines, you could instead choose a credit line from a different financial institution. First, other lines of credit give you the option of spending your money however you’d like, while Amazon’s lines of credit only allow you to spend your money at Amazon. Another benefit of outside lines of credit is that you can often have a longer period to pay them back, while Amazon’s credit lines must be paid back on a term of anywhere from 30-60 days.

For example, BlueVine offers business lines of credit for amounts of anywhere from $5000 to $250 000. You can pay back your balance with weekly or monthly payments over a period of 6-12 months. And unlike Amazon, there are no restrictions for where you can spend the money.

Great For High Spenders

If youre a high spender, take advantage of its current sign-up bonus: Enjoy a one-time bonus of 60,000 miles once you spend $3,000 on purchases within 3 months from account opening, equal to $600 in travel. You can not only redeem these miles for travel but for everyday purchases. You can erase your Amazon purchases using your Capital One miles, making your rewards extremely valuable for various needs.

Also Check: Does Paypal Credit Affect Credit Score

If You Count Yourself As A Loyal Amazon Customer You Might Be Able To Earn A Nice Chunk Of Your Spending Back Or Even Finance Your Purchases With One Of The Amazon Credit Cards

There are four to choose from, so how do you pick which one is right for you? Here are a few questions to ask.

- What type of Amazon shopper are you ?

- Do you want the option to finance a large Amazon purchase or not? Well guide you through your four choices in this Amazon credit card review so that you can make the best decision for yourself.

- Are you a frequent Whole Foods shopper? As of October 2020, eligible Prime members will earn 5% back on Whole Foods Market purchases when using the Amazon Prime Rewards Visa Signature Card. Cardholders who arent eligible Prime members will now earn 3% back on Whole Foods Market purchases when using the Amazon Rewards Visa Signature Card.

Is The Card For You

This card makes absolute sense for you if you are an Amazon Prime Member and/or Whole Foods enthusiast. While other cards such as the Discover it or Chase Freedom may offer cash back category bonuses on groceries or quarterly bonuses on Amazon purchases, its hard to find a card that offers a higher return rate on both.

Chances are that if you shop Amazon frequently, you already pay the $119 Amazon Prime membership fee so the card effectively has no annual fee. That said, dont hold a balance on this card as it charges a higher interest rate than many other cards available. If you do need to carry a balance on your card, consider a card thats best for 0% APReither on purchases or on balance transfers. As long as you pay your bill in full every month, you will come out ahead with the Amazon Prime Rewards card.

To view rates and fees of the Blue Cash Preferred® Card from American Express, please visitthis page.

To view rates and fees of the American Express® Gold Card, please visitthis page.;

Read Also: Paypal Credit Hard Pull

How The Amazon Prime Rewards Visa Signature Compares To Other Rewards Cards

Although they may not be as rewarding for as the Amazon Prime Rewards Visa signature is, plenty of other cards are designed to reward online shopping beyond this one retailer. However, many of these alternatives are limited by quarterly categories, bonus category spending caps and limited-time offers, such as the Chase Freedom Flex card and the Blue Cash Preferred® Card from American Express.

What Does Amazon Check Credit Scores For

Amazon checks credit scores to determine if customers are eligible for their Amazon Prime Visa, and for potential employees whose applications are under consideration.

When Amazon conducts a credit check for customers, they are doing so to confirm the identity of the customer if they didnt have sufficient information, which is generally done for credit card applications.

As well, when Amazon does a credit check for potential staff, they are doing so as part of a thorough background check, which may include a criminal record check, consumer report, and similar perusals.

Read Also: Does Opensky Report To Credit Bureaus

Alternate Pick: Ink Business Preferred Credit Card

The Ink Business Preferred® Credit Card may be a solid alternative to the Amazon Business American Express Card*,; offering a strong rewards rate on areas many businesses are likely to find appealing. Earn 3 points per dollar on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per dollar on all other purchases. It also comes with an annual fee of $95 but that may be balanced out by the flexibility of your earnings.

Rewards earned are Chase Ultimate Rewards points which can be redeemed for cash back at 1 cent per point or redeemed for 25% more value when used to book travel through the Chase Travel Center. You can also use your rewards to , but that yields a lesser value of around 0.8 cents per point.

How Did We Choose These Credit Cards And Credit Options

When choosing which Amazon credit options to include in this account, we made sure to find products that would suit a variety of types of businesses in a variety of sizes. While no product on our list will be well-suited to all businesses, most businesses should be able to find a product that works for them.;

Factors we considered when choosing these products include:

- How easy it is to apply

- Interest and fees

- Payment terms

You May Like: Aragon Collection Agency

Get Your Credit Score Improved Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.