What Is A Credit Score

The credit scores you get from different companies will not be the same. There are a number of reasons for that:

- There are many different formulas used to calculate credit scores. The differences in the formulas may lead to differences in your credit scores.

- Companies may produce scores that give results on different scales.

- Businesses don’t always report to every credit reporting company, and even when they do, they may send their information on different days. This means that on any given day, the information that one credit reporting company has may differ from the credit activity being reported to another credit reporting company.

Businesses use credit scores to estimate how likely you are to pay back loans or services. People with higher credit scores may be more likely to pay back their debts. People with lower credit scores may be less likely to pay their debts.

What Is A Credit Report And What Does It Include

Reading time: 3 minutes

Highlights:

- A credit report is a summary of how you have handled your credit accounts

- It’s important to check your credit reports regularly to ensure the information is accurate and complete

A credit report is a summary of how you have handled credit accounts, including the types of accounts and your payment history, as well as certain other information thats reported to credit bureaus by your lenders and creditors.

Potential creditors and lenders use credit reports as part of their decision-making process to decide whether to extend you credit and at what terms. Others, such as potential employers or landlords, may also access your credit reports to help them decide whether to offer you a job or a lease. Your credit reports may also be reviewed for insurance purposes or if youre applying for services such as phone, utilities or a mobile phone contract.

For these reasons, it’s important to check your credit reports regularly to ensure the information in them is accurate and complete.

The three that provide credit reports nationwide are Equifax, Experian and TransUnion. Your credit reports from each may not be identical, as some lenders and creditors may not report to all three. Some may report to only two, one or none at all.

Your Equifax credit report contains the following types of information:

- Identifying information

- Inquiry information

There are two types of inquiries: soft and hard.

- Bankruptcies

- Collections accounts

Open And Closed Accounts

Open and closed accounts will both appear on your credit report, with the exception of negative, closed accounts that are older than seven years. Those accounts have passed the credit reporting time limit. Accounts that were closed in good standing remain on your credit report about 10 years after the account has been closed, or whatever period the credit bureau has specified.

Don’t Miss: Is 626 A Good Credit Score

Business Credit Reports For Customers

Rather than relying on a customer self-reporting their creditworthiness or providing you with hand-picked references, business credit reports offer an independent assessment of a companys financial history along with predictive analysis of future risk.

Business credit reports are also valuable for checking the financial health of current customers. The earlier you spot warning signs of financial distress, the sooner you can take appropriate action to avoid putting your own business at risk.

What Is Not Included In A Credit Report

Odysseas Papadimitriou, WalletHub CEOJul 27, 2013

Weve already discussed what IS included in your credit report, and while one could infer that any omissions from that list would amount to what is NOT included, we all still thirst for specifics. Lets therefore take a closer look at what you will not find in your credit reports from Experian, Equifax, and TransUnion.

First of all, its important to note that the major credit bureaus tend to include and exclude the same types of information. Sure, there may be some slight discrepancies here and there, depending on each bureaus sources and information gathering techniques, but the fundamentals are fairly uniform.

Thats partly due to the fact that credit reporting agencies are actually prohibited from tracking certain types of information by federal law, as youll see below. Overall, the types of information not included in your credit report can be grouped into the following categories:

Recommended Reading: Speedy Cash Extension

Number Of Credit Obligations

On average, today’s consumer has a total of 13 credit obligations on record at a credit bureau. These include credit cards and installment loans . Not included are savings and checking accounts . Of these 13 credit obligations, 9 are likely to be credit cards and 4 are likely to be installment loans.

What Is A Credit Report

Most people have more than one credit report. Credit reporting companies, also known as credit bureaus or consumer reporting agencies, collect and store financial data about you that is submitted to them by creditors, such as lenders, credit card companies, and other financial companies. Creditors are not required to report to every credit reporting company.

Lenders use these reports to help them decide if they will loan you money, what interest rates they will offer you. Lenders also use your credit report to determine whether you continue to meet the terms of an existing credit account. Other businesses might use your credit reports to determine whether to offer you insurance rent a house or apartment to you provide you with cable TV, internet, utility, or cell phone service. If you agree to let an employer look at your credit report, it may also be used to make employment decisions about you.

Personal information

- Your name and any name you may have used in the past in connection with a credit account, including nicknames

- Current and former addresses

- Current and historical credit accounts, including the type of account

- The credit limit or amount

- Account balance

- The date the account was opened and closed

- The name of the creditor

Collection items

Read Also: Is Creditwise Good

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

If I Have Absolutely New Credit How Soon Can I See A Credit Score Developing

Developing your credit score comes naturally as a result of building your credit history. Youve heard the saying if you build it they will come? It applies to credit scoring as well. If you build your credit history then your score will come shortly after followed by more creditors that will want your business. The credit scoring models are looking for two things before they will score your credit files: age and activity. For some credit score models, you must have at least one account that is greater than 3 to 6 months old and at least one account that has been reported to the credit bureaus within the last 6 to 12 months. The same account can qualify you for a score. So, a credit report with one account open for 9 months that has reported to the credit bureaus within the past 30 days will qualify for a score. Once youve built a score, the challenge is to maximize it.

Also Check: What Bank Is Syncb Ppc

Checking Your Credit Reports

Monitoring your credit helps you know what information is in your credit reports at all times. Sometimes, errors may pop up and you will need to dispute them.

If you want to improve your credit, the first thing you should do is request to see your credit reports. Checking your reports helps you understand whats helping your score and what is hurting your score. When checking your credit reports for errors that may be hurting your credit score or indications that you may have been a victim of identity theft, make sure that:

Considering that lenders will look at your credit report as well as your score, it can be helpful to look at your credit reports if youre about to apply for something big, like an auto loan or a mortgage. The better your credit score, the more likely youll be able to get approved and have a lower interest rate. Having your credit reported a few months before you apply gives you the chance to fix anything that may be negatively impacting you.

What Is A Credit History

Sometimes, people talk about your credit. What they mean is your credit history. Your credit history describes how you use money:

- How many credit cards do you have?

- How many loans do you have?

- Do you pay your bills on time?

If you have a credit card or a loan from a bank, you have a credit history. Companies collect information about your loans and credit cards.

Companies also collect information about how you pay your bills. They put this information in one place: your credit report.

Recommended Reading: Is 672 A Good Credit Score

How Do I Order My Free Annual Credit Reports

The three national credit bureaus have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three national credit bureaus individually. These are the only ways to order your free credit reports:

- Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

First Tell The Credit Bureau In Writing What Information You Believe Is Inaccurate

The credit bureau must investigate the item in question – usually within 30 days – unless they consider your dispute frivolous. Include copies of documents that support your position. In addition to providing your complete name and address, your letter should:

- Clearly identify each item in your report you dispute.

- State the facts and explain why you dispute the information.

- Request deletion or correction.

You may want to enclose a copy of your report with the items in question circled. Your letter may look something like this sample. Send your letter by certified mail, return receipt requested, so you can document that the credit bureau received your correspondence. Keep copies of your dispute letter and enclosures.

Second, write to the appropriate creditor or other information provider, explaining that you are disputing the information provided to the bureau.

Again, include copies of documents that support your position. Many providers specify an address for disputes. If the provider again reports the same information to a bureau, it must include a notice of your dispute. Request that the provider copy you on correspondence they send to the bureau. Expect this process to take between 30 and 90 days.

In many states, you will be eligible to receive a free credit report directly from the credit bureau, once a dispute has been registered, in order to verify the updated information. Contact the appropriate credit bureau to see if you qualify for this service.

Read Also: Syncb Ppc Closed

Financial Information That’s Not Related To Debt

While your credit report features plenty of financial information, it only includes financial information that’s related to debt. Loan and credit card accounts will show up, but savings or checking account balances, investments or records of purchase transactions will not. Did you buy a car? Your purchase won’t appear on your credit report, but any loan you used to finance it will.

Checking Your Business Credit Report

It is also a good idea to monitor the credit scores for your own business so you know what others see when they check your credit.

When you know you have a good credit score, you can negotiate better credit and more favorable terms. Keeping an eye on your business credit report can also help you spot areas that need improvement in case you want to apply for a loan.

You May Like: What Is Cbcinnovis On My Credit Report

Whats In Your Credit Report

There are three major credit bureaus that produce and sell credit reports: Equifax, Experian, and TransUnion.

You have a separate credit report from each of these companies, giving you three different credit reports in all. For the most part, the information in each report will be similar. But you might notice some differences because not all lenders report to the same credit bureaus.

Your personal and financial information will be laid out differently in each of your three reports there is no uniform formatting for credit reports. But theyll each contain the same general types of information about you and your credit history.

The following types of information will be included in your credit reports:

- Personal Identification Information

- Consumer Statements/Alerts/Disputes

In addition to the list above, youll also see a description of your rights as a consumer and contact information for the credit bureau.

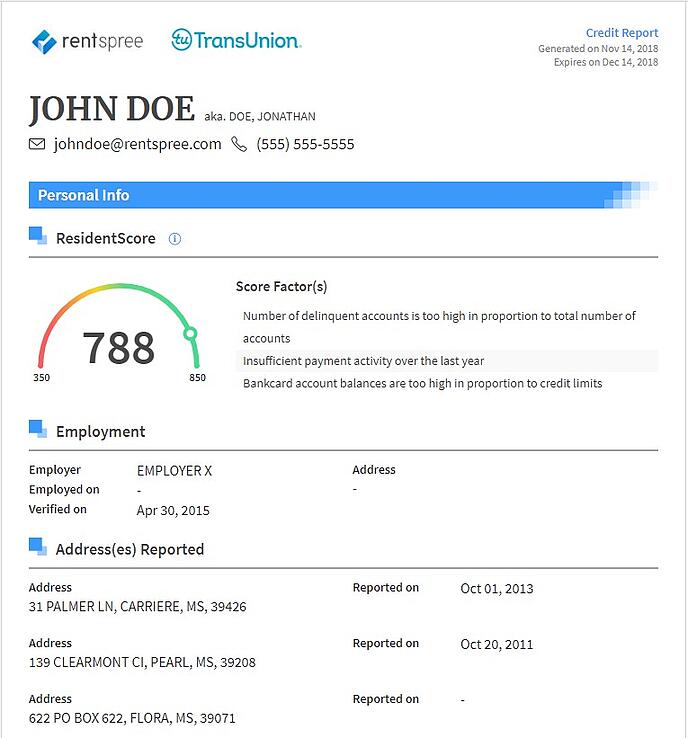

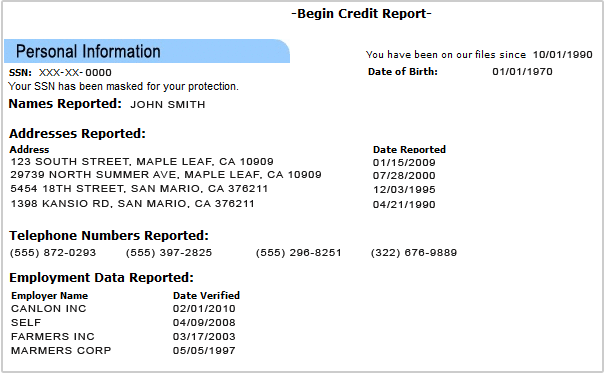

Example Credit Reports

Before jumping into your own credit reports, you may find it useful to browse some simple examples. Follow the links below to get an idea of how your credit reports might look, although your reports may have updated layouts.

- Current and previous addresses and phone numbers

- Current and previous employers

- Other identifying information

Take a close look at your data to make sure everything is correct. Check the spelling, and make sure all numbers are accurate.

An example Personal Information section from a TransUnion sample credit report.

Who Looks At Credit Reports

The Fair Credit Reporting Act and some state laws attempt to restrict who can access your credit report and how that information can be used, but generally speaking, any business you seek credit from or anyone who has legitimate business need, can request to see your report.

Businesses with access to credit reports:

One thing worth noting: by law, you have the right to know who has inquired about or requested your credit report in the last six months. When you request a copy of your report, a list of all businesses or individuals should be on it.

Recommended Reading: Is 698 A Good Credit Score

Why Do I Have A Credit Report

Businesses want to know about you before they lend you money. Would you want to lend money to someone who pays bills on time? Or to someone who always pays late?

Businesses look at your credit report to learn about you. They decide if they want to lend you money, or give you a credit card. Sometimes, employers look at your credit report when you apply for a job. Cell phone companies and insurance companies look at your credit report, too.

What Is Included On The Credit Report

A credit report contains your personal and credit information.

|

PERSONAL INFORMATION includes |

|

Type of loan Name of the lender Number of overdue payments, if any Date of next payment Amount of next payment |

Each month personal and credit information is submitted by your lender to the Central Credit Register.

Personal information ensures that all your loans that you may have with different lenders are correctly matched on the Central Credit Register.

Also Check: Does Acima Report To Credit

How To Start Monitoring Your Credit For Free Today

You could also use a tool like . Itâs free for everyoneânot just Capital One customers. And with CreditWise, you can access your TransUnion credit report as often as you would like without hurting your credit. Plus, youâll get alerts when there are meaningful changes to your TransUnion and Experian credit reports.

You can also check your VantageScore® 3.0 credit score for weekly updates. And the Credit Simulator can give you an idea about how financial decisions could affect your credit. Best of all, using CreditWise will never hurt your credit. Thatâs because it uses soft inquiries to monitor things.

You can today to get a look at whatâs in your credit report and more.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

We hope you found this helpful. Our content is not intended to provide legal, investment or financial advice or to indicate that a particular Capital One product or service is available or right for you. For specific advice about your unique circumstances, consider talking with a qualified professional.

Should I Pay Off A Judgment That Is Showing Up On My Credit Report If I Do And It Is Marked Paid What Will This Mean

At Credit.com we will always advise you to pay off your debts, delinquent or otherwise. If you have a judgment on your credit report then it serves you well to pay it off. Heres why:

- Lenders with whom you want to do business will look upon a paid judgment more favorably. As a matter of fact, some lenders will require that you pay off delinquent obligations before they will approve your loans. You might as well do it sooner rather than later so you look proactive rather than reactive.

- Since credit scoring is used in almost all of your credit transactions its in your best interest to maximize your scores by paying off your past due obligations.

Also Check: Why Is There Aargon Agency On My Credit Report