How Low Can Fico Go

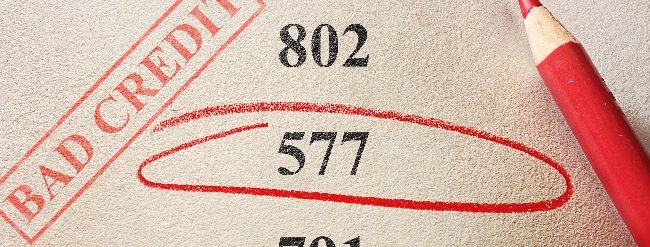

One of the scoring options used for evaluating personal credit, FICO , is used in over 90% of credit decisions, and it ranges from 300 to 850 . But just because youre hanging out well above the 300 mark, doesnt make your credit good. In fact, most lenders consider anything below 600 in the poor range, and youll find it hard to qualify for the best credit, mortgage, and loan offers available.

Business Loan Builder

Access your full business credit scores & reports, including the FICO SBSS the score used to pre-screen SBA loans.

If youre sitting at a 579 or lower, Experian lumps you into this substandard group. They have determined that 61% of consumers in this category are likely to become seriously delinquent, or even default on a loan, in the future. So, even if you arent anywhere near the 300s, you could still have problems getting good rates, an adequate credit line, or access to the better utility plans offered in your area.

Who determines what is a bad or poor score? Its not FICO or the other reporting companies. They just supply the number, which is an indication of your risk to lenders. Its the lenders themselves that make the determination of whether a score can pass their lending rules. So, a consumer who cant get a mortgage from one bank with a 620 score, may be able to get one with another lender. While the scores are standard, how they are interpreted isnt.

Is It Possible You Get A Good Credit History

If your credit score is lower compared to minimum your lender needs to own a good Virtual assistant financing, it doesnt mean you simply cannot qualify for a great Va mortgage later. You can look to have ways to improve your credit score and you can try again!

Below are a few of the situations credit reporting agencies such as Equifax, Experian and you can TransUnion use to calculate your credit rating. Your credit score is actually influenced by things such as

It could be best if you change your credit score even though its higher than minimal your financial need to have good Virtual assistant financing. This is because a high credit history can change your probability of getting acknowledged to have a Virtual assistant financing that will help you to get a diminished rate, as well.

Tips For Increasing Your Approval Chances

If you donât meet the minimum criteria for a home loan in Australia, there are steps you can take to improve your credit score and rectify your financial situation.

- Put together a financial plan and start saving. Figure out your regular expenses, establish a budget and set a reminder for paying bills. These are the small steps you can take to improve your credit score.

- Take steps to settle your outstanding debts. If you can show youâre capable of paying off outstanding debts, your credit score will improve.

- Be honest about your history. Thereâs nothing you can hide from a lender so itâs good to be open and transparent with them. Show them the steps youâve taken to improve and how you plan to make repayments.

- Avoid applying with someone else who has bad credit. You probably wonât be able to borrow as much but if your partner has a bad credit score as well, it will probably hurt your chances of approval.

Recommended Reading: When Do Companies Report To Credit Bureau

How Is The Credit Score Calculated For A Home Loan And Can I Improve My Credit Score Using This Information

Understanding your credit score and how it affects home buying contains a huge amount of the following data that the lenders use to assess your financial situation objectively. Moreover, the information provided in this section will also serve as a checklist to help you keep your credit report healthy. For example, you can make amendments wherever it is needed to restore, maintain and/or improve your credit score. Letâs check it out!

1. Your Credit History

According to Australia’s comprehensive credit reporting requirements, here are 10 pieces of information that will be recorded on your credit file and, thus, try avoiding these harmful habits that can negatively hurt your credit rating.

- Missing your credit or loan repayments

- Paying your bills late, missing payments or unpaid bills

- Making too many loan applications for credit

- Missing your Afterpay or other âBuy Now, Pay Laterâ payments

- Payday loans

- Applying for balance transfers frequently

- Bankruptcy listing or court judgments

- Forgetting to update your contact details

- Not fixing errors on your credit report

- Not regularly checking your credit report

So if you are currently facing a bad credit situation, you can overcome the adverse event by offsetting unhealthy accounts for your credit rating. For example, if you pay bills late, start making sure all of your next repayments are on time or figure out a way to ensure you do not repeat the mistakes you made in the past.

2. Your relationship with the bank

How To Get A Good Credit Score

Good credit habits, practiced consistently, will build your score. Heres what you need to do:

-

Pay bills on time. This is important because payment history has the largest impact of all the factors in your score. A missed or late payment can do tremendous damage to a credit score and it can stay on your credit report for up to 7 years.

-

Try to keep your credit card balances well below your credit limits aim for, and lower is better. High utilization dings your score, but the damage will fade when you’re able to reduce your balances and the lower utilization shows up on your credit reports. You also may be able to lower utilization by getting a higher credit limit or becoming an authorized user on a lightly used card with a large limit.

-

Keep credit accounts open unless there is a compelling reason, such as high fees or poor service, to close them. Keeping older accounts open helps your average age of accounts, which has a small influence on your score. Also, closing an account cuts into your overall credit limit, driving up your credit utilization.

-

Avoid making several credit applications in a short time frame. Credit checks for the purpose of credit decisions can cause a small, temporary dip in your score, and several in a short time can add up. That’s why it’s important to research credit cards before you apply.

-

Monitor your credit reports and dispute information you believe is incorrect or too old to be included .

Also Check: How To Remove Hard Inquiries Off Credit Report

What Else Do Mortgage Lenders Consider

Your credit score is a key factor in determining whether you qualify for a mortgage. But its not the only one lenders consider.

Income: Lenders will also look at your income. They want to make sure you make enough money each month to afford your payments.

Debt-to-income ratio: Lenders also look at your monthly debts. Lenders vary, but they generally want your total monthly debts, including your estimated new mortgage payment, to consume no more than 43% of your gross monthly income. If your debt-to-income ratio is higher, you might struggle to qualify for a mortgage.

Down payment: The bigger your down payment, the more likely it is that youll qualify for a mortgage with a lower interest rate. Thats because lenders think you are less likely to stop making your payments if youve already invested a significant amount of your money into your loan. A higher down payment makes your loan less risky for lenders.

Savings: Lenders want to make sure that you have funds available to make your mortgage payment if your income should unexpectedly dry up. Because of this, most will want to see that you have enough money saved to cover at least two months of mortgage payments.

Employment history: Lenders vary, but they usually like to see that youve worked at the same job, or in the same industry, for at least 2 years. They believe youre less likely to lose that job, and that stream of income, if youve built up a longer work history.

Which Are The Va Mortgage Credit Score Conditions Within Freedom Financial

In the Liberty Home loan, minimal credit score we need depends on the purpose of the fresh new Virtual assistant financing. Listed below are the current minimum credit ratings:

- If you want to acquire a home having a good Virtual assistant financing, we can usually accept at least credit rating as little as 600.

- When you wish to refinance a property that have a keen Va mortgage, we could tend to provide an easy credit history degree.

- When you need to locate bucks out of your home equity which have a good Virtual assistant mortgage, we could usually bring a straightforward credit score qualification.

We offer Va IRRRL refinancing, which lets you get a lower life expectancy price in your Virtual assistant mortgage with quicker documentation and you can a quicker closing. We could also help you tap their houses collateral to find currency to possess extremely important investments with a great Virtual assistant cash out re-finance.

You May Like: Comenity Capital Bank Credit Score

What Is A Good Vantagescore

FICO’s competitor, VantageScore produces a similar score using the same credit report data from the three bureaus.

A good VantageScore lies between 661 and 780, which the company calls a “prime” credit tier. VantageScores above 780 are considered “superprime” while those between 601 and 660 are “near prime.” VantageScores below 600 are considered “subprime.”

The average VantageScore 3.0 in July 2021 was 693.

Can You Have A Credit Score Without A Credit Card

Is it possible to build credit without a credit card? Yesbut you still need to have at least one line of credit associated with your name. If you take out a student loan or a car loan, for example, those credit accounts become part of your credit history and help establish your starting credit score. You could also build credit by becoming an on a friend or relatives credit card, or use a service like Experian Boost to add telecommunications and utility payments to your Experian credit report.

If you dont have a credit card, where does your credit score start? It all depends on how you use the other credit accounts under your name. If you make on-time payments on your student loan, for example, youre doing the work of building a positive credit history. If your payments are consistently late, your credit historyand credit scoremight not be as good.

Recommended Reading: What Is Syncb Ntwk

What Are The Fico Credit Score Ranges

In addition to understanding how a FICO credit score is calculated, its a good idea to know the FICO credit score ranges. FICO scores range from 300 to 850, and are divided into the following categories:

- Exceptional: 800-850

- Fair: 580-669

- Very Poor: 300-579

Your goal should be to get your FICO score above 670 as quickly as possible. Once you have good credit, youll be able to apply for some of todays best credit cardsplus, itll be easier to take out a mortgage, rent an apartment, buy a car, sign up for a new smartphone plan and more.

Fit Mastercard: Best For Credit Rebuilding

FIT Mastercard is all you need if you want a credit card to gently boost up your credit history and reputation with all three bureaus. It is an unsecured credit card, and you can expect to use a credit limit worth $400 as an initial credit line. Once you have passed the screening, you might become eligible for an increased limit after six months of responsible use.

Being a product of Mastercard, this credit card is also protected against unauthorized purchases and includes theft protection using Zero Liability Protection. In addition, you can receive a credit report of your Vantage 3.0 Score every month. FIT Mastercard is a beneficial solution if you need an urgent line of credit. Nevertheless, it may eat your budget up due to high fees.

Highlights

Pros

- Good for any credit score

- Initial credit limit is $400

- Free access to Experian credit score

Cons

Don’t Miss: How Long Until Closed Accounts Fall Off Credit Report

Minimum Credit Score Required For Mortgage Approval In 2022

Home \ Mortgage \ Minimum Credit Score Required For Mortgage Approval in 2022

Join millions of Canadians who have already trusted Loans Canada

Getting approved for a mortgage these days can be a real challenge, especially with housing prices constantly on the rise. In Toronto, for instance, youll be paying over $820,000 for a home, which is nearly $100K more than the average price the year before.

Unless youre rolling in cash, thats a lot of money to have to come up with in order to purchase a home. Moreover, a lot goes into getting a mortgage. Lenders look at a number of factors when theyre assessing a borrower for a mortgage such as a sizeable down payment, a good income and, of course, a favourable credit score.

A high credit score, in particular, will not only get you approved for the mortgage but a favourable interest rate as well. Being that credit scores are such a significant part of the lending process, its no wonder that we get so many inquiries about what qualifies as an acceptable score in terms of getting approved for a mortgage.

See If You Qualify For A Conventional Loan

To qualify for a conventional loan, you typically need a minimum credit score of 620. But even if your credit score is lower, you may be able to get a mortgage.

A lender can explain your loan options when you get preapproved, and they can help you decide which type of mortgage is best for you based on your finances.

Also Check: Personal Loan 580 Credit Score

Fha Credit Score Requirements In 2020 According To Hud

The Department of Housing and Urban Development manages the FHA home loan program. They also set the rules for credit scores, down payments, debt ratios, and other eligibility criteria. They are the official source for rules and guidelines.

According to HUD, mortgage lenders must “determine the borrower’s minimum decision credit score … The MDCS will be used to determine the maximum insured financing available to a borrower with traditional credit.”

Here is how HUD defines the MDCS:

- When the lender pulls three scores , the middle number must be used for FHA qualification purposes.

- When two scores are pulled , the lower number must be used to determine eligibility.

- When only one score is obtained, that becomes the MDCS.

The table below shows the minimum credit score for FHA eligibility in 2020. This table was adapted from a draft version of HUD’s Single Family Housing Policy Handbook, which was published earlier this year

| If your score is… | |

| eligible for maximum financing | |

| between 500 and 579 | limited to a maximum LTV of 90% |

| 499 or lower | not eligible for an FHA-insured mortgage loan |

As you can see from the table above, the minimum score required in 2020 is 500. That is the absolute minimum for borrower eligibility. If your “decision” credit score is below 500, you won’t be able to qualify for an FHA-insured mortgage loan .

What Affects A Credit Score

While every credit scoring model is different, there are a number of common factors that affect your score. These factors include:

- Payment history

- Balances on your active credit

- Available credit

- Number of accounts

Each factor has its own value in a credit score. If you want to keep your number at the higher end of the credit score scale, its important to stay on top of paying your bills, using your approved credit, and limiting inquiries.

However, if you are in the market to purchase a house or loan, there is an annual 45-day grace period in which all credit inquiries are considered one cumulative inquiry. In other words, if you go to two or three lenders within a 45-day period to get find the best rate and terms available for a loan, this only counts as one inquiry. This means that they are not all counted against you and will not affect your credit score.

Don’t Miss: Itin Credit Report

How To Check Your Credit Score & Report In Canada

Many people think if you pull your credit report from the two major credit bureaus TransUnion or Equifax, that it will contain your credit score also. This is not always the case. But its still essential to check your credit report for errors and correct reporting, to ensure your credit score is always accurate. Your credit reporting agency will provide you with a monthly copy for free. Requesting this report on a monthly basis will not affect your credit score.

Requesting your credit score is often separate from your credit report. Both may charge a fee for your request. Its also important to note that each credit reporting agency uses its own bespoke scoring algorithm, which may differ from each other. Learn more about why your credit score may vary depending on where you check here.Its important to note, you can often check your credit score for free through your bank, financial institution or any significant financial technology website such as .

How To Check Your Credit Score

If you are new to credit, its a good idea to check your own credit score before you start applying for additional credit cards or loans. That way, you wont make the mistake of applying for a when your own credit is still average.

How do you check your own credit score? Many banks and credit card issuers give you access to free credit scores, so start there. provide weekly credit score updates and keep track of potential threats to your credit . You can also access your credit score through certain popular personal finance apps, such as Mint.

Some free credit score services will provide you with a VantageScore instead of a FICO score. VantageScore is one of FICOs main competitorsand although its scoring system is slightly different than FICOs, the credit ranges overlap. If you have good credit with VantageScore, youll have good credit with FICO.

Read Also: Does Kornerstone Credit Report To The Credit Bureaus