Consumer Credit Reports And Scores

On the consumer side, you can generally get access to your VantageScore® credit report and score from one of the bureaus on a regular basis. For instance, you can get your free VantageScore 3.0® report and score from TransUnion® and Rocket HomesSM once a week.

There are two other credit bureaus in addition to TransUnion®: Equifax and Experian. You may be able to get access to their reports on a regular basis if you have bank or credit card accounts. These services can sometimes also give you access to your VantageScore®.

By law, the credit bureaus have to give you access to at least one credit report from each bureau every year. You can access these at AnnualCreditReport.com. Because theres a chance each bureau doesnt have access to the same information, its a good idea to pull a report from all three if you plan on applying for loans in the near future. This way there are no surprises and you have the opportunity to correct any inaccurate information. On the other hand, if youre not applying for a loan anytime soon, you should pull one from each bureau every 4 months.

In any case, its important to remember that when youre viewing these reports, youre only looking at a single source of information. This is in contrast to mortgage lenders, who look at several sources before they accept you for a mortgage.

The Credit Score Needed To Buy A House

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

What Do I Need To Buy A House

The basic forms required to purchase a property include proof of income. You must submit copies of your tax return at least two years in advance to demonstrate income stability. In addition, you will need forms with current sources of income, such as payroll, W2 forms, 1099 forms, child support payments, and child support payments.

Read Also: Does Rent A Center Report To The Credit Bureau

Want A Mortgage The Credit Score Used By Mortgage Companies Will Surprise You

Shutterstock

If you are applying for a mortgage, your credit score will be a critical part of the process. You could get rejected with a credit score that is too low. And once approved, your score will determine the interest rate charged. Someone with a 620 might have to pay an interest rate that is as much as 3% higher than someone with a 740. But what credit scores do mortgage lenders actually use? The answer might surprise you.

Much Older Versions Of FICO

Fannie Mae and Freddie Mac are government-agencies that purchase the majority of mortgages originated in the country. These agencies set the rules and underwriting criteria for the loans that they purchase, including what credit scores should be used. Surprisingly, the agencies require much older versions of the FICO credit score. According to a review of the agency Selling Guides by MagnifyMoney, these are the scores that matter:

- From the Equifax credit bureau: FICO Version 5

- From the Experian credit bureau: FICO Version 2

- From the TransUnion credit bureau: FICO Version 4

Even though FICO has just recently introduced Version 9 of its score, most mortgage lenders will still be using a much older credit score.

Watch on Forbes:

Which Older Version Of FICO Will Be Used?

How Do I Get A Good Credit Score ?

What If My Mortgage Is Not Purchased By Fannie Mae or Freddie Mac

What Can You Do With No Credit Score

Without a loan, it is more difficult for lenders to estimate the risk of lending. Traditional credit information refers to information about credit card, loan and mortgage accounts. Non-traditional credit information is information about your recurring payment history for things like rent, utilities, and insurance.

Don’t Miss: Speedy Cash Loan Extension

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Why Is It So Important To Get A Low Interest Rate On My Mortgage

You probably already know that a lower interest rate means a smaller monthly payment. But do you know just how big of an effect a smaller monthly payment can have?

Lets look at an example. According to the U.S. Census Bureau, in March 2018 the average sales price of a new home sold in the United States was $366,000. If you were to go to the closing table with a 20% down payment and opted for a 30-year fixed-rate mortgage, heres how much it would cost you over time depending on your interest rates.

| $3,408 | $102,183 |

In this example, boosting your credit before you get a mortgage could save you $284 per month, $3,408 per year, and $102,183 over the life of your loan! What would you do with all of that extra cash?

Pro tip: Use our to learn more about what could impact your credit scores.

Also Check: Does Affirm Report To Credit Bureaus

How Your Credit Score Affects Your Interest Rates

Knowing your credit score is the first step in getting the best rates on your mortgage. While mortgage interest rates are currently at an all-time low, they drop even lower when your credit score is above 760.

According to FICO, the current interest rate for a 30-year fixed mortgage is 2.377% APR for a 760+ borrower, and 3.966% for a borrower with a score between 620 and 639 .

This 1.589% savings in APR may seem negligible. But it means saving about $260 per month on your mortgage, or $3,120 per year and roughly $93,600 over the lifetime of the loan.

If you currently have a mortgage and are interested in seeing if you can switch to a better rate, look into the pros and cons of refinancing your home.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: Bpvisa/syncb

Minimum Credit Score By Mortgage Loan Type

The minimum credit score you need to qualify for a mortgage in 2021 depends on the type of mortgage youre trying to obtain. Scores differ whether youre applying for a loan insured by the Federal Housing Administration, better known as an FHA loan one insured by the U.S. Department of Veterans Affairs, known as a VA loan or a conventional mortgage loan from a private lender:

|

Type of loan |

|

|

FHA loan requiring 3.5% down payment |

|

|

FHA loan requiring 10% down payment |

500 – Quicken Loans® requires a minimum score of 580 for an FHA loan. |

|

VA loan |

How To Check Your Credit Score

To find out your credit score, contact Canadas two credit-reporting agencies: Equifax Canada at www.equifax.ca and TransUnion Canada at www.transunion.ca.

For a fee, these agencies will provide you with an online copy of your credit score as well as a a detailed summary of your credit history, employment history and personal financial information on file. You can also obtain a free copy of your credit report by mail. If you find any errors in your report, notify the credit-reporting agency and the organization responsible for the inaccuracy immediately.

Read Also: Does Snap Report To Credit Bureaus

What Are Mortgage Fico Scores Need To Apply For A Mortgage Loan

The credit score used to determine if you qualify for a mortgage loan is called your qualifying credit score which is simply the middle of your three FICO® scores. For example if you have the following credit scores:

- TransUnion 663

- Experian 710

- Equifax 661

The lender will use your middle score of 663 from TransUnion as your qualifying score. The minimum qualifying score for a mortgage loan is determine by the loan type minimum score and if the lender has any overlays. Below are example minimum qualifying scores by loan type

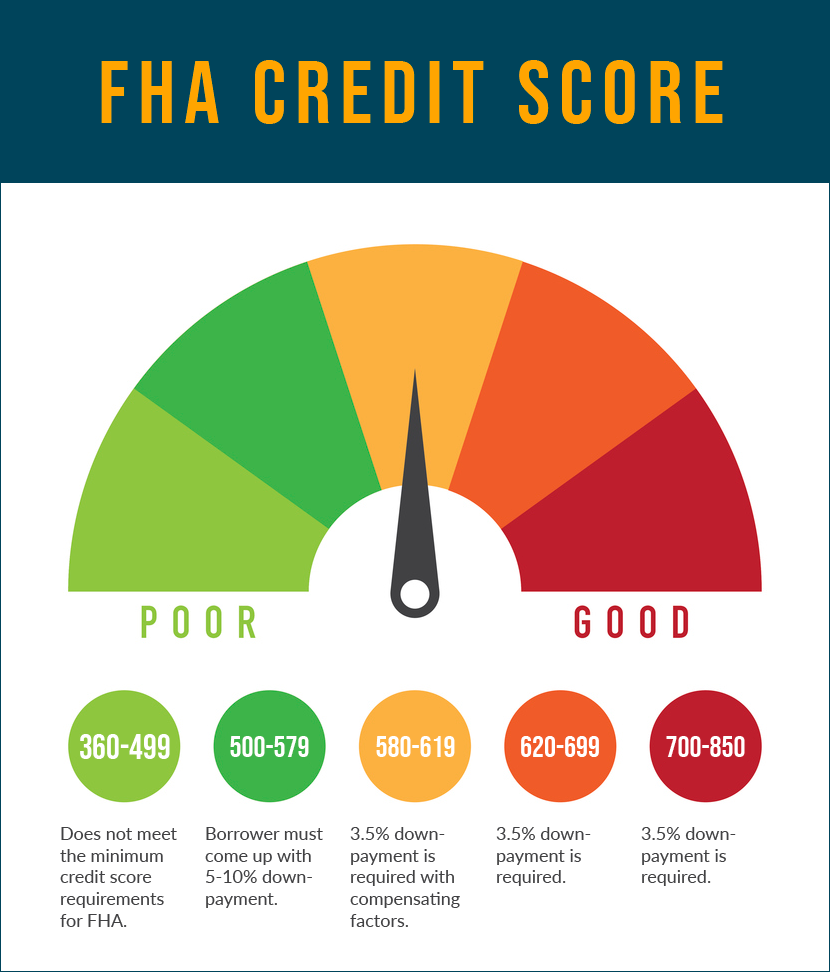

FHA Loan 580 minimum for 3.5% down and 500 minimum with 10% down

If I Meet A Minimum Credit Score Will I Be Accepted For A Mortgage

Not necessarily as lenders take lots of factors regarding your affordability into consideration. You are more likely to be accepted if you meet a minimum score as this suggests that youre a careful borrower.

However, its also important to prepare for your application for a mortgage by organising your:

-

Pay slips and proof of bonuses/commission and tax paid or self-assessment tax accounts if youre applying for a self-employed mortgage

-

Passport, birth certificate and drivers license

-

Proof of deposit

-

Proof of address

-

Gift letter If you’re receiving help with your deposit, the lender will need a letter from the person providing the gift explaining that they are gifting the deposit and understand that they in no way own any share of the property being mortgaged or expect the money to be paid back.

Lenders work across a lot of different criteria, and your credit score is just one part, so even if you do not meet the minimum levels, you should speak to one of our specialist mortgage advisors to see how we can help.

You May Like: Report Death To Credit Bureau

Check Your Credit And Monitor Your Progress

While you’re working your way toward the credit score needed to buy a house, check your progress with a free score some credit cards and many personal finance websites offer them.

Free credit scores often are VantageScores, a competitor to FICO. Either type of score can be used to track your progress they both emphasize the same factors, with slight differences in weighting, so they tend to move in tandem.

Mortgage lenders check older versions of the FICO score . If you want to see where you stand on those so you know exactly what mortgage lenders will see, youll have to purchase a comprehensive FICO report. You can do that at myFICO.com, then cancel the monthly service rather than pay an ongoing fee. Be sure to cancel before the next billing cycle starts the monthly subscription fee will not be prorated.

However, if youre near or in the excellent credit score range on a free score source, you dont need to pay to check your FICO scores. You almost certainly have good enough credit to qualify for the best rates.

About the authors:Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Kate Wood writes about mortgages, homebuying and homeownership for NerdWallet. Previously, she covered topics related to homeownership at This Old House magazine.Read more

What Credit Rating Do You Need To Buy A House

Youve spent years saving up your deposit for a new home. Youve waited for the right moment. Now its here. The only thing left is to secure your mortgage. We can help show you how.

If youre thinking of buying a home, youll need a credit rating thats good enough to secure a mortgage. Your credit rating is a snapshot of how youve managed money in the past including past borrowing, repayments, how much of your available credit you routinely use, how many payments youve missed and several other factors to create a score. The higher the score, the better your chance of being offered a better deal on your mortgage.

There are three major credit reference agencies each with a slightly different scoring system. So its a good idea to check your credit rating with all three to find out how you rate. That way, youll know whether youre likely to get a mortgage.

Read Also: Is 517 A Good Credit Score

Length Of Credit History

This category isn’t as weighty to lenders as the first two, but it’s still significant because it shows lenders how long you’ve had credit and built a history, The longer your history, the better your scores. This includes:

- The total length of time tracked by your credit report

- Length of time since accounts were opened

- The time that’s passed since the last activity

Checking Your Credit Score

You should check your credit score well before you begin the mortgage process so you will know where you stand and the mortgage rate you could qualify for. You can check your credit score for free through several online services. Many banks, credit unions, and credit card providers offer credit scores as a regular feature. Since most major mortgage lenders use your credit score in their decision, it’s worthwhile to obtain all three of your reports to make sure the information on your record is accurate.

It’s a good idea to research your credit score and your credit reports well in advance of making a major purchase so you have time to address any errors or other issues you might discover.

Read Also: Does Paypal Credit Report To Credit Bureaus

Mortgage Lenders Pull All Three Reports But Only Use This One

According to Darrin Q. English, a senior community development loan officer at Quontic Bank, mortgage lenders pull your FICO score from all three bureaus, but they only use one when making their final decision.

“A bank will use all three bureaus,” tells CNBC Select. “It’s called a tri-merge.”

If all three of your scores are the same, then their choice is simple. But what if your scores are different?

“We’ll use that median score as the qualifying credit score,” says English. “Not the highest or lowest.”

If two of the three scores are the same, lenders use that one, regardless of whether it’s higher or lower than the other one.

And if you are applying for a mortgage with another person, such as your spouse or partner, each applicant’s FICO 2, 4 and 5 scores are pulled. The bank identifies the median score for both parties, then uses the lowest of the final two.

What Credit Score Is Needed For A Va Loan

Qualifying service members, veterans and surviving spouses can buy homes with little or no down payment and no private mortgage insurance requirements, thanks to housing benefits from the U.S. Department of Veterans Affairs, commonly known as VA loans. Issuers of VA loans have some discretion in setting minimum credit score requirements, but they may accept applications from borrowers with FICO® Scores as low as 620.

Also Check: Creditwise Score Accuracy

Why Do Credit Scores Matter

Ultimately, your credit score is important in many ways. To give just a few examples:

- Your credit score determines the types of loans you can get

- It determines the mortgage interest rates you pay

- It affects how large of a house or how expensive of a car you can afford

- Insurers in most states use credit scores to set premiums for auto and homeowners coverage. Policyholders with bad credit scores often pay more

- Landlords use credit scores to decide who gets to rent their apartments

- Cell phone companies might require a deposit if your credit is too low

Whether youre looking for a mortgage or any other financial product, your credit score makes a big difference. Thats why its so important to know yours before you apply.

How The Two Credit Scoring Models Affect Your Score

In the old days, banks and other lenders developed their own scorecards to assess the risk of lending to a particular person.

But these scores could vary drastically from one lender to the next, based on an individual loan officers ability to judge risk.

To solve this issue, the Fair Isaac Corporation introduced the first general-purpose credit score in 1989.

Known as the FICO Score, it filters through information in your credit reports to calculate your score.

Since then, the company has expanded to offer 28 unique scores that are optimized for various types of credit card, mortgage, and auto lending decisions.

But FICO is no longer the only player in the game.

The other main credit scoring model youre likely to run into is the VantageScore.

Jeff Richardson, vice president for VantageScore Solutions, says the VantageScore system aimed to expand the number of people who receive credit scores, including college students and recent immigrants, and others who might not have used credit or use it sparingly.

According to VantageScore reports, there were approximately 10.5 billion VantageScores used between June 2017 and June 2018.

You May Like: How To Remove Repossession From Credit Report