Make The Most Out Of Your Credit Score 757

Now if the financing company is not providing you with the lowest possible interest rate that you can have, then move on to the next. There are a lot of lenders out there that give an excellent rating for people with a credit score of 757. That is why it would be best to be patient and shop around more.

What Affects 757 Credit Score Negatively

When dealing with a credit score, any negative information will cause it to get lowered. This is not ideal for anyone. However, there are many ways that a person can work to boost their credit score and make it more positive. Even though you are at a 757 FICO credit score, you can still maintain or even grow that score by following some credit-worthy tips.

Dispute any negative reports that are on your credit report that you did not make or that are untrue. Disputing these and then having them cleared from the report helps.

Always make on time payments to uphold the credit score that you have.

Keep the credit usage to around 30% of what you currently have available. You can go a small amount above this, but make sure to pay it off so that it is below the 30% mark.

Take out loans responsibly to make sure that you are able to afford the payments that come with them.

Keep accounts open, the longer the account is open, the better it will have an impact on the credit score in a positive way.

Refrain from opening up many new accounts over the years, as the newer ones can negatively impact a credit score.

Keep the amount of times that your credit is hard checked in balance. Hard inquiries on your score can cause it to go down a few points.

Have a good mix of debt loans, vehicles, mortgage, credit cards and other credit. Having a mix shows youre good and responsible with all types of debt.

What A Credit Score Of 757 Can Do For You

The first thing to do when you have an excellent credit score is to try and negotiate your loan interests. With an excellent credit score, you will be attractive to lenders, and some will still want to pull you their way. Therefore this is an opportunity to negotiate your loans and bargain for excellent interests. Due to your excellent credit score status lenders are likely to reduce their interest rates so as to do business with you. They know you will pay back on time. The interest rate you pay throughout a lifetime of loan is significant, more especially when you bargain a loan.

Also Check: How To Remove Hard Inquiries Off Credit Report

Understanding Mortgage Credit Scores

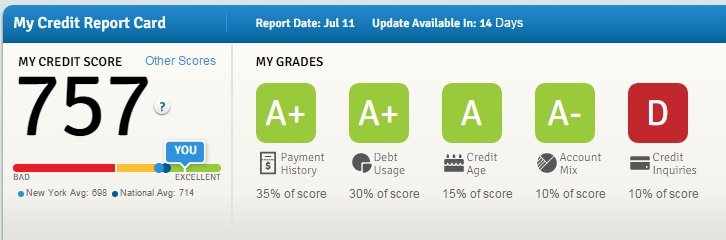

Your credit report is separate from your credit score, though the score is developed from the report. In addition to viewing credit reports from the three major reporting bureaus, you also should obtain your FICO score. Your score is like a report card. Fair Isaac & Co. assigns you a number based on the information in your credit report. Since there are three credit-reporting bureaus, you have three FICO scores. Here are the scoring factors:

Smart Tips To Improve Your Cibil Score

-

Dont be a co-signer for a loan unless you dont need to borrow around the same time

-

Avoid acquiring too many debts over a short period of time

-

Ensure you repay all your EMIs and credit card bills on time

-

Use debt consolidation loans as and when necessary so that your dues arent handed over to a debt collection agency

-

Be cautious about borrowing loans without a proper repayment plan in place

-

Always negotiate your rate of interest with lenders to keep your costs down

-

Dont borrow the entire amount you receive a sanction for

-

Choose a shorter loan tenor to repay your loan fast and at a lower interest payment

-

Talk to a CA or financial planner to get help on saving taxes and managing your money more efficiently

-

If you dont have any credit history, borrow a small personal loan and repay it on time to build a credit score

Now that you know everything from A to Z about your CIBIL credit score, be smart about your financial practices. Try to keep your CIBIL score high and youll be able to access funds on your terms.

Recommended Reading: What Credit Report Does Paypal Pull

Fico Score Vs Vantage Score

The three major credit bureaus created the Vantage Score back in 2006 to compete with Fair Isaac Corporations FICO credit score model. Since then Vantage Score has released several new credit score models, including Vantagescore 3.0 and 4.0.

While the Vantage Score has grown more popular and is easier to check, thanks to free credit monitoring services like Credit Sesame, both your FICO score and your Vantage Score work to reveal your credit behavior.

The credit score ranges are very similar, although Vantage Score does have a category for perfect credit .

If you earn an improvement within one of these credit score models, you will almost always see the same result with the other model, too especially if you have a shaky credit history and have a couple years of work to achieve a good credit score.

Your Fico Score: Just One Piece Of The Puzzle

Id like to conclude this post by offering a little perspective. You may want a perfect credit score, and if you do I suggest you go for it.

But theres more to your personal finance life than perfect credit. Different lenders consider criteria other than your credit history when you apply for a loan or a credit card.

Your debt-to-income ratio, for example, could disqualify you for some of the best credit cards and loan options. This ratio measures how well youre able to pay your current bills with the income youre bringing in.

Your employment history could matter to some lenders, too. Just like with the length of credit history, a longer employment history works in your favor.

If you work to create the most stable personal finance life possible, your FICO score will fall into place, and youll stay at the top of the credit score range.

Don’t Miss: How To Unlock My Experian Account

Dont Apply For Loans Or Credit Cards For At Least A Year

Once youve paid down your installment loans, I suggest you stop applying for loans and credit cards altogether. By this point, you should have a few credit cards in your wallet, a couple of paid off cars, and a mortgage.

When youre in this position, there is really no need to apply for more credit.

By not applying for credit, you wont get any hard inquiries on your credit report and this helps your credit score. If you need to apply for credit, just keep in mind the hard inquiries will stay on your credit for about a year.

Again, you should be in a situation by this point where you dont need anymore credit.

Measuring Your Credit Score

Measuring your credit score is something that has to be done. Every specific credit bureau has a different way of measuring the score. Some measure to 850 while others will measure to 830 and so on. Each one is different and while one might record one default on their records, another might not and so on.

With the three major credit reporting agencies: TransUnion FICO, Equifax and Experian, you can be sure that you have all of the information you need. Youre allowed to have a free print out of your credit score every year from each of these three bureaus. If youre ever curious about what is on your report or ways that you can find out what you can do to fix your report, printing a copy and reading it is the best way to find out more about it, as well as report anything that shouldnt be on the report.

Don’t Miss: Can You Remove Hard Inquiries Off Your Credit Report

Key Things That You Must Know About Credit Score

If you are new to the concept of credit or CIBIL score, you may have several questions about how it works, what impacts credit score, etc. Here are some of the additional aspects you must know about credit score.

1. You can check your credit score and get a credit report for free

Most credit bureaus and third-party websites provide credit scores for free. You can sign up with them and check your credit score for free at any time. It is good to check your credit score frequently to keep a close watch on your credit health. While checking your credit report, you can look for any errors and get them resolved by raising a dispute with the credit bureaus.

2. Not everyone has a credit score

A credit score is available only after an individual takes some form of credit from banks, NBFCs or online lenders. This can include credit card, personal loan, home loan, two-wheeler loans, loan against property, gold loan, car loan, etc. If you have never borrowed before, you would not have any credit score.

3. Factors that Make your Credit Score

If you are wondering how a credit score is calculated, you must know that it is based on factors such as your repayment history, credit utilisation ratio, credit age, credit mix and number of hard enquiries, etc. You will have a good credit score if you have a good combination of all of these factors.

4. It takes time to build an excellent credit score

5. Poor credit score can be improved

6. Checking your own credit score doesnt hurt it

Growing Your Score Of 700

There are some cases you might have grown from lower credit score to higher credit score. If you took a mortgage with a credit score of below 600, you are in good position to go back to the bank to negotiate you montage. Take advantage of excellent credit score to refinance your montage, finish paying lower interest rates with the new loans on offer for you, more so, financial advisors will tell you that you need to use excellent credit to save money. The good news with giving money is that you will still grow your credit score to perfection. Aim at 850 and the way to do that when at 757 is an opportunity that you have.

You May Like: How To Get Credit Report Without Social Security Number

The Issuer Thinks Youre A Card Churner

Some issuers shun potential borrowers who appear to sign up for cards and ditch them soon after they earn bonus rewards. For example, Chase denies many of its cards to applicants who have opened five or more accounts from any bank or issuer within the past 24 months a practice informally known as the 5/24 rule.

Additionally, Bank of America is rumored to limit customers to no more than two of its cards in two months, three cards in 12 months and four cards in 24 months. Other issuers such as Citi and American Express also have restrictions designed to cut down on the number of times cardholders can get their sign-up bonuses.

Dan Mahoney, president of True Square Financial in Atlanta, said card churning rules have nothing to do with your risk of missing a payment while juggling many card accounts, but rather your lack of loyalty to a specific card.

It reflects the banks belief that customers who frequently open new cards are less profitable, because they tend to move on to the next hot product after a few months, he said.

What Is A Good Credit Score To Avail A Home Loan

To avail a home loan, you need to ensure that you have a CIBIL score at least above 650. Since a home loan is a secured loan, lenders have the option of seizing your home if you are unable to repay the loan. This is why a slightly lower credit score is allowed. However, it is in your best interest to maintain a good credit score so you can get a larger loan amount at nominal interest.

You can maintain a good CIBIL score by following these simple steps:

-

Pay your EMIs on time to create a proper track record

-

Avoid having a credit card that you dont use cancel dormant credit cards

-

Manage your credit cards carefully by setting payment reminders or limit your use to one credit card

-

Avoid re-applying for loans or credit cards that you did not get approved for in quick succession

-

Dont make too make loan applications in a short span of time

-

Choose lengthy loan tenors with care and try to make part-prepayments when you can

Recommended Reading: Does Klarna Affect Your Credit Score

Wait Wait Then Wait Some More

You simply have to be patient. Even when you make all the right decisions, itll take some time to see results.

Part of your score relates directly to the length of credit history. But even on more important credit reporting factors such as your payment history and credit utilization ratio, time is your friend.

This is especially true if your past credit behavior has been questionable. With each passing year, your past bad decisions have less of an impact on your current credit information.

So be patient and continue making good decisions to establish a positive credit history, even if you dont see immediate results.

Keep making your payments on time and make sure you dont get any negative entries like a collection account. And let your current credit accounts grow older. The older your accounts, the better your credit score can be.

For example, my oldest credit card is 15 years old, and my average credit card is 8 years old.

Learn More:

How Is A Credit Score Calculated

Whenever you apply for credit, lenders will look at information from your credit report, application form, plus any information they hold on you . All this data is then used to calculate your credit score. Every lender has a different way of calculating it, largely because they all have access to different information but they also have different lending criteria.

Generally, the higher your score, the better your chances of being accepted for credit, at the best rates.

like ourselves, calculate a version of your credit score. How each CRA calculates this varies but there are certain factors they all consider, including – how much you owe, how often you apply for credit, and whether your payments are made on time. You can read more about the factors that influence your score in our guide to what affects your score.

Also Check: Syncb Ppc

How To Keep On Track With A Very Good Credit Score

Your 767 credit score means you’ve been doing a lot right. To avoid losing ground, be mindful of avoiding behaviors that can lower your credit score.

Factors that can have negative effects on Very Good credit scores include:

Utilization rate on revolving credit Utilization, or usage rate, is a measure of how close you are to “maxing out” credit card accounts. You can calculate it for each of your credit card accounts by dividing the outstanding balance by the card’s borrowing limit, and then multiplying by 100 to get a percentage. You can also figure your total utilization rate by dividing the sum of all your card balances by the sum of all their spending limits .

| Balance | |

|---|---|

| $20,000 | 26% |

Most experts recommend keeping your utilization rates at or below 30% on individual accounts and all accounts in totalto avoid lowering your credit scores. The closer any of these rates gets to 100%, the more it hurts your credit score. Utilization rate is responsible for nearly one-third of your credit score.

Late and missed payments matter a lot. More than one-third of your score is influenced by the presence of late or missed payments. If late or missed payments are part of your credit history, you’ll help your credit score significantly if you get into the routine of paying your bills promptly.

37% Individuals with a 767 FICO® Score have credit portfolios that include auto loan and 38% have a mortgage loan.

What Matters Most For Vantagescores

VantageScore prefers not to use percentages to describe how much weight it gives various , as FICO does, but instead describes them in terms of influence.

Payment history is extremely influential, while age and type of credit and the percentage of credit used are highly influential.

Total balances and debt are moderately influential, and recent credit behavior and debt are less influential.

However, VantageScore has also broken down its contributing factors this way in the past:

-

Payment history: 40%

-

Recent credit applications: 5%

-

Available credit: 3%

Still, the factors that matter most in FICO scores are also the most heavily weighted for VantageScores. For both, the single most important thing consumers can do to help their scores is to pay on time.

Recommended Reading: Carmax Financing With Bad Credit

How To Get A 756 Credit Score

Theres no secret for getting a 756 credit score. Rather, it simply requires consistency and commitment. You need to pay your bills on time, use only a portion of the credit made available to you, and generally work to make any mistakes youve made look like freak occurrences rather than standard practice. You also need to know exactly where youre starting from and then actually track your progress over time to hold yourself accountable. So make sure to regularly check your latest credit score for free on WalletHub as you work your way to a 756 credit score.

You can find specific recommendations for what we recommend doing in your situation on your personalized credit analysis page. And below, you can check out some of the most common steps people need to take to get a credit score of 756.