Why Your Credit Karma Credit Score Differs

There are multiple reasons why your credit score differs between what a personal finance website tells you and what your credit card company or a prospective lender find.

This is mainly because of two reasons: For one, lenders may pull your credit from different , whether it is Experian, Equifax or TransUnion. Your score can then differ based on what bureau your t is pulled from since they don’t all receive the same information about your credit accounts. Secondly, different credit score models exist across the board.

As it states on its website, Credit Karma uses the VantageScore® 3.0 model. VantageScore may look at the same factors that the other popular FICO scoring model does, such as your payment history, your amounts owed, your length of credit history, your new credit and your credit mix, but each scoring model weighs these factors differently.

For this reason, VantageScore and FICO Scores tend to vary from one another. Your VantageScore® 3.0 on Credit Karma will likely be different from your FICO Score that lenders often use.

If you plan on applying for credit, make sure to check your FICO Score since there’s a good chance lenders will use it to determine your creditworthiness. FICO Scores are used in over 90% of U.S. lending decisions.

*Results may vary. Some may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost.

Editorial Note:

Less About Perfect Accuracy And More About Improving Credit Health Over Time

Are there any drawbacks to Credit Karma? Users of the tool notice that the credit score they see on the site can vary slightly from the ratings they see on other websites and from other providers.

The company devotes a whole article to discussing the question of accuracy and variation. They explain that differences in credit scores are typical and expected due to the nature of credit reporting.

The variations are unlikely to be significant. The companys overall goal is to help people track the way their credit score changes over time and offer them ways to improve their score and financial health over time.

There are several reasons why credit scores can vary from those found on Credit Karma, including:

Why Is My Credit Score Important

Your will play a large role in determining the answer to three crucial questions regarding your mortgage.

- Will the lender approve my mortgage?

- How much will they lend me?

- What will my interest rate be?

If your credit score is low, you might not be able to qualify for a loan large enough to purchase the home you want. Or, you might get the loan but at a rate so high that you will be wasting hundreds or even thousands of dollars each year just on interest payments.

You May Like: How To Check Your Credit Score Without Lowering It

Does Credit Karma Give You An Accurate Credit Score

Here’s the short answer: The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

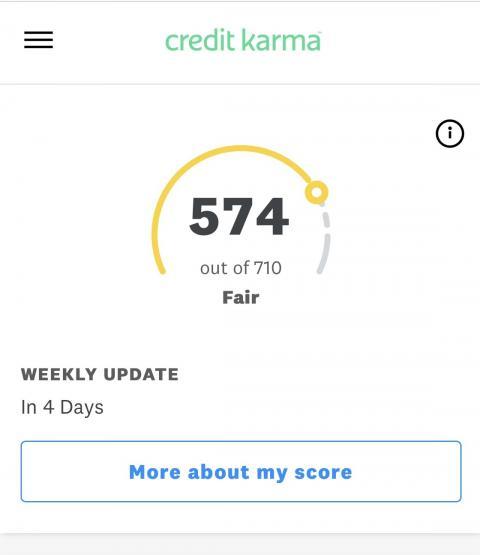

What Is A Credit Score

A credit score is a number based on the information in your . Most credit scores range from 300 to 850, and where your score falls in this range represents your perceived credit risk. In other words, it tells potential lenders how likely you are to pay back what you borrow.

Your credit scores can affect whether a lender approves you for a mortgage, auto loan, personal loan, credit card or other type of credit. And if youre approved, your credit scores can also help determine the interest rate and terms youre offered.

Also Check: What Is A R9 On Your Credit Report

What Is Credit Karma Savings

Another feature the company offers is whats called Credit Karma Savings or their trademarked name, Credit Karma Money. Like it sounds, the company offers a high-yielding saving account where you can deposit your money.

If you are risk-averse and dont want to put your money in places where you could lose some of it, a savings account is usually an excellent choice.

Like traditional savings accounts, high-yield savings plans are insured for up to $250,000. A Credit Karma account can be an excellent enhancement to improve your financial situation.

How Many Points Is Credit Karma Off

Many people ask ‘how many points is credit karma off?’ and the answer varies for each individual case. Credit Karma receives information from two of the top three credit reporting agencies. This indicates that Credit Karma is likely off by the number of points as the lack of information they have from Experian, the third provider that does not report to Credit Karma. If you can figure out your Experian credit score you will be able to generate an accurate detailing of how many points Credit Karma is off as it relates to your actual score.

Recommended Reading: How To Remove Items From Your Credit Report Yourself

Is Credit Karma Accurate Yes But With Limitations

However, if youre gearing up to apply for a loan or mortgage, you might want to seek additional information. Track down your FICO scores and monitor them alongside your Vantage 3.0 score.

That way, you wont have to wonder how accurate Credit Karma is. Youll have the fullest picture of your financial profile as you work to improve your credit score.

An Easy Way To Get Your Credit Report

The three major credit reporting bureaus, TransUnion, Equifax, and Experian, are required to give you a free credit report once a year by federal law. You have to apply for your reports through AnnualCreditReport.com.

While these reports are handy to see what lenders have reported to the credit reporting agencies and find inaccuracies to correct and improve your credit they do not include your actual credit score.

Since you need to know your credit score to get an idea of where you stand when applying for credit, the reports lack of a credit score is problematic. The reporting agency provided a less than an adequate solution offering to sell you your score for a steep price.

In 2007, Credit Karma came on the scene with a better option. They partnered with Equifax and TransUnion to give members ongoing access to their credit reports and credit scores.

Instead of having to wait once a year to check your reports or being price gouged to get your actual credit score, you could sign up for Credit Karma and get what you needed. This is how Credit Karma works and one of its best features.

So, to be crystal clear the company offers a free service where youll have access to your credit profile.

Recommended Reading: How To Find Out Your Credit Score For Free

How Do I Obtain My Fico Score

If your bank is on board, you can generally check your FICO Score by logging onto your online banking portal. Click here for a list of lenders participating in the FICO® Score Open Access program. Credit card companies If you carry the right kind of plastic, you may be able to get your FICO Score for free.

What Consumers Have To Say

If you want to know what people really think check social media. Some people have been pretty vocal regarding Credit Karma. Here are a few Tweets from Twitter:

Credit Karma always says my credit score is like 750. But then we just refinanced, and the bank sent out the credit disclosure letter and said my score was 825.

is wrong 99% of the time. They can be anywhere from 100 points higher to like 80 less than the actual score.

If you think your credit score on is right, you wrong, lol.

And for the last one a bit more colorful!

Credit Karma: your credit score is 800.

You May Like: How Many Points Does A Hard Inquiry Affect Credit Score

How Do I Correct My Fico Score

However, there are steps you can take to fix your credit that we outline below.

A Credit Karma Account Has Security Measures

For example, you can get a texted code to verify your identity with two-factor authentication if you plan on logging in from different devices.

You will be able to turn credit and identity monitoring on or off. You will also be able to request email notifications for changes to your credit score, special promotions, etc. Having these options comes in handy, especially if there is suspicious activity.

If you need to reach Credit Karma by phone, you can do so by calling their phone number at1-888-909-8872. They are available to answer your calls from 8 a.m. to 11 p.m. Eastern time.

Using their toll-free number will be how you reach Credit Karma customer service.

Also Check: Why Is My Credit Score Going Down

Confused By Your Credit Karma Score Credit Karma Scores Explained March 19th 2021

I dont get it. I checked my score through Credit Karma before I applied for a mortgage, and now my score is lower? Whats going on?

We cant tell you how often we get this question. A lot of our customers monitor their credit scores for free using Credit Karma. When they go to apply for a mortgage or another type of loan, they are then shocked when their score is not as high as they expected.

In worse case scenarios, this can even lead to a customer being turned down for a loan. And if there is an approval, it can come at the cost of higher interest.

What Does Credit Karma Offer

You can get a free credit score and credit report from Credit Karma in exchange for providing some personal information. Your credit score will be calculated using the VantageScore 3.0 credit scoring model. Credit Karma also offers a wide range of other free services. For instance, you can access tools and education, such as financial calculators and useful articles, so you can learn how to make the most of your money. Based on data you share, Credit Karma makes recommendations for managing your finances.

Looking for an auto loan, home loan, credit card or other credit product? Use the site to get personalized recommendations for loans and credit cards that fit your credit profile. Credit Karma also offers free credit monitoring, which includes alerts of important changes to your TransUnion credit report this can help you spot identity theft.

Also Check: What To Do About Closed Accounts On Credit Report

Who Should You Trust

When youre going to get a mortgage, have your credit pulled by the lender youre going to use. Theyll get all three of your scores and take the middle one. If your score is too low, a good lender will tell you how to raise it. Knowing your score and whether you have good credit or great credit is important. Thats because your ability to get a mortgage and what type of interest youll be paying is connected to your score.

What Is The Vantagescore Model

The VantageScore Model was originally developed in 2006 and the VantageScore Model 3.0 debuted back in 2013. There is currently a 4.0 model as well but it has not been as widely adopted as it has only been out since 2017. VantageScore Model 3.0 is used for other credit services like , Chase Journey, etc.

The VantageScore Model Credit Karma uses is pretty similar to the FICO model but it has some key differences. It uses the same FICO range of 300 to 850 for the score and stresses many of the same factors as FICO it just gives them different weight and has some slightly different criteria for calculating them.

Here are the 3.0 factors according to :

- Payment history

Don’t Miss: How Much Does Overdraft Affect Credit Rating

Age And Type Of Credit

This is different from the FICO model because account history and the types of credit are two of the three least important factors for FICO. One of the big differences for the VantageScore Model is that it does not consider closed accounts when determining the age of your accounts. FICO will continue to count your closed accounts until 10 years after they are closed.

So your average age of accounts will often be significantly lower with the VantageScore Model. This is why people like me who have opened up and closed a lot of cards have a significantly lower VantageScore Model Score than FICO the average age of our accounts is significantly lower and it carries more weight.

Similarities Between Fico And Vantagescore

Both the FICO Score and VantageScore models use a credit score range from 300 to 850. Both consider the same general factors when assessing your creditworthiness: your payment history, how much credit youre using, the length of your credit history, the different types of credit you have and whether youve recently applied for new credit.

Also Check: Is 591 A Good Credit Score

What Is Experian Boost

If youve been regularly checking your Experian credit score, you may have come across Experian Boost.

Experian Boost isnt a model used to calculate a credit score. Rather, its an offering that goes beyond the traditional credit score factors to incorporate your payment history from common bills for things like cell phone service, popular streaming services and other utility bills.

Keep in mind that not everyone sees a credit score increase with Experian Boost, and a lender may use a different credit score that isnt affected by Experian Boost when deciding whether to approve you for a loan.

Be Prepared To Negotiate

Its more than likely that the seller will come back to you with a counteroffer. Thats just part of the negotiations. Its up to you whether you can comfortably accept their counter, respond with your own counteroffer, or walk away.

Keep your finances in mind and dont let yourself get carried away in the excitement of buying your first home. No matter how much you might think a house is perfect for you, if you cant comfortably afford it, its time to think twice.

Remember buyers: you need to know what a home will require in order for it to be up to your expectations of build quality. Houses may need a few things fixed either prior to purchasing a home or immediately after. Its important to be aware of these issues, as it may cause a headache further down the road after youve purchased the house.

Often, if the seller is motivated enough to sell the house, they might work with you and include fixes and light renovations as a stipulation in the contract for the sale of the house. Making sure you have inspectors and independent contractors to inspect the house for any major issues can help save you a headache in the long run.

Ensure you dont bid either too high or too low on the house. Bidding too high will probably get you the house quicker, but you may end up paying over market value for the home and will probably have to recoup that cost before you can be in a suitable position to generate equity into the home.

Read Also: Is Fico Score Different From Credit Score

What Else Does Credit Karma Provide

I was impressed with how easyand fastgetting my credit score was with Credit Karma, but the service also provides:

- A graph showing your credit score over time

- How your credit score compares to others by age, income and state

- A credit report card that shows you how certain factorslike your payment history and debt utilizationimpact your credit score

- Tools to let you simulate how paying down debt or applying for new credit will change your score

- Access to your free credit report with weekly updates

Should I Even Bother With The Credit Karma Score

Since most major lenders utilize the FICO model, you need to be very cautious about relying solely on your Credit Karma score. As I have shown, in some instances, this score can be really different from your FICO score like when you only have a couple of months of credit history or when you have closed a lot of credit card accounts.

Sometimes a lender might have a hard cut off for approvals or for certain interest rates. For example, if your score is below 700 your interest rate could go up another 1% or 2%. Or if your score is below 650 you might not be able to get approved for a certain loan or card.

In those cases, when you were dealing with hard cutoffs, it becomes very important that you get a truly accurate and up-to-date score. This is especially true if you are dealing with a large sum of money like in the case of a mortgage.

In those situations you would want to stray away from Credit Karma and do what you can to obtain an official FICO score. It will also benefit you to try to figure out exactly which credit score model your lender uses, since there are many different versions of FICO score.

And some point you might actually run into a lender that uses the Vantage score model . If they are pulling from Equifax for TransUnion then Credit Karma could be very useful for that lender.

Read Also: How To Keep Your Credit Score High

Using The Credit Karma App

If you love to access your financial information on your phone, you can use the Credit Karma App. The mobile app is free to download for iOS and Android users. The app has tools and features that allow you to stay on top of your finances and check your credit score for free.

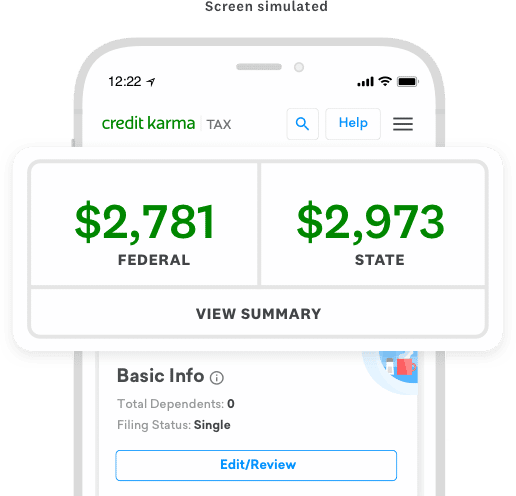

You can also file your state and federal tax returns with Credit Karma tax and put away cash with Credit Karma Savings.

With the app installed on your phone, you will have the ability to receive credit alerts if the company gets a crucial change to your credit reports from either Equifax or Transunion.

For example, if your credit card bill got paid off. Their free credit monitoring tool helps you keep up to speed on your finances and any unwelcome surprises.