Late Payments And Credit Scores Faqs

1. What happens to your credit if you make a late payment?

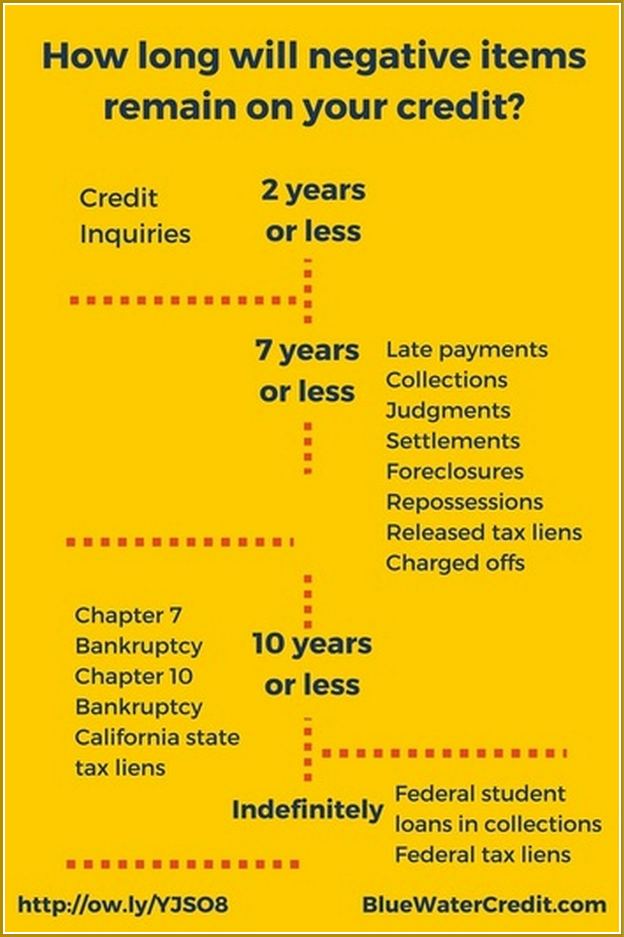

The impact of a late payment on your credit report depends on the number of days delay and the frequency of delays. If youre frequently delaying EMIs and credit card bills, then your credit score and history will take a hit. The late payment is recorded on your credit report and can stay up to seven years. However, the silver lining here is that the impact of a delayed payment decreases with time, especially if you have been making timely payments after the initial delay.

2. Can I get late payments removed from my credit report?

Removing an actual late payment from your credit report is not possible. However, if the late payment was reported by error when you have paid on time, then you can raise a dispute with the credit bureau online. Send proof of timely payment, and the credit bureau will investigate the issue. If your dispute is proved right, then the corresponding late payment record will be deleted from your credit report.

3. How long will a late payment stay on my credit report?

Late payment remains on the credit report for seven years since the day it was reported. However, the good news here is that the late payment impact reduces with time, especially if you have been consistent with your payments.

4. By how much points will my credit score drop due to late payment?

5. How can I know if a late payment is recorded on my credit report?

6. When is a late payment recorded on my credit report?

Will I Be Charged Fees And Interest On Late Payments

Companies often charge penalty fees and interest on overdue payments, so it can get quite expensive. Some companies will give you a grace period â this starts when the payment is due, and if you pay during this time you wonât be charged late fees. Check your contract with the lender to see if you have a grace period.

Some companies have tiered late fees based on how much you owe. However, there are legal restrictions on what you have to pay. For example, charges of over £12 for late credit card payments may be seen as unfair. If you think youâve been charged too much, speak to your lender first. If you canât come to an agreement with them, you may want to seek free advice from the Financial Ombudsman.

When Do Late Payments Fall Off A Credit Report

A late payment typically stays on credit reports for seven years. For example, say a payment was missed on September 1, 2021. After 30 days, the issuer reports it as late to the bureaus. That means the late payment wouldnât fall off the credit report until October 2028.

But the CFPB says there are circumstancesârelated to certain job, credit or insurance applicationsâin which the seven-year limit may not apply. So even though a late payment may have fallen off a report, the information could still be in a personâs file.

Don’t Miss: How To Report A Death To Credit Bureaus

How To Get Late Payments Removed

The simplest approach is to just ask your lender to take the late payment off your credit report. That should remove the information at the source so that it wont come back later. You can request the change in two ways:

If the late payment is accurate, you can still ask lenders to remove the payment from your credit reports. They are not required to do so, but they may be willing to accommodate your request, especially if one or more of the following apply:

- You paid late due to a hardship like hospitalization or a natural disaster

- The late payment was not your fault, and you can document the cause

- You can offer them something in return, like paying off a loan that youre behind on

- You usually pay your bills on time and you made a one-time mistake

Some situations are so complicated or unfair that you need professional help. An attorney licensed in your area can review your case and offer guidance on additional options.

Knowing Your Rights Can Help You Negotiate Late Payments

Congress has passed several laws to help consumers negotiate with credit reporting agencies and creditors.

The Fair Credit Reporting Act, for example, gives you access to your credit file for free every year.

Visit annualcreditreport.com to get your free credit reports from the three credit reporting bureaus.

If you discover inaccurate information, the law requires the bureaus to fix this information or remove it.

Be sure to file a complaint with the Consumer Financial Protection Bureau if your attempts to remove inaccurate negative information get no response.

Recommended Reading: How To Get Credit Report Without Social Security Number

What Is Considered A Late Payment And When Does The Seven

Theres no set rule that applies to all lenders frustrating, we know. Each lender decides what is considered a late payment and when to report it to a credit bureau.

In most cases, if your payment is more than 30 days late, the major credit bureaus are notified, meaning the late payment will show up on your credit reports.

A late payment, also known as a delinquency, will typically fall off your credit reports seven years from the original delinquency date. For example: If you had a 30-day late payment reported in June 2017 and bring the account current in July 2017, the late payment would drop off your reports in June 2024.

The same generally applies if you miss two payments in a row. If you had a 60-day late payment reported in June 2017 and bring the account current in August 2017, both late payments would be removed in June 2024.

How Do I Avoid Late Payments

The easiest way to avoid late payments entirely is to on all your accounts. If youre not budgeting regularly, try setting up these payments for right after you get paid, when you have the most cash.

A lot of people dont like to do this in case they overdraft their accounts, which is a legitimate concern. Alternatively, you could try some old-school tricks like writing due dates on a calendar or a recurring to-do list.

If you find yourself making late payments often, it might be a good idea to have a chat with yourself and your family about your budget. Most people are able to find expenses to cut and ways they can earn extra cash. But if thats not an option for you, try talking with a credit counselor through the National Foundation for Credit Counseling. Its an affordable solution that anyone can use to help better manage their finances.

Don’t Miss: When Does Usaa Report To Credit Bureaus

Make Your Due Dates Work For You

There are a couple different ways that you can organize your due dates, and each come with their own set of benefits.

You can stagger your bills throughout the month so a chunk of change is not coming out of your account all at once. This method helps with money management. Not all billers offer this service, but many do. You might prefer to have two different due dates that align with your paycheck schedule and allow you to space out your major expenses.

On the other hand, it might help to have all of your bills come out at the beginning or end of each month. You could set a bill-paying date and schedule all of your bills to be paid on that day. This works especially well if you do not want to dedicate time and energy several times a month to sitting down and paying bills.

In either case, its important to set reminders so your bill-paying dates do not come and go quietly. You should keep arrival and processing times in mind when paying your bills. This is especially important for payment methods that are not immediately received by your biller, such as if you pay your bills with cash by mail.

How To Know If There Is A Late Payment On Your Credit Report

Under the Fair Credit Reporting Act, you have legal access to one free credit report per year from each of the three major credit bureaus: Equifax, Experian, and TransUnion. You can request your reports at AnnualCreditReport.com.

When youre ordering your free copy, you should review your credit reports all at once to compare the information. This will allow you to find any discrepancies between agencies and ensure your credit scores are accurate.

Also Check: Is Capital One Credit Wise Accurate

How Do Late Payments Impact Credit Score

When you miss a payment, your credit score is affected. When you are late with a payment by 30 days or longer, as much as 100 points can be taken from your credit score. Your payment history is an essential part of the credit score, which is why its taken into account when calculating it. Therefore, one single late payment is enough to drag down your score.

How Do Late Payments Affect Your Credit Scores

In a Nutshell

The offers that appear on our platform are from third party advertisers from which Credit Karma receives compensation. This compensation may impact how and where products appear on this site . It is this compensation that enables Credit Karma to provide you with services like free access to your credit score and report. Credit Karma strives to provide a wide array of offers for our members, but our offers do not represent all financial services companies or products.

Don’t Miss: What Is Syncb Ntwk On Credit Report

What Qualifies As A Late Payment

Lenders use standard codes when sending your payment information to the credit reporting agencies. At the end of each code is a number between one and nine that relates to whether your payment was made on time.

If you make an on-time payment within 30 days of billing, this is considered ideal and youll typically receive a one rating.

This rating can help maintain and improve your credit health. If the number is two or higher, its considered a late payment and could negatively impact your credit health. A rating of two means your payment was made 31 to 59 days late.

There are many factors that affect your credit scores, and payment history is a key component, says David Blumberg, public relations director of TransUnion. Paying bills on time each month can have a positive impact on your scores, while late payments can negatively impact your scores and stay on your report for up to six years.

Also, a more recent late payment may be more detrimental to credit scores than one from several years prior, Blumberg says.

Fire A Dispute With The Credit Bureau

You can dispute anything on your report with the three major credit bureaus. The credit bureau must launch an investigation into the disputed account. They will send a request to the creditor asking for validation of the late payment. This is basically what credit repair companies do to increase the clients credit scores.

If the creditor fails to respond within 30 days, the late payment will be deleted. However, large banks and lenders have departments that handle credit disputes. They are usually very good at responding with all the information the credit bureau needs.

This makes having late payments removed by disputing with the credit bureaus quite difficult. However, its not impossible.

Also Check: What Credit Score Do You Need For Affirm

How Can You Fix Your Credit Score

A missed payment becomes less significant over time. Remember, credit reports are designed to show how financially reliable you are. So, if you are careful not to miss more payments and demonstrate that you are using your credit wisely, your credit score will improve, even as youre waiting for the initial delinquency to disappear.

After a short time it will become clear that the late payment was an anomaly in an otherwise pristine credit history, and your positive payment history since that time will offset any negative impact it had on your creditworthiness, according to Experian.

Generally, the impact of a late payment on your credit score depends on several factors, such as how severe the missed payment was, how recently it occurred and how frequently youre making late payments. The longer a bill goes unpaid for example, if it is 90 days late rather than 30 days late the bigger impact it could have on your credit score.

Many people are surprised to learn that the higher your credit score, the more a single late payment will hurt you. Equifax notes, A 30-day delinquency could cause as much as a 90- to 110-point drop on a FICO score of 780 for a consumer who has never missed a payment on any credit account.

Its also helpful to communicate directly with the provider of the inaccurate information that youve brought to the credit bureaus attention. That way, the information, if proven to be inaccurate, cannot be reported again.

Discount For Family Members Couples And Active Military

Lexington Law is now offering $50 off the initial set-up fee when you and your spouse or family members sign up together. The one-time $50.00 discount will be automatically applied to both you and your spouses first payment.

Active military members also qualify for a one-time $50 discount off the initial fee.

Read Also: Square Capital Eligibility

Q: How Do Late Payments Affect My Credit Score

A: Many of us have made late or missed payments in the past and we can all agree its not a pleasant feeling. A single missed payment could cost you a late fee by the company and potentially leave a black mark on your credit report, thus affecting your credit score.

With Comprehensive Credit Reporting , credit providers are able to record a late or missed payment on your credit file as part of your repayment history information when your payment is over 14 days late. Late payments can stay on your credit file for up to 2 years.

Remember, only your repayment history from credit providers who hold an Australian Credit Licence can be recorded. This includes banks, building societies, credit unions, credit card companies, and some payday lenders but not telecommunication or utility companies.

This doesnt mean you can care less about repaying your phone or energy bills on time, as any late payments can incur a late fee with the company, plus if these late payments are over $150 and more than 60 days overdue, they can be classed as defaults on your credit report.

Both late payments and defaults have a negative impact on your credit score, but defaults are potentially more damaging to your credit reputation, as it can stay on your credit file for up to 5 years regardless if you have already settled it, making you less attractive to lenders as long as it remains on your file.

Goodwill Letters Dont Work Anymore

A few years ago, if you were late on an account that otherwise was always in good standing. You could ask customer service to remove the late payments as a one-time courtesy, and sometimes they would. Thats all been ended by the credit bureaus.

A creditor can no longer offer any forgiveness for late payments unless the late payment resulted from an error by the creditor. If you ask a creditor to remove a late payment as an act of goodwill, it will get you nowhere.

In fact, it will be noted you admitted you were late, and it will be much more difficult to have the late pay deleted in the future.

Also Check: What Credit Score Does Carmax Use

How Do Late Payments Affect My Credit Scores

Late payments will have a different impact on each persons credit scores depending on the situation. That said, there are some general rules that can help you determine the severity of the impact.

- First off, a longer delinquency will have a greater negative impact on your scores than a shorter delinquency. Assuming everything else is equal, a 90-day late payment can hurt your scores more than a 30-day late payment.

- The number of delinquencies on your reports matters, too. Usually, more delinquencies result in a more significant negative impact to your scores.

- A delinquency will have the largest impact on your credit scores when its first reported. However, as the delinquency ages, the impact on your scores should decrease. The length of time your scores take to recover may depend on any other negative issues that might be affecting them.

Its important to remember that each credit bureau has its own way of evaluating your information and assigning you a credit score. A late payment could have a more significant impact on one score than on another, which is one reason why your scores may vary between credit bureaus.

What’s Considered A Late Credit Card Payment

This would make a good trick question on a test. While the obvious answer is “any credit card payment made after the due date,” that’s not how the credit bureau sees it.

Your card issuer can’t report your payment as late to any of the three credit bureaus until it’s at least 30 days past the due date. That’s because all those credit bureaus use the Metro 2 Reporting Format, which requires that creditors follow the Industry Standard for Reporting Account Delinquency. Here’s how it works.

On the reporting date, your card issuer sends a status code about your account to each credit bureau that it reports to . That code indicates your account’s current standing. Accounts from zero to 29 days past due are a Code 11, the code for current accounts. The codes for reporting late payments start with accounts that are 30 to 59 days past due.

This doesn’t mean it’s a bright idea to take your time with your credit card payments. Your card issuer still can charge a late fee as soon as you miss the due date, and you’ll also have to pay interest on the amount due. You might also get hit with an interest rate hike.

Also Check: How Long Do Inquiries Stay On Chexsystems