Personal Loans With A 691 Credit Score

Are you in the market for a personal loan?

While you might qualify for a personal loan with fair credit, you could be charged a higher interest rate and more fees than you would with scores in the good or excellent range.

These higher rates and fees might make the loan a less desirable proposition, depending on what you need it for. For example, if you want to consolidate credit card debt with a personal loan, the interest rate with your new loan may not be low enough to save you money in the long run especially considering all the fees you might be charged upfront.

On the other hand, if youre using a personal loan to finance a major purchase, you should consider whether its something you need now or can wait to buy. If you can wait and spend some time building your credit, you might be able to qualify for a loan with a lower interest rate.

When youre ready to move forward with a personal loan, you can compare personal loan options on Credit Karma.

How Your 691 Credit Score Was Calculated

As mentioned earlier, the two main credit scoring models are FICO and VantageScore. Although the two models have minor differences, both calculate credit scores based on the following factors:

- Payment history:Late payments lower your credit score. The later the payment, the more damage it will do. Charge-offs, collection accounts, and bankruptcies are even more damaging to your score.

- : This refers to the proportion of your available credit that youre using . A lower utilization rate is better for your credit score. Many experts recommend keeping yours below 30% . VantageScore recommends keeping your credit utilization even lower, under 10% if possible. 1

- Length of credit history: This is determined by the age of your oldest and newest credit accounts as well as the average age of all of your accounts. Old accounts that youve had for many years boost your credit score, whereas new accounts lower it.

- : Your credit score will be lower if you dont have a balanced mix of revolving credit accounts and installment accounts .

- New accounts: When you apply for a credit card or loan, the lender will run a credit check. This will trigger a hard inquiryHard inquiries take a few points off your credit score, and the effect lasts for up to 12 months. 2Actually opening the account can further hurt your score and have even longer-lasting effects.

To maintain your good credit score, follow these tips:

What Counts Towards Your 691 Credit Score

In essence, your credit score tells you whether you have a responsible credit management and a history showing that you have been financially stable. So what factors contribute to showing that you are fiscally responsible and stable?

The first and most critical factor will be your overall payment history. This is simply whether you have paid all of your bills on time. There are also a variety of aspects of your payment history that your credit rating will include, including how late you were on your payments , how many bills you paid and how many you did not, if any of your accounts have gone into collections and if you have a history of foreclosures, bankruptcies, and debt settlements.

The second biggest factor that counts towards your credit score is the total amount of money that you owe. Again, there is a variety of aspects of this that goes into your 691 credit score. One such example is the amount of your allotted credit that you have used up. Heres a piece of advice: the less you owe on the credit, the better your credit score will be.

Another aspect of your amounts owed is how much money you owe on each of your loans, including your credit cards, your car payments, and your mortgage payment. The best way to have a positive credit rating here is to have a variety of credits and loans and to manage each of them in a very responsible manner.

Also Check: Letter To Remove Student Loans From Credit Report

What Is A Good Credit Score And Tips To Maintain It

Get answers to commonly asked questions related to the credit score and credit reports

If you are wondering what exactly constitutes a good credit score and how it is calculated, we have all the details for you. Read on to find out everything about a good credit score and the various benefits it offers.

About Good Credit Score

What Credit Score Do I Need For A Car Loan

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

A better credit score can increase your chances of approval for loans and credit cards and can also get you better interest rates and other terms. With some types of loans, like mortgages and credit cards, you simply cannot get approved if your credit score is below a certain amount.

Auto loans are a different story. There isn’t a set FICO® Score floor for auto lending, and a good percentage of auto loans made in the U.S. are to borrowers with ultra-low credit scores.

With that in mind, here’s a rundown of how to check and interpret your own , what it means to you as a potential auto loan borrower, and a few money-saving tips that you should use in the auto-buying process, regardless of your credit score.

Also Check: How Long Does It Take For Opensky To Report

Learn More About Your Credit Score

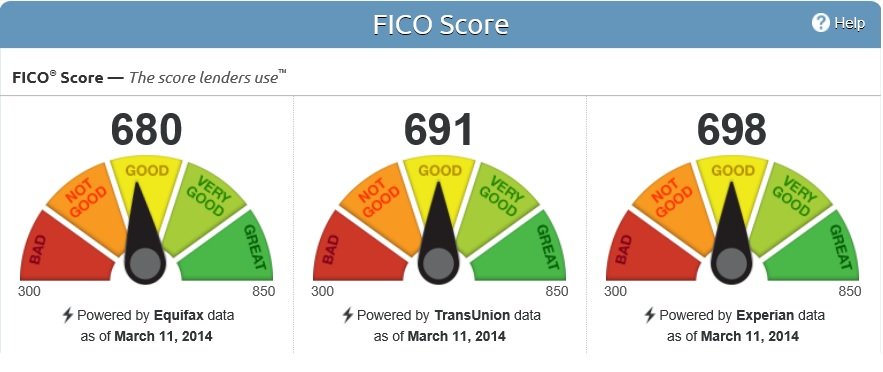

A 691 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.

What A Good Credit Score Can Get You

Having good credit matters because it determines whether you can borrow money and how much you’ll pay in interest to do so.

Among the things a good credit score can help you get:

-

An unsecured credit card with a decent interest rate, or even a balance-transfer card.

-

A desirable car loan or lease.

-

A mortgage with a favorable interest rate.

-

The ability to open new credit to cover expenses in a crisis if you don’t have an emergency fund or it runs out.

A good credit score helps in other ways: In many states, people with higher credit scores pay less for car insurance. In addition, some landlords use credit scores to screen tenants.

So having a good credit score is helpful whether you plan to apply for credit or not.

If your credit score is below about 700, prepare for questions about negative items on your credit record when shopping for a car. People with major blemishes on their credit are routinely approved for car loans, but you may not qualify for a low rate. Read about what rates to expect with your score.

You dont need flawless credit to get a mortgage. In some cases, credit scores can be in the 500s. But credit scores estimate the risk that you wont repay as agreed, so lenders do reward higher scores with lower interest rates. Read about your mortgage options by credit score tier.

Landlords or property managers generally aren’t looking for immaculate scores, they are interested in your credit record. Learn more about what landlords really look for in a credit check.

You May Like: Bp Visa Syncb

How A Bad Credit Score Isbad

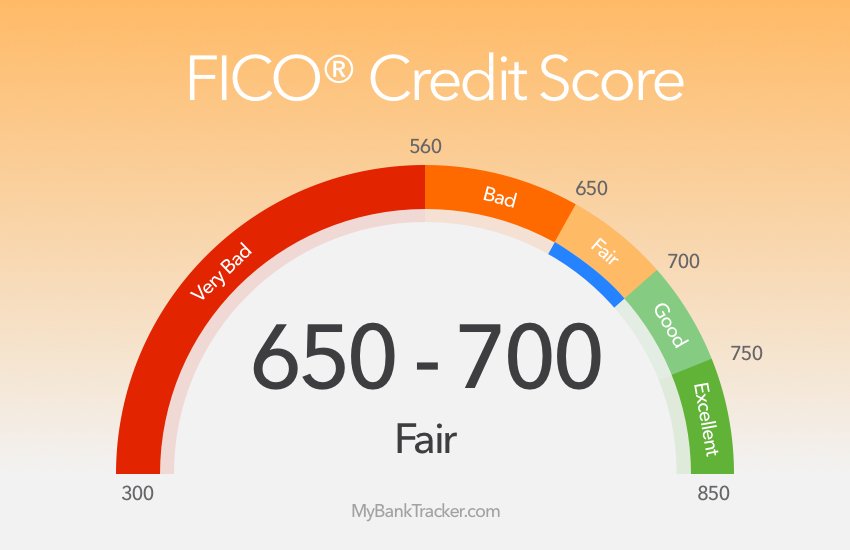

As mentioned formerly, a bad credit score is anything listed below 670. If you want to get more particular, a score varying between 580-669 is thought about reasonable, while anything in between 300 and 579 is considered poor. This is going off the FICO scoring thats most typically used.

Not sure what your credit score is? . Its free!

Having a bad score can stop you from doing a lot of things. This includes getting authorized for much better charge card, home loans, homes, individual loans, service loans, and more.

Plus, any loans or charge card you do get authorized for will be far more pricey . This is because loan providers charge much higher rate of interest to those they consider high danger in order to balance out the extra threat they feel theyre taking by loaning you cash.

How do they get more costly? By charging higher rates of interest. If you take out a $10,000, 48 month loan on a automobile with a 3.4% interest rate, youll pay about $704 in interest over the course of the loan. If you secured that same loan with a 6.5% rate due to bad credit, you d pay about $1,376 in interest. Thats almost double!

How To Get Your Credit Report In Canada

A credit report is a record of a borrowers credit history including active loans, payment history, credit limit and how much they still owe on each of their loans. Your credit activity, which is found on your credit report, impacts your credit score.

There are two national credit bureaus in Canada: Equifax and TransUnion. Once a year, you can request a free copy of your credit report by mail, though if you want instant results online, there will be a charge.

Read How to Check Your Credit Score 101 for detailed information on how to get your free credit report.

Also Check: Carmax Minimum Down Payment

Why Your Credit Score Is 691

If youre wondering how you came to have a score of 691, its a fair question to ask. Your rating of 691 is calculated through an amalgam of all of your different past financial activities. This makes it impossible to delineate a specific formula, as each persons score is uniquely their own.

While its difficult to see exactly how you got to your current score, it is possible to get a rough idea of what behaviors influenced it the most.

The following are seven of the biggest factors that can raise or lower your credit score depending on the decisions you make. Consider each one and think of how it might be a positive or negative influence on your credit.

How Good Is A 690 Credit Rating

A good credit score is 690 to 719 on the scale commonly used for FICO scores and VantageScores. Generally speaking, scores between 690 and 719 are considered good credit. Scores above 720 are considered excellent, while scores between 630 and 689 are considered fair. Scores below 630 fall into the bad credit range.

Don’t Miss: How Do I Unlock My Credit

What Can You Do With A 691 Credit Score

If your credit score is 691, you are officially part of the good credit club. Even though it isnt higher, you can already begin to experience some of the benefits that come with good credit, such as:

- Getting approved for an apartment and avoiding hefty security deposits.

- Qualifying for higher credit limits and certain .

- Being approved to take out or refinance a loan.

- Wielding more negotiating power with lenders and getting lower interest rates.

- Landing a job more easily when an employer checks your credit score.

There are many benefits to having good credit. However, at 691 youve only just started to tap into the positive aspects of having a higher credit score.

Heres How To Improve A 691 Credit Score:

- Dispute Negatives: If you can prove that negative information on your credit report is inaccurate , you can dispute the record to have it corrected or removed.

- Pay Off Collections Accounts: Once you bring a collection accounts balance down to zero, it stops affecting your VantageScore 3.0 credit score.

- Reduce Utilization: Its best to use less than 30% of the available credit on your credit card accounts each month. You can reduce your credit utilization by spending less, making bigger payments or paying multiple times per month.

- Pay On Time: Payment history is the most important ingredient in your credit score. Paying on time every month establishes a track record of responsibility as a borrower, while a single late payment on your credit report can set back credit improvement efforts significantly.

You can track your credit scores progress for free on WalletHub, the only site with free daily updates and personalized advice.

Was this article helpful?

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Related Scores

Don’t Miss: Cbc Innovis Credit Inquiry

Can You Get A Personal Loan With A Credit Score Of 691

Most lenders will approve you for a personal loan with a 691 credit score. However, your interest rate may be somewhat higher than someone who has Very Good or Excellent credit.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

See Also:12 Best Personal Loans for Good Credit

Shopping For The Best Rates On Loans And Credit Cards For A Credit Score Under 691

If you are ever on the market for high-priced items, such as home appliances, it is very common for people to walk into the store and get offered a discount or an otherwise excellent financing deal.. .but only if they open up a credit card account with that store.

Why do stores offer these credit cards? The reason why is because theres usually a high interest rate or multiple fees that go along with them. Those rates and fees can be found on the small fine print of the credit card deal, but of course, the store doesnt tell you.

A golden rule of credit cards is that you should only apply for credit that is a necessity for your financial life. When applying for a credit card from a retail store, youre probably only going to use it once, twice, or three times maximum. You could just as easily be using an existing credit card that you already have.

Heres why this is so critical: applying for multiple credit cards within a few months of each other will be very harmful to your overall credit score. Never apply for a credit card that you dont need.

Now, when you do decide to apply for credit cards and loans in general, there are a few factors that you will want to remember, including:

Recommended Reading: How To Get Credit Report With Itin

What Does A 696 Credit Score Get You

| Item |

|---|

| 88% |

As you can see, most people who are at least 35 years old have a credit score of 650 or higher. And even younger folks nearly have a majority. This just goes to show that people with 650 credit scores come in all shapes and sizes, with diverse backgrounds and differing financial obligations.

As a result, the grades for each component of your credit score, which you can find on the Credit Analysis page of your free WalletHub account, might not exactly match those of another individual with a 650 score. But the sample scorecard below will give you a pretty good idea of what a 650 score is made of.Sample Scorecard 696 Credit Score:

- Payment History: C = 98% on-time payments

- B = 10% – 29% utilization

- Debt Load: A = Debt-to-income ratio below 0.28

- Account Age: B = Average tradeline is 7 or 8 years old

- Account Diversity: C = 2 account types or 5 – 9 total accounts

- Hard Credit Inquiries: A = Fewer than 3 in past 24 months

- Collections Accounts & Public Records: A = 0 collections accounts and public records

These are by no means the only credit-score grades capable of producing a score of 650, nor will they necessarily result in that exact rating. However, this is representative of the type of scorecard someone with a 696 credit score can expect: plenty As and Bs, but no failing grades to be found.

Getting A Mortgage With A Thin Credit History

One option to boost yourcredit score is to become a credit card authorized user on someone elsesaccount. You can be added tohealthy credit card accounts, and that can boost your score.

This strategy can help you if youre new to managing credit and dont have many open lines of credit or tradelines.

Tradelines arecredit-lingo for accounts with creditors. When youre short on tradelines, itcan be hard for the credit bureaus to assign to you a credit score and hardfor lenders to know whether youre a good borrower.

Getting yourselfauthorized to use a family members credit card can be a terrific way toboost your own credit rating andqualify to buy a house sooner.

Don’t Miss: Usaa Credit Score Free

How To Earn A Fair Credit Score:

If you are trying to get your credit score into the “fair” range, pull your credit report and examine your history. If you see missed payments or defaulted loans or lines of credit, do your best to negotiate with the lender directly. You may be able to work out an agreement that allows you to make manageable, on-time payments. Getting back on track with these consistent payments could help improve your credit score over time. As you work through meeting your debt obligations, take care not to close any of your accounts. Open accounts with a long history could be positively contributing to your score and can continue to be used responsibly in the future.

Look at your credit report, create a budget that sets aside money to pay off your debts, and learn more about how credit scores are generated: these are the three fundamental steps in moving your credit score upwards.