Can Utility Bills Hurt My Credit

While Experian Boost won’t use late payments for utility bills, it’s still possible for a delinquent account to damage your credit score.

Specifically, this can happen if the service provider sends the account to collections or charges off the debt. This typically won’t happen after just one missed payment. But if you miss multiple payments or leave a monthly bill unpaid for months, the provider may enlist the help of a debt collector. Leave it long enough, and it may charge off the account instead, assuming you’re not going to pay.

Your payment history is the most important factor in determining credit scores. It makes up 35% of your FICO® Score and is considered extremely influential to your VantageScore. So having a collections account or a charge-off reported to the credit reporting agencies can damage your credit score significantly.

What’s more, the negative tradeline will stay in your credit file with each reporting agency for seven years. And while adding positive payment history can help reduce its impact on your credit score, it can take a long time to recover fully.

Your Options Will Vary Depending On What You Want To Report

There are a number of services available that allow you to proactively add information to your reports or self-report your data to a lender.

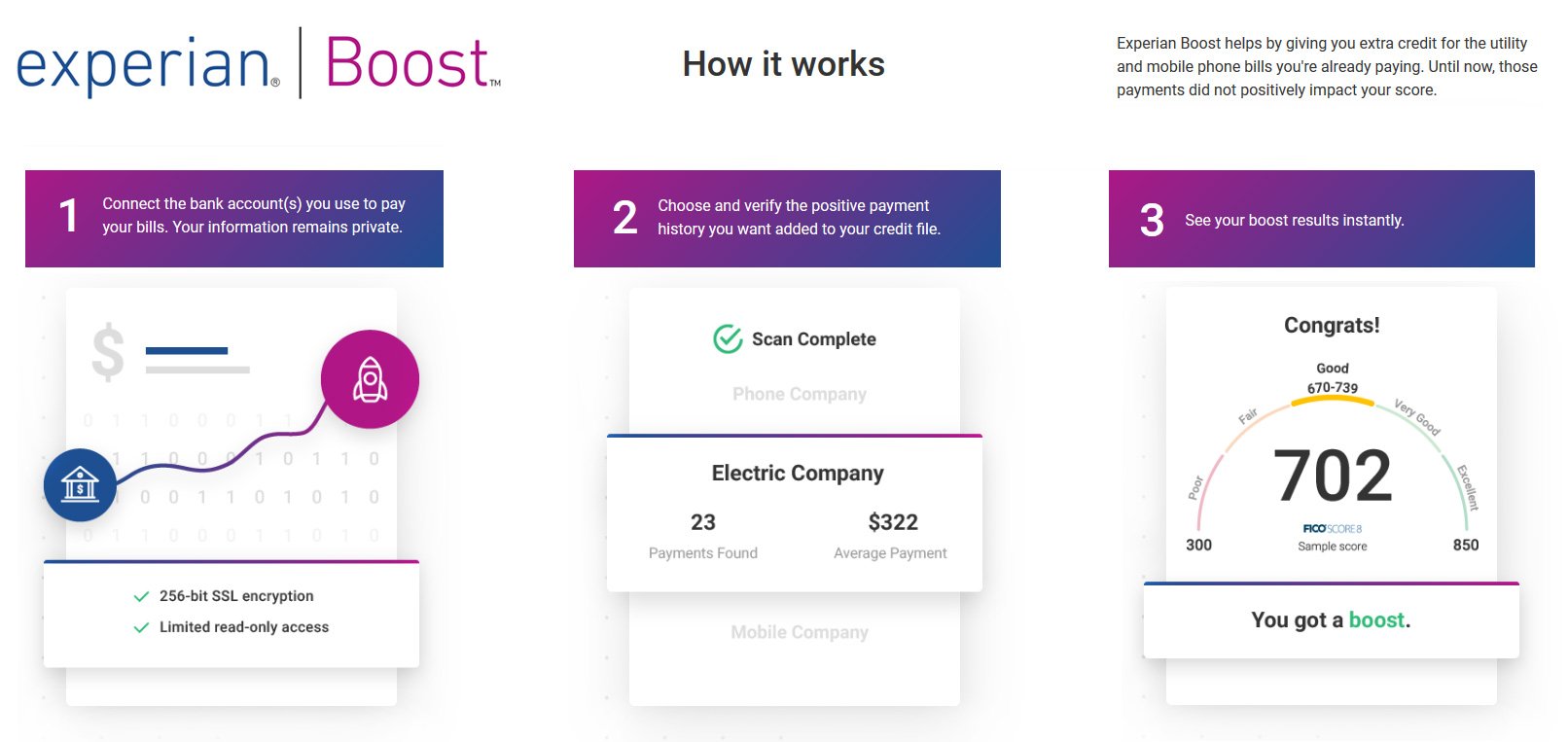

They all work slightly differently and use different information to bulk up your financial profile. Experian Boost, for example, zeroes in on your cable, phone and utility payments. UltraFICO pulls an even wider variety of information from your account, including your cash flow, spending habits and account history.

Meanwhile, rent reporting services, such as Rent Reporters and Rental Kharma, will relay your on-time rent payments on your behalf.

Alternatively, you can work directly with a lender that uses alternative data and link your bank accounts so they can assess your transaction history. Or, you can use a nontraditional score service, such as PRBC, and ask a lender to consider it.

Depending on your goals and financial history, you could even use multiple alternative data reporting services to showcase your financial history.

If youre confident that giving lenders a more comprehensive view of your financial situation will help give you an edge, rounding out your financial profile with alternative data could be really useful especially if your credit history is thin or nonexistent.

Tip: In general, you cant remove accurate negative items from your credit report. And theyll stay there for up to seven years. But in some cases, black marks such as missed payments can be removed by contacting your creditors.

Why Do I Have So Many Student Loans

Student loans may be reported as multiple entries on a credit report based on disbursements. A disbursement may occur for each school semester attended. The numbers added before and after the account number indicate that an additional disbursement was made. These extra numbers also help differentiate between the entries.

Student loans are often sold to other lenders and can be reflected on the credit report as transferred. Because they are not considered duplicates, we will continue to report the accounts separately.

Please contact the creditor directly if you want to dispute this information or need additional information.

You May Like: Paypal Credit Reporting To Credit Bureaus

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Heads Up: The More Recent The Late Payment The More It Could Hurt Your Credit

Even after the time limit is up, you arent necessarily in the clear. While the credit bureaus should remove this information on your credit reports past the seven- or 10-year mark, they may still keep it on file. And, if you apply for a job paying more than $75,000 a year or seek more than $150,000 worth of credit or life insurance, credit reporting agencies may disclose your past financial problems even if theyve fallen off your credit reports.

Recommended Reading: Ccb/mprcc On Credit Report

Make Timely Utility Payments

Timely payments are the No. 1 factor that goes into calculating your credit score, so the first step toward getting your utility payments to work in your favor is to make sure they are paid on time.

While positive payments on these types of accounts are not automatically reported to credit bureaus, delinquent accounts are, said Griffin. If youre late on a utility, phone and/or cable TV bill, your provider may report late payment information to Experian, and it would show up on your credit report in the form of a collection.

For credit agencies to be notified of your delinquent account, it must be more than 30 days past due, he said. For instance, missing a payment by a few days or a couple weeks may be considered overdue by the provider and result in late fees or penalties, but if a payment is made before the 30-day mark, it should not impact your credit.

However, remember its always best to pay all your bills on or before the due date to be certain it doesnt hurt your credit.

How Poor Credit Scores Impact Utility Bills

While utility companies arent going to charge you huge interest rates for having a low credit score, you may be looking at additional costs when you want to set up your water, electricity, or gas account, according to Jim Chilsen, spokesman for Citizens Utility Board, an Illinois nonprofit that looks out for the interests of residential utility customers:

Keeping a good relationship with your utility avoids a lot of headaches but a bad credit score is like a bad first date. You dont want to start off on the wrong foot. Thats because utility companies are allowed to assess you a deposit if you have a low credit score.;

Chilsen clarifies that not all providers will require a deposit, and low-income customers may be exempt, so you should look up the laws and regulations in your area. Even if you currently have a good credit score, Chilsen warns that previous credit scoring issues, like an account that had fallen into collections, could lead to requiring a deposit.

Read Also: Does Paypal Credit Report To Credit Bureaus

What Goes Into A Credit Score

Each company has its own way to calculate your credit score. They look at:

- how many loans and credit cards you have

- how much money you owe

- how long you have had credit

- how much new credit you have

They look at the information in your credit report and give it a number. That is your credit score.

It is very important to know what is in your credit report. If your report is good, your score will be good. You can decide if it is worth paying money to see what number someone gives your credit history.

The report will tell you how to improve your credit history. Only you can improve your credit history. It will take time. But if any of the information in your report is wrong, you can ask to have it fixed.

Do I Need To Get My Credit Score

It is very important to know what is in your credit report. But a credit score is a number that matches your credit history. If you know your history is good, your score will be good. You can get your credit report for free.

It costs money to find out your credit score. Sometimes a company might say the score is free. But if you look closely, you might find that you signed up for a service that checks your credit for you. Those services charge you every month.

Before you pay any money, ask yourself if you need to see your credit score. It might be interesting. But is it worth paying money for?;

Also Check: What Is Cbcinnovis On My Credit Report

How You Could Benefit

If you don’t have a long borrowing history, which is likely the case if you’ve never taken out a loan or opened your own credit card, this could help you. Your is a measure of how trustworthy you are in the eyes of financial institutions. Showing that you’re consistent about paying your utility bills gives lenders more reason to think you’re a safe bet.

With established credit, you’re more likely to be qualified for;some jobs and financial services. You may be able to pay smaller security deposits for apartments and lower insurance rates. And you could have more access to the best credit cards;and competitive loan rates.

FICO determines credit scores by looking at your credit report for loan payment history, how much you owe, the length of your credit history, the types of credit you have and how often you apply for new credit. Commonly used FICO scores range from 300 to 850. A score of 700 or above is considered good and, once you’re above around 750, you’re in the excellent range.

This shift is “a good thing for people with thin or subprime credit. It’s particularly advantageous for young adults who may be interested in applying for credit but don’t have much of a credit history,” says;CreditCards.com industry analyst Ted Rossman.

The program will not track missed payments and, if consumers stop paying bills for three consecutive months, Experian will delete the account, which may revert your score back to what it was before you added the information.

You Should Add Information Showing Stability And Unreported Positive Accounts To Your Credit Report Here’s How

By , Attorney

Get Free Credit Reports Weekly During the Coronavirus Crisis

During the coronavirus national emergency, the three major credit reporting bureaus are offering free weekly credit reports to consumers.

In addition to disputing incorrect or incomplete information and adding explanations for negative information the won’t remove, you might want to ask the credit reporting agency to add information to your report that makes you look more creditworthy. This information usually includes:

- information demonstrating your stability, and

- positive account histories that are missing from your report.

Recommended Reading: Carmax Auto Finance Defer Payment

Why Arent Payments On Utility Bills Reported To Credit Bureaus

Theres no law that says utility companies do or dont have to report your good payment history to credit reporting agenciesso its really a matter of choice.

If they do, however, they are subject to the Fair Credit Reporting Act. Under the act you have the right to challenge inaccurate or incomplete information. If you do challenge the report, utility companies are required to perform costly investigations and must correct the information. No utility company wants to go through the time and money to fix your report, so they simply choose not to report payments.

Landlords and property management companies usually;dont report your on-time payments, either, because theres a fee to do so. On the other hand, both your landlord and utility company want to get paid, so thats why they report late payments, whether theres a fee to do so or not.

Why Do I Have A Credit Report

Businesses want to know about you before they lend you money. Would you want to lend money to someone who pays bills on time? Or to someone who always pays late?

Businesses look at your credit report to learn about you. They decide if they want to lend you money, or give you a credit card. Sometimes, employers look at your credit report when you apply for a job. Cell phone companies and insurance companies look at your credit report, too.

Also Check: Which Credit Score Does Carmax Use

How Is Your Payment History Determined

Many creditors, vendors and service providers report your monthly payments to the three major consumer credit bureaus Equifax, Experian and TransUnion. Those reports include whether the payments were on time.

Payment history is built month by month, a spokesman for TransUnion told Credit Karma.

Many of the organizations you owe money to can report your payment history to one or more of the three main credit bureaus. Lenders who report the information include personal loan;lenders, auto loan lenders, credit card companies, mortgage lenders and stores where you have a credit card or have financed purchases.

Information about unpaid medical bills can also be reported to credit bureaus, TransUnion explained, but utility companies dont usually report payments .

A new account is typically reported to Equifax within 60 days, Bistritz-Balkan explained. After that, the creditor typically reports updates on a monthly basis. This ongoing reporting ultimately creates the consumers payment history.

If you have filed for bankruptcy, had your wages garnished by court order or had a judgment against you in a lawsuit, it shows up in the public records/collections section of your credit reports too. So do foreclosures. Thats because the credit reporting agencies comb through public records, including court and property records, to get a complete picture of your financial situation.

Focus On What Matters Most

Remember, good credit scores could easily save you thousands of dollars per year. Its well worth the effort it will take you to achieve and maintain a good credit rating.

Experian Boost and UltraFICO do show some encouraging signs of more consumer control over credit scores. Yet that doesnt change the fact that the traditional information on your credit reports remains the most important. If your credit reports have late payments, Boost isnt going to erase them. If your reports show high credit card balances month after month, Boost isnt going to offset those high credit utilization ratios.

Experian Boost might help your score some, but it isnt a magic wand. Youll still need to follow sound credit management habits. Thats the only way to earn and keep the good credit scores you need to get loans, credit cards and even insurance premiums at affordable prices.

Of course, if Experian Boost can give you a little bit of an edge on one of your credit scores, it might be a good idea to throw that into the mix as well. If you get lucky and improve your score with Boost, it certainly couldnt hurt.

Featured photo;by Jose Soriano / Unsplash.

Don’t Miss: Does Barclaycard Report To Credit Bureaus

How Long Can Negative Payment Info Affect Your Credit Health

If you run into trouble managing your money, your payment history on your credit reports could be affected for a long time.

Late bill payments can stay on your report for up to seven years and accounts sent to collections also can stay for seven years. Information on judgments against you can be reported for seven years or until the legal window to bring a claim against you runs out whichever is longer. Completed Chapter 13 bankruptcies typically stay on your reports for seven years, while Chapter 7 bankruptcies stay on your reports for 10 years. Foreclosures will remain on your reports for seven years.

Dont Apply For Too Many Credit Cards

Each credit application you make is added to your file and lowers your score. Why? Because too-frequent applications can be a sign of financial desperation.

Unfortunately, the ease of online applications â and the fact some customers enter âtrialâ submissions â means many have a lot on their file.

So do your research online, but talk to lenders rather than formally applying .

Read Also: Syncb/ppc Credit Inquiry

Why Should You Care

The Credit Access and Inclusion Act could help consumers, but it could also raise the stakes for them, too.

How could it help? By having lenders provide more information about borrowers, consumers may have a more diversified way to build credit and more-accurate credit profiles. With more data at their disposal, potential lenders may be able to better determine a borrowers creditworthiness when deciding whether to approve them for credit.

On the flip side, if you miss rent payments and your landlord reports that to the bureaus as a result of this new bill, not only could you be facing a landlord scolding, but you could also be hurting your credit.

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

You May Like: How To Get Credit Report Without Social Security Number

Applying For Utility Services Is Applying For Credit

If youre moving into a new home and you need to set up and pay for utilities, youll need to apply for those services. When you apply, companies often look at how youve paid your bills in the past, including how youve paid bills for utilities where youve lived before.;

Heres what you should know when you apply for utilities:

- Youre applying for credit.;Utility companies send you a bill at the end of the month based on how much gas, water, or electricity you use. That means theyre extending you credit for their services until you pay your bill.

- Companies will look at your credit history.;Like other creditors, utility companies will ask for information like your Social Security number so they can check your . A good credit history can make it easier for you to get services. A poor credit history can make it harder.

- How you pay your utility bills can become part of your credit history.;If you pay your bills in full and on time, it can help your credit. If you dont, it can hurt your credit. Failing to pay on time can also lead to collections and charge-offs, which can especially damage your credit. Not paying on time also can affect whether you can get other types of credit. Learn more in Understanding Your Credit.