Best Auto Loan Rates With A Credit Score Of 650 To 659

A review of the best auto loan rates for new, used & refinanced vehicles based on credit scores between 650 to 659.

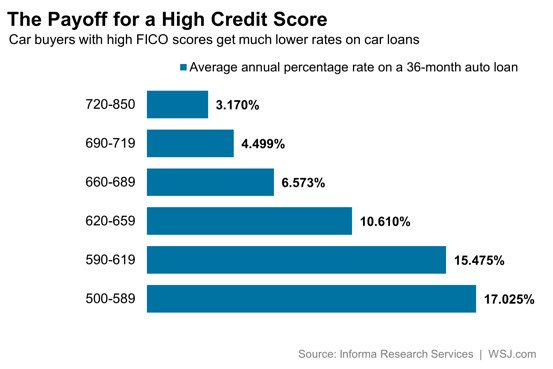

If you have a credit score between 650 and 659 then you are right on the edge of a better interest rate.

Most lenders will give you an interest rate break if you have a credit score of 660 or higher.

Disclaimer: Credit score refers to the FICO score in this article. If you have a different score , that does not likely equal your FICO. For example, a 645 VantageScore could equal any FICO score 643, 644, 645? Who knows? You can get your FICO score here.

In this post:

The Right Credit Score

You may have visited this article thinking you have a FICO score somewhere in the 650-659 range.

The truth is, depending on where you checked your score, you may not be using the same score the auto lenders use.

In the U.S. today most people receive a free credit score with their credit card services or other financial institution supported websites such as Chase Credit Journey.

The problem with these credit scores is that they are usually a FAKO score, not a FICO score.

FAKO scores, such as Vantage, intended use is for educational purposes and not to be relied upon for financial decisions.

The largest producer of FAKO scores is the VantageScore 3.0 .

Whats the difference?

Well, both FICO and Vantage pull your credit history from the big three credit agencies Experian, Equifax, and TransUnion, to calculate your credit scores.

However, the credit scores that FICO generates from your account history at the three credit bureaus are used to assess the risk of a borrower by 90% of lenders in the U.S.

The VantageScore 3.0 is given away free on websites like Credit Karma and in 2018 was prohibited from being used by Fannie Mae and Freddie Mack for real estate mortgages.

Consequently, as you can imagine, the Vantage credit score can be volatile and inaccurate.

For example, according to CreditCards.com, the average VantageScore in Riverside, CA is 652, whereas the median FICO score in CA is 712 to 722, making the first number hard to believe.

How Do I Refinance My Car Loan

Refinancing a car loan is essentially just taking out a new car loan so the steps for applying are mostly the same. You’ll need your driver’s license, Social Security number and proof of income, as well as details about your car. If approved, you’ll use the funds from your new loan to pay off your old car loan, then begin making monthly payments with your new interest rate and terms.

You May Like: What Is Syncb Ntwk On Credit Report

What Is A Fico Score

A FICO score is a three-digit number that acts as a summary of your credit reports, myFICO.com explains. It measures how long youve had credit, how much you currently have, how much of that credit is being used, and if youre making payments on time. These scores were created in 1989 to improve the decision-making process for lenders and increase consistency. The number helps lenders understand how likely a person is to repay a loan. This affects how much money you can borrow, how many months youll have to repay, and how much the interest rate will be.

FICO scores are a win-win for everyone involved. They help lenders make better decisions about whom they lend money to and why, and customers get a more fair shake when it comes to accessing credit. Each lender can determine what is a good score, but generally speaking, they go like this:

Because FICO scores are based on your credit, your score is affected by whether you pay your bills on time, your amount of personal debt, and other major financial decisions.

How To Apply For An Auto Loan

You can apply for an auto loan online, at a financial institution, or at the dealership when purchasing a car. Some lenders allow you to browse the inventory of participating dealerships after your loan is preapproved. Because most loan applications require vehicle information, you may need to have a particular car in mind before applying.

When you apply for a car loan, be sure to have the following information handy, as it may be required to prequalify and will certainly be required before you submit your formal loan application:

- Personal details such as name, address, and age

- Social security number

- Gross annual income information

- Vehicle information such as age, mileage, and vehicle identification number

While not required during prequalification, before you can secure your loan, you may need additional documentation such as your driver’s license, pay stubs, and personal references.

If you plan to have someone cosign your loan, that person will also need to supply the information and documents mentioned above.

To start comparing the best auto loan rates from multiple lenders, visit AutoCreditExpress.com.

Read Also: Does Opensky Report To Credit Bureaus

Financing At The Dealership

Plus, the dealership may have special offers available for using its lending partners, like low-interest financing or rebates. These offers are usually limited to new cars and financing through a captive financing company the automaker owns, such as Toyota Motor Financing or GM Financial.

Dealerships also have special relationships with lenders and may be able to get poor credit situations approved even if you couldn’t get approved on your own.

As mentioned, the downside to financing at a dealership is they can mark up your interest rate, costing you more money in the long run.

Best Overall: Penfed Credit Union

PenFed Credit Union

- As low as 0.99%

- Minimum loan amount: $500

PenFed Credit Union provides some of the best rates available. It also has flexible loan amounts and a number of auto loan options for members. Even though membership is required, a disadvantage for some, PenFed makes the requirements to join fairly straightforward.

-

Offers new, used, and refinance loans

-

Loan amounts from $500 to $100,000

-

Provides rate discounts for using its car buying service

-

Borrow up to 110% on new and used vehicles

-

High minimum loan amount for longer terms

-

Excellent credit history required for lowest rates

-

Membership in the credit union is required

Our top pick for auto loan rates, PenFed Credit Union, offers some of the lowest rates available.

At PenFed, rates for 36-month refinance loans start as low as 1.79%. Deep discounts are available for members who use the credit union’s car buying service, with rates starting as low as 0.99% APR for a new car and 1.99% APR for a used vehicle.

You’ll have to become a member of the credit union, but the requirements to join are fairly easy to meet. Car loans from PenFed start as low as $500 and move up to $100,000, a wide range that beats out many of the lenders we surveyed.

Don’t Miss: How Does Balance Transfer Affect Credit Score

Fico Scores Are Evolving To Keep Up With Modern Behaviors And Needs

Think of how people use different versions of computer operating systems or have older or newer generations of smart phones. They all share the same base functionality, but the latest versions also have unique updated features to meet evolving user needs.

The same goes for FICO Scores.

The various FICO Score versions all have a similar underlying foundation, and all versions effectively identify higher risk people from lower risk people. Every time the FICO Score algorithm is updated it incorporates unique features, leverages new risk prediction technology, and reflects more recent consumer credit behaviors.

The end result is a more predictive score that helps lenders make more informed lending decisions, which ultimately makes the credit process easier, faster and fairer.

Benefits Of Learning About Auto Loan Score Requirements

Understanding the loan requirements can give you great insight into your ability to finance a car before you apply for any financing. If you know the requirements, you can take steps to improve your credit, if necessary. Or, if you know that you dont meet a particular lenders requirements, you can go somewhere else or make alternative arrangements, like getting a co-signer.

You May Like: 779 Credit Score

Going For A New Vehicle

While the value is almost always in buying a used car, their financing terms are generally not as favorable as new cars. If your only concern is the interest rate and monthly payments, then going with a new car over a used car may be beneficial.

Yes, you may have to drop down in car class or forgo a few features to keep the prices close, but the new car loan will almost always have better interest rates and financing options.

How To Access Your Fico Auto Scores

While some credit scores can be monitored for free, you may have to hand over some cash if you want access to your FICO® Auto Scores. When you pay $39.95 a month through FICO, you can monitor a handful of your credit reports and scores, including your FICO® Auto Scores.

Before you pay for credit monitoring though, note that there are several versions of the FICO® Auto Score model. Monitoring just one doesnt guarantee youll see the same version your lender pulls. Consider calling your prospective lenders financing department to see which version they use, and check to see which scores youll get through the monitoring service, before paying for your scores.

Recommended Reading: How To Remove Repossession From Credit Report

Fico Credit Score & Auto Loans

FICO Credit Score & Auto Loans

If you are considering buying or leasing a new vehicle, you may be paying close attention to your credit score. This number determines what your car loan interest rate will be, and will also determine your eligibility for loans. So what what exactly is a credit score and how does it impact the car buying process?

The three major credit bureaus are Experian, TransUnion and Equifax. The two big credit scoring models used by auto lenders are FICO® Auto Score and Vantage. Were going to take at look at FICO® since it has long been the auto industry standard.

FICO is an acronym that stands for: Fair Isaac Corporation, the company that developed the FICO® credit scoring.

FICO® credit scores are the auto industry standard for determining a potential buyers creditworthiness. Using a variety of factors, the company will give you a three digit score ranging from 300 to 850 .

Though FICO keeps the specifics of their credit scoring algorithm a secret, there are certain known factors that weigh into determining a persons credit score.

Many people are surprised when they arrive at the dealership, and find that their FICO credit score is not the same three-digit number they saw on the credit monitoring service that they have used.

If you want to know your exact score before you begin car shopping, simply visit myfico.com

Generally speaking, banks require a minimum credit score of 600 to give an auto loan without any down payment.

Best Bank For Auto Loans: Bank Of America

Bank of America

- As low as 2.39%

- Minimum loan amount: $7,500

Bank of America auto loans come with the backing of a major financial institution. Low rates and a big selection of loan options make it a major competitor in the auto loan landscape. In J.D. Power’s 2020 Consumer Financing Satisfaction Study, which deals with auto loans, Bank of America ranked seventh out of 12 in its segment and scored equal to the average.

-

Offers new, used, and refinance auto loans

-

Transparent rates and terms online

-

Well-known financial institution

-

Restrictions on which vehicles it will finance

-

High minimum loan amount

Bank of America is a large financial institution offering a number of auto loan options, including new, used, refinance, lease buyout, and private party loans.

For the most creditworthy borrowers, APRs start at 2.39% for new vehicles. Used vehicle loans start at 2.59% APR, while refinances start at 3.39% APR. Customers of the bank who are Preferred Rewards members can get up to a 0.5% discount on their rate.

BofA provides a no-fee online application that it claims can offer a decision within 60 seconds. You can choose from a 48-, 60-, or 72-month term online, but there are additional options ranging from 12 to 75 months if you complete the application process at a branch or over the phone.

Also Check: 611 Fico Score

What Determines My Auto Loan Rate

The most important factor that decides your auto loan rates is your credit score. The better your score, the lower your APR will be. The best rates are reserved for those with credit scores above 800, but according to Equifax, any score above 670 makes you a low-risk borrower and opens the door to lower rates.

However, your credit score isnt the only determining factor. Employment status, income, and the type of vehicle you purchase also affect rates. Having a steady income stream and purchasing a newer vehicle will result in better auto loan rate offers.

Can You Sell A Car With A Loan

It is possible to sell a vehicle when you still have a loan, but it adds a few extra steps. There are a few different options in this situation. One option is to pay off the loan in full before selling the vehicle, which involves contacting your lender to determine your payoff amount. After paying off the loan, your lender will release the lien.

You can sell a vehicle that’s financed without paying it off by selling it to a private buyer or trading it in with a dealer.

Read Also: How To Remove Items From Credit Report After 7 Years

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Shopping Around For A Car Loan Can Help

Perhaps the most important suggestion I can give you, especially if you have so-so credit, is to shop around for your next car loan. You may be surprised at the dramatic difference in offers you get.

Many people make the mistake of accepting the first loan offer they get . It’s also a smart idea to get a pre-approval from your bank as well as from a couple of other lenders. Online lenders and credit unions tend to be excellent sources for low-cost loan options. Not only are you likely to find the cheapest rate this way, but you’ll then have a pre-approval letter to take to the dealership with you.

The best part is that applying for a few auto loans won’t hurt your credit. The FICO credit scoring formula specifically allows for rate shopping. All inquiries for an auto loan or mortgage that occur within a 45-day period are treated as a single inquiry for scoring purposes. In other words, whether you apply for one car loan or 10, it will have the exact same impact on your credit score.

You May Like: Aargon Agency Inc Las Vegas

You Can Get A Car Loan With A Low Credit Score

To be clear, you can get a car loan with a low credit score. Although the subprime mortgage market has virtually disappeared since the financial crisis about a decade ago, the subprime auto loan market has exploded in recent years. Roughly 1 of every 4 car loans made in the U.S. is made to a subprime or deep-subprime borrower.

While the exact definitions of these terms vary depending on who you ask, the Consumer Financial Protection Bureau, or CFPB, defines subprime as borrowers with credit scores of below 620 and deep subprime as borrowers with scores below 580.

How Do You Get Prequalified For An Auto Loan

You can get prequalified for an auto loan online and without ever leaving your home. All you have to do is select one of the lenders on this list and choose its online option to get prequalified or apply for a loan. Many lenders let you get prequalified for an auto loan without a hard inquiry on your credit report.

Read Also: Does Paypal Credit Report To Credit Bureaus

Why Is Your Credit Score Different With Each Bureau

If youre wondering the differences among the three bureaus, the answer is not much. The main difference, and really the only difference, is how they use the information in your credit report to calculate your score. They each have their own algorithms and ways they weigh your debt to generate your score. Additionally, each bureau might rely on the FICO or VantageScore model to determine your score.

The credit score an auto lender obtains can be different from the like Credit Karma. According to CNBC, your scores can differ for six reasons. First, depending on which scoring model and version are used, along with which bureau is used, your credit score can be different because each model and bureau have slightly different formulas they use.

Additionally, lenders are not required to report information to all three credit bureaus, so one credit report might have information the other does not. Also, the time a lender performs a credit inquiry and any errors on your report contribute to different scores.

Your credit score is a major part of determining whether you can get a car loan and a good interest rate. Dealerships want to buy a car from them, but their lenders have some restrictions for financing based on your score and debt-to-income ratio. For instance, you might get a loan even if you have a low score, but youll likely pay a high annual percentage rate .