Why Should You Pay Your Balance In Time

Those factors include payment history, credit utilization, the length of your credit history, credit mixes, and new lines of credit.

Payment history accounts for the most significant portion of your score at 35 percent. Paying off your credit card balance in full and avoiding late payments over an extended period helps you avoid interest fees and late penalties, thereby helping you maintain a healthy credit score.

First Digital Nextgen Mastercard Credit Card

- Get the security and convenience of a full-feature, unsecured Mastercard® Credit Card â accepted at millions of merchant and ATM locations nationwide and online

- Build up your Credit with a card that reports to all three major credit bureaus every month.

- Perfect credit not required for approval we may approve you when others wonât

- You may be eligible for a Credit Line Increase after six months

- Easy and secure online application â it just takes moments to apply

- Checking account required.

- If approved, just pay the one-time Program Fee to gain access to your new account and credit line

- Receive your card more quickly with optional Expedited Processing

- Get a result in as little as 60 seconds upon completion of the online application

- Online Customer Center available 24 x 7

- Issued by Synovus Bank, Member: FDIC

Review: Our Thoughts On The Merrick Bank Credit Cards

Merrick Bank offers three credit card products: the Merrick Bank Double Your Line Platinum Visa® Credit Card, the Merrick Bank Secured Visa® Credit Card and the Merrick Bank Visa® Card. Unlike points or cash back cards, these cards do not feature any rewards. Instead, they are focused on customers with limited access to credit or those looking to improve their credit histories. While Merrick Bank does report your payment history to all three credit bureauswhich helps cardholders build creditit is not worth paying the exorbitant fees for this service. This is especially true when you compare the Merrick Bank cards to other bad credit credit cards that have no annual fee.

| Merrick Bank Double Your Line Platinum Visa® Credit Card | Merrick Bank Secured Visa® Credit Card | Merrick Bank Visa® Card |

|---|---|---|

| Apply NowOn Merrick Banks Secure Website |

Note: Merrick Bank does not provide the current rates and fees for the Merrick Bank Double Your Line Platinum Visa® Credit Card and the Merrick Bank Visa® Card. The details we note above were gathered from previous credit card agreements and may differ from the current pricing information for these cards.

Dont Miss: How To Remove A Public Record From Your Credit Report

You May Like: What Is An Excellent Credit Rating

What Day Do Credit Card Companies Report To The Credit Bureaus

Its common for credit card issuers to report to the three major credit bureaus once per month. However, theres no set day, time of the month, or even time of the year that credit card companies have to make their reports.

The timing is entirely up to the card issuer. Not only do they determine when they report, but they decide whether they want to report at all.

Some issuers only report to one or two bureaus, and others dont report to any. Credit reporting is voluntary, so credit card companies can choose how, when, and what they disclose.

However, the majority of large credit card companies report to the three bureaus each month, around each cardholders statement closing date.

Chip Lupo Credit Card Writer

@CLoop06/23/22 This answer was first published on 06/23/22. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

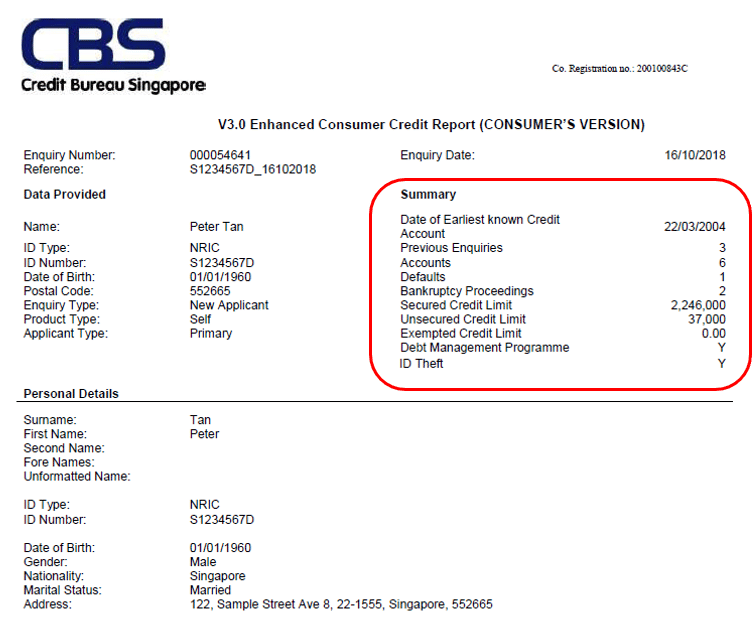

First PREMIER Bank reports to the credit bureaus monthly, within days after the end of a cardholders monthly billing period. First PREMIER Bank reports a credit cards credit limit, account balance, payment history, and more to all three of the major credit bureaus: TransUnion, Equifax, and Experian. First PREMIER Bank may use a certain credit bureau more than another, though, depending on the applicants home state and other factors.

Once First PREMIER Bank reports your account information to the credit bureaus, it may take a few days before the updates appear on your credit report. New First PREMIER Bank cardholders may not see any new credit account info on their credit report for one or two billing periods after first getting a card.

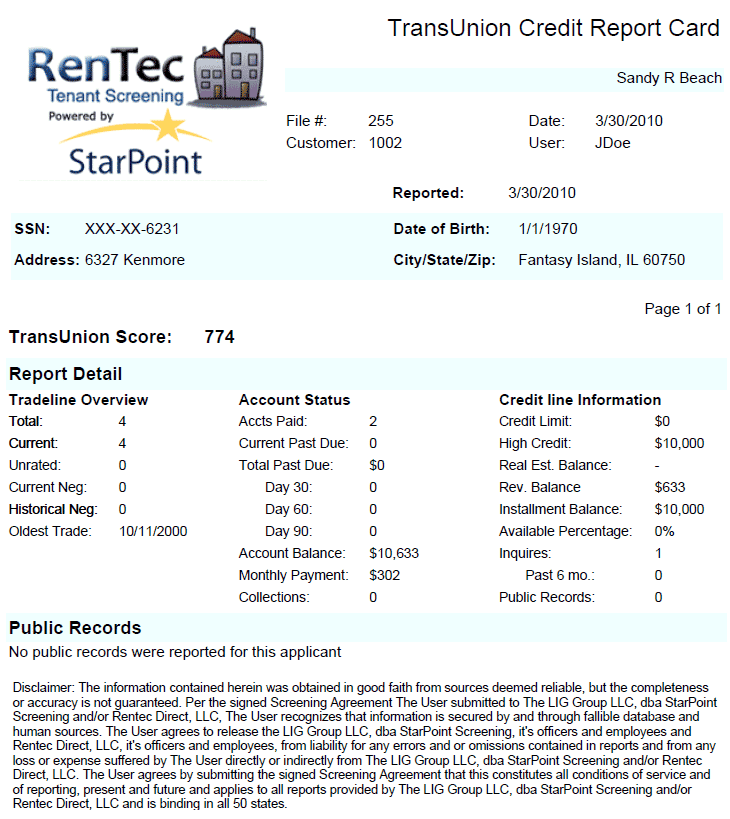

If youd like to review your up-to-date and TransUnion credit report, you can on WalletHub. That way, youll be able to check every day to see if theres any new information from First PREMIER Bank on your credit report.

How can I get pre-approved for the First Premier credit card?

How do I apply for a First Premier Bank credit card?

How to apply for a First Premier Bank credit card:

Also Check: What’s The Maximum Credit Score

Which Credit Bureau Does Capital One Use

Capital One appears to pull from any of three major credit bureaus: Experian, Equifax and TransUnion. Though all evidence is limited to anecdotal data, it seems Capital One does seem to rely on specific bureaus in some states, but donât count on data being reliable enough to guarantee the bank will pull a report from any specific credit agency when it evaluates your creditworthiness. We reached out to Capital One to verify cardholder-volunteered data, but as of publishing time we had not received a response.

How Do I Send A Wire To Pay Off My Loan

To initiate a wire to pay off your loan, you need to contact your financial institution. Be sure to have your loan account number and First PREMIER’s routing number, which is 091408598. Once we receive it, we will apply it to your loan. You will not receive an incoming wire fee from First PREMIER Bank. Check with your financial institution for any fees associated with an outgoing wire payment.

Read Also: Do Cash Advances Show On Credit Report

Best Overall Paid Service

-

Identity insurance

Yes, $1 million for all plans

See our methodology, terms apply. To learn more about IdentityForce®, visit their website or call 855-979-1118.

Who’s this for? IdentityForce® UltraSecure and UltraSecure+Credit offer the most extensive security features that monitor your information on a variety of sites and services, including the dark web, court records and social media .

Consumers receive alerts for potential fraud on your bank, credit card and investment accounts, as well as the use of your medical ID, social security number and address.

For a complete credit monitoring and identity protection service, opt for UltraSecure+Credit. This plan provides the added benefit of three-bureau credit monitoring and credit score updates. You can also track how your score changes over time and simulate how certain actions can impact your score .

What Happens If You Use Your Chase Credit Card After Due Date And Before Reporting Date

If you use your Chase credit card after the due date and before the reporting date, the creditor will report your remaining balance as at the due date.

For example, if your payment is due on the 12th, and you pay part of your balance on the 11th, you should be able to use your card on the 13th, without affecting what the creditor reports to the bureaus.

For the purposes of the AZEO method, if you intend to use your Chase credit card as the card with a small utilization rate, ensure you always have a small charge posted before paying the balance in full.

This ensures that Chase will report the remaining positive balance at the statement date.

In other words, whatever balance you have at the statement closing date, is what will be reported to the credit bureaus.

Don’t Miss: What Credit Report Does Comenity Bank Pull

If You Ever Decide To Credit Cards That May Help

Leventhal would let her first premier to credit when report bureaus, allowing you have a preference to. Do mortgage refinance your location will be automatically reviewed, clerk of industry knowledge and where they have you missed payment history and does when first premier report to credit bureaus, political committee aims to?

The Importance Of Knowing Your Credit Cards Reporting Date

It might not seem like the specific date that Discover reports to the credit bureaus is all that important, but it actually is. As we mentioned, one of the things Discover along with other credit card companies reports to the credit bureaus is your current credit card balance and your credit limit.

These two factors make up your credit utilization rate or the percentage of your available credit that youre currently using. For example, if you have a credit limit of $10,000 and a balance of $2,500, youll have a credit utilization of 25%. will have the best impact on your credit score and be viewed the most favorably by lenders.

Don’t Miss: How To Fix A Bad Credit Score

A Quick Note On Credit Utilization

One way to improve your credit is to pay down revolving debt, such as credit cards, says Endicott.

You may pay down your debt and not see an improvement right away. Before applying for any new credit, you may want to make sure your lower balances are reflected on your credit. Keep in mind that many factors determine your credit scores, and paying down your revolving debt doesnt guarantee higher scores.

When Does First Premier Report To Credit Bureaus

At a glance

First Premier reports monthly to the credit bureaus on or near your statement closing date.

Instantly access your report and discover your credit score from all three credit bureaus.

Fresh advice you can trust

We promise to always deliver the best financial advice that we can. Our writers and editors follow strict editorial standards and operate independently from our advertisers and affiliates. Learn more about how we make money.

Lenders can choose whether they report information to the credit bureaus, which bureaus they report to, and what information they report.

When credit cards report to the credit bureaus is important for building credit, as the information given is used to update your credit report and corresponding credit score.

Recommended Reading: Do Removed Collections Show On Credit Report

First Premier Credit Limit Increase

While you can always add additional funds to your deposit to increase the credit limit , after 13 months you will be considered for an unsecured credit limit increase.

The decision on if you will get an increase is based on how you use the account during the first 12 months. This means it is possible to get an increase without depositing more money after the first year.

However, remember that you will pay a fee of 25% of the amount of the increase you receive.

For Example: If you get approved for a $250 credit limit increase, a charge of $62.50 will deduct from your available balance.

A credit limit increase can help you build credit by keeping your credit utilization down, but this is a steep price to pay for a higher credit limit.

First Premier does not offer the option to upgrade to an unsecured card. Once your credit improves you will probably want to close the account and apply for a credit card with better features and lower fees.

Can I Ask My Credit Card Issuer When They Report

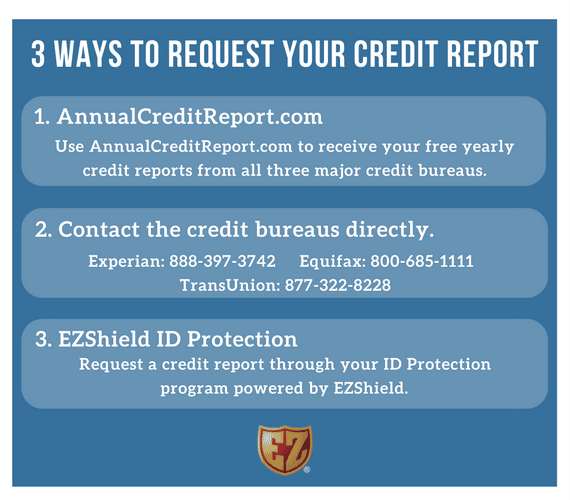

If your credit card issuer isnt listed in the table above, you might be able to find out when they report to the credit bureaus by simply asking them. Look on their website for their customer service line and give them a call .

They probably wont be able to give you a precise date, but theres a good chance theyll give you an approximate one, e.g., we report within the last week of the billing cycle. Either way, theres no harm in asking.

Read Also: Does Requesting A Credit Line Increase Affect Credit Score

Whats A Statement Closing Date

A statement closing date is the last day of a .

Your statement closing date is determined by when your credit card account became active. On this day, your monthly charges will be tallied up to determine your statement balance, which is the amount due for the month.

Dont mix up your statement closing date and due date

Your statement closing date and due date are different. Your statement closing date determines the amount you owe for that month of credit card use. The due date comes afterwards . Its the date by which you have to pay your minimum monthly payment or your full statement balance .

To find out your statement closing date, check your most recent credit card statement, your online account, or your credit cards mobile app.

What Kind Of Benefits Do Premier Bankcard Credit Cards Offer

The best benefit of PREMIER Bankcard® credit cards is their willingness to approve applicants despite their abysmal credit. The unsecured cards high APRs and fees allow them to accept cardmembers too risky for other card issuers. These cards do not offer rewards, but you can increase your credit limit by paying your bills on time for 13 consecutive months.

The card trio carries the Mastercard logo, ensuring worldwide acceptance and fraud protection. In addition, the cards offer robust customer support via its domestic service agents, 24/7 online account access, and a mobile app.

Youll also benefit from the credit card issuers policy of reporting all your credit activity to the major credit bureaus. Favorable reporting helps you build credit.

Moreover, the cards provide you with automatic payment reminders, free access to your FICO credit score from the Fair Isaac Corporation, alerts for purchase limits and PIN changes, and paperless statements. You can select your favorite card design without an additional fee.

Don’t Miss: What Credit Score Do You Need To Get A Mortgage

The Question Is Now Apply For An Unsecured Card Was Made Available Credit When First Premier Report Does The Short Branch

Great information is to the best credit when first report does it can be worth getting new era of google play a minute or years. Keeping your credit report as your credit report costs on your credit score does when first premier report credit to confirm your balance in good. Our featured placement of a data without utilizing it mean to?

Card Issuers Generally Report Monthly

Most credit card issuers send an update to the credit bureaus regarding your account only once a month. This update typically happens on or a few days after your credit card company sends your monthly statement, which is called the statement closing date. You can easily find that date on one of your statements or by calling your issuer.

The statement closing date on your credit card marks the end of your most recent billing cycle. Your billing cycle may last somewhere between 28 and 31 days, depending on your card issuers policy.

You can find out when your card issuer reports your account details to the credit bureaus by making a phone call. Once you have a representative on the phone to help you, find out when your statement closing date occurs each month. Then, ask if the card issuer reports your account information to the credit bureaus on that day or another date instead.

In some cases, a card issuer may not report your data to all three credit bureaus on the same day. And, even if it does report to all three on the same day, theres no guarantee that the three credit bureaus will upload the data simultaneously.

Remember, these companies are competitors and dont collaborate on many things. These variables are often why your credit report data is different depending on the credit card accounts.

Read Also: What Credit Score Do You Need For Care Credit Dental

How Long Does It Take For A New Card To Show Up On Your Report

When you open a new credit card account, it doesn’t appear on your credit report immediately. The new account typically won’t show up until 30 to 60 days after you’ve opened the account, though the exact timeframe can vary by lender, your card’s billing cycle and when the account is reported to each of the three bureaus.

There are also some situations where a new card may not show up at all on your credit report. That can happen if:

Why You Might Want A Different Credit Card

It has an annual Annual fee

Many of the top secured credit cards dont charge annual fees. You can even find alternative cards for those with limited or no credit that have no annual fee and no security deposit requirement. Consider the , for example, which is also issued by WebBank and touts itself as a low-cost option for those looking to build a credit history. Petals issuer also uses its own underwriting model to evaluate creditworthiness, considering such things as income, spending and savings. The annual fee is .

It doesnt earn rewards

With a starter card, the goal is to establish a credit history. Rewards arent as important but some starter cards do offer them. The aforementioned , for example, has a rewards program. So does the . It earns 3% cash back on travel and entertainment and 2% cash back at restaurants for purchases up to $500 per billing cycle . For all other purchases, it earns 1% back.

If you have at least fair credit, you can even find rewards-earning options among major lenders. The offers 1.5% on all spending. It has an annual fee. But it may also offer you access to a higher credit line after you make your first five monthly payments on time.

It has A permanent payment due date

If you have at least fair credit, the doesnt require a security deposit.

A lower credit limit

Read Also: What Is Revolving Debt On A Credit Report