Why Employers Check Credit And What They See

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Employers sometimes check credit to get insight into a potential hire, including signs of financial distress that might indicate risk of theft or fraud. They dont get your credit score, but instead see a modified version of your credit report.

Heres what you need to know about employer credit checks, including what information prospective employers can see, your rights and how to present the best possible face.

What Is A Credit Score

A credit score is a grade that indicates how good you are with managing debt and payments. Whenever a lender loans money, there is always some amount of risk involved. A credit score helps lenders decide if lending to you is worth the potential risk.

Your credit score is a number that falls within a range, from low , to high . The lower your score, the more of a credit risk you are. The higher your score, the lower the risk, and the more likely you are to get approved for credit and qualify for better rates.

There are two main types of credit scores youll encounter. The FICO® Score and the VantageScore. Though they use slightly different scales and different methodology to calculate their scores, the general principles for earning and maintaining a good credit score are the same for both.

There are three major credit reporting companies that collect information and calculate your credit score. They are: Equifax, Experian, Transunion. Youre credit score will often differ slightly between these three agencies. This is because each of the companies maintain their own credit report information and it is unlikely that your credit report will match identically across all three companies at any given time.

Take Stock Know What Personal Information You Have In Your Files And On Your Computers

- Inventory all computers, laptops, mobile devices, flash drives, disks, home computers, digital copiers, and other equipment to find out where your company stores sensitive data. Also, inventory the information you have by type and location. Your file cabinets and computer systems are a start, but remember: your business receives personal information in a number of waysthrough websites, from contractors, from call centers, and the like. What about information saved on laptops, employees home computers, flash drives, digital copiers, and mobile devices? No inventory is complete until you check everywhere sensitive data might be stored.

- Track personal information through your business by talking with your sales department, information technology staff, human resources office, accounting personnel, and outside service providers. Get a complete picture of:

- Different types of information present varying risks. Pay particular attention to how you keep personally identifying information: Social Security numbers, credit card or financial information, and other sensitive data. Thats what thieves use most often to commit fraud or identity theft.

SECURITY CHECK

To find out more, visit business.ftc.gov/privacy-and-security.

Read Also: Does Paypal Credit Report To Credit Bureaus

Release Of Inaccurate Data

A different harm can result from release of information when data are incomplete, inaccurate, or out of date. Examples are medical records or insurance claims on which diagnoses are listed or coded incorrectly . Other problems involve diagnoses that were considered at one time and ruled out but are still listed as a final diagnosis, incorrect inferences drawn from diagnostic tests, and clinical distortions that result from coding limitations. Data inaccuracies also arise from actions that are intended to be beneficialfor example, to protect the patient from a stigmatizing diagnosis, to permit insurance reimbursement for a test or procedure that might otherwise not be covered , or to allow a frail patient to be treated on an inpatient rather than outpatient basis.

Harm resulting from inaccurate or out-of-date data can be mitigated or prevented in a number of ways, including adequate and regular attention to the reliability and validity of database contents as described in . Allowing individuals to obtain, challenge, and correct their own records can also help to improve their accuracy.

Lock It Protect The Information That You Keep

Whats the best way to protect the sensitive personally identifying information you need to keep? It depends on the kind of information and how its stored. The most effective data security plans deal with four key elements: physical security, electronic security, employee training, and the security practices of contractors and service providers.

Recommended Reading: Can You Remove Hard Inquiries Off Your Credit Report

How The Fair Credit Reporting Act Works

Credit reporting agencies compile reports that contain sensitive information about consumers’ financial history. These details can include how timely your;;payments are and what kinds of loans you have outstanding. This information is helpful in proving your;;in a variety of contexts — but at the same time, you don’t want it available to just anyone.

The FCRA benefits lenders, consumers and credit reporting agencies by holding these organizations responsible for the accuracy and completeness of reports.;

“The Fair Credit Reporting Act is an increasingly relevant and helpful tool from a consumer’s perspective,” says Ragan. “Consumers often become aware of the FCRA due to data breaches and alerts, as well as credit protections they’ve been enrolled in. But many consumers still struggle to understand the ins and outs of the process.”;

If Your Credit Application Is Denied You’re Entitled To Know Why

Most people don’t think much about their credit score and report until they’re denied for a loan or credit card application. If you’re surprised by a denied application for credit, you’re legally entitled to hear why they denied your request. This is actually one way that people discover errors on their credit reports, so make sure you understand the reasons why you were denied credit. If it isn’t an error, this information can still help you make good decisions to grow your credit score in the future.

Read Also: Why Is There Aargon Agency On My Credit Report

Factors That Do Not Affect Credit Score

It is illegal for credit scoring formulas to consider race, religion, color, sex, marital status or national origin. Credit scoring formulas also may not take into consideration your age, where you live, or soft credit inquiries.

Your occupation, salary, employer and employment history are not factors that affect your credit score, however, lenders may factor in this information when making credit approval/denial decisions.

Governance Options As An Approach To Privacy Protections

Issues relating to the structure and governance of an HDO will be critical to both the substance and the appearance of privacy protection and, therefore, to the HDO’s political acceptability. In this context, the principal question will be the extent of government involvement in the operation of the HDOs. In the absence of federal preemptive legislation, state legislation might include a number of options. Although the laws in this section are all state oriented, if federal preemptive legislation is enacted, it would set confidentiality standards for HDOs and possibly preempt state statutes.

State-Based Systems

At one end of the governance spectrum, HDOs could be operated by state or local agencies. This kind of structure has privacy benefits. Constitutional privacy protections, for example, would attach if the HDOs were operated by public agencies. Further, governmental operation would increase the likelihood of effective public and regulatory oversight and accountability. Under this formulation, legislative hearings for budgetary and policy purposes could be expected to be a regular feature of the HDO process.

Were an HDO to be operated by a state agency, it would resemble in several ways health data commissions now in place in a number of states. Because some of these have operated for some time, typical characteristics are worth reviewing here.

Private-Sector Systems

Mixed Governance Systems

Recommended Reading: Does Paypal Working Capital Report To Credit Bureaus

The Who Why What How And When Of Employers Use Of Credit Reports

Certain employers have utilized credit checks in some form in their employment screening process for over 40 years since prior to the passage of the Fair Credit Reporting Act in 1970.3;However, the use has increased dramatically since then. In the past, besides governmental bodies, routine credit checks on potential employees were generally done only by banks and financial service companies, but today employers in other sectors are increasingly including credit reports in the screening process. In fact, recent surveys indicate that approximately 60 percent of employers use credit histories in some portion of their hiring decisions, up from just 19 percent in 19964;and 35 percent in 2001.5

The increased use of credit information is driven, in part, by the need for background information on potential employees in the current environment where it is difficult to obtain anything other than the most basic information in job references.6;More specifically, the most common reasons cited for why employers use credit checks for employment purposes are as follows:

Employers Want To Know If Financial Issues Will Distract You

Another reason employers might check your credit report is to see if you have financial issues that could affect your performance, Ulzheimer said. They could be looking for the following:

- Do you have defaulted credit that can lead to distractions at work?

- Will debt collectors call you at work? Will you call debt collectors from work?

- Is there a chance your employer will be dragged involuntarily into your credit mess by way of a wage garnishment?

An employer might be reluctant to hire someone whose financial problems could interfere with their work.

Read Also: Does Les Schwab Report To Credit Bureaus

Employers Want To Know That You Are Prepared For What Matters

However, if youâre looking for a job, particularly in the industries where credit checks are more common, like banking and accounting, you should check your credit report for negative information that could be a strike against you. GOFreeCredit offers affordable credit reports and credit monitoring.

Even if youâve been responsible with credit, you might find mistakes on your report that are hurting your credit. You donât want to be surprised by this information after youâve applied for a job. Checking your report before a job search may give you time to report and dispute credit report errors with the credit bureaus and your creditors.

Can Employers See Your Credit Score

Potential employers will never be able to see your three-digit credit score when you apply for a job. They will, however, be able to look at a version of your credit report that’s different from the one that lenders see. This modified report will exclude information such as your date of birth, account numbers, details about your spouse or anything that could potentially violate equal employment laws.

Since your credit score is meant to indicate your creditworthiness to a lender, it’s not something a potential employer would use to make a hiring decision and is therefore not included in the report they see.

You May Like: Is 524 A Good Credit Score

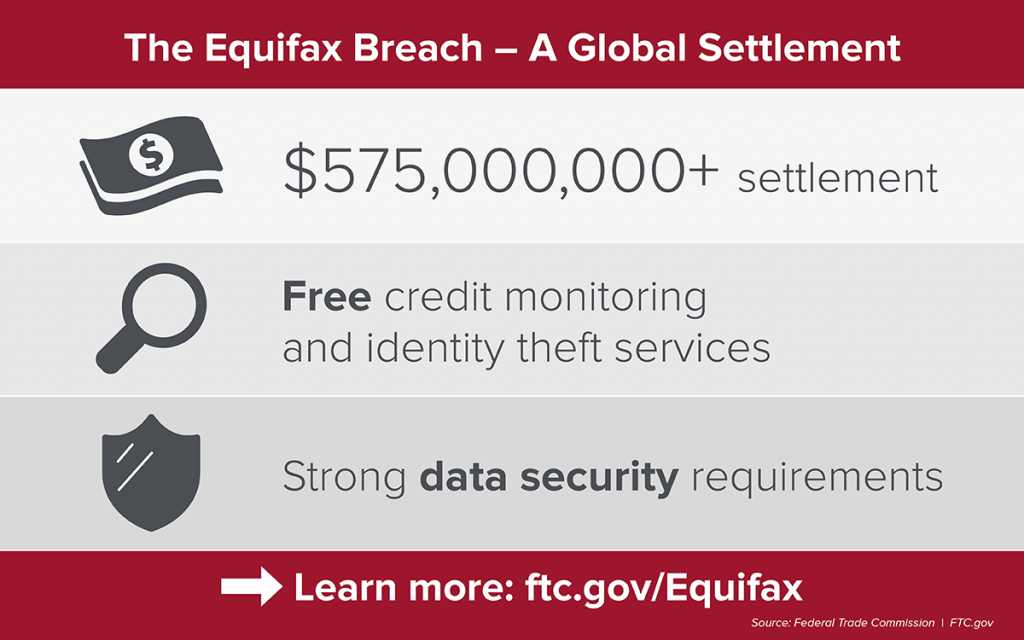

Complaints And Lawsuits Against The Credit Bureaus

An investigation published earlier this month by the Atlanta Journal-Constitution found consumers filed 175,000 complaintswith the Consumer Financial Protection Bureau related to credit reports between 2015 and 2017. About 65 percent of the complaints filed in 2017 pertained to inaccurate information on credit reports across all three of the bureaus.

The investigation revealed that more than 4,000 lawsuits have been filed in federal court against Equifax, Rep. Katie Porter, D-Calif., pointed out during Tuesday’s hearing. She asked Equifax CEO Mark Begor if he would provide his Social Security number, his birthday and address out loud to the committee.

“I would be a bit uncomfortable doing that,” Begor told Porter, because of concerns about identity theft. “It’s sensitive information that I like to protect and I think consumers should protect theirs.”

“If you agree that exposing this kind information information like you have in your credit reports creates harm and therefore you’re unwilling to share it, why are your lawyers arguing in federal court that that there was no injury and no harm created by your data breach?” Porter asked.

The reality today is that if you have a credit file, your information is probably on the dark web.Patrick McHenrya North Carolina Republican

Porter argued that Equifax lawyers, in defending the company in a number of lawsuits filed by affected consumers, claimed those consumers had not suffered any harm as of yet.

Employers Want You To Know They’re Looking Into You

Federal law requires employers to get job applicants’ permission to do a Yost said. So you’ll know if your company wants to look at your credit report. “There’s no surprise,” he said.

Plus, several states have restrictions or prohibitions on using credit history as part of the employment decision process, Yost said. Companies doing business in California, Colorado, Connecticut, the District of Columbia, Hawaii, Illinois, Maryland, Nevada, Oregon, Vermont and Washington face limits on credit checks.

Also Check: Does Klarna Affect Your Credit Score

Privacy Interests And Hdos

HDOs may pose a threat to privacy interests in four ways. The first arises through harm from secondary use. This includes the potential for stigmatizing and embarrassing patients; adversely affecting their opportunities for employment, insurance, licenses, and other benefits; undermining trust and candor in the health care provider-patient relationship; and defeating patients’ legitimate expectations of confidentiality. Second is the unpredictable effect that will be produced by the mere existence of HDOs as described. Third, HDOs may exacerbate societal concerns about the emergence of national, centralized personal record databases, which may be perceived as a national identification system or dossier. Issues concerning the Social number and its analogs are especially pertinent here. Finally, HDOs will need to be mindful of the possible effect that research uses may have on privacy.

Is Rent Reporting Really Worth It

It’s unlikely that timely rent payments will help obtain any of the major forms of credit cards, mortgages, auto loans without a lender willing to work with higher risk borrowers. Yet many landlords still look at the actual credit report along with the score. So, for prospective renters with some questionable ‘established’ credit and a favorable reported rental history, adding positive credit in this way could help their chances, Paperno says.

Unfortunately, however, other than in this specific example there really isn’t much upside to paying for positive rental data, Paperno concludes.

Read Also: How Long Does A Repossession Stay On Your Credit Report

Why Arent Rental Histories Included In Traditional Fico Scoring Models

The decision to include any piece of credit bureau information in the FICO scoring formula rests on whether the score development process finds such information to be predictive of future risk once vast quantities of it have been studied, Paperno said.

If the information is present, but not predictive , or has simply not been available on a credit report , it’s left out of the formula, Paperno said.

While the FICO scoring models used by most lenders have traditionally ignored rent information even when reflected on a credit report, the latest FICO model FICO 9, released in 2014 incorporates rental data when added to the report being scored, Paperno said.

Employers May Allow You To Explain The Results Of A Credit Check

If a credit check turns up something negative, you might be given the chance to address it. The SHRM survey found that 64 percent of organizations gave job candidates the opportunity to explain the results of their credit check.

This is why itâs important to know what’s on your credit report before applying for jobs, so you can come up with a plan to deal with any negative information. For example, if you have a lot of debt, you may be able to negotiate settlements with creditors, Ulzheimer said. âSettlements won’t result in the removal of the items from your credit reports, but the employer will likely take a more favorable view if the items have been disposed of,â he said.

You May Like: What Is Cbcinnovis On My Credit Report

Identity Theft In The Context Of Domestic Violence

Victims of domestic violence can be particularly vulnerable to identity theft. Survivors of domestic violence often need to take extra precautions to protect themselves from abusers who may use their personal information as a means of control. Their partners have easy access to confidential information that may come to their home in the form of credit card bills and Social Security mailings. Abusers may use such information to open new credit cards in the survivors’ names and/or open lines of credit in their children’s names. Below are useful tips to help identify if someone is a victim of identity theft and help them to take control of their financial well being and reclaim their financial independence.

Next Section

Continue

Other Information And Resources

- Division of Consumer Protection.;For more complete information regarding identity theft, specific instructions regarding security freezes and other remedies, or to file a consumer complaint with the Division of Consumer Protection call the toll-free hotline at 1-800-697-1220 or visit the Divisions website at;.

You May Like: Is 739 A Good Credit Score

Changes To Credit Reports Are Coming

In addition to any bills that Waters or McHenry are planning to put forward, there are already changes to consumer credit reporting on the way.

Experian and FICO are both working on products that will roll out this year and will incorporate additional information in your credit report, such as your phone and utility payment history. The programs, called Experian Boost and UltraFICO, allow consumers to opt in to share their payment history, as well as the overall health of their bank accounts and if their spending and income ratios are positive.

“The consumer is in control,” Nick Thomas, co-founder and president of Finicity, one of the companies powering the data collection behind these new products. Early indicators show that, with Experian Boost, consumers saw their credit score increase, Thomas says. In one case, a pilot participant boosted their score by 74 points.

Raising your credit score can have a real impact. For example, research shows boosting you score by roughly 100 points, from good to excellent, can save you over $10,000 in interest on a mortgage.

This commodification of consumers and their personal data is the core reason why our nation’s consumer credit reporting system is broken.Maxine WatersDemocrat of California