Pay Bills And Fees On Time

Late bill payments, outstanding debts, and so forth can all negatively impact your credit score. When it comes to matters like negative checking account balances and unpaid overdraft fees, it could appear on your ChexSystems account as well. By making sure youre completely on top of these matters, youll avoid most of the problems that may occur with these two accounts.

How Do I Get Credit

Do you want to build your credit history? You will need to pay bills that are included in a credit report.

- Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit.

- Many credit cards put information into credit reports.

- Sometimes, you can get a store credit card that can help build credit.

- A secured credit card also can help you build your credit.

When Does Info On Credit Reports Get Updated

We regularly get questions from readers who are curious about when a new account will show up on their credit reports and how often lenders report information to the bureaus. As a result, we reached out to a selection of the largest credit card issuers for answers. You can find information about their policies below.

| Within 30 days of approval | Monthly |

You May Like: How To Raise Credit Score 100 Points

Financial Information That’s Not Related To Debt

While your credit report features plenty of financial information, it only includes financial information that’s related to debt. Loan and credit card accounts will show up, but savings or checking account balances, investments or records of purchase transactions will not. Did you buy a car? Your purchase won’t appear on your credit report, but any loan you used to finance it will.

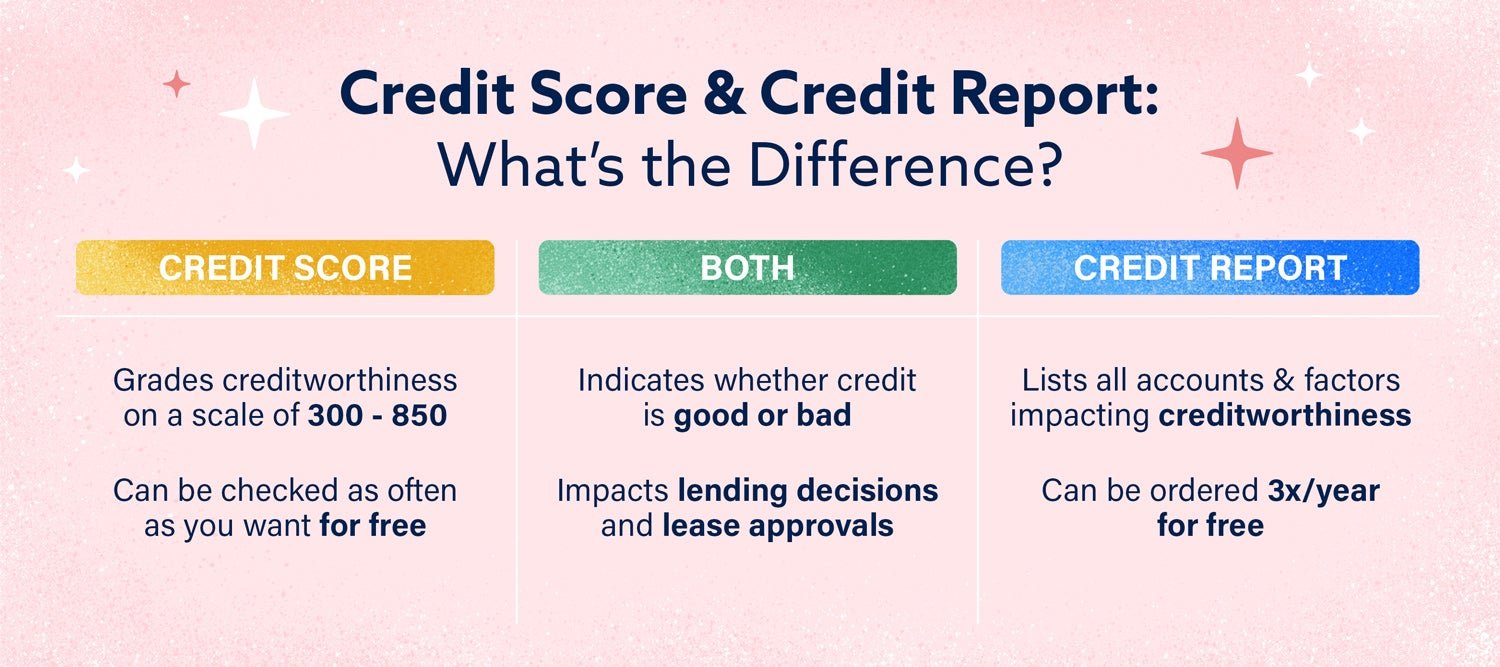

What Is A Credit Rating

A credit rating is a measure of how dependable you are in repaying your debts. Most credit-reporting agencies will give you a rating on a scale of 1 to 9, others will assign letters corresponding to the type of credit you’re using. For example, a rating of “1” means you pay your bills within 30 days of the due date, while a rating of “9” can mean that you never pay your bills at all.

An “R” rating is also included in your credit score. This rating is assigned by lenders based on your past history of borrowing and paying off debts, and it can range from 1 through 9. An R1 rating is the best, meaning you pay your debts on time, within 30 days, and an R9 is the worst.

Your credit rating is not established by the government or by financial institutions – it is established by you. If you don’t pay your bills on time or fail to repay a loan, you may be reported to a credit bureau.

Recommended Reading: Creditwise Score Accuracy

Why Is My Credit Report Important

Businesses look at your credit report when you apply for:

- loans from a bank

- jobs

- insurance

If you apply for one of these, the business wants to know if you pay your bills. The business also wants to know if you owe money to someone else. The business uses the information in your credit report to decide whether to give you a loan, a credit card, a job, or insurance.

What Is On A Credit Report

The short answer to that question is: A lot!

The typical credit report will include personal identifying information: a list of credit accounts , type of account , and your payment history on those accounts.

The three major credit bureaus Experian, Equifax and TransUnion compile data from sources that extend you credit. Bits and pieces of your credit history may vary slightly among the three companies because not all businesses supply information to all three agencies. However, the broad picture of your credit history should be relatively consistent.

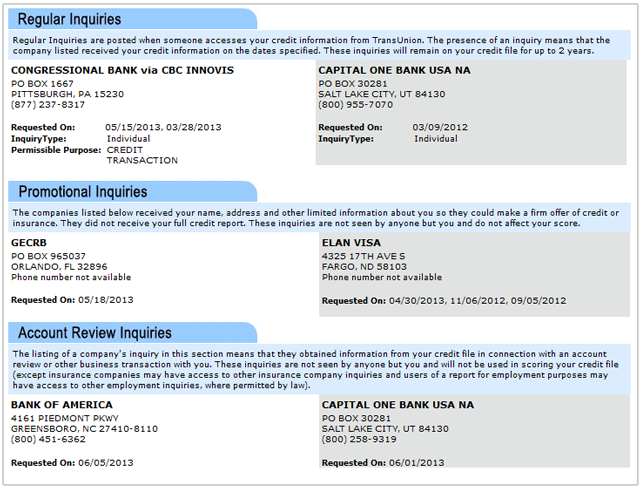

Each credit report has four basic categories: identity, existing credit information, public records and recent inquiries.

Heres how they break down:

Don’t Miss: When Do Companies Report To Credit Bureaus

Prepaid Debit Cards Checking Accounts And Traditional Debit Cards

None of these aforementioned items appear on your credit reports. Debit cards and checking accounts are really the same thing, as a debit card is like a plastic version of a paper check.

And, a prepaid debit card is really not much more than a reloadable gift card with fees.

None of the three items are a true extension of credit, as youre only able to spend money that is already either: A) loaded on the card, or B) deposited in an account with a bank or credit union.

There is considerable confusion over the prepaid debit card and credit reporting issue because some of the companies and individuals who are paid to endorse these cards suggest they will help your credit reports and scores, which isnt at all true.

In fact, the credit bureaus now have language in their reporting standards guide that addresses the issue of prepaid debit cards and credit reporting.

It reads, Do not report prepaid credit cards/gift cards because the consumer has no credit obligation.

There is, however, one scenario when you checking account could bleed into your credit report: If you have overdraft protection in the form of an unused installment loan that loan can be reported to the credit bureaus.

I personally have one of these on my credit reports and have had it for many years.

Why Should I Get My Credit Report

An important reason to get your credit report is to find problems or mistakes and fix them:

- You might find somebodys information in your report by mistake.

- You might find information about you from a long time ago.

- You might find accounts that are not yours. That might mean someone stole your identity.

You want to know what is in your report. The information in your report will help decide whether you get a loan, a credit card, a job or insurance.

If the information is wrong, you can try to fix it. If the information is right but not so good you can try to improve your credit history.

Also Check: Does Paypal Credit Report To Credit Bureaus

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

How To Read Credit Report Codes

Youll find a variety of different codes on your credit reports. Each major credit bureau has its own codes though, so dont assume a code used by one bureau means the same thing on another bureaus report.

Each bureau offers a guide explaining the codes youll see on that particular bureaus report. Heres where you can access those guides.

Also Check: When Does Paypal Credit Report To Credit Bureau

How Do I Improve My Credit

Look at your free credit report. The report will tell you how to improve your credit history. Only you can improve your credit. No one else can fix information in your credit report that is not good, but is correct.

It takes time to improve your credit history. Here are some ways to help rebuild your credit.

- Pay your bills by the date they are due. This is the most important thing you can do.

- Lower the amount you owe, especially on your credit cards. Owing a lot of money hurts your credit history.

- Do not get new credit cards if you do not need them. A lot of new credit hurts your credit history.

- Do not close older credit cards. Having credit for a longer time helps your rating.

After six to nine months of this, check your credit report again. You can use one of your free reports from Annual Credit Report.

Benefits Of Banks Who Dont Use Chexsystems:

ChexSystems records wont show up on your credit report

Banks that dont use ChexSystems often offer better rates on loans, higher limits on checking accounts, and more lenient restrictions for opening new bank accounts.

Banks that dont use ChexSystems are also more likely to be generous with credit, allowing people who have ChexSystems items a chance to get approved for loans or checking accounts without those negative records affecting their ability to do so.

Don’t Miss: Is Chase Credit Journey Accurate

Fixing Credit Report Errors

Credit reports are monitored by the three major credit bureaus under the authority of the Federal Trade Commission. Sometimes these bureaus report false information as a result of a clerical error, erroneous information from credit lenders, or even fraud. If there is an error on your credit report, there are several simple yet important steps you can take.

Whats In Your Credit Report

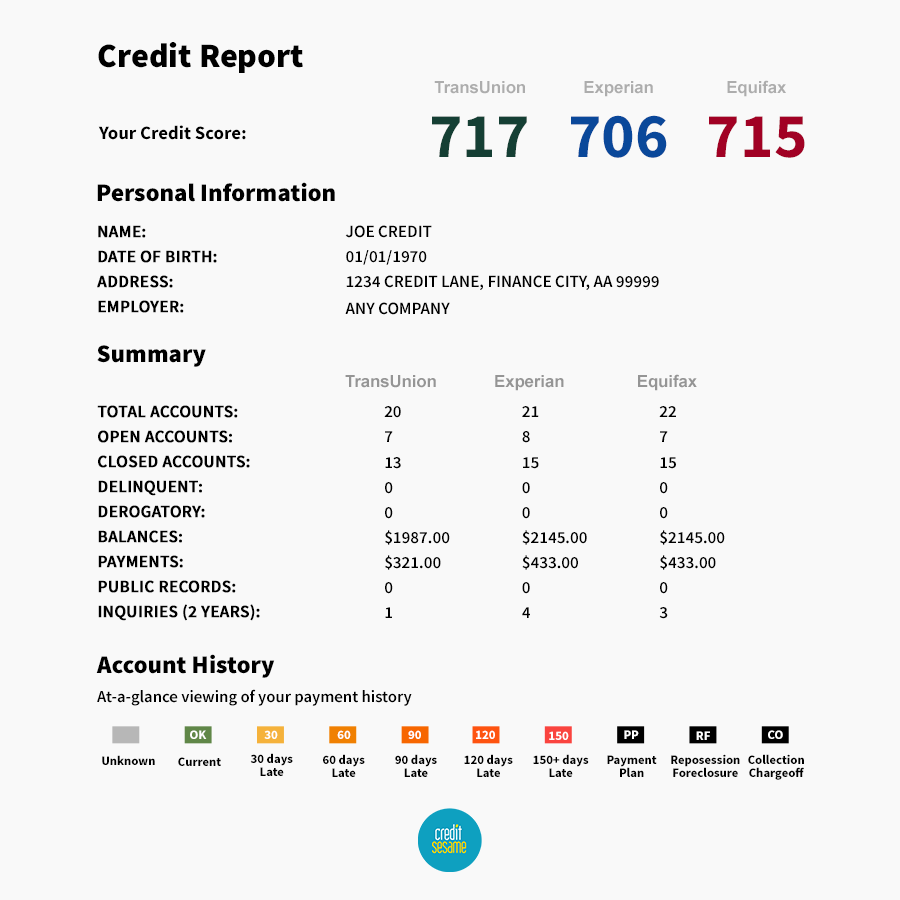

There are three major credit bureaus that produce and sell credit reports: Equifax, Experian, and TransUnion.

You have a separate credit report from each of these companies, giving you three different credit reports in all. For the most part, the information in each report will be similar. But you might notice some differences because not all lenders report to the same credit bureaus.

Your personal and financial information will be laid out differently in each of your three reports there is no uniform formatting for credit reports. But theyll each contain the same general types of information about you and your credit history.

The following types of information will be included in your credit reports:

- Personal Identification Information

- Consumer Statements/Alerts/Disputes

In addition to the list above, youll also see a description of your rights as a consumer and contact information for the credit bureau.

Example Credit Reports

Before jumping into your own credit reports, you may find it useful to browse some simple examples. Follow the links below to get an idea of how your credit reports might look, although your reports may have updated layouts.

- Current and previous addresses and phone numbers

- Current and previous employers

- Other identifying information

Take a close look at your data to make sure everything is correct. Check the spelling, and make sure all numbers are accurate.

An example Personal Information section from a TransUnion sample credit report.

Read Also: Syncb/ppc On Credit Report

Evidence That You Are Now Married

When you get married nobody in the credit industry knows about it.

The credit reporting agencies dont know about it, your credit scores dont know about it, and lenders dont know about it.

There is nothing on a credit report that appears or changes just because youve gotten married.

Now, if you choose to apply jointly with your new spouse or you otherwise co-mingle your existing debt obligations and liabilities, then eventually your credit reports will look similar to your spouses credit reports because the data will be so similar.

Want some free advice?

Maintain credit independence even after youre married.

Theres no reason to co-mingle your debts and theres no reason to jointly apply for credit, except in the instance where youll need two incomes to qualify for a loan.

Why Lenders Might Ask For More Information

Banks and lenders look at everything from your car loan to your mortgage when you apply for new credit because they need to assess your capacity to pay your bills.

While this is standard with mortgage lending, auto lending and sometimes even personal loans, it might also come up when you apply for a new credit card. Because of the high unemployment rate and general economic uncertainty, card issuers are tightening requirements on credit card approvals and looking at your income documentation as well as your credit score to see if you qualify.

You May Like: Does Paypal Report To Credit Bureaus

Closing An Account With A Negative Balance

Opening and closing a checking account doesnt normally affect your credit. However, if you close an account with a negative balance and then neglect to pay it off, your financial institution may send it to a collections agency. If that happens, the debt will likely be reported to the credit bureaus and affect your score.

How To Get Your Free Credit Report Information

You can get free credit report information in two ways:

-

You’re entitled to a free report directly from the three credit bureaus by using AnnualCreditReport.com. Reports had been available annually, but in response to the coronavirus pandemic the site will offer free weekly updates through April 2022.

-

Some personal finance websites, including NerdWallet, offer free credit report information. NerdWallet’s credit report includes a credit score, providing your VantageScore 3.0 using TransUnion data, and updates weekly.

See your free credit reportKnow what’s happening with your free credit report and know when and why your score changes.Get started

You May Like: Does Capital One Report Authorized Users To Credit Bureaus

How Do I Get A Copy Of The Report Banks Use To Decide Whether To Let Me Open A Checking Account

To get a copy of your checking account report, you have to request your report from the checking account reporting company that compiled your report.

Some banks and credit unions use checking account reports to help decide whether to offer consumers a checking account. Checking account reporting companies compile these reports using information from other banks and credit unions about consumers checking account and transaction history.

These companies include Chex Systems, Early Warning Services, Certegy, and Telecheck. The contact information for these companies is below. See a more complete list of consumer reporting companies.

Tip:

In many instances, you will be able to request a free copy of your report:

By law, you have the right to request a free copy of your checking account report every 12 months from the nationwide checking account reporting companies. You have to request the reports individually from each company.

You also have the right to request a copy of your report from other checking account reporting companies, although some may charge you a fee.

Tip:

You might also consider getting a prepaid card.

You can use the contact information, below, to request a free copy of your own report from the largest checking account reporting companies. Not every company has information on everyone.

ChexSystems

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Also Check: Kroll Factual Data Dispute

What’s In Your Credit Report

Your credit report contains personal information, credit account history, credit inquiries and public records. This information is reported by your lenders and creditors to the credit bureaus. Much of it is used to calculate your FICO Scores to inform future lenders about your creditworthiness.

Although each of the credit bureausExperian, Equifax and TransUnionformat and report your information differently, all credit reports contain basically the same categories of information.These four categories are: identifying information, credit accounts, credit inquiries and public records.

How Is Your Credit Score Calculated

Although there are few different types of credit scores, FICO® scores are used by 90% of top lenders are calculated based on the following five factors:

- Payment history

- Inquiries for credit

Now that you know how much each factor impacts your score, lets dive into how Credit Builder does reporting differently.

You May Like: Is 672 A Good Credit Score

A Quick Note On Credit Utilization

One way to improve your credit is to pay down revolving debt, such as credit cards, says Endicott.

You may pay down your debt and not see an improvement right away. Before applying for any new credit, you may want to make sure your lower balances are reflected on your credit. Keep in mind that many factors determine your credit scores, and paying down your revolving debt doesnt guarantee higher scores.

How Is My Credit Score Determined

Your credit scores are determined by . Every month, credit card companies and lenders will report your activities to credit bureaus, who then update your credit score based on the activities reported. Chime reports to all 3 major credit bureaus, Experian®, Transunion® and Equifax®, to help you build credit history over time.

You May Like: How Personal Responsibility Can Affect Your Credit Report