Can You Use Your Car Insurance To Help Build Credit

Even though the insurance company will not directly report to the credit bureau, there are some clever ways that you can use your car insurance and payments to help raise your credit score or maintain a good one, as mentioned in Wallet Hub.

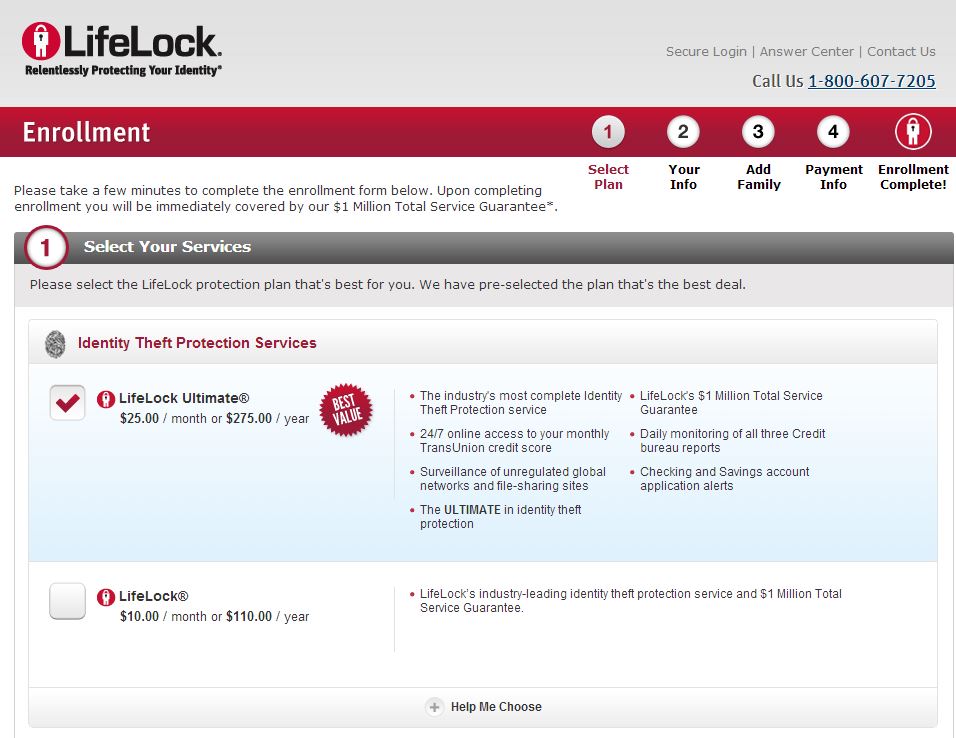

One option is to make your premium payments on a credit card and pay the balance off each month. Your credit card company will then report these on-time payments to the credit bureau, where they will benefit your score. You can also set your credit card as the default payment for payment, which can sometimes give you a discount on your monthly premium.

Why Do Insurers Check My Credit Score

Insurance companies check your credit score in order to gauge the risk theyll take to insure you. Studies have indicated that those with lower credit scores are likely to file more claims or have more expensive insurance claims, while those with higher credit scores are less likely to do so.

If you have a low credit score, youll often pay a higher premium than if you had a high credit score. Having a higher credit score can pay off in a number of ways besides lower insurance premiums, though. And getting your is as simple as exercising good personal finance habits.

But your credit score isnt the only thing that affects your insurance premium depending on the type of insurance youre looking for, your driving history, geography, property value and claim history can all affect how much youll pay per month.

Free Auto Insurance Comparison

Secured with SHA-256 Encryption

|

Mathew B. Sims is Editor-in-Chief and has authored, edited, and contributed to several books. He has been working in the insurance industry ensuring content is accurate for consumers who are searching for the best policies and rates. He has also been featured on sites like UpJourney. |

Written byMathew B. Sims Editor-in-Chief |

|

Dan Walker graduated with a BS in Administrative Management in 2005 and has been working in his familys insurance agency, FCI Agency, for 15 years . He is licensed as an agent to write property and casualty insurance, including home, auto, umbrella, and dwelling fire insurance. Hes also been featured on sites like Reviews.com and Safeco.He reviews content, ensuring that ex… |

Also Check: 611 Credit Score

How Can I Improve My Credit Information If I Have Been Adversely Affected

Find out which credit information factors had a negative impact on your credit score. Your agent or company may be able to tell you up to four factors that had the most impact on your score.

Insurers and credit scoring model developers suggest several ways to improve your credit score:

- Dont try to quick fix your credit overnight or you could end up hurting your score. Instead, understand that the most important factors generally are: late payments, amounts owed, new credit applications, types of credit, collections, charge-offs, and negative items such as bankruptcies, liens and judgments.

- Create a plan that will improve your credit over time. Pay your bills on time. Pay at least the minimum balance due, on time, every month. If you cannot make a payment, talk to your creditor. Work to reduce the amount you owe, especially on revolving debt like credit cards.

- Limit the number of new credit accounts you apply for. Several applications for credit in a short time will usually have a negative effect on your credit score.

- Keep at it. Your credit information will improve over time if you make changes now and continue to improve. If you show good credit behavior over time, your credit score may improve as a result.

If Im Late Paying My Car Insurance Will It Affect My Credit Score

On the bright side, while your insurance doesnt help your credit score, it also wont hurt your credit. But there are some major ramifications to missing car insurance payments:

In the worst case, if you dont pay, your car insurance may be canceled. If you drive without active insurance, you could get in trouble with the law if you get pulled over. Even if you are rear-ended by someone else, you could get a ticket for driving without insurance. In some states, you could incur a large fine, drivers license suspension, or even jail time for driving without insurance.

If you get a ticket for driving without insurance and dont pay your fine, it could be sent on to collections. In that case, driving without insurance would negatively affect your credit, since collections show up as a major bad mark on credit reports.

Read Also: Is 672 A Good Credit Score

Can You Get Affordable Insurance Rates Without Great Credit

Don’t panic if you’re looking to apply for insurance without an exceptional credit-based insurance score. Credit-based insurance scores are only one of the many factors that insurance companies use when determining rates.

For example, if you’re applying for auto insurance, your driving history, car age and mileage, and zip code could all be additional factors considered. So with a low-risk car type and stellar driving record, you may still qualify for great insurance rates despite a below-average credit-based insurance score.

Clint Proctor

Clint Proctor is a freelance writer and founder of WalletWiseGuy.com, where he writes about how students and millennials can win with money. His work has been featured in several major publications including Business Insider, U.S News and World Report, Yahoo Finance, and Forbes.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

How To Report To Creditsafe

If your business wants to report information on your clients payment histories, you can join . To take advantage of this free program, you will claim your business on their website and then authenticate through one of many commonly used accounting tools, such as QuickBooks, Freshbooks or Xero. With most accounting tools, this will automatically submit relevant tradelines, removing the need for manually submitting them each month. Note: Creditsafe has a manual option for adding tradelines that is not self-service, although fees may apply to that service.

If you are a business owner looking to add accounts you pay on a regular basis to your own Creditsafe business credit report, you can take advantage of Creditsafes free Stay Safe program. This will allow you to add tradelines to your business credit reports. Youll also get access to free business credit monitoring along with other benefits. Get started here.

Read Also: Capital One Authorized User

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

What Can I Do To Improve My Credit

Things like the length of your credit history can only change with time however, you can always strive to improve your overall credit-based insurance score and credit score by paying your bills on time and maintaining a low balance on your credit cards.

But remembera credit-based insurance score is only one of many factors used to determine insurance premiums. Other things like driving safely and responsibly are also important if you’re looking for ways to reduce insurance costs.

Recommended Reading: Does Affirm Show Up On Credit Report

Insurance Inquiries Do Not Hurt Your Credit Score

When an insurance company checks your credit, a record of the credit check will be added to your credit file. You’ll see this credit inquiry if you review a copy of your credit report, but because it’s a soft inquiry, it won’t impact your credit scores. In contrast, hard inquiries, the type that can come from applying for a new loan or credit card, can slightly hurt your credit scores temporarily.

Because applying for auto insurance doesn’t impact your credit, you don’t need to worry about rate shopping and submitting multiple insurance applications. You may even want to get quotes for a new policy every six months to a year to ensure you’ve still got the best deal.

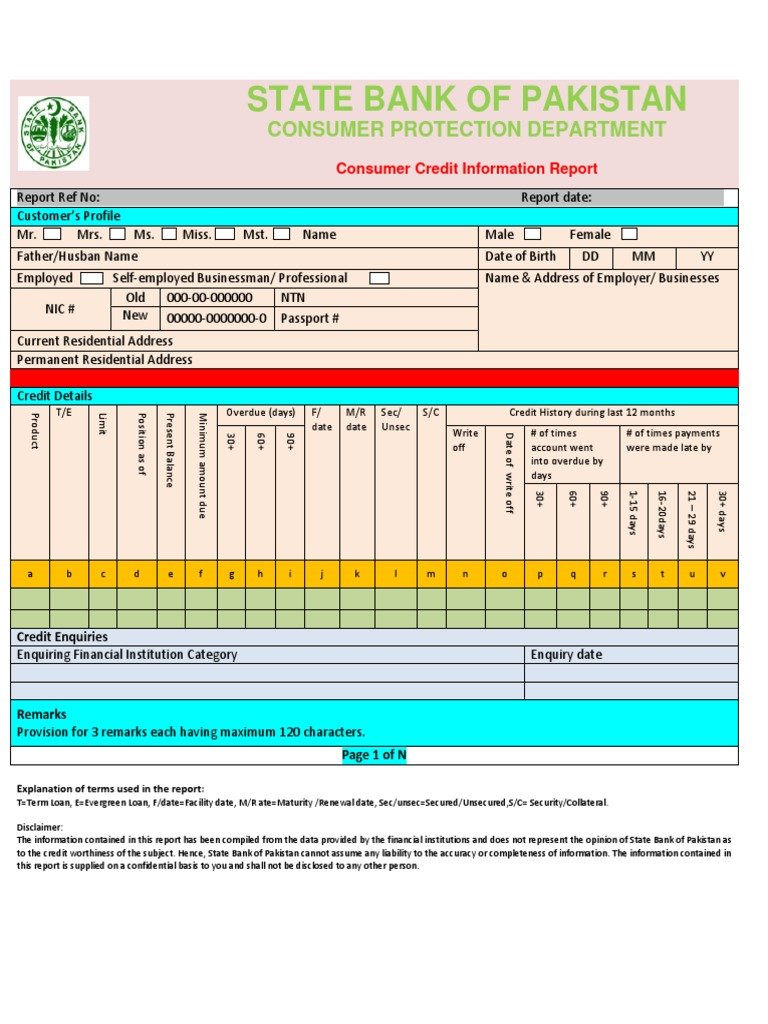

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Recommended Reading: Zzounds Payment Plan Credit Check

What If My Credit Report Is Wrong Can You Tell Me What Is On My Credit Report

If there is an error on your credit report, contact the consumer reporting agency directly and notify them of any discrepancy. Once they correct their records, please contact us and we will be happy to re-evaluate your quote.

If your GEICO quote was adversely impacted by your credit-based insurance score, we will share with you the name and address of the consumer agency that provided us with the information that was used to help determine your rate. We will include contact information for the consumer reporting agency so that you can contact them for a copy of your complete credit report. To protect your privacy, our sales and service agents do not have access to your credit information.

If you’d like to review your credit report, you are entitled to one free report each year from each of the three major credit bureaus: Experian, Equifax, and TransUnion. For the most accurate understanding of your credit, you should review the reports from all three bureaus annually.

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Don’t Miss: Syncb Amazon Credit Inquiry

Why Knowing When Credit Card Companies Report To Credit Bureaus Is Important

Knowing when credit card companies report to credit bureaus can clear up some confusion you may have with your credit reports. Have you ever checked your credit reports and seen a balance, but you know you pay off your card every month in full?

This is likely because credit card companies provide a snapshot of your current balance when they report to the credit bureaus.

So, if youre concerned about how this snapshot of your balance may affect your credit, consider keeping tabs on your spending by your statement closing date. You could also make a payment before your statement closing date, so your balance is lower when its reported. Keeping a low balance can help your credit overall.

Why? Because when it comes to your credit scores, one important factor is your credit utilization.

Get Familiar With Your Credit

While your credit-based insurance score is different from your typical consumer credit score, what’s found in your credit report will still play a role in how it’s calculated. Getting home insurance won’t have a negative impact on your credit, but if your credit is in bad shape, you may find it difficult to get approved for coverage, or you may be charged a higher insurance premium. If you’re planning to buy a home soon and haven’t checked your credit in a while, check your credit report for free through Experian to get a sense of where you stand. If it needs some help, you can spend some time working to improve your credit before you begin the homebuying process.

Recommended Reading: Does Opensky Report To Credit Bureaus

Auto Insurance Discounts For Good Credit

Since paying your auto insurance premium is necessary for being able to maintain the required auto insurance in your state, it makes sense to try to pay as little as possible for sufficient auto insurance coverage for you.

If you are hoping to get the lowest premium possible on your auto insurance, you should ask your auto insurance directly about discounts that may be available to you.

In addition to trying to get as deep of a discount as possible, consider installing anti-theft devices on your car or signing up for driver safety courses if your auto insurance company tells you that those things could make a difference in reducing your premium.

Every auto insurance company offers discounts differently, so it is always best to check with your specific auto insurance company to see what kind of discounts you can get on your auto insurance.

Policyholders are eligible for several discounts. Some providers will give an auto insurance discount based on good credit history. Individuals with good credit are less likely involved in automobile accidents, have little to no claims, and can make timely payments to premiums.

What Information Is Included In A Credit

Like your credit risk score, your credit-based insurance score is based on credit report data. Examples of the types of credit categories that could influence your insurance score include:

- New credit

Note, most insurance providers also use internally developed methodologies that consider other non-credit bureau related data.

As credit-based insurance scores are based on credit bureau data, errors in your credit bureau report could impact your credit-based insurance scores. As such, it’s a good practice to frequently check your credit reports for accuracy and dispute erroneous information.

Recommended Reading: Zzounds Credit Approval

How Getting Car Insurance Quotes Can Affect Your Credit Score

Getting a quote for car insurance won’t affect your credit score.

When you ask for a quote, insurance companies will run a soft check at most.

It’s only when you apply that a hard check comes into it. And again, that’s only if you pay monthly.

When you take out an insurance policy, you’ll be given a 14-day ‘cooling-off period‘ in which you can change your mind.

If you do change your mind and decide to go with another insurer, the first hard check will be on your record, and you’ll have another one for your new application.

That might be a problem if you’re trying to improve your credit score.

What To Do If You Have A Low Score

You should never just accept a low credit score. Start by checking your credit report to find the details that may be holding your credit back. You may find some negative items that you were not aware were there. If you have unexpected collections, see if you can make arrangements to settle them. If you see any discrepancies, file for a correction.

Don’t let bad credit affect your insurance premium rates. While paying your car insurance on time will not boost your credit, there are other ways to improve it to help lower your premium rates.

Check this out if you need additional information, resources, or guidance on car insurance.

Recommended Reading: Opensky Billing Cycle

If You Pay Your Auto Insurance Bill Late Will You Be Charged A Late Fee

If the company is nice enough to offer you a few more days or a few more weeks to pay, you cant forget that missing your payment will cost you. Not only do you have to catch up your auto insurance premiums, youll also likely be charged a late fee on your next months invoice, which is still due on its normal due date.

The actual fee for being late depends on the carrier that youre with. With most companies, the fee is fixed and will range between $15 and $50.

Heres a video on how you can communicate with your auto insurance provider to maintain your credit and dispute late payments.

The actual fee for being late depends on the carrier. A late car insurance payment with Progressive may be different from missing a payment with State Farm. With most companies, the cost is fixed and will range between $15 and $50.

Some companies will charge a late fee based on the number of days that youre late. This type of fee can add up quickly and make maintaining your coverage with the same carrier difficult.