How Can I Remove An Eviction From My Public Record

You can remove your eviction from your public record bypetitioning the court, winning your case or disputing an inaccurately reported eviction.

While the process is more difficult, its not impossible.

Petition the court: In the county where the case was filed, you can petition the court to have the eviction expunged from your record.

Win your case: If the landlord served you an eviction notice without a legal or valid basis, prove that. A judge is more likely to rule in your favor if you demonstrate that the eviction was unfounded and not the result of you breaking your lease.

Prove that you didnt violate the lease: Make it evident you didnt break the terms of your lease. For example, prove that you paid your rent and that you left the property in a satisfactory condition. Provide evidence when possible. Documentation, such as cleared rent checks and photos, can support your case.

Ensure proper procedures are followed: Keep an eye on the landlords process of carrying out the eviction. Laws vary by state, but theres always a specific procedure a landlord must follow when filing the eviction and serving the eviction notice to you.

Make yourself familiar with your states laws governing eviction suits. Be sure to document how your landlord fails to abide by the required legal process.

How To Dispute Eviction From Your Credit Report

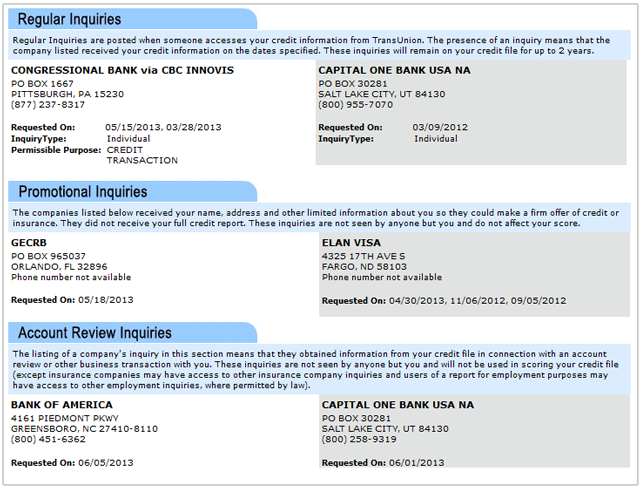

You will need to gather some documentation and submit a credit dispute form to the credit bureau.Youâll need to provide evidence of your lease, your rental agreement or any other written documentation that shows you should not be on the eviction list.

Youâll also need statements from those in authority as well as any other evidence that will show why youâre not behind in payments and why you were evicted.

You may want to hire a lawyer or attorney if this is your first time filing a dispute because the process can be complicated.

Donât Miss: How To Make My Credit Score Go Up

Does A False Eviction Affect My Credit Score

Your credit report doesn’t differentiate between a false and legitimate eviction. If the eviction goes through the proper channels, even if it was a simple clerical error, it will show up on your credit report and can have a profound impact on your credit score. Your credit report will show a “Civil Judgment,” and that will lead to negative marks that lower your credit score. Even if you paid off the debt owed to the landlord, the hit to your credit score from the civil judgment could remain indefinitely. If you’re successful in getting the eviction expunged from your record, you’ll still need to contact the credit bureaus and have them remove the civil judgment. Removing the civil judgment from your credit report requires gathering the documentation proving the expunged eviction or dismissal, sending a credit dispute to each bureau, and following any instructions they send back.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Removing Evictions From Reports

You have no legal right to get an accurate item removed from your credit file. Most negative facts, such as a landlord’s judgment against you, are removed after seven years, though. If the judgment or the collection agency account is still on the report after seven years, ask the credit bureau, in writing, to remove it.

If the reference to eviction is truthful and recent, you’ll need to make arrangements with the landlord to pay off the balance, or come to some type of settlement agreement. Once this has been done, you can petition a judge to have any rental eviction that appears on a civil record expunged. Make sure you submit a notarized letter from your landlord that the debt has been satisfied.

How Can I Get An Eviction Off My Record

Removing an eviction from your public record actually isnt that difficult. If you have an eviction record that will show up in your background check, you can petition the court in the county where the case was filed to have the record expunged, or sealed. This typically requires filing a petition with the court and paying a filing fee . Your chances that a judge will agree to expunge a case are higher if the case did not result in an eviction. If you still have an outstanding balance from an eviction case, you should pay the balance before petitioning the court for an expungement.

Also Check: Speedy Cash Change Due Date

Who Can See If I Have An Eviction On My Record

Evictions first require the landlord to obtain a civil judgment against you. The civil judgment is recorded on your public record and can remain there forever if no action is taken to have it removed. Public records, as the name suggests, are available to the public. Pulling individual public records is impractical however, since credit reports contain a “Public Records” section, the civil judgment will often show up there. Also of note, even if seven years have passed and the eviction is gone from your public records, the civil judgment may still show up on your credit report.

Access To Credit In The Future

It will most likely be difficult to find housing with an eviction on your rental history and credit history. You may also have limited access to credit in the future.

Even if the landlord doesnt check your credit report, or you were evicted but didnt owe any money, many landlords use a tenant screening company when considering rental applications.

You May Like: What Credit Report Does Comenity Bank Pull

Can Lexington Law Remove Evictions

Lexington law can help you with this issue, they can remove evictions from your credit report once they find that it was an error or past due.

You can also remove evictions from your credit report by waiting for seven years and letting it lapse from your report and rental history. Chances are you need these changes done asap and Lexington Law will help.

In certain states, you can possibly file for an expungement in order to remove such evictions from your records. However, this is quite difficult too.

In order to offset the damaging effects of an eviction, you will need to rebuild your credit by paying off your debts, limiting the number of your credit inquiries, and by keeping your balances low.

How Do You Get An Eviction Removed From Your Rental History

Discover the following tips for how to have an eviction removed from your rental history.

- Settle your debt. If youre able to get your debt settled and negotiate a settlement with your former landlord, make sure that the landlord is willing to contact the major credit bureaus and have the amount of the collection removed. You should also make sure that the landlord is willing to get the eviction removed from renter-screening company records as well. If the landlord agrees, ask for a statement in writing through a confirmation letter.

- After youve made the final payment, make sure you get your letter that confirms the eviction removal from the proper reporting agencies. You may want to include a statement requesting this confirmation along with the payment.

- Verify your eviction removal by ordering copies of your credit report and renter-screening agencies. If not, then follow up with your previous landlord.

- If youve followed these steps and the eviction is still present, file a formal dispute form with the credit bureaus to get the information removed.

- If you believe you were wrongly evicted, petition the court. If the required paperwork wasnt served to you as ordered by the courts, then a judge may be more likely to rule in your favor. If you can prove that you didnt violate your lease, you could get the eviction removed from your record. If you win, then you can petition to have the eviction removed from your record.

You May Like: Speedy Cash Debt Collection

Dispute Errors With The Credit Bureaus And Tenant

If you believe there are inaccuracies related to eviction on your credit report, look into the procedure for filing a dispute with the credit bureau. You can also contact tenant-screening companies directly to dispute errors. Be prepared to show proof that the report is inaccurate. That includes any written documents you asked for when you paid your rental debt or agreed on a settlement.

How Does An Evictionaffect My Credit

Evictions canresult in negative marks that bring down your creditscore.

If you didnt pay the full amount due, your landlordcan bring you to court. Once youre sued for unpaid rent and the landlord winsthe case, youll have a civil judgment against you. The civil judgment is what will be reported on your credit history.

A civil judgment is a very serious negative mark and stays on your credit report typically up to seven years, even if youve paid off the amount. A potential employer or landlord may review your credit reports and learn of the civil judgment.

You May Like: Does Apple Card Pull Credit Report

Can An Eviction Make It Harder For Me To Rent In The Future

Yes. Some landlords report to tenant screening services, like Experian’s RentBureau or TransUnion’s SmartMove. Even though your credit report may not read “eviction”, a check with one of these services will reveal your eviction record. If the screening service has incorrect information about your rental history, you should contact them to dispute the information. If someone rejects your lease application because of one of these rental reports, they must give you the name and contact information of the company that made the report.

An eviction will make it difficult to rent in the future. The best way to avoid an eviction is to pay your rent on time and comply with your lease.

Life After An Eviction: How To Restore Your Credit

Eviction cases cannot be expunged in Texas

Texas law does not allow tenants to have an eviction suit expunged as many other states do, but there are steps you can take to repair the damage to your credit report.

HOUSTONâ Many families are facing eviction proceedings now that courts are hearing cases again. While an eviction can hurt your credit and chances for renting again, there are ways to repair the damage.

One of the biggest challenges a renter in Texas faces is that being sued for eviction, even if you win and your case is dismissed, could damage your credit for up to seven years.

âI know some people, their life will never be the same again,â said Reggie Fox, an attorney with Lone Star Legal Aid.

Fox says whether a tenant wins or loses, being sued for eviction can make renting again, getting loans, even getting a new job more difficult.

âOnce the eviction is filed, itâs on your record. I donât think thatâs right. You can expunge a criminal case, but thereâs nothing on the law in Texas, as of now, that will allow a person to get an eviction expunged, said Fox.

Texas law does not allow for tenants to have an eviction suit expunged like many other states do.

Even if you went to court and won, the eviction is on your record. So itâs going to hurt you down the line and when you try to find another place to live, try to buy a house, he explained.

Donât Miss: How To Get Charge Offs Off Of Your Credit Report

You May Like: Does Klarna Report To Credit

Are Evictions On Credit Reports

Many people wonder how to get an eviction removed from their credit report. To that, we have good news: Technically, evictions donât show up on your credit report.

If youâve faced an eviction, youâre not in the clear just yet. While evictions donât have a spot on your credit report, the collection, accounts, and debts that lead to your eviction do. So itâs not so much about getting an eviction off your report, but clearing the bad credit history that got you there.

So if you fell behind on your rent, your credit may take a hit, especially if your landlord sent your debts over to a collection agency. Any unpaid debts that follow an eviction, like due rent, may go to a collection agency. This is why it is so important to closely review your credit report from the three main credit bureaus â Experian, Equifax, and TransUnion â once a year .

The lender would have to review a separate rental history report through a screening company and some credit bureaus to find eviction records. Landlords are more likely to review these reports than lenders.

The good news is that not all landlords report or sell debts, so double check your credit report to confirm where you stand credit wise.

What You Need To Know To Remove An Eviction From Your Credit Report

- 1Share

Being evicted from the place one calls home can be upsetting and painful, and believe it or not, it happens more than expected and for various reasons.

According to the research done by the Eviction Lab at Princeton University, 3.6 million eviction cases are filed in the United States every year on average. Out of which, 1.5 million eviction judgments are passed annually.

Getting evicted is not only emotionally and physically challenging, but financially too. It can damage your credit score. Although an eviction case doesnt directly show up on your credit report, it can seriously impact your credit score in indirect ways as a possible judgment.

The eviction case will create problems for you while applying for a loan, obtaining a credit card, and affect your ability to rent in the future as well.

However, the damage can be rectified or minimized by removing the eviction from your credit report. We will be discussing this further ahead in the article. But, before that, lets understand what precisely an eviction is.

Please seek legal advice when dealing with an eviction.

Recommended Reading: When Do Companies Report To Credit Bureaus

Avoid Eviction If Youre Able

Do your best to avoid eviction in the first place by being proactive and working with your property manager. But if youve already faced that stressful situation, knowing how to get an eviction off your record can empower you. It will take some effort, but in the end, youll be ready to find the perfect place to live.

How To Resolve The Issue Before It Gets On Your Credit Report

Eviction is the last resort for the landowners as it costs them a tremendous amount of time and money. However, if they are resorting to this, then there must be some serious reason behind it.

What can you do to resolve the issue before it affects your credit score and shows up on a background check?

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

What Options Do I Have

First of all, avoid the actual legal process of eviction at all costs. Renting or buying a home after an eviction can be extremely difficult, depending on your location.

This could mean anything from borrowing money to pay the rent to moving out voluntarily. Whatever you can do to avoid eviction is preferable.

Work Something Out

Your landlord is in the business of making money. Its far easy for him or her if you simply pay your rent. If its your first time running into issues with rental payments, your landlord may be willing to work with you on a payment plan and help you get back to the black.

A handshake agreement of this kind is always preferable over a legal process for all parties concerned. Its far cheaper, does not require lawyers and everyone walks away happy.

Do ensure, however, that any payment agreement you come to is in writing and notarized. Your landlord should not have any issue with this.

Move Out

The eviction process is long and expensive. Your landlord doesnt want it and you dont, either.

If you are unable to work out a payment plan with your landlord, consider simply moving out and calling it even. See if he will simply let you out of your lease and cut his losses. Its highly likely that this is an attractive option for him.

Can You Get Evictions Off Your Record

In addition to appearing on your credit report, an eviction also shows up on a background check. This could prevent you from getting a job, or being approved to purchase a home or condominium with a homeowners association.

To remove an eviction from a background check, find the county where the case was filed. Your landlord had to obtain a civil judgment to have you evicted. You can petition to have the record expunged or sealed, but you might have to pay the balance owedin full.

Don’t let a past eviction keep you from buying a home.

A Clever Partner Agent will help you weigh your options.

Recommended Reading: Is 584 A Good Credit Score

Rent With An Eviction On Your Record Need Help Paying Bills

Find how it may be possible to rent an apartment with an eviction, and learn what financial or legal steps to take to get the eviction off your record.

Courts will expunge eviction cases sometimes, but it can be hard to get an expungement. Paying what you owed does not take the case off your record.

Can I Get An Ohio Eviction Off My Record Andrew J Ruzicho

Unlike certain criminal records, eviction filings usually cannot be taken off your record see exceptions listed above. Your eviction case may have been

When your landlord files an eviction case against you, this becomes a public record. To get the eviction off your record, you will have to get a judge to

Mar 26, 2021 Evictions do not appear on your credit report. A notice of eviction is your landlords declaration that they intend to evict you unless you take

Read Also: Why Is There Aargon Agency On My Credit Report