Can You Get A Personal Loan If You Have Bad Credit

Yes, you can get a personal loan if you have bad credit. Some lenders even specialize in bad credit loans.

Consider a peer-to-peer lender that accepts a lower credit score and focuses on work and education history instead when deciding whether to loan you money. If you belong to a credit union, it may have more lenient borrowing criteria than some larger banks or financial institutions.

If youre having trouble getting approved for a personal loan on your own, you can apply with a cosigner who has good or excellent credit. Adding a cosigner to your loan application can make it easier to qualify for a personal loan and help you secure a lower interest rate.

Does Credit Score Matter Differently If Buying A New Vs Used Car

Whether youâre buying a brand new car or a used car, your credit score will have a similar impact. Loans for new cars sometimes have better interest rates than used cars, but a borrower with good credit will typically get a good interest rate regardless of the type of car they choose.

For example, according to Experian, borrowers with a credit score of around 700 would pay about 4.68% for a new car compared to 6.04% for a used car.

If you buy a reasonable, reliable used car with a slightly higher interest rate, youâll still probably save a bundle compared to buying a brand new car with a lower interest rate. New cars cost more than used cars and lose most of their value when you drive them off the lot. Even with higher interest rates, buying a used car is typically a better financial decision.

In either case, you are usually better off buying a car with a loan than choosing a car lease. With a lease, you are effectively renting the car and have to give it back and the end of the lease unless youâre willing to make a big payment to buy it outright. When you buy with a loan, you own the car in the end and can choose to sell it or keep it for years to come.

Am I Eligible For A Personal Loan

Many lenders typically require that you have a credit score of at least 600 and a debt-to-income ratio no more than 35%. However, since each lender is different, youll need to research the lenders youre interested in to understand the specifics.

If you dont meet a lenders personal loan qualifications because of your credit score, consider looking into bad credit loans.

Also Check: How Long Are Collections On Credit Report

What Credit Score Is Needed To Get A Personal Loan

Your credit score is extremely important when it comes to qualifying for a personal loan as well as what interest rate you receive.

When lenders evaluate your loan application, they want to see that you have a history of paying off your debt. Because your credit score is the primary indicator of your debt and repayment history, it is a key factor in determining if you will qualify for a loan and how much interest you will have to pay.

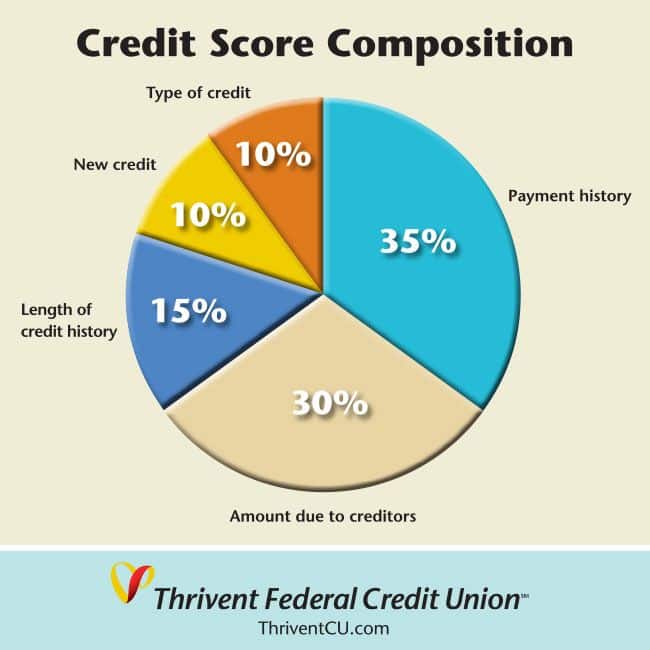

The most commonly used credit score system is FICO, with scores ranging from 300 to 850. Your FICO credit score is determined based on your payment history, total outstanding debt, the length of your credit history, your credit mix and any new debt youve taken on. Payment history is weighed the most heavily in determining your credit score, along with your total outstanding debt.

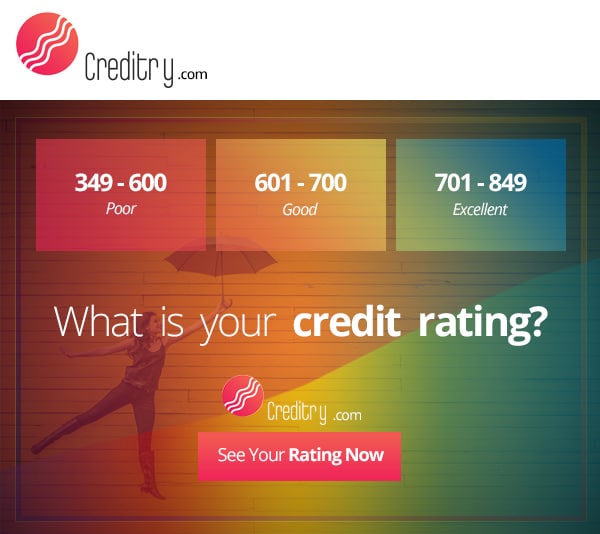

Generally, borrowers need a credit score of at least 610 to 640 to even qualify for a personal loan. To qualify for a lenders lowest interest rate, borrowers typically need a score of at least 690.

Is 599 Good Credit Score To Buy A Car

You should be able to get a car loan with a 599 credit score without a problem. Truthfully, people can get a car loan with almost any credit scorethe difference will be what kind of interest rate you can secure. A score of 599 may get you an interest rate of between 11.92 percent and 4.68 percent on a new car loan.

Also Check: How Long Does Debt Settlement Stay On Your Credit Report

What Are The Minimum Credit Requirements To Receive A Loan

To the extent the applicant has a credit score, the applicant has a score of 300 or above on at least one of the consumer reports received in connection with their application, or insufficient history to generate a credit score on each consumer report

In addition, there cannot be any material adverse change in your credit report from the time the loan was offered to you and your funding. Material changes include significant drops in your credit score or additional debt obligations. If this occurs, your loan approval will be withdrawn.

Meets the minimum debt to income requirement that total monthly debt payments listed each of the consumers credit report not including rent or mortgage must not exceed 45% if the applicant resides in Connecticut, Maryland, New York or Vermont, and 50% in all other states, of projected pre-tax income except that such requirement will not apply to applicants that have been accepted to one of our partner institutions that provides vocational training

No bankruptcies on any of their consumer reports within the last 12 months

No public records on any of their consumer reports within the last 12 months, unless the public records consist only of paid civil judgments or paid tax liens

You must also not have on your report any accounts that are currently delinquent.

You must have fewer than 6 inquiries on your credit report in the last 6 months, not including any inquiries related to student loans, vehicle loans, or mortgages.

Name: TransUnion

Applying For A Personal Loan In 5 Steps

Recommended Reading: Why Does Credit Score Matter

Best For Military Members: Navy Federal Credit Union

- Time To Receive Loan:1 Days

- Loan Amount:$250 – $50,000

-

Repayment terms of up to 180 months

-

No minimum credit score requirement

-

Only available to credit union members

-

Must submit a full application to see if you qualify

-

Membership limited to military members, their families, and DoD civilians

Besides not having a fixed minimum credit score requirement, which is a nice feature for borrowers with fair credit, Navy Federal Credit Unions rates and terms set it apart from the competition. You can also get repayment terms of 36 to 180 months, and APRs range from 7.49% to 18% with no origination fees.

Plus, its easy for members of all branches of the armed forces, their family members, and civilians working for the Department of Defense to apply for membership to Navy Federal Credit Union. Its loans are also available in all 50 states.

While Navy Federal doesnt disclose its requirements to qualify for a loan, its customary for lenders to want their borrowers to demonstrate the ability to pay back the loan. This means you likely shouldnt have any actively past due debts and you should have enough income to comfortably repay your debtmeaning your debt-to-income ratio should be fairly low.

Raise Your Credit Score

It’s a good idea to get your score as high as possible before you apply for a personal loan. Remember, the higher the credit score for a personal loan, the more likely it is your lender will approve a low interest rate.

The fastest way to raise your credit is paying off debt. You can also check for errors on your credit report. The three credit bureaus — Equifax, Experian, and TransUnion — are each legally required to provide you with one free copy of your credit report per year upon request. Read through your credit reports, and if you find a mistake, notify the credit bureau that issued the report.

Don’t Miss: How To Unfreeze Your Credit Report

What Loan Features Should I Compare Before Taking Out A Personal Loan

Before finalizing a personal loan, compare common fees and costs.

- Interest rates: Check both the interest rate and the annual percentage rate, or , of the loans youre considering. APR will include any fees and interest and give you an idea of the affordability of your loan.

- Fees: Fees can add up, so check for common ones such as fees for late payments, payment processing and any prepayment penalty for paying off the loan early. Factor in loan origination fees, which are fees for issuing the loan and are usually a percentage of the amount youre borrowing.

- Loan term: Compare how much time youll have to pay off the loan and the size of your monthly payments.

- Loan amount and total interest: For each loan, calculate the total amount you would pay in interest over the course of the loan.

- Co-signer or joint applicant option: Check whether each lender will allow you to add a co-signer or to apply jointly with another person. Having a co-signer with better credit than you may help you get approved for a loan you wouldnt qualify for otherwise or may help you get a better interest rate.

How Do You Apply For Personal Loans

When youve shopped around among lenders and found the right one, youre usually able to apply online and can often get a decision within minutes. However, some small local banks or credit unions may require you to visit a branch to apply for a loan.

When you apply for a personal loan, youll need to submit personal information, including your Social Security number and other relevant info. Lenders check your credit and either approve or deny your loan. Theyll also let you know the specific loan terms youve qualified for. Pay attention not only to the monthly payments, but also any fees youll have to pay and how long youll have to pay off the loan.

Also Check: Which Credit Score Do Lenders Look At

How Paying Off A Car Loan Could Affect Your Credit Score

With the categories of FICO information in mind, there are a few reasons why paying off yourcar loan could adversely affect your score.

The amounts you owe category is the biggest one that is affected. Specifically, your loans never have as much positive impact on this part of your credit score than when theyre almost paid off. In other words, if you only owe 1% or 2% of your original balance, its a major positive factor . After you pay the loan off, you lose this positive factor the status changes to paid loan on your credit report.

Your length of credit history category could also possibly suffer, especially if your car loan was originated more than a couple of years ago. After all, paying off your loan can eliminate an established account from the calculation. Among other things, this portion of your score considers the average age of all of your reporting credit accounts, so if a paid-off loan causes your average to decrease, it could certainly be a negative factor.

Recommended Reading: How To Tow A Car

What Credit Score Is Needed For A Personal Loan

It’s possible to get a personal loan with a lower credit score, but a FICO® Score that falls in the good range or higher will give you access to a broader array of lenders and better interest rates.

A personal loan is an unsecured loanone that doesn’t require property to be put up as collateralthat can be used for just about any purpose you choose. Loan amounts typically range from $1,000 to $10,000, and popular uses include debt consolidation, covering medical expenses, and financing once-in-a-lifetime events such as weddings, honeymoons and dream vacations.

You May Like: When Does Navy Federal Report To Credit Bureau

Enhancing The Credit Mix

The credit score always takes into account the credit mix. Credit mix is the diversification of differenttypes of credit loans you’re currently paying. If you add a personal loan to that mix, it will positivelyimpact the credit score as it shows that you have experience handling different credit types.

When a personal loan is used to pay off credit cards or other loans, it will help increase your creditscore, thus improving your mix in terms of usage. So, paying down all of the debt that you currentlyhave with a personal loan will help improve your credit score.

You may read this: Difference between Credit score and Cibil score

Consider Bringing Your Own Financing

While dealerships do provide financing, checking with your local bank or credit union is a good idea, too. You can even compare car loan rates online. Compare quotes from the top potential lenders and, once youve settled on your top choice, you can get preapproved to make the process run smoothly,

Keep in mind that getting financing results in a hard pull on your credit. It helps to cluster applications closely together when rate-shopping for a loan.

If you end up with a loan with a higher rate than you wanted, keep an eye on your scores. You may be able to refinance your auto loan at a lower rate after youve made on-time payments for six to 12 months.

Don’t Miss: What Are The Credit Score Companies

Other Factors That Affect Personal Loan Eligibility

While your credit score plays a significant role in determining whether you will qualify for a personal loan, lenders also will take into account other factors, including:

- Collateral, if any

Your DTI ratio measures how much of your income goes toward paying debts each month. Lenders calculate this ratio by adding up your monthly debt payments and dividing that number by your gross monthly income. In general, financial institutions prefer to lend to applicants with a lower DTI ratio, as it can signal to lenders whether youd be able to manage your new debt.

Debts such as student loan payments, auto loans, mortgages and child support payments are included in your DTI ratio. Lenders prefer to see a ratio of 35% or lower.

What If I Have A Poor Credit Score

Several lenders offer personal loans for bad credit. This means you could still have a chance of approval even if your credit is less than stellar though remember that these loans usually come with higher interest rates compared to good credit loans.

While many reputable lenders offer loans to people with bad credit, you should also be aware that some lenders prey on people with poor credit who need to borrow money. Do your research to make sure youre working with a reputable lender, and avoid predatory lending at all costs.

Tip:

A cosigner can be anyone with good credit such as a parent, another relative, or a trusted friend who is willing to share responsibility for the loan. Just keep in mind that this means theyll be on the hook if you cant make your payments.

Before applying for a personal loan, be sure to shop around and consider your options from as many lenders as possible. This way, you can find the right loan for your needs.

This is easy with Credible. Below youll find our partner lenders that offer personal loans for bad credit you can compare your prequalified rates from each of them in just two minutes.

| Lender |

|---|

| All APRs reflect autopay and loyalty discounts where available | LightStream disclosure | 10SoFi Disclosures | Read more about Rates and Terms |

Read Also: What Credit Report Do Apartments Look At

How Do I Know If I Will Qualify For A Loan

Each lender has their own personal loan eligibility requirements youll need to fulfill. Just because you dont qualify with one lender doesnt mean others wont be willing to work with you. Lenders typically list their basic personal loan requirements on their websites, so you can sometimes find out whether youre likely to qualify without ever having to apply. Here are a few of the criteria youll need to look out for:

- Minimum credit score

Personal Loans For Fair Or Bad Credit

Borrowers with credit scores below 669 have fair or bad credit, which lowers their chances of qualifying for a personal loan. But there are certain lenders who cater to these borrowers. Most will charge higher interest rates and offer lower loan amounts than they would for borrowers with good or excellent credit.

Lenders who specialize in borrowers with fair credit include Upgrade, Wells Fargo, Avant, LightStream, Marcus and Rocket Loans, to name a few. Borrowers with bad credit can apply for a personal loan with Upstart, Lending Club, Wells Fargo, Avant and Upgrade.

Also Check: Is Annual Credit Report Safe