Can A Late Payment Be Removed If It Was Caused By The Covid

The answer to this is yes, IF you had a late payment for the month of March 2020 or after that, but not before.

The economic fallout from the coronavirus has caused lenders to make exceptions for those who suffered a loss of income or health complications as a result of the pandemic.

If you find yourself in this situation, the first step would be to simply call the creditor and see if theyll be able to issue a courtesy removal of the late payment. They may ask you to prove your loss of income or health complications.

Readthis articleabout how to address and remove Covid-19 related late payments.

However, lates for February 2020 or prior will not qualify for goodwill deletion under the Covid-19 pandemic situation. In that case, youll likely need professional help.

What If The Information Is Rightbut Not Good

If theres information in your credit history thats correct, but negative for example, if youve made late payments the credit bureaus can put it in your credit report. But it doesnt stay there forever. As long as the information is correct, a credit bureau can report most negative information for seven years, and bankruptcy information for 10 years.

Request A Goodwill Removal From Your Creditor

While the credit bureaus can control the information that shows up on your credit reports, the information furnishers i.e., your creditors can also request that items be removed.

Known as a goodwill removal, some creditors will remove a late payment from a customers credit reports when requested. Of course, theres a catch: you need to be on good terms with your creditor, well above and beyond that late payment.

Basically, goodwill removals are just that: a gesture of goodwill by your creditor as thanks for your custom. As such, the best results will typically be seen by those who have an otherwise spotless payment history and/or a long-standing relationship with their creditor. Youll also need to be completely current on your debts.

Goodwill removals can be requested by writing a letter to your creditor and mailing it to the customer service department, but more modern methods such as calling the customer service line or sending an email can also be effective.

Perhaps the most important thing to remember when requesting a goodwill removal is to be polite. Your creditor is under absolutely no obligation to remove any legitimate items from your reports, so being rude will likely get you a quick and resounding, No.

You May Like: Removing Items From Credit Report After 7 Years

The Credit Repair Option

Another option is to work with a legitimate company to try to get charge-offs or other negative information removed from your credit file. While this can save you time, there’s typically a fee involved, and in most cases, the credit repair company can’t do anything for you that you couldn’t do by yourself.

Worse, some credit repair companies are just thinly disguised scams whose only goal is to defraud people who need credit help.

Increase Your Credit Score By Paying Down Your Credit Card Debt

I had a credit utilization ratio of 40%. Meaning I was using up 40% of the credit limits on all of my cards. Your credit utilization makes up 30% of your overall FICO score. Only your payment history has a bigger impact.

You want to keep your balances below 10-15% of your credit limits. This will ensure youre maximizing your scores. So I paid all my credit card debt down to 0, along with the removed late payments, my score increased by 84 points in just one month! You, too, can have this level of success by doing what I did.

Don’t Miss: 779 Credit Score

Impact Of Identity Theft On Your Credit Report

Identity theft occurs when someone steals your personal information and uses it to apply for new lines of credit. If these new accounts go into default, they will appear on your credit report and hurt your score.

Cleaning up your credit after identity theft can take anywhere from a day to several months or even years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. Monitoring your credit report will help you to stay on top of potential fraudulent charges.

Thoughts On Delete 30 Day Late Payments From Your Credit Report

Hi Ali, I incurred a 30 day late payment with Macys during the pandemic. This was not due to financially inability , but I just forgot. Ive called and theyve given me the cold shoulder and even lodged complaints with the CFPB. My credit is taken a dive and me and my partner cant get approved for a loan. What can you do to help ?

Recommended Reading: How Long Does Missed Payments Stay On Your Credit

Dispute The Late Payment With The Creditor

Disputing a late payment with the bank or creditor directly is often the most effective. If the late payment is, in fact, an error. You can explain the situation to customer service to investigate. Usually, they will need some time to have a department look into the error and respond.

In most cases, if the error is on the creditors behalf, they will refund the late fee and have the late payment removed from your credit report. However, this is not always the case. If they refuse to remove the late payment, you can move on to the next step.

How Do Late Payments Impact Credit Score

When you miss a payment, your credit score is affected. When you are late with a payment by 30 days or longer, as much as 100 points can be taken from your credit score. Your payment history is an essential part of the credit score, which is why its taken into account when calculating it. Therefore, one single late payment is enough to drag down your score.

Also Check: What Is Syncb Ntwk On Credit Report

Ways To Dispute Information On Your Credit Report

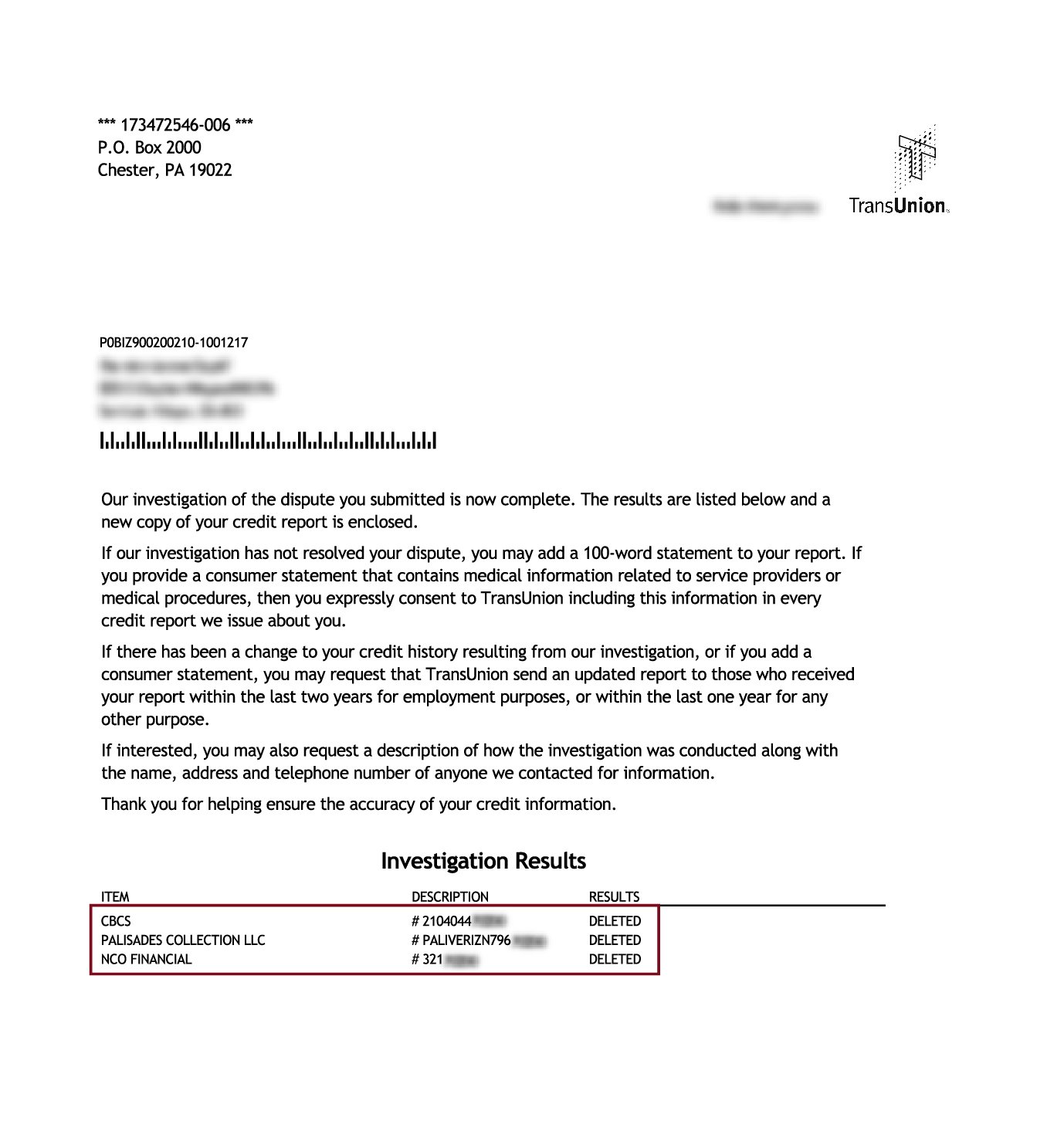

TransUnion and Equifax have their own processes for disputing credit reports, but Experian provides three methods for submitting disputes:

- Online: Get access to your Experian credit report and initiate a dispute at the Experian Dispute Center . There is no cost to you for using this service.

- : To initiate a dispute by phone, you’ll call the number displayed on your Experian credit report. If you’d like to have a copy of your credit report delivered to you by mail, call 866-200-6020.

- : You can dispute without a credit report by writing to Experian, P.O. Box 4500, Allen, TX 75013. .

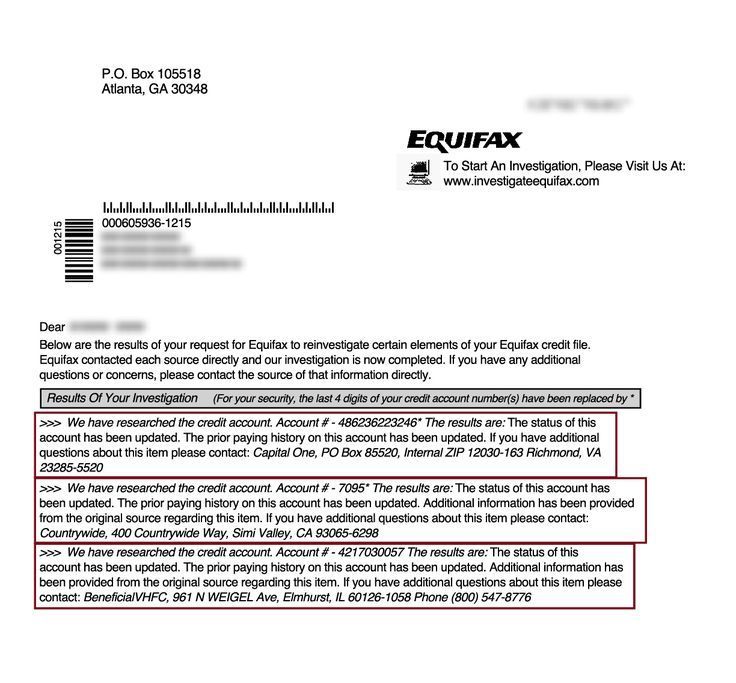

What Happens After You Submit Your Dispute

After you’ve submitted a dispute, Experian goes to work to resolve the issue. The data furnisher will be asked to check their records. Then one of three things will happen:

- Incorrect information will be corrected.

- Information that cannot be verified will be updated or deleted.

- Information verified as accurate will remain intact on your credit report.

Don’t Miss: 877-392-2016

Check Your Credit Reports After Your Disputes

If your late payment dispute with either Equifax or TransUnion is successful, the credit bureau will correct the error and remove the error from your credit report. The credit bureau agency should notify you of the results of their investigation. Even if theyâve said that theyâve corrected the error, check your credit reports from both bureaus to make sure the error was fixed. Make sure to follow up if the mistaken late payment notation is not removed within 30 days.

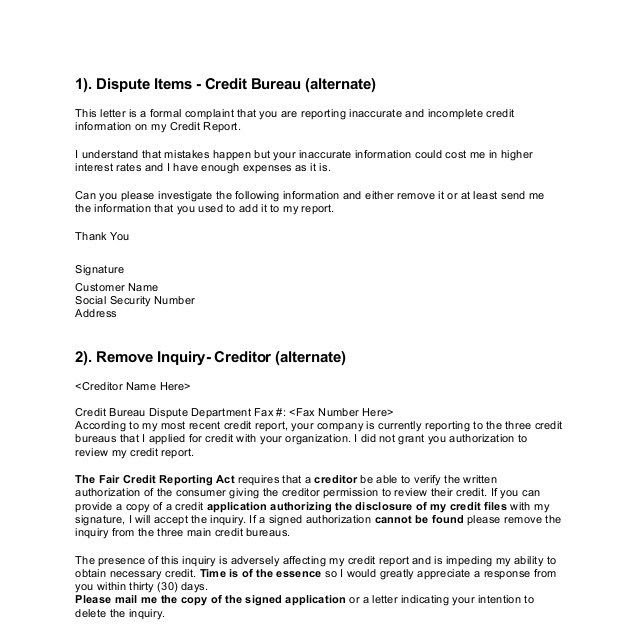

Dispute Mistakes With The Credit Bureaus

You should dispute with each credit bureau that has the mistake. Explain in writing what you think is wrong, include the credit bureaus dispute form , copies of documents that support your dispute, and keep records of everything you send. If you send your dispute by mail, you can use the address found on your credit report or a credit bureaus address for disputes.

Equifax

Read Also: Report Death To Credit Bureau

Kohls Late Fee Reversal

Kohls generally charges a late fee of $25 every time youre late. Many people have asked if its possible to reverse this fee in addition to removing the negative entry from your credit report.

While it is possible, honestly, that would be the least of my worries. Your main concern should be removing the late payments from your credit report, because its this that will have a lasting impact on your financial situation.

Unless you have several late fees, you should just pay the late fee. That said, it doesnt hurt to ask.

If you have been a long time Kohls customer and heavily used their credit card, they may be willing to reverse the late fees out of goodwill.

Update: Several readers have written in and said that Kohls was willing to reverse the late fee. Again, this might not work every time, but its worth a try.

Consider Contacting A Data Furnisher

When disputing credit report errors, the FTC recommends sending a dispute letter to the data furnisher as well. A data furnisher is a financial institution, such as a lender or credit card issuer, that provides data to the credit bureaus. Each credit report that includes the error should list the furnishers name and address. If you dont see an address listed, contact the company.

Once you submit your dispute to the furnisher, it has 30 days to conduct an investigation. If it finds that the information youre disputing is inaccurate, it is required to notify each credit bureau it has reported the information. However, if the information is found to be accurate, it will remain on your credit report.

Read Also: Does Paypal Working Capital Report To Credit Bureaus

Write To Inform The Appropriate Creditor Or Provider That You Are Disputing The Information Provided To The Bureau

Often your is incorrect because bureaus have been misinformed by creditors or creditors have not reported your information at all. To correct this, you should submit a dispute to the source. Even if the error is not corrected, the provider must then include a notice of your dispute if they report the same information to a bureau again.

If you’ve been told you were denied credit because of an “insufficient credit file” or “no credit file” and you have accounts with creditors that don’t appear in your credit file, ask your creditors to begin reporting your credit information to credit bureaus. However, creditors are not required to report consumer credit information to credit bureaus, and if they dont, you may wish to move your account to a different creditor who does report regularly to credit bureaus.

When writing to your creditor, include copies of documents that support your position. Request that the provider copy you on correspondence it sends to the bureau. Your credit providers should specify an address for disputes and this process should take between 30 and 90 days.

When Does A Late Credit Card Payment Show Up On Credit Reports

Reading time: 2 minutes

Highlights:

- Even a single late or missed payment may impact credit reports and credit scores

- Late payments generally won’t end up on your credit reports for at least 30 days after you miss the payment

- Late fees may quickly be applied after the payment due date

If you are facing financial hardship because of a job loss or furlough, and having trouble paying credit card bills on time or if you just missed the due date by accident you may want to know when a late payment will appear on your credit reports, and if there is any kind of grace period.

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally wont end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

If youre only a few days or a couple of weeks late on the payment, and you make the full late payment before that 30 days is up, lenders and creditors may not report it to the credit bureaus as a late payment. Keep in mind, if you arent able to make the full payment, and only make a partial payment, it generally will be reported as late.

Heres how the process generally works:

On the account closing date, your statement or bill is generated.

A third date is the reporting date, which is usually the date your account information is reported to the nationwide .

Recommended Reading: How To Dispute A Missed Payment On Credit Report

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your credit report. The NFCC can provide debt counseling services, help review your credit reports, work with lenders, and help create a debt management plan free of charge.

As always, be wary of predatory credit organizations or companies. Make sure to find a reputable counseling agency and keep a lookout for any red flags, like hidden fees or lack of transparency.

When looking for a credit counselor, the Federal Trade Commission advises consumers to check out each potential agency with:

- The Attorney General of your state

- Local consumer protection agencies

- The United States Trustee program

Write A Goodwill Letter

If you normally have good payment habits and your credit card payment just slipped your mind, consider writing a Goodwill Adjustment Letter to Kohls.

If you have a decent relationship with Kohls because you normally make your payments on time and/or you use the card often, they may work with you. The process is simple.

Write Kohls a letter stating that youre aware you missed your payment. State the reason you were late and ask them to forgive it this one time. If you havent made a habit of making your payments late, they may accept your apology and erase the late payment from the credit report.

This works best if you prove it was a one-time thing. For example, you or a relative were in the hospital and you got behind or you moved and not all your mail got forwarded. It has to be something thats rectifiable.

Also Check: How Does A Repo Show On Your Credit

Kohls Late Payment Forgiveness

In order to remove the late payment from your credit report, your first step should be to write Kohls whats called a Goodwill Forgiveness Letter.

This is a letter that basically explains why you were late, states that it wont happen again, and kindly asks them to remove the late payment from your credit report out of goodwill.

I have created a goodwill letter template that you can use.

This method works best if youve only been late once. If you have multiple late payments with Kohls, this probably wont work.

You can give it a try, but honestly, I wouldnt count on them forgiving more than one late payments.

Goodwill Letters Dont Work Anymore

A few years ago, if you were late on an account that otherwise was always in good standing. You could ask customer service to remove the late payments as a one-time courtesy, and sometimes they would. Thats all been ended by the credit bureaus.

A creditor can no longer offer any forgiveness for late payments unless the late payment resulted from an error by the creditor. If you ask a creditor to remove a late payment as an act of goodwill, it will get you nowhere.

In fact, it will be noted you admitted you were late, and it will be much more difficult to have the late pay deleted in the future.

You May Like: What Credit Score Does Carmax Use

The Late Payment Occurred More Than Seven Years Ago

If a late payment is correctly reported, it should fall off your credit reports after seven years.

Lets say youve missed a payment by 30 days, then 60 days and then 90 days. Even though this one late account can lead to multiple negative marks on your credit reports, the original delinquency is the one that starts the clock. That means the entire sequence should disappear seven years from the first date the payment was late.

If you see a late payment thats more than seven years old, it could be a mistake, and you may want to dispute it.

What To Do If It Gets Verified

Write a new letter and request that you be sent a copy of the application that verified the account. If you do owe the debt Dont send them anything. You dont want to provide any information that can be used against you. Let them show you what they have first! Tell them you want the following:

- You want the original agreement sent to you

- You want a complete breakdown of the amount they are showing. How much of it is principal, interest, fees etc.

Make sure you are keeping all correspondence! If they can not provide the above again state that its not yours and you want this removed under the guidelines laid out in the Fair Credit Reporting Act.

If you truly dont owe the debt, send them a copy of the evidence you have. Make sure you keep a copy! Never send originals.

If the credit reporting agencies choose to ignore you, advise them you are willing to take it to court. Experian, TransUnion and Equifax have all be successfully sued at one time or another!

Also Check: Does Increasing Credit Limit Hurt Score

Understand How Credit Report Errors Happen And Correct Them With A Dispute Letter

When a contains errors, it is often because the report is incomplete or contains information about someone else. This typically happens because:

- Your does not reflect all credit accounts.

- The person applied for credit under different names .

- Someone made a clerical error in reading or entering name or address information from a handwritten application.

- The person gave an inaccurate Social Security number, or the number was misread by the lender.

- Loan or credit card payments were inadvertently applied to the wrong account.

If you feel your contains errors, or is missing accounts, learn more about how to file a dispute on a below.