How Does Child Support Affect Your Credit Score

In short, child support only affects your credit score if youre late on your child support payments. If your child support account was never late, it will never appear on your , explained Miranda Vance, a financial coach for AAA Fair Credit.

Credit is only built by borrowing money and paying it back on time and in full, said Vance.

That means monthly payments on things like auto insurance, utilities and phones do not typically build your score because you never actually borrowed money. But if you miss a payment on these accounts, they can appear on your credit report and drag down your score. Child support works the same way.

Once you miss a child support payment, that late payment can be reported to the credit bureaus and can remain on your credit report for seven years.

Its also worth noting that even if youre on time with child support payments, having to pay child support can make it more difficult for you to get approved for a mortgage or other loan. Thats because it contributes to your debt-to-income ratio, and signals you might have difficulty meeting the loan payments.

Communicate With The Credit Issuer

Its tempting to ignore past due bills, especially from credit card companies that cant turn off your utilities or repossess your car. But try to avoid this temptation.

A lot of credit accounts offer payment flexibility you should take advantage of if youre struggling to make on-time payments.

Some companies will let you skip a payment so you can get your personal finances back on track.

But you wont know about these possibilities if you dont get in touch with your creditor.

So dont ignore their phone calls or emails, especially when youre still not 30 days late.

Write A Goodwill Letter

If you normally have good payment habits and your credit card payment just slipped your mind, consider writing a Goodwill Adjustment Letter to Kohls.

If you have a decent relationship with Kohls because you normally make your payments on time and/or you use the card often, they may work with you. The process is simple.

Write Kohls a letter stating that youre aware you missed your payment. State the reason you were late and ask them to forgive it this one time. If you havent made a habit of making your payments late, they may accept your apology and erase the late payment from the credit report.

This works best if you prove it was a one-time thing. For example, you or a relative were in the hospital and you got behind or you moved and not all your mail got forwarded. It has to be something thats rectifiable.;

Also Check: How To Unlock My Experian Credit Report

Can Paying Off Debt Remove A Late Payment From A Credit Report

Instead of letting a late payment stay on your credit report and become a charge off, you can pay it off. Paying off the debt may be your best course of action if the late payment is your fault and your creditor refuses to negotiate or consider your goodwill letters.

If your creditor agrees to you paying off your late payment, expect to pay a late fee. However, your credit card company may waive this requirement if you have a good track record and relationship with the company.

Note that paying off your debt wont automatically erase it from your credit report. It will stay there for seven years, but it wont become a charge-off and severely damage your credit score and reputation among lenders.

Send A Request For Goodwill Deletion

Like pay-for-delete, writing a goodwill letter seems like a long shot, but its an option for borrowers who want to exhaust every possible alternative. Write to the creditor and ask for a Goodwill Deletion. If you have taken appropriate steps to pay down your debts and have become a more responsible borrower, you might be able to convince the creditor to remove your mistake.

There is no guarantee that your plea will get a response, but it does get results for some. This strategy is most successful for one-off problems, such as a single missing payment, but it may be futile for borrowers with a history of missed payments and credit mismanagement.

When writing the letter:

- Assume responsibility for the issue that caused the account to be reported to begin with

- Explain why the account was not paid

- If you can, point out good payment history before the incident

Read Also: Is 524 A Bad Credit Score

The Late Payment Occurred More Than Seven Years Ago

If a late payment is correctly reported, it should fall off your credit reports after seven years.

Lets say youve missed a payment by 30 days, then 60 days and then 90 days. Even though this one late account can lead to multiple negative marks on your credit reports, the original delinquency is the one that starts the clock. That means the entire sequence should disappear seven years from the first date the payment was late.

If you see a late payment thats more than seven years old, it could be a mistake, and you may want to dispute it.

What If Theres Been A Mistake

If you think you have a delinquency thats been misreported due to identity theft or because something was just misreported, you should attempt to negotiate with the creditor first. They will usually correct any errors quickly. Then notify the 3 credit bureaus once you contact them and present your evidence.

The first thing you should do is . This is especially if its just a simple clerical error.

Thats typically something theyll recognize right away. They might even be able to fix the error on the spot without needing any documentation.

If the problem is something more sinister, like identity theft, this may become a more tedious process. Your creditor may require copies of your identification, police reports, sworn affidavits, or other documents related to the case. The Federal Trade Commission has a helpful Identity Theft Recovery Plan on their website.

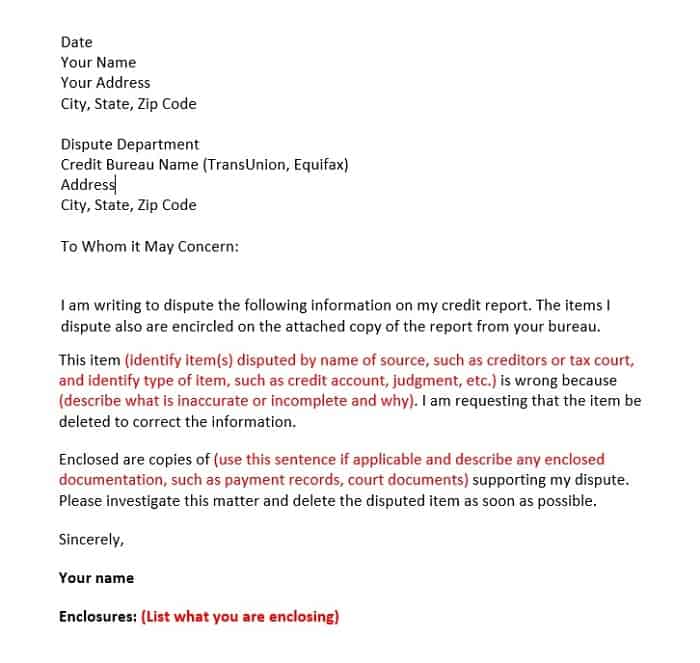

If the creditor is not legitimate, out of business, or not able to cooperate for some reason, you can always go directly to the credit bureaus. In this case, its best to send each bureau a dispute letter. Include any supporting documents you think theyll need.

If you arent sure what to send, you can first and ask. When you send the dispute letter, be sure to send it via certified mail.

It may be a quick and easy process or it might take a bit longer. However, once the issue is resolved, you could see an improvement in your credit score in a matter of weeks.

Don’t Miss: Is Paypal Credit Reported To The Credit Bureaus

Hire A Credit Repair Service

A reputable company like may be a viable solution if your report is riddled with inaccuracies that further complicate the repair process. can help you with the following items:

- Cleaning up credit report errors

- Disputing inaccurate negative entries

- Handling creditor negotiations

If you decide to hire a credit repair service, know that laws govern how they operate and what they can do. The establishes the following regulations governing credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the service

- They cannot receive payment for the performance of any service until said service has been entirely performed

- There must be a written contract detailing the services to be performed, the time frame during which these services will be performed, and the total cost for those services

- They cannot promise to remove accurate information from a credit report before the term set by law

- The consumer will have three days in which to review the contract and cancel without penalty

Ftc Advisory Opinion On Section 623 Of The Fcra

And thats when I stumbled upon the FTC advisory opinion on Section 623 of the FCRA which changed everything.

This advisory opinion basically states that a student loan provider is required to both update and correct information provided to credit reporting agencies when that information is provided.

Theres dispute as to whether this means removing late payments entirely from a credit report or merely to updating that the report to reflect that a payment status is no longer delinquent or past due.

Theres a huge difference between the two because in the latter situation your payments may no longer show that they are currently delinquent but in the former scenario your payments are completely removed from your credit score.

Thus, I changed my strategy from employing the nice-guy, apologetic tone to going with a more aggressive and authoritative style and actually asserted that this loan provider was in violation of;Section 623 by not removing my late payments.

The below is the letter that I responded to the loan provider with. This time I sent the letter via certified mail.

As you can see, the tone was much different from the email I had previously sent. There are a few points to consider about my situation and the letter I sent.

Tip: Use WalletFlo for all your credit card needs. Its free and will help you optimize your rewards and savings!

Read Also: Speedy Cash Repayment Plan

Impact Of Identity Theft On Your Credit Report

Identity theft occurs when someone steals your personal information and uses it to apply for new lines of credit. If these new accounts go into default, they will appear on your credit report and hurt your score.

Cleaning up your credit after identity theft can take anywhere from a day to several months or even years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. Monitoring your credit report will help you to stay on top of potential fraudulent charges.

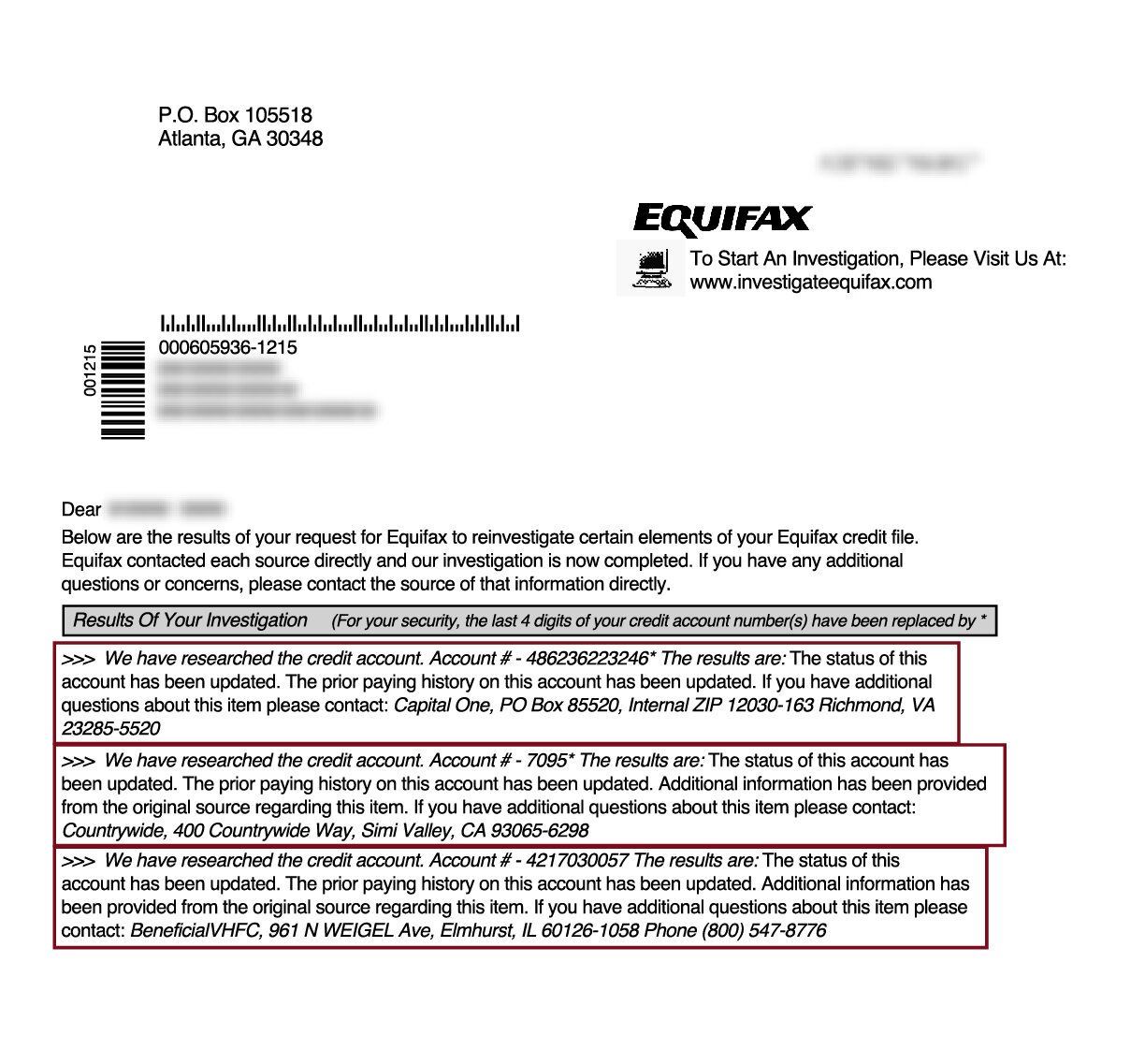

Check Your Credit Reports After Your Disputes

If your late payment dispute with either Equifax or TransUnion is successful, the credit bureau will correct the error and remove the error from your credit report. The credit bureau agency should notify you of the results of their investigation. Even if theyâve said that theyâve corrected the error, check your credit reports from both bureaus to make sure the error was fixed. Make sure to follow up if the mistaken late payment notation is not removed within 30 days.

Also Check: Comenitycapital/mprcc

How Can I Negotiate To Have A Late Payment Removed

Some creditors might be more open to reassessing the circumstances surrounding your dispute or plea for a goodwill adjustment if you offer them some kind of incentive to take such action. The incentives can be wide-ranging, and would depend on your specific situation.

If you have a late payment in one of the first few months with a new creditor, you might be able to make a compelling case by offering to set up automatic payments. As a new client with a late payment right out of the gate, your creditor might jump at the opportunity to set up automatic draws to lock in future payments.

If you suddenly came into some money through a large bonus or an inheritance, and you have a late payment on a long-standing account with a large monthly balance, you might consider offering to pay down a large portion or even the full amount of the outstanding debt in exchange for their agreement to remove the late payment.

Not all creditors will agree to these kinds of negotiations, but if you think strategically about what might interest the creditor in making a deal, this could be an option worth pursuing.

Negotiate Removal By Offering To Sign Up For Automatic Payments

I have never actually tried this method myself, but from what I understand creditors frequently offer to remove late payment entries if you, in exchange, agree to sign up for automatic payments.

This strategy works well for both parties: the creditor can ensure future on-time payments will be made, and you dont have to worry about remembering to make payments or being charged late fees if you forgot to pay by the due date.

Of course, automatic payments are only good when you have the money in your bank account to cover the transaction.

I would love to hear from those of you who have succeeded with this method!

UPDATE: Several readers have verified that this method did work for them, so try this next if a goodwill letter doesnt work.

Also Check: Is 779 A Good Credit Score

Ask The Lender To Remove It With A Goodwill Adjustment Letter

This is a straightforward way to get a late payment removed from your credit report. In some cases, creditors are willing to make a if your payment history has been good or if you have a good relationship with them.

The process is easy: simply write a letter to your creditor explaining why you paid late. Ask them to forgive the late payment and assure them it won’t happen again. If they do agree to forgive the late payment, your creditor will adjust your credit report accordingly.

Requesting A Goodwill Adjustment Via Phone

If you hate writing letters, youll be happy to know that you can apply for a goodwill adjustment and have your late payment removed via phone calls. Like writing goodwill letters, no guarantees exist that your creditor will agree to your request over the phone. However, you can increase your chances of success by being polite during your call and taking responsibility for your late payment.

Also, before starting your call, make sure you have all the information you need to support your request. If your phone call convinces your creditor to remove the late payments from your credit reports, make sure to get the agreement in writing.

After removing a late payment from your credit report, your creditor must forward your updated payment history to the relevant consumer reporting agencies.

Don’t Miss: Syncb/ppc Credit Inquiry

What Is A Credit Charge

Banks, lenders and credit card companies will write off an account balance after a certain amount of time of nonpayment. That account balance is now a bad debt and referred to as a charge-off.

The time-frame of an account balance going to a bad debt is usually 180 days of non-payment. The creditor can no longer keep the debt on their books as an asset and therefore write it off as a bad debt.

But this does not mean you no longer owe the debt. The account may be transferred or sold to a collection agency and a negative credit mark will be entered on your credit reports by the creditor and the collection agency.

Charge-offs are difficult to remove but there are ways to dispute a charge-off which may result in it being removed from your credit report. You can request a creditor to substantiate each and every fact they are reporting about the charge-off. Demand that they prove a particular fact about the listing or delete it.

Unpaid charge-offs can also lead to a legal action. The original creditor or collection agency can pursue legal action as long as the debt is within the statute of limitations. After the statute of limitations has run, a debtor can no longer be sued and the debt basically becomes uncollectible.

The best way to handle a charge-off is with a legitimate dispute of an error in reporting.

Get A Free Copy Of Your Credit Report

The Fair Credit Reporting Act promotes the accuracy and privacy of information in the files of the nations credit reporting companies. Monitoring your credit report is a necessary practice to keep in check any negative information. Consumers should obtain their free credit report and review it at least once a year to catch any irregularities on time and keep track of disputed items.

Consumers are entitled by law to a free annual credit report from each of the three main reporting bureaus: Equifax, Experian, and TransUnion, and you can access all three of them through one single website:

AnnualCreditReport.com is the only authorized website through which you can gain free access to your credit report from the three major bureaus. Be wary of other sites that promise the same, as they may have hidden fees, try to sell something, or collect personal information.

| Mail: Download, print, fill out, and mail to: |

| Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281 |

Equifax made headlines in 2017 due to a massive data breach, but it remains one of the top 3 services to get your credit report. The company provides a few different service levels if you want to monitor your credit score monthly . Monitoring packages start at $14.95 per month, and the $19.95 per month options include, ironically, a host of identity-theft protection options.

You May Like: Credit Score 524

Repayment History Information What Is It How Do I Manage It

Repayment History Information is information about whether you have repaid credit on time. RHI can only be collected on credit regulated under the;National Consumer Credit Protection Act 2009;, not utilities and other debts.

If you are paying on time you will get a 0 . Some credit reporting agencies put a tick mark instead of a zero. If you are behind in your repayments you will get a number from 1 to 7 indicating how many months you are behind in your repayments. If you are more than 7 months behind there will be an X.

You have a grace period of 14 days from the payment due date to make the payment, before any late payment is recorded on your credit report. The lateness of the payment is updated every 29 days. The 1 to 7 scale indicates how many months the payments have been overdue.

IMPORTANT:;RHI is different to a default listing. You do not get any notice when a RHI listing is made you need to check your credit report.