Tip : Limit New Credit Applications

Each time you apply for credit, an inquiry appears on your credit report, regardless of whether you’re approved or denied. This can temporarily lower your credit score by roughly five points, though it will bounce back in a few months. While one credit inquiry isn’t likely to hurt your score, it can add up if you apply for multiple cards within a short period of time.

If you want a new card, but you’re not sure you’ll qualify, you can submit;a pre-qualification form;online. You can submit as many pre-qualification forms as you want, as they won’t impact your credit score.

For anyone looking to open a new card to take advantage of a sign-on bonus, make sure you space out your applications for new cards. There’s arguably no such thing as;too many credit cards, but it’s not wise to apply for several cards within a short period of time it sends a message to issuers that you might be a credit risk.

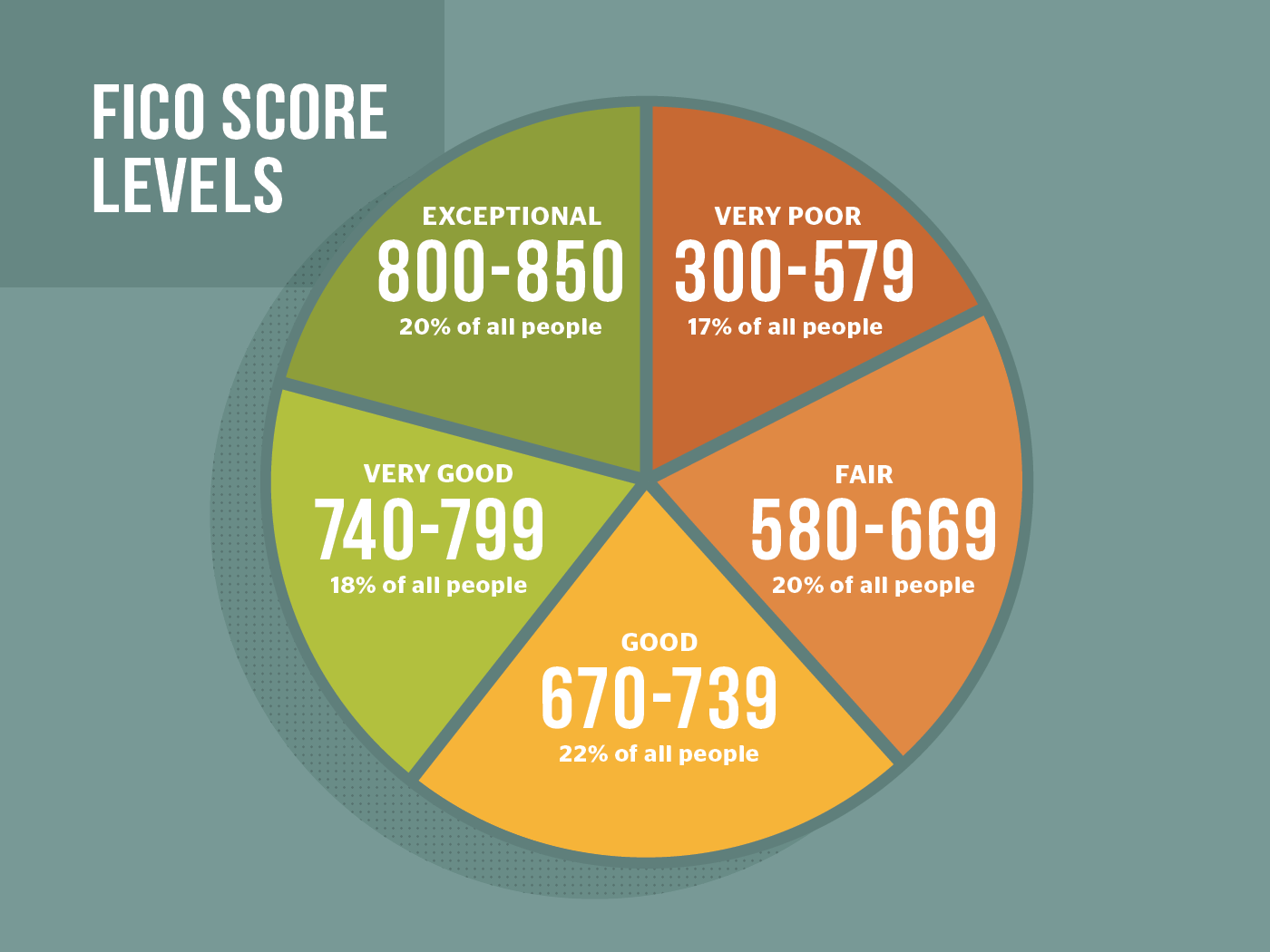

Whats A Good Credit Score Range

A good credit range depends on where a score comes from and whoâs judging it. Itâs important to remember that lenders set their own and standards to determine creditworthiness. That means what FICO, VantageScore or anyone else considers good may not all be the same.

Keep that in mind as you read what might be considered a good credit score range.

Whatâs a Good FICO Credit Score Range?

When it comes to âwhatâs good,â FICO says scores between 670 and 739 qualify. Scores in that range, it adds, are near or slightly above the U.S. average.

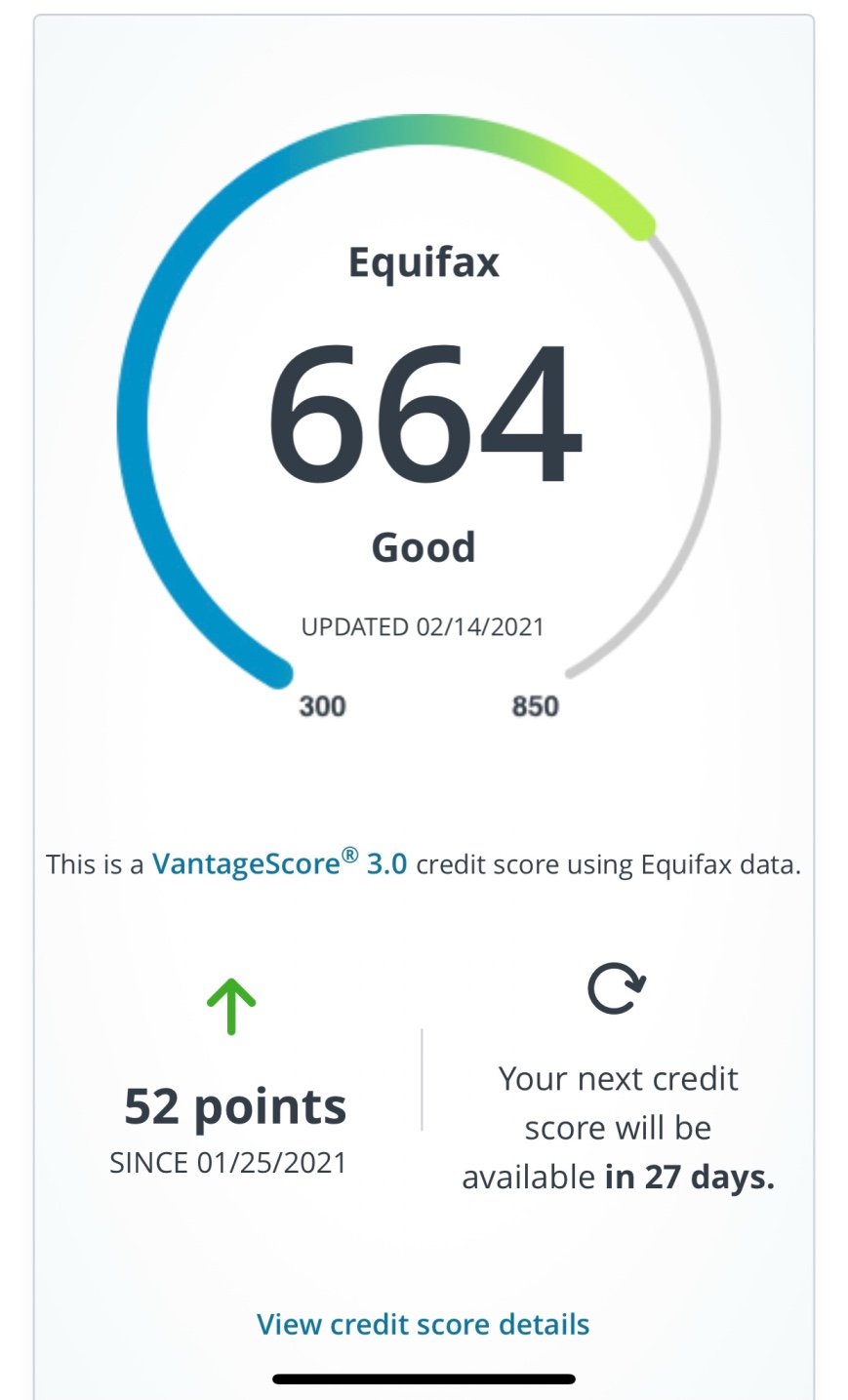

Whatâs a Good VantageScore Credit Score Range?

When it comes to VantageScore, scores between 661 and 780 might be considered good.

Why Having A Good Credit Score Still Matters And How To Check Yours For Free

It’s OK if you haven’t yet reached a 760 credit score. The national average FICO score has steadily risen over the years and hit a record high of 703 in 2019, so many are in the same boat. The good news is that, whether you have a good credit score or even an excellent one, you will most likely qualify for some of the best cards and even cards with the best rewards.;

The American Express® Gold Card was voted CNBC Select’s best overall rewards card for giving cardholders 4X points per dollar spent at restaurants and at U.S. supermarkets . Plus, the option to earn 3X points on flights booked directly with airlines or on Amextravel.com. Applicants can qualify with good or excellent credit.

And the Blue Cash Preferred® Card from American Express ranked as the best rewards credit card for groceries, as cardholders earn 6% cash back at U.S. supermarkets on up to $6,000 per year in purchases . This card also offers 6% cash back on select U.S. streaming subscriptions, 3% cash back at U.S. gas stations, 3% cash back on transit and 1% cash back on other purchases. Applicants can qualify with good or excellent credit.

To track your own credit progress, make sure you routinely check your credit score. It’s smart to monitor your credit, and your score will not be affected by doing so . You can check your score for freewith most card issuers, using apps such as Discover’s Credit Scorecard and Chase’s Credit Journey, which are available to all card users.

You May Like: What Is Cbcinnovis On My Credit Report

Option : Get Credit For Paying Monthly Utility And Cell Phone Bills On Time

Having a credit card is not the only way to build credit. If you are already responsible about making your utility and cell phone payments on time, but you don’t have a credit card, then you should check out;Experian Boost. It’s a free and easy way for consumers to improve their credit scores. Roughly two out of three people see instant increases to their credit scores, with an average increase of 10 points, and many people become scoreable for the first time as a result, according to;Rod Griffin, senior director of consumer education and advocacy at Experian.

The way it works is simple: Connect your bank account to Experian Boost so it can identify your utility and cell phone payment history. Once you verify the data and confirm you want it added to your Experian credit file, you’ll get an updated FICO score delivered to you in real time. Visit;Experian;to read more and register. By signing up, you will receive a free credit report and FICO score instantly.

How Is My Credit Score Calculated

- Your total available credit balance.

- Balance between your secured and unsecured loans.

- Number of loans and credit cards you have.

- Plus, a whole host of other factors

A credit scoring algorithm is then used by the bureaus to calculate your credit score. Your credit score not only helps lenders assess your loan eligibility, it also helps them understand if you are worthy of credit. The higher your credit score, the higher are your chances to get your loan approved. So, its always advisable to check your credit score before you;apply for a loan

Recommended Reading: Does Zebit Report To Credit

What Factors Go Into A Credit Score

Its important to know your credit score and understand what affects it before you begin the mortgage process. Once you understand this information, you can begin to positively impact your credit score or maintain it so you can give yourself the best chance of qualifying for a mortgage.

While exact scoring models may vary by lender, some variation of the standard FICO® Score is often used as a base. FICO® takes different variables on your credit reports, such as those listed below, from the three major credit bureaus to compile your score. FICO® Scores range from 300 850.

From this information, they compile a score based on the following factors:

- Payment history

Become An Authorized User

If you have a trusted family member with a good credit score, you have an opportunity to dramatically increase your credit score. You can become an authorized user of their account in order to boost your score.

However, this can be a taxing emotional burden. If you dont repay your debts, then you could hurt their credit score. Talk through the pros and cons with your family member before trying this method.

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

Get Your Credit Report

Start by getting a copy of your credit report from one of the following places.

According to the Fair Credit Reporting Act, each of the three major credit bureaus Equifax, Experian and TransUnion is required to give you a free copy of your credit report upon request once a year.

You can request your free credit report at AnnualCreditReport.com. Beginning in 2020, you can get at least six more free credit reports each year through 2026. To get started, visit Equifax;or call 866-349-5191.

During the COVID-19 pandemic, all three of the major credit bureaus are offering free weekly credit reports, which you can request and review online.

Many credit card issuers provide access to credit scores along with updates to cardholders. Check with your card issuer to see whether it provides this benefit.

A nonprofit credit counselor can often provide you with a free copy of your credit report to discuss it with you. You can find such organizations through the National Foundation for Credit Counseling.

Credit Score Credit Cards

Unfortunately, one with fair 670 credit score will not qualify for just any credit card, such as ones that offer big initial bonuses. The general approval process will also be more difficult for those with less than good credit. However, individuals within this credit range typically qualify for the following cards: ones with zero financing, no foreign fee, or no annual fees; airline/hotel cards; and store cards. Based on this, there are several credit card options available for those with average credit to turn to, but most come with annual fees and only allow a low credit limit.

Don’t Miss: 524 Credit Score Good Or Bad

How To Improve Your 660 Credit Score

The average FICO® Score is 704, somewhat higher than your score of 660, which means you’ve got a great opportunity to improve.

70% of U.S. consumers’ FICO® Scores are higher than 660.

What’s more, your score of 660 is very close to the Good credit score range of 670-739. With some work, you may be able to reach that score range, which could mean access to a greater range of credit and loans, at better interest rates.

The best approach to improving your credit score starts with a check of your FICO® Score. The report that’s delivered with the score will use details from your unique credit report to suggest ways you can increase your score. If you focus on the issues spelled out in the report and adopt habits that promote good credit scores, you may see steady score improvements, and the broader access to credit that often comes with them.

How Can I Improve My Credit Score

The biggest ways improve your credit score are to pay off any outstanding debt, make future payments in full and on time, and keep credit utilization low. It’s also important to make sure you aren’t making too many applications for new credit at one time.

The bottom line: Your credit score is ever-evolving. It’s not impossible to improve a credit score, it often just takes careful planning, diligence in paying bills, and keeping spending in check.

Need to improve your credit? Our partner learn more about removing negative items from your credit score. Learn more »

Don’t Miss: Is 524 A Good Credit Score

Ology: How We Chose The Best Credit Cards For Good Credit

Methodology: We analyzed 1,478 of the top credit cards on the market to narrow down a selection of the best choices. Core criteria we considered in our analysis include:

- Base rewards program: The best cards in this category for cash back, points or miles offer competitive rewards rates, helpful spending categories and straightforward redemption policies.

- : APR is the interest charges you pay if you carry a balance. The top credit cards offer reasonable APRs, especially for those who have good credit scores.

- Sign-up bonus: Sign-up bonuses give you the opportunity to earn cash back, points, statement credits and other types of rewards for meeting a spending requirement within a specified time. Bonuses with a good ratio of spending-to-value are rated highly.

- Annual fee: Is a cards annual fee worth it? We measure the annual fee against each cards features and benefits to rate its holistic value.

Shopping For Credit Cards With A 670 Credit Score

When shopping for credit cards, make sure you explore all of your options. In other words, dont just sit down with one potential creditor and decide to accept their deal or not. Sit down with multiple potential creditors and compare and contrast them to find out what works best for you.

If you already have a credit card, but have been shopping for one that is cheaper, you can then go to your existing creditor and request them to either match or beat an offer from another credit card company. Tell them that you believe you are paying too much money in fees and interest, and ask them if they are willing to lower their rates and fees down to the other credit card company that you are thinking about switching to.

If they refuse, then you can switch accounts, but dont close your existing account immediately. You still want to make the minimum payment on. it while you are waiting for your balance to transfer to your new account. You only want to close a credit account when your balance is at zero.

You May Like: Does Paypal Credit Affect My Credit Score

What Is A Good Credit Score For An Auto Loan

Next to a mortgage, vehicles are often among the most expensive purchases the average adult makes in the United States. According to the Kelley Blue Book, an independent automotive valuation agency, the average price for a light vehicle purchase in the U.S. was $38,940 in May of 2020.

For a significant purchase like a car, having good credit could mean saving thousands when youre financing your purchase.

For example, someone with a FICO score of 620 who is looking to buy a new car is told by the car dealer they could qualify for a 60-month loan for $38,000.

According to the FICO Loan Savings Calculator, your loan in June 2020 would have an APR of 16.714% and your monthly payments would be $939. Over the life of the loan, youd pay an additional $18,315 in interest.

A $942 per month car loan payment is a significant amount, even if you can get approved. So, lets assume you hit the pause button and decide to work on improving your credit before taking out a loan. When you apply again down the line, you learn that youve boosted your score to a 670, which is considered a good credit score by most credit scoring models.

With a 670 credit score, the FICO Loan Calculator now estimates that you might qualify for an APR around 7.89%. Based on that rate, your monthly payment on the same $38,000 auto loan would be $768. You would pay $8,106 in total interest over the life of your loan.

Because you improved your credit score from poor to good, you would save:

Common Document Requirements For A Loan Application When You Have Good Credit

Below is a list of documentation commonly required for loans of all types. Exactly which items youll be required to furnish will depend on the lender and the kind of loan youre applying for.

- Your most recent pay stub and W-2 to document your income.

- Evidence of Social Security or pension income .

- Contact information for your employer .

- Copies of completed income tax returns for the past two years, if youre self-employed or work on commission.

- Make, model, and value of your car; VIN number if youre applying for an auto loan.

- If youre paying or receiving child support or alimony, list the amount youre paying or receiving.

- Bank or brokerage statements, or even retirement account statements.

Don’t Miss: Paypal Credit Hard Pull

Keep An Eye On Your Credit

Sign up for a credit monitoring program that can alert you when changes are made. Even if you do this, however, it is important that you monitor your credit manually.

At least once a month, pull your report through a company like Credit Karma or Experian. Its free to do and gives you an overview of any changes.

More From GoBankingRates

Best Auto Loan Rates With A Credit Score Of 670 To 679

A review of the best auto loan rates for new, used & refinanced vehicles based on credit scores between 670 to 679.

With a credit score in the range of 670;to 679, you will qualify for the best prime auto loan rates.

Interest rates will vary based on the type of loan you are looking for. You will get the best rates if you are purchasing a new car.

Interest rates to refinance an existing auto loan start slightly higher than new car rates.;

The APR for used vehicle financing is usually about 2% higher than new car or truck loan rates.

Disclaimer: Credit score refers to the FICO score in this article. ;If you have a different score , that does not likely equal your FICO. ;For example, a 645 VantageScore could equal any FICO score 643, 644, 645? ;Who knows? ;You can;get your FICO score here.

In this post:

Read Also: Does Zzounds Report To Credit Bureau

Interest Rates And Your Credit Score

While theres no specific formula, your credit score affects the interest rate you pay on your mortgage. In general, the higher your credit score, the lower your interest rate, and vice versa. This can have a huge impact on both your monthly payment and the amount of interest you pay over the life of the loan. Heres an example: Let’s say you get a 30-year fixed-rate mortgage for $200,000. If you have a high FICO credit scorefor example, 760you might get an interest rate of 3.612%. At that rate, your monthly payment would be $910.64, and youd end up paying $127,830 in interest over the 30 years.

Take the same loan, but now you have a lower credit scoresay, 635. Your interest rate jumps to 5.201%, which might not sound like a big differenceuntil you crunch the numbers. Now, your monthly payment is $1,098.35 , and your total interest for the loan is $195,406, or $67,576 more than the loan with the higher credit score.

Best For Frequent Hotel Users: Mariott Bonvoy Boundless Credit Card

If you regularly spend on hotels, consider the . There are numerous travel and hotel-related rewards.

- 3 free night awards plus 10x total points if you spend $3000 in your first 3 months.

- 10x total points on up to $2500 in total purchases at gas stations, grocery stores, and restaurants in your first 6 months.

- 6x points for every dollar spent at 7,000 participating hotels.

- 10x points from Mariott.

Don’t Miss: Does Paypal Credit Affect Your Credit Score

Why Is A Good Credit Score Important

The truth is that your credit score can impact your entire life. For example, a low credit score can:

- Prevent you from getting certain jobs and housing, as it can be seen as a sign of irresponsibility.

- Lead to high interest rates on mortgages, car loans and other types of loans. This can mean you are paying double or more for a product than those with higher credit scores.

- Keep you from getting approved at furniture or appliance stores. When you desperately need a new fridge, you might find yourself paying steep prices through a rent-to-own store.

While these are just a few examples, they are excellent illustrations of how a bad credit score can cost you a lot over time. A good credit score opens the door for opportunities to have lower payments, lower interest, better jobs and housing, and more.