Why The Data Matters

Whether your credit is poor or pristine, all three of your credit scores from Equifax, Experian, and TransUnion will reflect similar scores, yet differ ever so slightly.

Being on the cusp of fair to good credit could make all the difference in getting accepted or rejected for a loan or credit, especially if, for example, your Equifax report reflected the poorer end of your credit history.

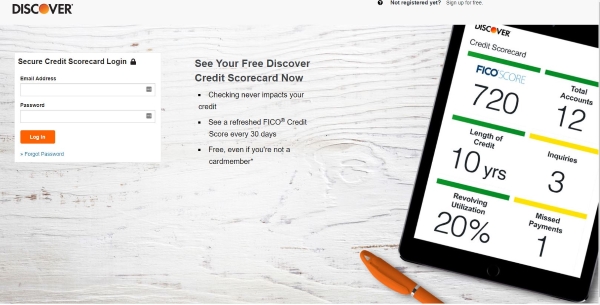

And in the case of Discover, a credit card provider with high approval standards, its imperative to have stellar credit when seeking out a card from their portfolio.

Were here to help you identify which credit report and credit bureau are the most applicable for affecting your approval rate for a provider like Discover.

Noting that, taking the steps to boost your credit through all three credit bureaus keeps your credit healthy, plus greatly improves your chances of approval the most for any loan or credit product you pursue.

How Do You Check Each One

You can get access to your reports in the following ways:

Experian

- You can get free access to your Experian score and report as often as you like through ClearScore. to see your score now.

- Everyone is entitled to one free statutory credit report a year through Experianâs CreditExpert service.

- Alternatively, you can pay R21 for a monthâs subscription or R145 for a yearly subscription.

- Your Experian score ranges from 0-705.

TransUnion

- You can get access your TransUnion report once a year for free.

- You can get a one off report for R40 or you can pay R40 per month for a subscription.

- The TransUnion score can range from 0-999.

Compuscan

- Again, you can get one free report a year from Compuscan.

- You can also purchase a one-off report for R25 or you can choose from 3, 6 and 12 month paid plans.

- Alternatively, the Credit4Life consumer club gives you access to your report for R99 per year.

The National Credit Act means that everyone is entitled to get their credit report free of charge, once a year from every credit bureau. Itâs definitely worth taking advantage of this and checking in with each credit bureau.

Once youâve done this, youâll have a good idea of your overall financial situation and you can fix any mistakes. To do this on ClearScore you can raise a dispute directly with Experian.

How Often Is My Credit Report Updated

If youre working to improve your credit or watching for a specific change to your , you probably want to know how often your credit report updates. Being able to predict how your credit reportand ultimately your credit scorewill change is a concern for anyone who knows the importance of having good credit or anyone who hopes to be approved for a major loan soon.

The timing of credit report updates largely depends on when lenders, credit card issuers, and other companies you have credit accounts with send your account information to credit bureaus. If you have multiple accounts with several businesses, your credit report could update daily.

Read Also: Bp/syncb Pay Bill

A Quick Note On Credit Utilization

One way to improve your credit is to pay down revolving debt, such as credit cards, says Endicott.

You may pay down your debt and not see an improvement right away. Before applying for any new credit, you may want to make sure your lower balances are reflected on your credit. Keep in mind that many factors determine your credit scores, and paying down your revolving debt doesnt guarantee higher scores.

How Does A Security Deposit Work

Cardholders must deposit at least $200 to their Discover it® Secured Credit Card account. Your credit limit will be equal to the amount of money you deposit.

Afterwards, this card will operate just as any other credit card. Youre not allowed to use your security deposit towards your monthly payments. Instead, the security deposit will be used to pay off your balance in the event that you become delinquent in your obligations. As long as your account remains in good standing, and you pay off all your debts, you can always get the security deposit back by closing your account.

Don’t Miss: How Do I Get A Repo Off My Credit

When Will My Credit Score Change

Once the changes appear on your credit report, the credit bureaus factor the new information into your credit score and the next time you pull your credit score, those updates will be reflected. That doesnt necessarily mean that every credit report update will move your credit score.

Whether or not your score changes depends on the information updated, the credit scoring model, and other information on your credit report. Youll notice the most significant credit score changes from activity like late payments or a change in your credit-card balances.

Keep in mind that not every company reports to all three major credit bureaus. Since your credit score is based solely on information in your credit report, some of your credit scores may not update at all despite your actual account activity.

How To Check Your Credit

Being in the dark about your credit, but applying for credit anyway, could mean risking rejection, unaware that your credit isnt up to par. Or, it could mean knowing that your credit is exemplary, just the ammunition you need to be confident about applying for loans and credit products that are more competitive.

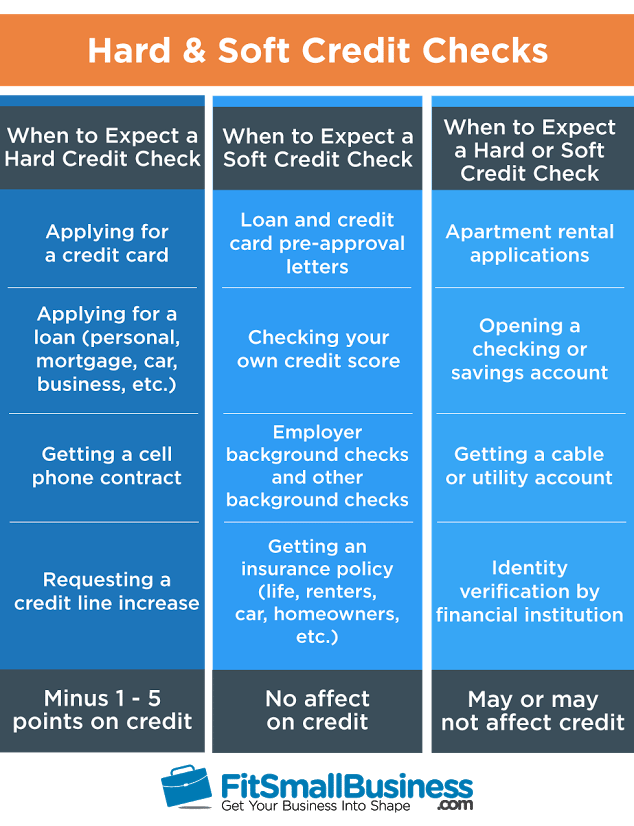

Start by checking your own credit. Dont worry, it wont drop your credit score. Discover pulling your credit through Equifax will affect your credit slightly, but a self-check is known as a soft pull that has zero effect on your score.

One legitimate and free resource is AnnualCreditReport.com, the only official credit report database authorized by the U.S. government itself, so theres no need to fret about scammers soliciting your credit card or personal information. The site provides you with your full, detailed credit report aggregated from Equifax, Experian and TransUnion alike.

Keep some of these tips in mind when accessing your credit report:

You May Like: How To Remove Child Support From Credit Report

Bogdan Roberts Credit Cards Moderator

Citibank reports to the credit bureaus once a month, typically 30 days from the statement closing date. So, if your billing cycle ends on the 15th of every month, Citibank will report information on your credit card balance on or around that date.

But when the information Citibank reports to credit bureaus actually appears on your credit report is a different story. Credit bureaus, in theory, report the balance on your Citibank credit card as soon as it’s received. Realistically, it can take up to a week, or sometimes up to two months, or billing cycles, for a new account.

It’s important to know when Citibank and other banks report to the credit bureaus. If you’re trying to boost your credit score in order to make a major purchase such as a mortgage, you’ll want to make sure any positive information is reported. Also, if there’s a dispute on your Citi credit card account that’s been resolved, you’ll want to confirm that information is removed.

The problem is, not all issuers report your activity, positive or negative, to credit bureaus. Those that do, may not report to all three of the major credit bureaus. Citibank reports to all three of the major bureaus: Equifax, Experian, and TransUnion.

Also, consider paying your Citi credit card bill well before your statement closing date. That way, the snapshot of your balance will be lower when it’s reported. A low balance helps your , which in turn, boosts your credit score.

How Credit Updates Work

The businesses you have accounts withcredit card issuers and lenderssend your updated account information to the at different times throughout the month based on their own schedule. Information in your account updates includes your current balance, payment status, and credit limit. New inquiries to your credit stemming from any applications youve submitted are also reported to the credit bureaus. After receiving updates, credit bureaus compile that information and adjust your credit report accordingly.

You can dispute inaccurate or incomplete information to remove it from your credit report. If you dispute an item, the results of a dispute will update as soon as the credit bureau completes the investigation. This credit bureau has 30 days to complete its investigation and, in some cases, may have an extra 15 days to investigate.

Also Check: How To Remove Repossession From Credit Report

When Is That Reflected In Scores

Every time one of your creditors reports on one of your accounts, that information is available to be calculated into your score. The current crop of scores are calculated based on the data available at the time a score is ordered. So, if a score is not ordered or requested, it is not updated until one is. FICO has a new generation of scores to be released soon that include more than a snapshot and instead use trends to develop a score.

According to an Experian article about zero balances, the length of time it will take for a zero balance to appear will depend on how close the payment is made to the reporting date. If you make the payment right after information has been updated, it could be 30 days or more before the balance is reported.

Conversely, if you make the payment just before the reporting date it could be just a short time before the update is made, Experian notes. Keep in mind that the reporting date is not your due date.

The reporting date is not always easy to find out, but you can ask the lender for that information. This can be helpful if you are planning a payoff that you are hoping will increase your score quickly.

See related: Get on the fast track to a good credit score

How Often Your Credit Report Changes

Because creditors that report to credit bureaus are continuously updating your information, your credit report can update as often every day or more than once a day. That doesnt mean all your accounts are updated daily, though. The businesses you have accounts with report to the credit bureaus at different times throughout the month.

Once your creditors provide the information to the credit bureaus, it doesnt take long for updates to appear on your credit report. Since most lenders send credit information electronically, updates sent to the credit bureaus will often show on your credit report immediately. However, its also possible not to see any credit report updates if none of your account information has changed significantly.

Most negative marks disappear from your credit report after seven years.

Some send an alert whenever your credit report information changes, which can provide insight into when your creditors send updates to credit bureaus.

Read Also: How To Remove Repossession From Credit Report

You Can Keep Your Credit Utilization Low

Your the percent of your credit limit youre using at any given timecan also help establish a good credit history if you keep it low. Plus, your length of credit history will grow as you use the card over time.

Most credit cards report all of this information to the three national credit bureausExperian, Equifax and TransUnionat least once a month. The credit bureaus maintain these records in your , which are then used to calculate your credit score.

The Problem With Credit Reporting

Looking to establish your credit history or boost your credit scores before buying a house or making a large purchase? Youll want to make sure your positive credit history is reported.

But heres the thing: Not all lenders report your activity to credit bureaus. If they do, they might not report to all three of the major credit bureaus, either. Credit reporting is a voluntary practice, and credit card companies dont always reveal which credit bureaus they report to. Some companies, like Capital One, explicitly state that they report your credit standing to the three major credit bureaus. Others may not reveal that information so openly.

All in all, its best to keep your credit in good standing across the board. You can do this by making on-time payments in full and keeping your balances low.

Also Check: Does Titlemax Report To Credit Agencies

High Balance On Credit Report

In addition to your last reported credit card balance, your credit report also includes a high balance. This balance is the highest balance ever reported to the credit bureaus for that credit card account.

The high balance remains the same each month unless a higher credit card balance is reported. While some creditors and lenders may include the high balance in a manual evaluation of your creditworthiness, this balance isn’t currently included in your credit score.

When Do Companies Report To Bureaus

Since the credit bureaus update the reports and scores that lenders use update 24 to 48 hours after companies report to them, it could prove helpful to break down when this typically occurs.

Reporting cycles run every thirty days , with some industries holding to month-end for all customers, while others process segments throughout the month for efficiency reasons.

Recommended Reading: What Is Syncb Ntwk On Credit Report

What Goes Into My Free Credit Score And What Doesn’t

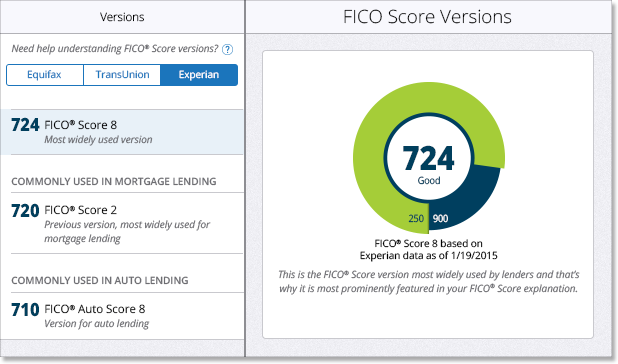

When you or a lender “check your credit,” a scoring model from either FICO® or VantageScore® is applied to the current data in one of your credit reports. Your score will vary, depending on which FICO® or VantageScore® version was used and whether it looked at your credit report from Experian®, Equifax® or TransUnion®. Your credit score can vary month to month or day to day as new data get sent to your credit reports.

NerdWallet uses VantageScore® 3.0 and your TransUnion® credit report data. Most lending decisions are made using the FICO® model. If you have a good VantageScore®, you may also have a good FICO® score and both will respond to the same basic rules for managing your credit score. That’s because they consider similar factors, with some differences in how they weight them:

Payment history:Age of credit history:Applications:Type of credit:

Discover It Secured Credit Card Benefits And Features

Unlike a lot of secured credit cards, the Discover it® Secured Credit Card comes with a rewards program.

Cardmembers get 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, 1% unlimited cash back on all other purchases – automatically.

In this way, the Discover it® Secured Credit Card is similar to the Discover it® chrome.

You May Like: Does Paypal Credit Report To Credit Bureaus

What Category On The Vantagescore Or Fico Credit Score Range Your Credit Score Currently Sits

If your score is very low, even a small sign of improvement in your payment history and reducing card balances might increase your credit relatively fast. But it will take more than paying your credit card bill on time for a month or two to really move your score into a range that’s considered good enough to get unsecured credit cards:

- Developing a solid payment history

- Keeping your card balances at less than 30% of each card’s credit limit

When Do Credit Card Issuers Report To Credit Bureaus

Essential reads, delivered weekly

Your credit cards journey is officially underway.

Keep an eye on your inboxwell be sending over your first message soon.

It would make sense to assume that your activity is reported at the end of each billing cycle. However, according to Experian, every lender reports to the bureaus following its own schedule. Typically, it happens every 30 to 45 days.

This runs counterintuitive to how most people understand credit reporting, says Ty Stewart, CEO at Simple Life Insure. People tend to think of the big three bureaus almost like Big Brother, constantly monitoring your every financial move and immediately aware even when you swipe your card at a nearby Starbucks. This isnt accurate. The three bureaus are completely reliant on reports generated by creditors themselves.

Furthermore, its rare that creditors send out the reports to all three bureaus Experian, Equifax and TransUnion on the same day. That means information on your credit reports regarding your credit card usage can differ, which is one of the reasons why your multiple credit scores dont match.

See related: My credit score is 776 and 815 and 828?

Tip: Late payments only get reported once youre at least 30 days past your due date. This means your late payment wont show up on your credit report unless it has reached a 30-day mark. If it has, you can expect it to appear on your credit report within a month or two.

Also Check: Is Paypal Credit Reported To The Credit Bureaus

Summary Of Capital One Reports Business Credit Activity

Capital One reporting your business credit activity to your personal credit reports can temporarily penalize your credit situation. You will need to be smart with how you use your Capital One business credit card and time your future credit card applications. Having another best small business credit card can give you more flexibility in building business credit with minimum effect on your personal credit.

Get Familiar With Your Score

Because credit scores can change so frequently as new data gets added or removed from your credit reports, checking yours daily or weekly isn’t necessary. Free credit monitoring from Experian can alert you to changes in your credit report and scores, so you can more quickly take action if necessary. These regular updates will give you a chance to look over what has been reported recently, see bigger-picture trends and help you understand how your credit habits help shape your credit score.

Also Check: Will Paypal Credit Report To Credit Bureaus