Do You Need A Perfect Credit Score

Here’s the good news. There is no lender, interest rate, or credit product that requires a perfect credit score. Generally speaking, a FICO® Score of 800 is considered to be exceptionally strong and is good enough to get the best possible interest rate on whatever loan or credit line you want. That will also mean you can take advantage of the best credit card offers available.

The bottom line is that there’s no way to know for sure how to get a perfect credit score, but you don’t really need one either. However, by implementing responsible financial behaviors and learning from those who have already achieved exceptional credit, your FICO® Score can be strong enough for any practical purpose.

Does Getting A New Credit Card Hurt Your Credit

Getting a new credit card can hurt or help your credit, depending on your situation. It can help to increase your credit mix and improve your credit utilization percentage, but it will add a new hard inquiry to your account and make your average credit age youngerboth of which could lower your score. For those in the credit-building stage, adding a new credit card will most likely lower your score in the short term but also lead to a stronger credit score in the long term.

Check Addresses On Old Accounts

This may sound bizarre, but a wrong address can have a disproportionate impact. If you had, for example, an old mobile phone contract or credit card that you don’t use any more, but is technically still listed as active on your credit reference files, then check the address is your current one.

If the account is still listed as open, and it lists you as being at a different address, this can stymie applications due to ID checks. Check your file and go through every active account’s address to ensure it’s up to date.

We’ve known people being rejected for mortgages because of this. Worse still, they didn’t know the exact reason why as that’s a nightmare to find out.

Read Also: How Do I Unlock My Transunion Credit Report

Diversify Your Credit Lines

When working on improving your financial standing, many consumers believe that you need to open multiple credit cards at strategic points throughout the years. Unfortunately, that doesnt do much to help you diversify your credit lines, which is what really matters when trying to attain improve your credit rating.

Diversifying your credit requires you to consider opening various financing accounts, including:

- Student loans

- Auto loans

- Personal loans, etc.

Maintaining multiple lines of credit proves to lenders that you can manage and can pay back different types of loans on time. Diversifying your credit mix can help you reach excellent credit score status.

Just remember, there will be a hard inquiry with every new loan you apply for so be careful not to open to many accounts at the same time.

Make Sure There Are No Negative Marks On Your Credit Report

Even if youve never missed a payment, there could be illegitimate negative marks on your credit reports. Be sure to check your Transunion and Equifax credit reports for free from Credit Karma and make sure there are no errors.

If you find incorrect marks on your reports, you can dispute them. Upon receiving a dispute, the credit-reporting companies are required to investigate and fix errors in a timely manner.

Even if you have legitimate negative marks on your credit reports, they will affect your scores less over time and should eventually fall off your reports completely.

Also Check: Navy Federal Auto Loan Credit Score

Sign Up To Mse’s Credit Club Which Includes Your Experian Credit Report

Our totally free MoneySavingExpert.com Credit Club helps you keep a track of your credit record. You can here’s what it does:

You can get your full Experian Credit Report for FREE through Credit Club. See our full details on how this will work.

You’ll get a free Experian Credit Score. This will give you an indicator of how lenders see you when assessing you for credit applications.

Our unique affordability score. This clever tool will help you work out how much you can afford to borrow, using calculations based on your income and estimated spending.

Our unique Credit Hit Rate this will show you your chances of success, expressed as a percentage, of grabbing our top cards and loans.

Eligibility tool to show your best credit deals. It reveals the likelihood of you getting top credit cards or loans.

Wallet workout tool to check if youre on the best credit products for YOU.

Your credit profile explained. It shows the key factors affecting your score and how to improve them.

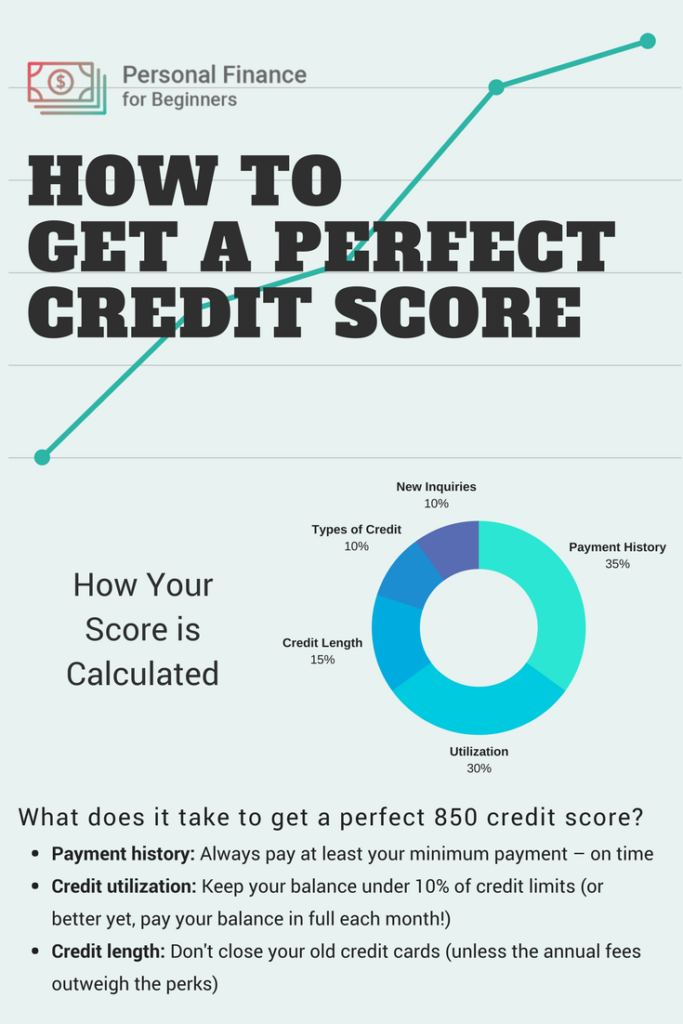

How Is Your Credit Score Broken Down

When determining your credit score, the bureaus look at four primary categories. The first is your payment history, which makes up approximately 35% of your rating. Credit utilization makes up the second-largest portion and accounts for about 30% of your overall rating.

The final three considerations include the length of time that your credit line has been opened, which accounts for approximately 15% of your overall score, while your new accounts each make up about 10% of your score.

Its important to note that the final two categories can and will vary. This may also appear on your report as new hard/soft inquires as well.

Read Also: How To Get Public Records Removed From Credit Report

Make The Most Of A Thin Credit File

Having a thin credit file means that you dont have enough credit history on your report to generate a credit score. An estimated 62 million Americans have this problem. Fortunately, there are ways to fatten up a thin credit file and earn a good credit score.

One is Experian Boost. This relatively new program collects financial data that isnt normally in your credit report, such as your banking history and utility payments, and includes that in calculating your Experian FICO credit score. Its free to use and designed for people with limited or no credit who have a positive history of paying their other bills on time.

UltraFICO is similar. This free program uses your banking history to help build a FICO score. Things that can help include having a savings cushion, maintaining a bank account over time, paying your bills through your bank account on time, and avoiding overdrafts.

A third option applies to renters. If you pay rent monthly, there are several services that allow you to get credit for those on-time payments. For example, Rental Kharma and RentTrack will report your rent payments to the credit bureaus on your behalf, which in turn could help your score. Note that reporting rent payments may only affect your VantageScore credit scores, not your FICO score. Some rent-reporting companies charge a fee for this service, so read the details to know what youre getting and possibly purchasing.

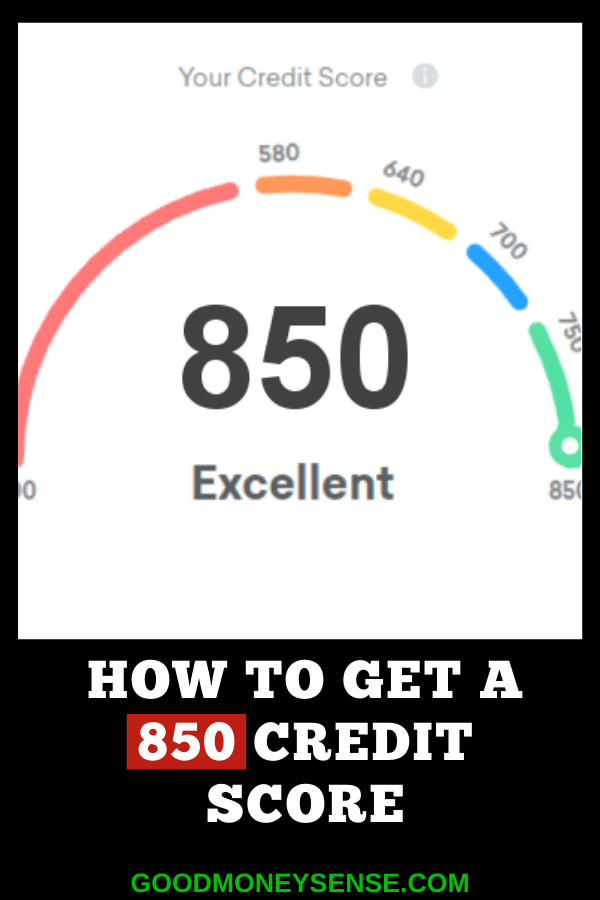

An Excellent Credit Score Is Good Enough

You don’t need a perfect credit score to get the best deals. A score of 720 or higher is generally considered excellent. And scoring 800 or above qualifies you for the best terms offered.

Thats pretty great news if you aspire to get into the group of people who have top-tier credit but you dont want to obsess over every single point in an effort to get the highest score possible.

Also Check: Paypal Credit Fico Score

Get A Handle On Bill Payments

More than 90% of top lenders use FICO credit scores, and theyre determined by five distinct factors:

- Payment history

- Age of credit accounts

- New credit inquiries

As you can see, payment history has the biggest impact on your credit score. That is why, for example, its better to have paid-off debts remain on your record. If you paid your debts responsibly and on time, it works in your favor.

So, a simple way to improve your credit score is to avoid late payments at all costs. Some tips for doing that include:

- Creating a filing system, either paper or digital, for keeping track of monthly bills

- Setting due-date alerts, so you know when a bill is coming up

- Automating bill payments from your bank account

Another option is charging all of your monthly bill payments to a credit card. This strategy assumes that youll pay the balance in full each month to avoid interest charges. Going this route could simplify bill payments and improve your credit score if it results in a history of on-time payments.

Use Your Credit Card to Improve Your Credit Score

Banks Score You Based On Products They’d Like To Sell You In The Future

Imagine a bank wants new mortgage customers. That’s a costly sell. Instead, it offers a current account paying a high rate of interest on a small amount kept in it. Yet when you apply, rather than scoring you as a bank account customer, it could actually be scoring to see if you’re likely to be a profitable mortgage borrower in the future you might face rejection if you aren’t.

The secretive nature of credit scoring makes this difficult to ever truly know.

Don’t Miss: What Fico Score Does Carmax Use

How To Check Someone Elses Credit Score

Category: Credit 1. Experian Connect Credit Report and VantageScore for Experian Connect allows you to securely share your credit report, or request access to view someones report, directly through the credit bureau. 18 steps1.Obtain written permission. Individuals and businesses must obtain written permission from the person whose credit

How To Maintain A Good Credit Score

Practicing healthy credit habits can help keep your score in a good range. Its smart to keep your balances as low as possible. Your credit utilization, which is how much of your available credit limit youre using, is a major factor in credit score calculations. Popular advice is to keep your utilization rate below 30%. But the lower the better its smart to leave some breathing room should an unexpected expense come up.

Because your payment history is another important credit score factor, youre likely to achieve and maintain a good credit score by not missing payments. Automate payments when you can because with multiple services, subscriptions and accounts, it can be easy to let one accidentally slip.

Aim to only apply for credit when needed. Of course, theres no need to avoid credit altogether. For many people, lifes major purchases may require loans or other credit, and a good credit score lays the groundwork for your credit goals. But because new credit may result in hard inquiries on your report its smart to limit credit applications.

Some people like to take advantage of rewards credit cards that are geared toward those with good credit scores. Just make sure youre mindful in your approach and not overspending and over-applying for the sake of some cash back or travel points.

You May Like: Does Care Credit Check Your Credit Score

How To Get The Highest Credit Score Possible

When you apply for a new line of credit, lenders consider several key aspects of your credit history, including:

- On-time payments

- How many lines of credit you have

- How recently youve taken out new credit

If youre looking to achieve the highest credit score possible, you should first consider all of the factors that make up your score. Then, follow these proactive steps to push you to get to the top of the scale.

Dont Close Old Accounts

The age of your credit history plays a more prominent role in your rating than you may think. While it may only account for 15% of your total score, your accounts age shows new lenders that you are a trustworthy, responsible individual. With a long financial history, it will prove that you are a low-risk borrower.

So, while you may have a line of credit that you opened years ago but hardly ever use, you dont want to close out that account. Instead, designate that card for a specific use to keep it active and make sure you pay off the balance each month to continue working towards improving your financial standing.

While the idea of keeping an account open may not sound right especially if you have not used it in a while, it can also harm your credit score in another way, it increases your overall utilization rates.

We highly recommend that you keep your finance accounts open if you can, even if you dont need or presently use these cards. It will help you maintain good rating and be beneficial when youre planning to borrow money within the next few months.

Recommended Reading: Usaa Credit Monitoring Review

The Fico Credit Scoring Formula

The FICO® Score is made up of five weighted categories of information. In order from most important to least, they are:

- Payment history — Do you pay all of your bills on time? The answer to this question is the single largest factor in your FICO® Score.

- Amounts owed –– How much of your available credit lines are you using? How much do you still owe on installment loans, relative to their original balances? These are some of the items included in this category.

- Length of credit history –– This includes a variety of time-related factors, such as how long ago you opened your oldest account, the ages of your individual credit accounts, and the average age of all of your accounts.

- New credit –– There are two main credit factors in the “new credit” category. First, it includes the new credit accounts you’ve recently opened . Second, it includes credit inquiries — that is, the times you’ve applied for credit — within the past 12 months.

- — The FICO® formula also considers the different types of credit accounts you have. The rationale here is that a consumer who has demonstrated the ability to manage several different account types responsibly has done a better job of demonstrating creditworthiness than one who has only used a single type of credit.

You Need To Have A Completely Clean Credit Report

If your goal is to have perfect credit score, you need to have zero collections reported to the financial rating agencies, which means no late payments on any of your accounts.

Since many individuals may have made some late payments, this is one of the biggest factors thats holding most people back from obtaining perfect rating. Thats because a hard inquiry remains on your report for approximately 36 months.

You May Like: How Long Credit Inquiries Stay On Report

He Has Long Standing Credit History

The average age of Droske’s accounts is 10 years and 11 months on the report that CNBC Select reviewed. His oldest account is 34 years and 10 months old.

Length of credit history is a key factor FICO considers when determining your credit score, so it helps that Droske started using credit at a young age.

Droske learned early on about the impact of people’s credit on their purchases during his first job in finance at a car dealership’s lending department.

“I would see two people buying the same car on the same day, and one person gets 5% and the other person gets 19% based on credit,” Droske says. “That very quickly taught me the impact of credit, and then I was really curious about what made that number move.”

How To Get A Perfect Score

While we certainly have a broad idea of the information that contributes to our FICO® Scores, the precise FICO® formula is a well-guarded secret. In other words, we can’t say what kind of impact any one specific credit behavior will have. So, there’s no way of knowing a precise set of steps to follow to achieve a perfect credit score.

While we don’t know the precise FICO® formula, and therefore can’t say exactly what is required for a perfect score, we do know some of the credit behaviors of those in the highest credit tiers.

According to the most recent data on FICO® “high achievers,” we know that about 23% of U.S. consumers have FICO® Scores above 800, which is generally considered to be exceptional credit. Here’s some of what we know about how people in this group behave:

- They opened their oldest revolving credit account more than 25 years ago and their average revolving credit line is nearly 12 years old. Since “length of credit history” is a factor in the FICO® formula, this shouldn’t be too surprising.

- It’s been nine months since the last inquiry on a high achiever’s credit report.

- 95% of consumers with FICO® Scores above 800 have no delinquent accounts on their credit report.

- They have an average revolving balance of $1,446 and have 10 active revolving accounts.

- However, this makes up just 4% of their overall revolving credit limit. In fact, the average 800+ FICO® consumer is using no more than 10% of any one revolving account.

You May Like: Notify Credit Bureau Of Death

How To Quickly Improve Your Credit Score

Use Credit Monitoring To Track Your Progress

are an easy way to see how your credit score changes over time. These servicesmany of which are freemonitor for changes in your credit report, such as a paid-off account or a new account that youve opened. Also, they typically give you access to at least one of your credit scores from Equifax, Experian, or TransUnion, which are updated monthly.

Many of the best credit monitoring services can also help you prevent identity theft and fraud. For example, if you get an alert that a new credit card account that you dont remember opening has been reported to your credit file, you can contact the credit card company to report suspected fraud.

You May Like: Navy Federal Internal Score