How Do Lenders Make Their Decisions On Whether Or Not To Give You Credit

Lenders may use a combination of the following to help them make their decision:

- Information supplied by you when you applied.

- Data supplied by a credit reference agency like TransUnion. This data allows lenders to check if you’re on the electoral register at your current address if you’ve paid your credit commitments on time and if you have insolvencies or County Court Judgments.

- Your financial connections Anyone youre financially connected to, such as those with whom you have a joint bank account, or taken out a loan or mortgage. When lenders assess your credit history, they may also look at your financial associates credit histories, as they may affect your ability to repay money you borrow.

- Information about any existing accounts you already have with the lender

- Their own policies and rules

How Do I Leave A Notice Of Correction

Send a letter to our Customer Service Team, TransUnion, PO Box 491, Leeds, LS3 1WZ, with the wording youd like to add in your file, your full name, date of birth and address. Please remember to sign your letter. Alternatively, you can email us with the above information at

Please remember the Notice of Correction cant be more than 200 words, defamatory, libellous, incorrect or frivolous. The note will remain on your TransUnion credit file until you ask us to remove it or until the information it is attached to is no longer on your report.

How to issue a notice of disassociation?

Is Factual Data A Legit Company

Factual Data is a company that offers consumer credit and verification services to the mortgage lending industry. If you see Factual Data on your credit reports, its likely because the company performed a credit check on behalf of a mortgage lender.

How long does a Factual Data inquiry stay on your credit report?

After two years, hard inquiries drop off your credit report entirely. In general, the number of hard inquiries on your credit report isnt a major factor in your credit score.

What is Factual Data hard inquiry?

Factual Data provides credit check services for lenders. Factual Data is probably on your credit report as a hard inquiry. This usually happens when you apply for financing. If a Factual Data hard inquiry is on your credit report, its damaging your credit score .

What is meaning of Factual Data?

Something that is factual is concerned with facts or contains facts, rather than giving theories or personal interpretations.

Recommended Reading: Does Capital One Report Authorized Users To The Credit Bureaus

How Can You Determine Whether A Credit Inquiry Was Authorized

There may be a number of ways you can determine if a credit inquiry on your report was authorized. Sometimes, it may be a case of mistaken identity.

Occasionally, the name of the inquiry on your report may be different from the name of the entity pulling your report, says Ken Chaplin, senior vice president at TransUnion.

For example, if you applied for a retail store credit card, the entity listed on your report might be under the name of the bank issuing the card, not the name of the store.

Or, you may have forgotten that you authorized an inquiry. If you contact the company listed beside the inquiry on your credit report, it should be able to provide proof that you authorized the hard pull.

An unauthorized hard inquiry could be an indicator of identity theft and warrants swift attention, Chaplin says.

With the ID monitoring feature, you can use your email address to search for any accounts that are in any public data breaches. If your information has been exposed in a breach, well let you know some tips and tools to help you take the right next steps.

Well also continue to monitor your identity and credit for free.

If I Miss A Rental Payment Will This Show On My Credit Report

Yes, if youve agreed for Property Rental data to be shared with TransUnion. Similar to the other financial account information you may see on your TransUnion Credit Report, Property Rental suppliers have the same obligations to report arrears, arrangements and defaults, where applicable, so these will be appear on your report.

You May Like: When Does Capital One Report To Credit

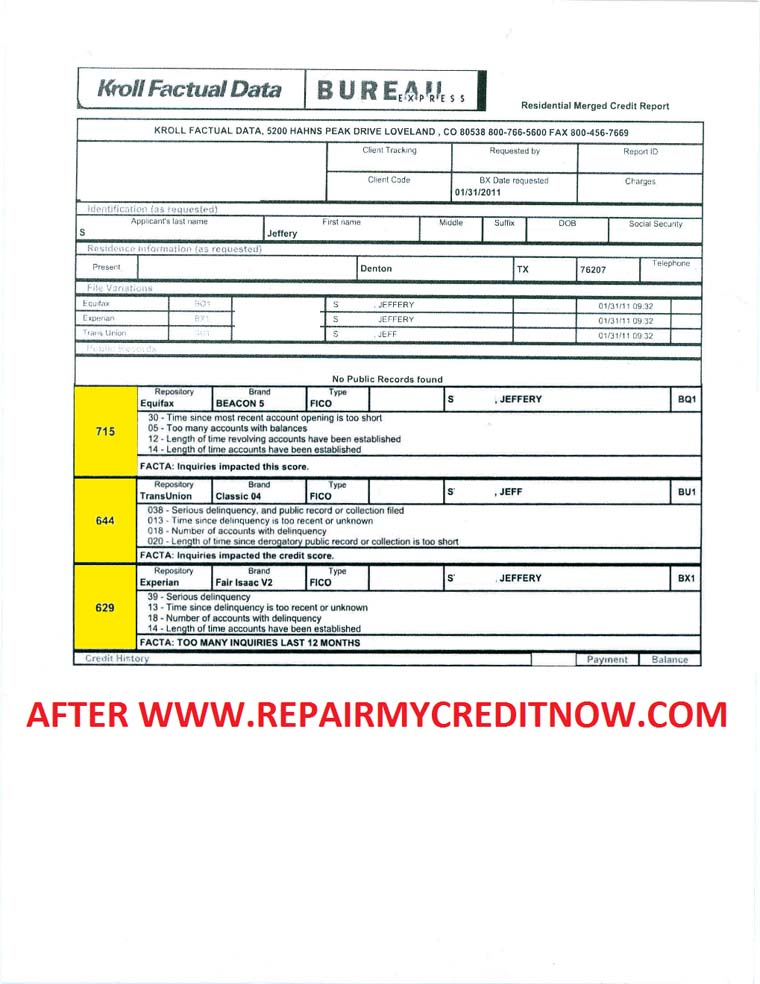

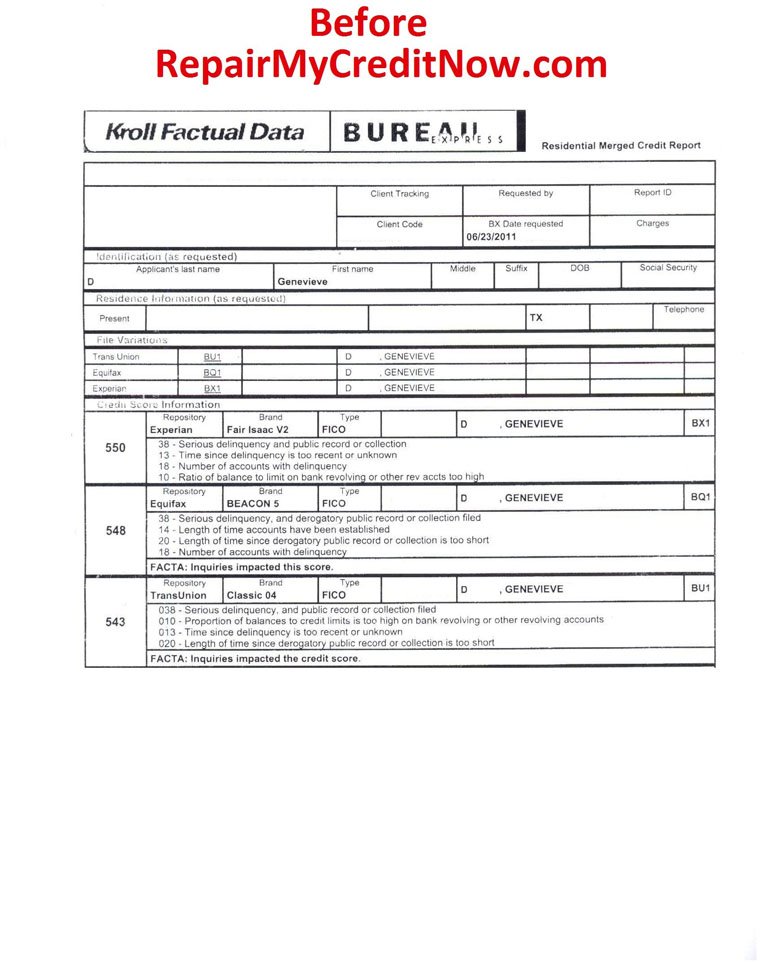

Kroll Factual Data Repair My Credit Now

Whats kroll factual data credit report?

Fellas! Are you currently Doing the job for a secretary in an organization or Firm? Absolutely sure, you may choose in charge in all letters concerns. And Sure, a kroll factual data credit report issue is among a issue try to be master in. Even Youre not an worker, a kroll factual data credit report is crucial for just about any purposes in order to ship a proposal to other Corporation, company or perhaps your teacher. Figuring out how crucial kroll factual data credit report functions are, we have an interest to debate it right now. Remember to remain tuned and luxuriate in looking at!A kroll factual data credit report is a proper and Skilled doc that is published by personalized, Corporation or company to its purchasers, stakeholder, company, Group and several more. This letter functions to provide any data, ask for, permission and several much more skillfully with The fundamental and customary templates among the people everywhere in the environment. Each a personal correspondent and firm will need to make the Make high-quality via your kroll factual data credit report in sake of showing your Specialist small business. Then how to make it? Right here we go.

What Should Contain in kroll factual data credit report?Nicely, it is the crucial elements you should point out within your kroll factual data credit report. And, below the pieces are:

| Title |

|---|

Read Also: Is 739 A Good Credit Score

Can I Dispute My Credit Score

A low credit rating can keep you from getting approved for a home loan. While you cant dispute the actual FICO credit score, you can dispute information that may be inaccurate on your credit report. The process is similar to an Experian hard inquiry dispute or disputes made for a Rocket Mortgage credit pull.

Your credit score is based on information including how much is owed, payment history, types of credit used, available credit, and public records information, so it is important to check your credit report for accuracy.

Don’t Miss: Equifax Address To Report Death

There Is An Entry On My Credit File That I Think Is Wrong My Broadband Provider Says I Owe Them Money But I Have Made It Clear That I Am Not Going To Pay For The Month Last Year When Their Service Was Down Can I Have This Entry Amended Because It Is Inaccurate To Show That I Owe Them This Money For A Time When Their Service Wasnt Being Delivered

The ICO cannot decide on issues outside of data protection law. In this instance, while you may consider the data to be inaccurate because you dont think you should have to pay for service you havent received, this is a service complaint which needs to be resolved before we could determine whether this information is accurately recorded on your credit file.

We may be able to look into cases where a repayment agreement is in dispute if:

- You have raised a complaint with the company and have received written confirmation that they agreed not to charge you for the period in question due to poor service.

- You are able to produce substantive evidence the company has acted wrongly. Unfortunately we cannot look into a complaint based on opinion alone.

- You have raised the issue of the dispute with the appropriate regulatory body, such as OFCOM, the Financial Ombudsman Service, or the courts, and they have upheld your complaint.

In the meantime you may wish to request that a Notice of Correction be added to the entry on your credit file. You can find more information about Notices of Correction in our .

How A Credit Score Is Determined

Your personal credit score is generated by a mathematical formula using information in your credit report. Credit scoring was first developed in 1958 by Fair Isaac Corporation to help predict whether a borrower will repay their loan on time. The resulting score is commonly called a FICO score, after Fair Isaac. Higher scores are better than lower scores.

When a credit bureau calculates your score, they do not take race, religion, age, sex or marital status into account. Neither does your income, occupation or employment history figure into the score, nor if you’ve been turned down for credit.

Don’t Miss: 691 Credit Score Auto Loan

Factual Data: What Is It And Why Is It On My Credit Report

- Factual Data may appear on your credit report if you applied for a loan or other type of credit.

- Read on to learn who they are, why youre seeing them, and how to get them off your credit report.

- Factual Data may be hurting your credit score.

Speak with our credit specialists today and start your path towards a better credit score.Specialists available Monday to Friday, 10AM – 7PM EST.

I Owed Money To My Credit Card Company And Stopped Making Repayments Because I Lost My Job Because I Was Able To Demonstrate Financial Hardship And The Stress This Was Causing Me The Credit Card Company Agreed That They Would Stop Pursuing Me For This Debt However They Have Refused To Remove The Default From My Credit File Can They Do This

Data protection law requires that the information on your credit file is an accurate reflection of your credit history. While we appreciate you may want this debt removed, the fact that this debt was accrued and defaulted on is accurate. The fact that this default remains on your credit file is likely to comply with data protection requirements.

In situations like this, whether the entry should be recorded in some way to indicate that a debt has been settled relies heavily upon the specific agreement between you and the lender and can vary on a case-by-case basis.

If the lender agrees to accept a lower payment from you in settlement of an account we would expect them to mark the entry in a way which indicates that you are no longer being pursued for a debt. However, if a debt has not been paid off in full we do understand that the lender may be reluctant to mark a credit file as satisfied. However, where an organisation has decided to stop pursuing a debtor for payment, it would appear unfair to show that money is still owed under the account. In these circumstances, we would generally expect an organisation to indicate the situation on an individuals credit file, in some way. Organisations will usually mark an account as partially settled or partially satisfied. This shows any lenders searching your file that you are no longer being pursued for the debt but also that the debt was not fully repaid.

Don’t Miss: What Does Serious Delinquency Mean On Credit Report

How Do You Dispute A Credit Inquiry

If you find an unauthorized or inaccurate hard inquiry, you can file a dispute letter and request that the bureau remove it from your report. The consumer credit bureaus must investigate dispute requests unless they determine your dispute is frivolous. Still, not all disputes are accepted after investigation.

How Does Factual Data Impact You

Factual Data is involved in six stages of the mortgage process pre-qualification, application, processing, underwriting, pre-closing, and post-closing.

Pre-qualification: They filter candidates based on 1, 2, or 3 bureaus’ soft inquiry credit reports.

Application: In this stage, they provide merged credit reports in easy-to-read formats.

Processing: With the help of DataVerify, Factual Data provides undisclosed debt monitoring for up to 120 days.

Underwriting: They help determine the risk and value of a property.

Pre-closing: In this stage, they provide a loan quality cross-check that identifies any changes in the borrowers credit file since the initial credit report.

During all these stages, if Factual Data reports something negative about you, there are high chances that your loan will be denied.

Recommended Reading: Affirm Approval Odds

Is Factual Data A Mortgage Lender

No, Factual Data doesnt lend money. However, it plays a key role in the mortgage lending industry, offering lenders a variety of reporting services, from prequalification to hard inquiry credit reports.

Before lending you the funds to purchase a home, a mortgage lender will want to know more about you and how you handle your finances. Thats where Factual Data comes in. Factual Data will look at your credit history to see your record of on-time bill payments and the amount of money you owe, as reported through FICO and credit reporting companies TransUnion, Equifax, and Experian.

This way, the bank or Factual Data mortgage lender will know more about how likely you are to repay the loan on time as agreed upon.

What If There’s Incorrect Information On My Credit Report

TransUnion will contact you with an outcome, by post or email, within 28 days. We will either send you an email or a letter to confirm the outcome of your dispute. The method of contact will depend on how you raised your dispute:

When you raise a dispute, TransUnion will investigate the data accuracy with the data provider and provide you with an outcome within 28 days, in accordance with our obligations under Section 159 of the Consumer Credit Act 1974.

If you decide to raise a dispute, the process can be broken down into these 3 simple steps:

If you use the online portal to raise a dispute, we will email you, or If you email your dispute to TransUnion, we will respond via letter.Here are some examples of potential outcomes:

- No changes made as evidence requested was not received within the 28 day timeframe.

- Data provider advises data is accurate, no changes made.

- Data provider agrees to change incorrect information.

- No response received from data provider within 28 days. If applicable data will be removed or suppressed from view .

What can I do if the information on my credit report is accurate, but I would like to explain the circumstances behind it?

Where your credit report data is accurate, but youd like to explain the reason behind an item, you can choose to add wording of your choice to your credit report in the form of a Notice of Correction .

To add a NOC to your credit report please email your chosen wording to: .

Or alternatively, you can write to us at:

Recommended Reading: Ntwk Credit Card

How Can I Dispute The Accuracy Of Information On My Credit Report

If you see something on your credit report you believe isnt being reported correctly, you can let us know by raising a dispute. To find out how to dispute an item on your credit report, you can read our Dispute FAQs.

Once we have received your dispute, along with any supporting evidence weve requested*, well begin our investigation and make any amendments where found necessary. You will receive an outcome within 28 days of the dispute being raised.

*For some disputes you will be required to provide supporting evidence. In the event evidence is not provided within a 28-day timeframe we will be unable to process your dispute further.

What Is Factual Data On Credit Report

Keep your credit reports in a safe place. Most of them contain identifying information that could be used for fraud or identity theft.

Credit granting decisions are largely automatic, based on a consumers credit scores, the factual data in credit reports, and the

Memphis Metropolitan Area · Senior Account Executive · Factual DataIn 2015 CBC purchased Factual Data® merging itself into one of the largest seller of Tri-merge Credit Reports in the Mortgage Industry. Factual

Also Check: Remove Repo From Credit

How Does A Hard Credit Check Affect Your Report

There are two kinds of credit inquiries: hard and soft.

Soft inquiries, as described above, simply verify your score. They can be run when you apply for a job or apartment, but also when you get pre-qualified for a loan or check your credit score yourself.

A soft inquiry doesnt hurt your credit, while a hard inquiry may.

Whenever you apply for a loan, a more invasive credit check is required. Lenders use your history with credit to determine how reliable of a borrower you are.

As such, they may obtain one or all of your credit reports in the screening process or a merged Factual Data credit report.

This type of inquiry is added to your report, where it will stay for two years. Hard inquiries typically drop your score by a couple of points, but they can be more detrimental if you have several of them on your report.

Having a slew of credit applications suggests that youre financially unstable, lowering your score more significantly than a single entry.

There are a few exceptions, like when youre comparison shopping for a mortgage.

You have a 14-day window to apply for loans, during which time your score shouldnt be lowered by each individual application.

Next Steps: What To Do If Theres An Inquiry Or Account You Dont Recognize On Your Credit Reports

Monitoring your credit is an important part of managing your personal finances. Its always smart to double check credit inquiries on your credit reports.

In some cases, names that you dont recognize, like Factual Credit, may appear on your credit reports because a bank or lender that youre working with hired the company to perform the credit check on its behalf. So when you notice an inquiry from an unfamiliar company, do a little extra research before you dispute it as a credit report error.

Heres an extra bit of good news: Credit Karma offers free tools and services to help you protect your credit.

- Free credit monitoring This service can alert you to important changes on your credit reports. Along with checking your credit scores regularly, this feature can send you alerts so you can check any suspicious activity and report any instances of identity theft.

- Free identity monitoring This service notifies you when Credit Karma learns theres been a data breach involving another company in which your information may have been compromised. Well also give you tips on how to lock your credit with the three major consumer credit bureaus.

About the author:

Read More

Recommended Reading: Brksb Cbna