Removing A Collection Account Will Usually Raise Your Credit Score

Its always good to stay on top of all three credit reporting agencies. When you contact a collector for settlement, you should try to agree with them to a payment for deletion. There is a good chance it will help to boost your score. You have to check whether you paid the collection or remove the collection account, in both cases how many point you can earn.

In this regard you have two options: 1) A mortgage company can pull your credit in the last 30 days and they can run such simulation. or 2) you can sign up in a three bureau-monitoring site for;www.privacyguard.com;and run the analysis.

These scores are consumer scores, not the FICO score but it helps you to decide which collection should you try to pay or delete based on the potential score improvement. Of course, there may be another reason to pay for a collection. But if you are looking for score improvement, follow the instruction above or call us we always use these tools. Not all agencies will agree to pay for deletion.

Dont Close Off Any Old Credit Accounts

Length of credit history factors into your credit score. Dont close off any old credit cards or lines of credit unless you specifically have a reason to. Old accounts that have been responsibly paid off are good for your credit health. For example, you may have opened a few credit cards years ago and dont use them anymore. Keeping these accounts open can help you get and maintain high credit scores.

How Can I Raise My Credit Score 10 Points Fast

Getting a 10 point boost on your credit report is a cinch.;

Unlike a 200 point increase, 10 points can be achieved by choose to act on one of the tactics below.;

Thats not the same for a higher increase, which would require both of these tactics and more to see a significant rise.;

What matters most is that you know the basic rules of :

Once you understand those rules you can actually pick and choose which factor would help you to raise your score the quickest.;

Also Check: Does Klarna Affect Your Credit Score

How Long It Takes To Raise Your Score

The length of time it takes to raise your credit score depends on a combination of multiple aspects. Your financial habits, the initial cause of the low score and where you currently stand are all major ingredients, but theres no exact recipe to determine the timeline. Thanks to studies done by CNBC and FICO, weve compiled the typical time it takes to bring your score back to its starting point after a financial mishap. The following data is an estimate of recovery time for those with poor to fair credit.

| Event | |

|---|---|

| Applying for a new credit card | 3 months |

What My Improved Credit Score Allowed Me To Do

In August of 2011, I had to purchase a car so I could switch jobs.

When I filled out the credit application to see if I qualified for lower financing rates, my credit score came back as 731.

In other words, I raised my credit score from 621 to 731 in just five months!

This is a very big deal because, at 621, I would have been denied a loan for the car, or would have had an interest rate that exceeded 9% on the auto loan.

Since I chose to get a secured credit card, I was able to take the car loan on my own and;qualify for the low rate of 3.99% financing.

The difference in the loan between the two interest rates would be $750 over the life of the loan, far surpassing the cards annual fee, and the opportunity cost of my secured credit card holding my $1,100 for five months.

Also Check: Why Is There Aargon Agency On My Credit Report

Keep Your Credit Information Up To Date

Another good strategy for how to raise credit scores involves updating credit card companies with any increases in your income. Higher income improves your ability to make payments on time, according to lenders. Informing lenders of your higher income makes it easier for them to grant you a credit line increase, which in turn increases your available credit, decreases your DTI ratio and can raise your scores.

Simple Letter Format For Disputing Items On Your Credit Report

The Consumer Financial Protection Bureau has an easy format with phrasing that will force these agencies to respond. It recommends mailing a copy of any documentation you have, along with your credit report from the agency and a copy of your drivers license or government-issued ID card.

Using this simple letter format, youll strike fear into the heart of Big Brother:

Be sure to request a receipt copy so you have proof that your mailing was received.; Therefore this simple step is the secret to winning against collectors in court. So it can save you literally thousands of dollars or more on your debts.

This is especially necessary with Equifax, which is known to be the most difficult of the three agencies to deal with. So if these agencies dont respond the way theyre required to by law , dont hesitate to fight Big Brother with an even bigger partner the government. Because the credit score Affects your life in many ways. What to do if the credit reporting agency refuses to fix your credit report. Read our blog about what next if the dispute with CRAS not solved within 30 days.

Dispute the debts directly with your creditors and also can force-creditors-to-validate-debt.;Now were going to discuss the secret to defend yourself against collectors. Get excited, because your life is about to change! And this is how your credit score will increase gradually.

Follow this step when starting disputing:-

1. When disputing, start with closed accounts.

Also Check: Aargon Collection Agency Address

Increase The Length Of Your Credit History

The longer you have a credit account open and in use, the better it is for your score. Your credit score may be lower if you have credit accounts that are relatively new.

If you transfer an older account to a new account, the new account is considered new credit.

For example, some credit card offers come with a low introductory interest rate for balance transfers. This means you can transfer your current balance to this new product. The new product is considered new credit.

Consider keeping an older account open even if you don’t need it. Use it from time to time to keep it active. Make sure there is no fee if the account is open but you don’t use it. Check your credit agreement to find out if there is a fee.

Lower Your Credit Utilization

Credit utilization is the ratio of the balance you have on your credit card compared to your credit limit. This factor also plays a key role in your credit score. Balances over 70% of your total credit limit on any card damage your score the most. The general rule of thumb is to shoot for a

There are two ways you can lower your credit utilization:

1. Reduce the balances on your credit cards.

2. Raise the credit limit on your cards.

Keep reading to find out how to raise your credit limit.

Recommended Reading: Ccb/mprcc On Credit Report

How Do Experian Transunion And Equifax Calculate Credit Scores

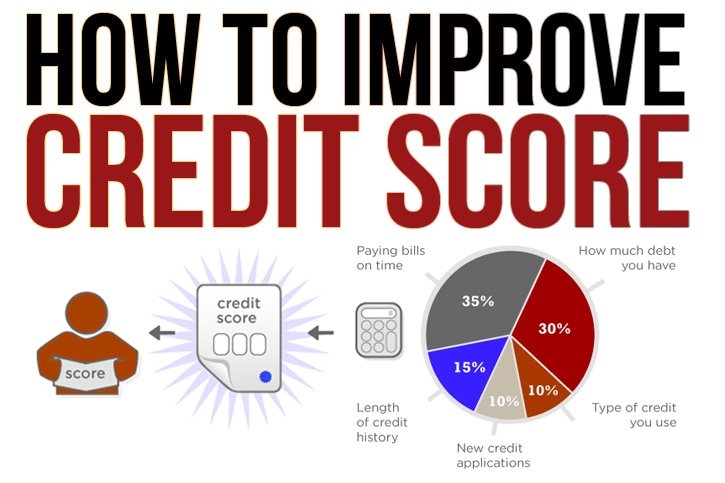

FICO score criteria rely on various factors to come up with viable details about your creditworthiness. The credit bureaus use the following method to come up with your score.

i) Payment History

How have you been paying your loans and other debts? Have you been paying on time? Your payment history contributes a significant percentage in your FICO score. For your information, your past payment pattern takes 35% of your entire score. Good payment history can be a sure way on how to improve credit score in 30 days.

ii) Credit Utilization Ratio

How much do you spend on your credit card? Do you spend all your credit on your card or just half of it? Credit utilization ratio refers to the total credit spend, divided by the total credit limit, multiplied by 100. The larger the percentage, the lower your score, and vice versa. Credit Utilization Ratio occupies 30% of your score. Keep the ratio at 15% or lower.

iii) Length of credit history

How old are your accounts? Recent bank accounts have lower scores as compared to old scores. You should keep your credit accounts for as long as possible. In this way, your rating will remain high. The length of a credit history occupies 15%.

iv) Credit Mix

v) New accounts

When opening new accounts, banks inquire about your . Too many inquiries can lower your score. However, with time, the inquiries may cease to affect your FICO score. New accounts contribute to 10% of your credit score.

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Read Also: Aargon Collection Agency Reviews

Apply For New Credit Only When Necessary

Try as much as you can to apply for a new credit card only when you need it. Having few credit cards boosts your credit score.

Constant applications for credit raises a red flag for lenders because they see it as risky behaviour. Before you apply for a new card, ensure its necessary and, if possible, avoid debt.

Pitfalls To Avoid When Working On Your Credit Scores

When it comes to building credit, its easy to get overly focused on ways to raise your credit scores fast. The truth is that building credit takes time. So take a step back and make sure your strategy doesnt do more harm than good.

Here are a few donts to keep in mind.

- Dont apply for a bunch of new credit cards just because you want to increase your credit utilization. Even though this might help lower your credit utilization ratio, it could also make you look like a risky borrower thanks to the new hard inquiries on your reports.

- For the same reason, dont take out a loan just to improve your credit mix. Only apply for a new loan if you actually need it.

- Dont carry a balance on your credit card just so you can build credit. Carrying a balance can lead to unnecessary interest charges, and it might actually hold your scores down by increasing your credit utilization ratio.

- Dont cancel your credit card after you pay it off unless you have a good reason to do so. Closing your credit card will hurt your length of credit history, so its better to leave it open, even if youre not using it anymore. Of course, if having a card tempts you to spend more, or it comes with an expensive annual fee, you might want to rethink this conventional wisdom.

Recommended Reading: How To Remove Items From Credit Report After 7 Years

Get Current On Delinquent Accounts

Dont allow past due accounts to keep dragging your score down. Bring all your delinquent accounts current so the lenders and creditors can stop adding negative marks to your credit report each month. If the past due amount is too large, reach out to a member of their customer support team and request a payment arrangement. You may also qualify for a hardship program that will allow you to get back on track without doing more damage to your credit score.;

How Do You Get Your Credit Report

If you want to get your credit report, you need to visit any of the three credit agencies and get your report as well as scores. A credit report is free, and it is your right to get it. However, for the scores, you have to purchase them. It is good to take a credit report from all the credit agencies and compare them. If you want free credit scores, you can get them from or at Credit Karma.

Recommended Reading: Check Credit Score Without Ssn

Keep Credit Cards Open

If;you’re racing to improve your credit profile, be aware that closing credit cards can make the job harder. Closing a credit card means you lose that cards credit limit when your overall credit utilization is calculated, which can lead to a lower score. Keep the card open and use it occasionally so the issuer wont close it.

Keep Credit Card Balances Low

If you want to maintain a healthy credit score, its important to keep your credit utilization ratio low. At the very least, your credit utilization ratio should be below 30%, but between 2% and 9% will help you optimize your score..;

You can calculate this number by dividing your total debt by your total available credit. For instance, if you owe $6,000 in debt but have $30,000 in available credit, your credit utilization ratio is 20%.;

One easy way to lower your credit utilization ratio is to request an increase in your credit card limits. Increasing your limits will automatically improve your credit utilization ratio, assuming you dont add more debt.;

This can be a better approach than applying for a new credit card account since the credit inquiry will likely lower your score by a few points.;

You May Like: Does Zzounds Report To Credit Bureau

How To Raise Your Credit Score Fast

The quickest way to raise your credit score is unearthing an error in your credit report. If erroneous information somehow was entered in your credit report or you are the victim of fraud, you can dispute the debt. Notify one of the credit bureaus immediately and provide the correct information or evidence that you were defrauded.

Once the incorrect information is changed, a 100-point jump in a month might happen. Large errors are uncommon, and only about one in 20 consumers have one in their file that could impact the interest on a loan or credit line. Still, its important to monitor your score.

Get someone with a high credit score to add you to their existing account. The good info theyve accumulated will go into the formula for your score. It doesnt hurt to ask and explain how you might benefit. If you can make it happen, you could see a quick, significant jump in your credit score.

Another quick way to improve your score is to make payments every two weeks instead of once a month. The increased payments method helps reduce your credit utilization, which is a huge factor in your score.

Along those same lines, ask your card company to raise your credit limit. If you go from a $1,000 a month to $3,000, you help the credit utilization part of your score again, because you have more spending room.

If you are applying for a second or third credit card, only make one application a month. Applying for two or three at a time will result in multiple .

More Information About Late Payment Negotiation

Here is an example for you. Susans middle-aged woman, her husband told her that he would no longer be able to work to medical issues. It is going to take months to get disability and in between the time, we will have very little income. We are not behind our bills yet, but next month we will not be able to make our minimum payments. So what should we do?

Answer: Call your creditors and explain the situation. Many issuers will help you work out an alternate payment plan or agree to waive a late fee or holding of reporting 30-day delinquency to the credit bureaus.

Tips: If you miss the payment on accident, call your issuer to see if it will abstain from reporting it to the credit bureaus or save the late fee. Most credit card companies will agree to your request if your payment history is good enough.

So, if you really make a late payment recently. There is still a chance, you can remove it from your credit reports by Ask nicely for a goodwill adjustment or Negotiate with your creditor. Therefore, if you are not at fault, reports dispute the payment.

Now were going to discuss another secret that will help you with improving your credit. You should know how to deal with your old debt if you have any and;;How to Eliminate your Old Debt.

If you dont have an old debt, good then continue to read another secret on how to stop harassing calls from the collectors or how to optimize your debt ratio to game the system.; Get excited, because your life is about to change!

Read Also: How To Remove Inquiries Off Credit

Keep Your Balances Low

The sweet spot for credit utilization for credit scoring purposes is 30% or lower. Try to pay down the outstanding balances on your revolving accounts to this percentage. If 30% is a stretch, pay as much as you can to start seeing an increase in your score.;

You can also request credit limit increases to reduce this percentage without forking over a wad of cash. But heres the catch you must be disciplined enough not to use the card. Also, know that some credit card issuers perform a credit check to determine if youre eligible for an increase, which could lower your score by a few points.;

Have A Credible Credit History

A stronger history increases your credit score. Closing a credit account shows you cannot manage your credit which weakens your file and lowers your score.;

To increase your credit score by 100 points, do not be quick to close your unused credit accounts. Leave the records of fully-paid old debts on your credit report and leave credit cards open, even if you dont use them. Its a wise way of increasing your credit score.

You May Like: Speedy Cash Credit Check