Not All Suspicious Inquiries Are Fraudulent

Some inquiries may seem suspicious: You might not recognize the name of the company that made the inquiry, or there may be more inquiries than you expect. But those situations dont necessarily indicate a mistake or fraud.

For example, you may have used a loan broker that shopped around to try to find you the best rate possible on your loan. Each application the broker submitted on your behalf could lead to an authorized inquiry, even if you only took out one loan.

How Long Does Information Stay On My Equifax Credit Report

Reading time: 3 minutes

Highlights:

-

Most types of negative information generally remain on your Equifax credit report for 6 years

-

Closed accounts that were paid as agreed remain on your Equifax credit report for up to 10 years after they were reported as closed by the lender

-

Hard inquiries may remain on your Equifax credit report for 3 years

When it comes to credit reports, one of the most frequently asked questions is: How long does information stay on my Equifax credit report? The answer is that it depends on the type of information and whether its considered positive or negative.

Generally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, or a bankruptcy stays on credit reports for approximately six years. Here is a breakdown of some the different types of negative information and how long you can expect the information to be on your Equifax credit report:

Here are some examples of “positive” information and how long it stays on your Equifax credit report:

- Active accounts paid as agreed. Active credit accounts that are paid as agreed remain on your Equifax credit report as long as the account is open and the lender is reporting it. ;

- Closed accounts paid as agreed. If the last status of the account is reported by the lender as paid as agreed, the account would stay on your Equifax credit report for up to 10 years from the date it was reported by the lender as closed to Equifax.

Impact Of Identity Theft On Your Credit Report

Identity theft occurs when someone steals your personal information and uses it to apply for new lines of credit. If these new accounts go into default, they will appear on your credit report and hurt your score.

Cleaning up your credit after identity theft can take anywhere from a day to several months or even years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. Monitoring your credit report will help you to stay on top of potential fraudulent charges.

Read Also: Aargon Collection Agency Payment

Applying For Credit Hard Inquiries

When applying for new credit you will generally give your name, address, phone number and social security number. These are needed to accurately identify the correct credit record to pull.

Your credit application will require your signature, giving the lender or a financial consultant permission to access your credit file. You may be familiar with this approach if you have ever bought a car.

If you walk into the dealership, they will ask you to fill out a credit application before they allow you to test drive. You may be subject to multiple hard inquiries using this approach, as the dealership will shop around for the best deal for you. Events like this results in a hard pull.

After I bought my car from a national dealership, I viewed my credit report and saw eight entries. I immediately panicked because I was not aware that the dealers finance personnel petitioned that number of lenders.

After some research, I found that the FICO scoring models treated multiple inquiries for one type of loan as one inquiry, indicating that you were shopping around for the best rates. This method prevents your score from taking a complete nosedive.

How long do hard inquiries stay on your report? Hard inquiries impact your score for about a year, but generally fall off your report within 2 years.

The Only Way To Remove Accurate Negative Items On Your Credit Report

A year ago you went 45 days past due on a few of your bills when you lost your job. Luckily, you were able to find a new position quickly and catch up on the amounts you owed. Now youre ready to apply for a mortgage, but when you check your credit report yikes! Those negative items stand out like klieg lights, beacons attracting the wrong kind of attention you want from a mortgage lender.

So you do what every Internet-savvy person does: You Google how to remove negative items from credit report fast. After a few minutes of scanning consumer finance blogs and websites, you breathe a sigh of relief. All it will take is a campaign of goodwill letters to the creditors whove stamped your accounts with black marks. Surely theyll take mercy on you once you explain why you were late paying them and delete that informationafter all, other people with credit issues have had luck with this tactic. Why shouldnt you?

Unfortunately, a goodwill letter-writing campaign to erase accurate negative information from a credit report falls into the dont-believe-everything-you-read-on-the-Internet lesson book. Heres why:

If youve got negative information on your credit report thats inaccurate, then of course you should file a dispute with the credit reporting bureau where the information appears, being sure to include documentation that shows why the information is inaccurate.

So in short: time heals all, even a credit report.

Others are reading:

Also Check: Does Speedy Cash Report To Credit Bureaus

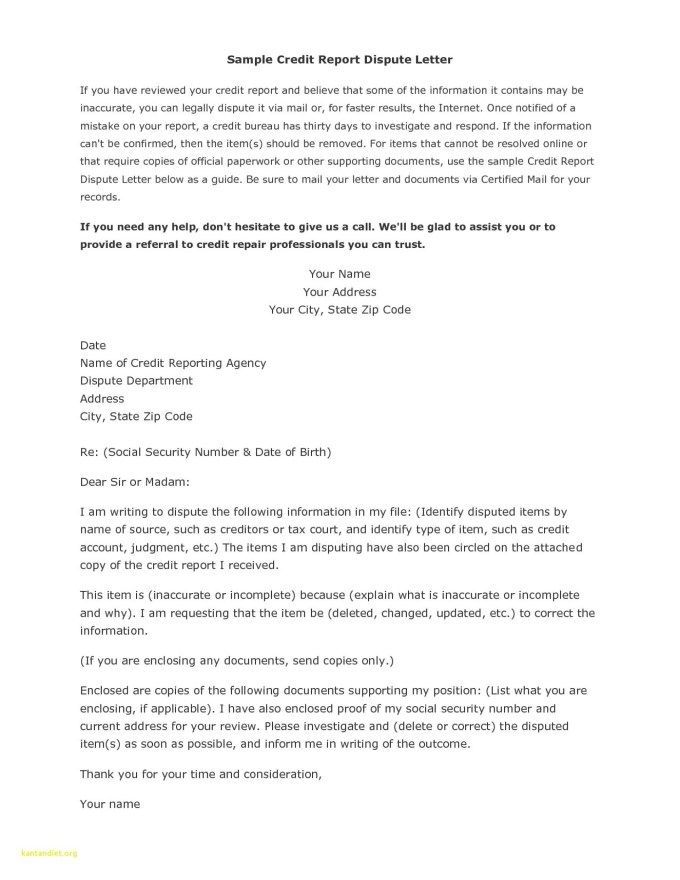

Submit A Dispute To The Credit Bureau

The Fair Credit Reporting Act is a Federal law that defines;the type of information that can be listed on your credit report and for how long . The FCRA says that you have the right to an accurate credit report and because of that provision, you can dispute errors with the credit bureau.

are easiest when;made online or via mail. To make a dispute online, you must have recently ordered a copy of your credit report. You can submit a dispute with the;credit bureau;who provided the credit report.

To dispute via mail, write a letter describing the credit report and submit copies of any proof you have. The credit bureau investigates your dispute with the business that provided the information;and removes the entry if they find that is indeed an error.

What Should I Send With My Letter

Its best to treat this like a trip to the DMV. Make sure you prepare;more than you think they would need in order to validate your claims and process your letter.

As a minimum, I would recommend that you include a copy of the report in question. Either circle or highlight items. This will make them easily identifiable for the investigators.

You should also send any supporting documents, like loan applications or rejection/approval letters. Using the letter sample, I would include the relevant application pages from Companies W, Y and Z.

You may even want to include personal identification items. This may include a copy of your drivers license. Its always better to send too much information. Too little could derail your efforts and prolong the process significantly.

I would encourage you to be aggressive in asking them to resolve the situation quickly. Ask for two or three weeks, but understand it may take them a bit longer than that.

Recommended Reading: Carmax Finance Companies

Removing Fraudulent Accounts And Inquiries From Your Credit Report

Any time a consumer discovers their bank account has been hacked, its a good guess that credit accounts could have been opened or credit card charges made fraudulently.

Therefore, in this situation, you will want to immediately check your credit reports from all three credit bureaus Equifax, Experian and TransUnion for any accounts or balances not belonging to you.

Should you find any such identity theft-related information on your credit reports, there are a few steps you can take to correct your credit file and keep you from being held responsible for debt that isnt yours:

Tip: Disputing negative items on your credit reports can be time-consuming and frustrating. Requesting a fresh report directly from the credit bureaus is just the first of 10 surefire steps to get errors off your credit reports.

Look For Unauthorized Or Incorrect Hard Inquiries

You can request to remove hard inquiries from your credit reports if

If you did apply for a credit account or authorize a hard inquiry, you cant remove it from your reports. It remains on your credit reports as part of an accurate representation of your credit history. If thats the case, it should fall off your reports after about two years.

Also Check: Innovis Consumer Assistance Letter

How Long Does It Stay On Your Credit Report

Inquiries remain on your credit reports for two years. However, the effect of the inquiry is only felt for one year at most. And usually the impact is gone after a few months. The impact is generally greater for someone with little data on their credit report than for someone who has an average or extensive history using credit.

How Credit Scores Are Affected By Hard Inquiries

When a hard inquiry is reported, be aware that you may see a minor decrease in your credit score. This decrease will last for about a year.

If you are in the market for a car or house and need to shop around for favorable loan terms, you should focus on keeping your inquiries within a 30-day time frame. All inquiries during this time frame will count as one, having a minimal impact on your score.

You may see a 1 to 5-point reduction in your score. However, continuing to pay on time and maintaining your good credit will result in a bad credit score increasing into the good territory over time.

Monitoring your credit utilization and refraining from obtaining new credit are other tactics to mitigate the effects of hard inquiries on your credit score.

I have found the point reduction to be minute in comparison to the decline in my score due to an increase in my credit card balance. With an inquiry requesting information on a car refinance, I saw a drop of two points. With the credit card balance increase, there was a on my report.

Recommended Reading: What Is Cbcinnovis On My Credit Report

Add A Consumer Statement

If the credit bureau confirms the information is accurate but you’re still not satisfied, submit a brief statement to your credit report explaining your position. It’s free to add a consumer statement to your credit report. TransUnion lets you add a statement of up to 100 words, or 200 words in Saskatchewan. Equifax lets you add a statement of up to 400 characters to your credit report.

Lenders and others who review your credit report may consider your consumer statement when they make their decisions.

Removing Bad Credit History With Credit Repair

Hiring a firm is another option for paying to delete bad credit information. Credit repair agencies essentially do the work for you by contacting the credit reporting agencies and providing objections to errors contained in the report or requesting that items that are untrue or incorrect be removed from the report, says McClelland. In this instance, youre not necessarily paying off any outstanding balances. However, you will pay a fee to the credit repair firm to act on your behalf in having negative information removed.

Also Check: Credit Report Without Ssn Or Itin

What Goes Into Your Credit Report

This is your first line of defense Knowing what information goes into your credit report can provide you an idea of your financial health and also identify if youve been the victim of identity theft.

To find out if the information on your credit report is correct, the three main credit reporting agencies allow you to obtain a copy of your credit report once a year.

Due to the current COVID-19 pandemic, all three credit reporting agencies are now offeringfree weekly online reports through April 2021; this should be your first step.

Next, you have to find out what information makes up your score and what factors can improve or negatively affect it. Finally, ask how you can improve your score. Usually, that information is provided to you as a list of risk factors when obtaining a copy of your credit report.

Rod Griffin, Senior Director of Public Education for Experian, said risk factors tell you exactly what you need to work on in your credit report to make those scores better.

Dispute Credit Report Errors

All three bureaus have an online dispute process, which is often the fastest way to fix a problem, or you can write a letter. You can also call, but you may not be able to complete your dispute over the phone. Here’s information for each bureau:

How to dispute Equifax credit report errors

-

Write to;Equifax, P.O. Box 740256, Atlanta, GA 30374-0256.

-

See our guide on;how to dispute your TransUnion credit report for details.

Read Also: Does Barclaycard Report To Credit Bureaus

What Should I Include With My Letter

Be sure to include a copy of the credit report page evidencing the credit inquiry. It also doesnt hurt to highlight the section, just so theres no mistake.

Otherwise, you run the risk of delaying the process and adding additional communications. Take the extra step ahead of time to save potential complications further down the road.

Strategies To Remove Negative Credit Report Entries

Negative details on your are unfortunate glaring reminders of your past financial mistakes. Or, in some cases, the mistake isn’t yours, but a business or credit bureau is to blame for credit report errors. Either way, its up to you to work to have unfavorable credit report entries removed from your credit report.

Removing negative information will help you achieve a better credit score. A better credit report is also the key to getting approved for credit cards and loans and to getting good interest rates on the accounts that youre approved for. To help on your way to better credit, here are some strategies to get negative credit report information removed from your credit report.

You May Like: What Is Factual Data On Credit Report

Hire A Credit Repair Service

A reputable company like may be a viable solution if your report is riddled with inaccuracies that further complicate the repair process. can help you with the following items:

- Cleaning up credit report errors

- Disputing inaccurate negative entries

- Handling creditor negotiations

If you decide to hire a credit repair service, know that laws govern how they operate and what they can do. The establishes the following regulations governing credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the service

- They cannot receive payment for the performance of any service until said service has been entirely performed

- There must be a written contract detailing the services to be performed, the time frame during which these services will be performed, and the total cost for those services

- They cannot promise to remove accurate information from a credit report before the term set by law

- The consumer will have three days in which to review the contract and cancel without penalty

Whats The Difference Between Hard Inquiries And Soft Inquiries

Each time a bank, lender, credit card issuer, or insurance company receives an application from you, an inquiry is made on your credit report. They have been authorized by you and are called hard inquiries.

Unsolicited credit card offers that come in the mail are called soft inquiries. Credit card issuers, insurance companies, and lenders make those inquiries. You did not make them, so they dont impact your credit score, even though they appear on your credit report.

Pre-approvals and pre-qualifications initiated on your own usually also only constitute a soft inquiry. To be sure, however, check with the creditor before agreeing to one.

See also:Hard vs. Soft Inquiries: How They Affect Your Credit Score

You May Like: How To Get Credit Report Without Social Security Number

Inquiries Affect Your Credit Score Less Over Time

Even though the impact on your credit scores lessens over time, lenders will still be able to see the full list of hard inquiries at the bottom of your credit report for a full 2 years.

Also, remember that the difference between being approved or denied for credit, or getting a lower or higher interest rate, is typically decided based on pre-set score ranges.

If your credit score is on the cusp between poor and fair, 5-10 points might make all the difference in getting better loan terms.

One or two hard inquiries could be all that is standing between you and better interest rates or access to a loan at all. So while hard inquiries may not have a huge impact on some peoples credit scores, they can leave a lasting imprint on the financial lives of many.

How Do Credit Inquiries Impact My Credit Score

They all check your credit, and by signing the application, you authorize them to do so. Credit scorers understand this is simply a consumer out shopping for the best rate they can get.

They allow for this activity and dont deduct points for each individual hard inquiry when this occurs. Instead, as long as the credit inquiries are all made within a 45-day window, they group them together and count them as one inquiry.

But if you take too long and shop around, the resulting credit inquiries can affect your score negatively.

Don’t Miss: Does Zzounds Report To Credit Bureau