Equifax Must Provide Free Copies Of Your Credit Report

A data breach at Equifax in 2017 compromised the personal information of at least 147 million consumers. As part of a court settlement related to the hack, everyonewhether they were affected by the breach or notcan get six more free credit reports from Equifax each year, beginning in January 2020, for the next seven years.

How Does Disputing A Name Affect Credit Score

The national credit bureaus use personal informationname, address, date of birth, Social Security number and the liketo associate you with the loans and credit accounts for which you are responsible. That information does not factor into the calculation of a credit score, so correcting your name through a credit report dispute has no direct impact on your credit score.

If you dispute a credit account incorrectly listed in your name and it’s removed from your credit report, the payment information for that account will no longer factor into your credit score. In that case, you may see some shift in credit scores. Of course that information never should have contributed to your score to begin with, so any score adjustment will mean a more accurate reflection of your credit history.

Why Would You Change Personal Information On Your Credit Report

There are many reasons you may need to change the personal information contained in one or more of your credit reports. Legal name changes are common due to marriage, naturalization and other reasons. Address changes are even more common. In rare instances, people even change their Social Security number due to problems like identity theft.

Even if everything remains the same for you, personal information on your credit reports may be incorrect due to errors. Your name may be misspelled, or the report may contain an address where youve never lived. Its important that you correct these mistakes so that your report accurately reflects your information.

You May Like: When Does Capital One Report To Credit

File A Dispute Directly With The Creditor

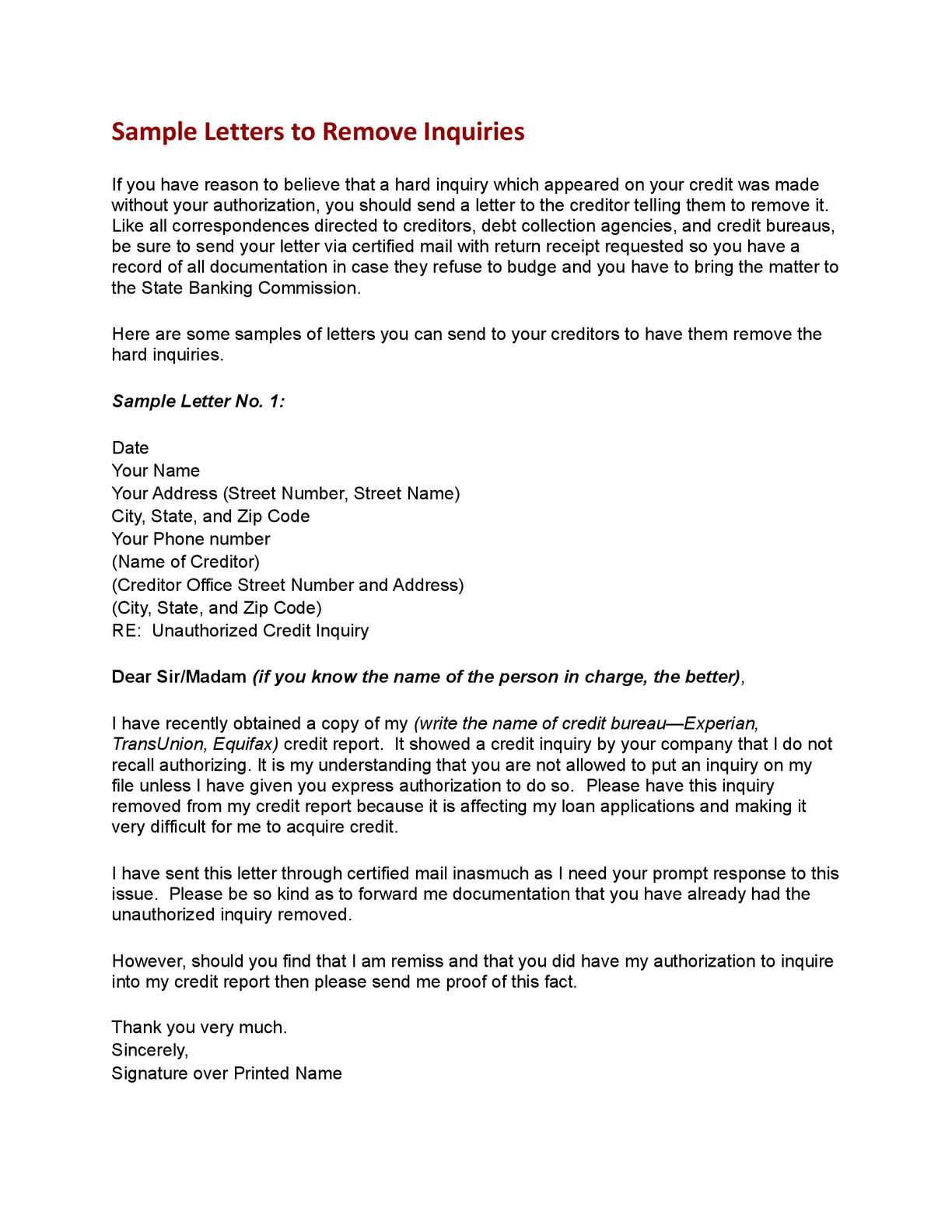

If the negative rating on your credit was made in error , you can contact the creditor directly and ask them to correct this. by providing proof. The downside to filing a dispute directly with the creditor is that they usually only accept disputes by mail. This means that you will need to send a written letter.

When writing your letter, focus on the relevant information and put the most essential information at the beginning of the letter. If you dispute more than one item, also say so very clearly at the beginning.

In your letter, include your full name and the account you are referring to, what you are disputing and why, a copy of your credit report with the errors circled in red, and copies of the documents originals that prove that you paid an account on time, for example, a credit card statement. Or, if the year you opened a loan is incorrectly reported, include a copy of an original document that shows the correct year.

How To Avoid The Defaulters List

Several factors can lead to your defaulting on your loanmedical emergency, loss of a job, loss in business, etc. If you think you may not be able to clear your dues, there are certain steps you need to take to avoid a suit-filed account tagged against your name.

One of the first things you can consider is extending your loans tenure. Approach your bank, justify why you require an extension, and ask them to increase it. Not only will this give you breathing space but it will also reduce your EMIs significantly. This will help you clear your dues and avoid defaulting too.

You can also ask your bank to defer your EMI payments for a few months. This can be especially helpful if youve lost your job or are dealing with a medical emergency. While its not common for banks to approve, if you negotiate properly, you may get a good deal. Do keep in mind that deferring your EMIs may attract charges.

At the end of the day, you need to try your best to avoid getting on the defaulters list. If you still think there are chances you may not clear your dues, look for a viable solution. Have a conversation with your lender and look at the options theyre willing to offer.

Once you have defaulted on a loan, theres no going back, especially if its wilful. There are legal consequences that can damage your credit score terribly. If youre struggling with your loan, dont hesitate to ask for assistance and advice.

To Know More About : Top CIBIL Score Improvement Factors

You May Like: Innovis Consumer Assistance Letter

Check Your Credit Report For Fraud

Look for accounts that don’t belong to you on your credit report. Accounts that you don’t recognize could mean that someone has applied for a credit card, line of credit, mortgage or other loan under your name. It could also just be an administrative error. Make sure it’s not fraud or identity theft by taking the steps to have it corrected.

If you find an error on your credit report, contact lenders and any other organizations that could be affected. Tell them about the potential fraud.

If it’s fraud, you should:

- report it to the Canadian Anti-fraud Centre

The Canadian Anti-Fraud Centre is the central agency in Canada that collects information and criminal intelligence on fraud and identity theft.

How To Remove Negative Items From Your Credit Report

Its smart to know how to remove negative items from your credit report, especially if you are soon to be applying for a mortgage or car loan.

In fact, you can remove something from your credit history before seven years pass.

Whatever youre dealing with, late payments, collections, charge offs, or foreclosures, the following techniques can clean up your credit quickly.

Also Check: Does Klarna Report To Credit

How Can I Find Out What Is In My Credit Report

There are a number of ways to find out what is in your credit report. You have the right:

- To get a free copy of your credit report once every 3 months. A credit reporting body cannot charge for this, unless you obtained a copy of your credit report from them in the previous 3 months

- To get a free copy of your credit report within 90 days of having an application for credit rejected

For more information see:

Dispute Credit Report Errors

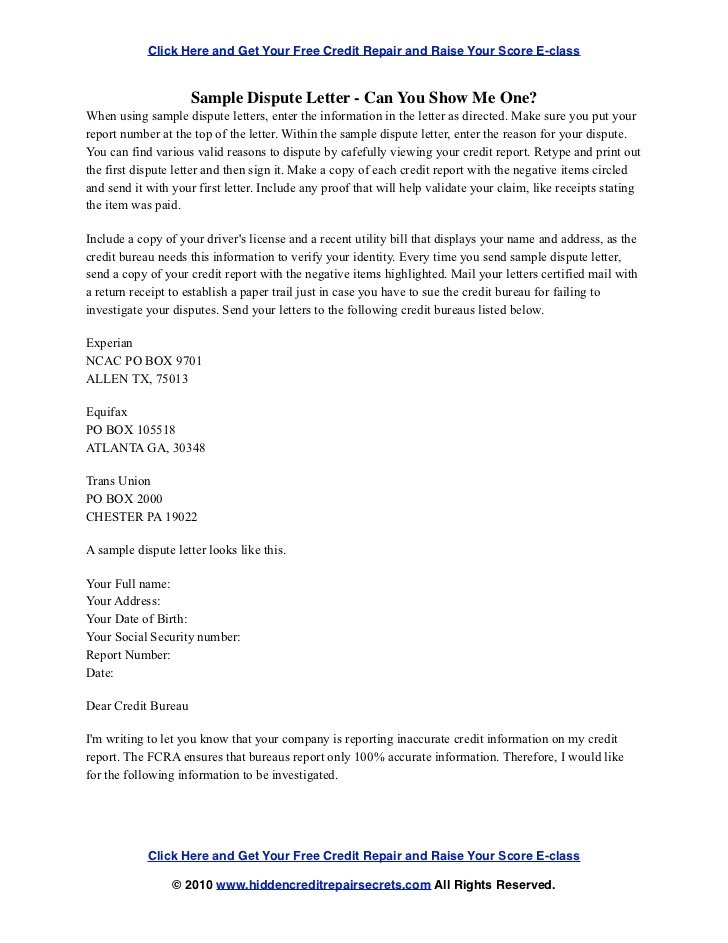

All three bureaus have an online dispute process, which is often the fastest way to fix a problem, or you can write a letter. You can also call, but you may not be able to complete your dispute over the phone. Here’s information for each bureau:

How to dispute Equifax credit report errors

-

Write to Equifax, P.O. Box 740256, Atlanta, GA 30374-0256.

-

See our guide on how to dispute your TransUnion credit report for details.

Read Also: Removing Repossession From Credit Report

Judgments Or Acts Of Bankruptcy

If you dispute a listing that comes from the public record, such as a judgment or act of bankruptcy, you would need to have the public record details changed to have the listing removed from your credit report. Credit reporting agencies get court judgment and bankruptcy information directly from the Courts and the Australian Financial Security Authority records. This might involve having the court judgment set aside.

Strategies To Remove Negative Credit Report Entries

Negative details on your are unfortunate glaring reminders of your past financial mistakes. Or, in some cases, the mistake isn’t yours, but a business or credit bureau is to blame for credit report errors. Either way, its up to you to work to have unfavorable credit report entries removed from your credit report.

Removing negative information will help you achieve a better credit score. A better credit report is also the key to getting approved for credit cards and loans and to getting good interest rates on the accounts that youre approved for. To help on your way to better credit, here are some strategies to get negative credit report information removed from your credit report.

Recommended Reading: Credit Score 524

Wait Up To 45 Days For The Credit Bureau Or Furnisher To Investigate And Respond

The credit bureau generally has 30 days after receiving your dispute to investigate and verify information with the furnisher. The credit bureau must also report the results back to you within five days of completing its investigation.

If you dispute the error with the information furnisher, that company must also report the results of its investigation to you. It also typically has 30 days to investigate. But if the furnisher stands by the accuracy of the information it reported, it wont update or remove the error.

One more thing to note is that either the credit bureau or the furnisher may decide that your dispute is frivolous. This generally happens when youve submitted incorrect or incomplete information on the dispute, but can also occur if youve tried to contest the same item multiple times without any new information or if youve attempted to claim that everything on your credit report is incorrect without proof.

If the bureau decides that your dispute is frivolous, it doesnt need to investigate it further as long as it communicates that to you within five days, along with the reasoning for deeming the dispute frivolous. If your original dispute was labeled frivolous, you can try to resubmit a dispute with updated materials.

How You Can Check Your Credit Reports

You can get a free copy of your credit report from each major credit reporting agency every 12 months at AnnualCreditReport.com.

Get Free Weekly Credit Reports During the Coronavirus Crisis

Equifax, Experian, and TransUnion are offering free weekly online credit reports, so that you can manage your credit during the COVID-19 crisis.

You May Like: Speedy Cash Credit Check

Identify Derogatory Branding Errors

Some common derogatory brand errors are paid collection accounts that show up as unpaid, a paid tax lien that is more than seven years from the date of payment, lawsuits with creditors, and an account that has been discharged in bankruptcy. But which always appears by mistake as active. And with a balance.

What To Do If You Spot A Problem

If you cant trace the reason for a hard inquiry or you believe it was done without your consent, you can dispute it online. If the credit bureau cant confirm it as a legitimate inquiry, its required to remove it. Contact each credit bureau individually:

If you suspect fraud, you can have a fraud alert added to your credit reports, which flags applications in your name as requiring extra scrutiny. Alert any one credit reporting agency it will share information with the other two.

Or, for the best protection, simply freeze your credit with all three bureaus to stop anyone from opening new credit in your name.

Don’t Miss: Is 524 A Good Credit Score

Checking Your Nationwide Specialty Credit Reports

Several nationwide specialty credit reporting agencies also exist. These agencies keep records on particular types of transactions, like tenant histories, insurance claims, medical records or payments, employment histories, and check writing histories. These agencies must give you a free report every twelve months if you request it. To get a specialty credit report, you’ll have to contact each agency individually.

How to Stop Getting Prescreened Credit Card and Insurance Offers

Under the FCRA, credit reporting agencies are allowed to include your name on lists that creditors and insurers use to make offers to you, even though you didn’t initiate the process. ). The FCRA also provides you the right to opt out of receiving these offers , which prevents the agencies from providing yourcredit file informationfor these offers. ). You can opt out for five years or permanently.

Paying To Remove Negative Credit Info Is Possible But May Not Succeed

A bad credit score can work against you in more ways than one. When you have poor credit, getting approved for new loans or lines of credit may be difficult. If you qualify, then you may end up paying a higher interest rate to borrow. A low credit score can also result in having to pay higher security deposits for utility or cellphone services.

In those scenarios, you may consider a tactic known as pay for delete, in which you pay to have negative information removed from your credit report. While it may sound tempting, its not necessarily a quick fix for better credit.

Read Also: Does Paypal Credit Report To Credit Bureaus

How To Remove A Suit

If you have defaulted on your loan, your bank or financial institution will file a complaint to a court, which leads to a lawsuit. This is so the bank or FI you have borrowed from seeks economic relief. If you have crossed the Rs.1 crore threshold or wilfully crossed the Rs.25 lakh threshold, your data will reflect in the public database.

So, how do you tackle a suit-filed account that has been reported to CIBIL?

Reach out to your lender and request them to consider an out-of-court settlement, where you pay the entire amount due. If your lender does consider this option, they will have to report this to the court and withdraw the lawsuit filed against you. However, the case will be withdrawn only once youve settled your loan. Your bank is also required to report this to CIBIL so they can update their records.

This may seem convenient and a little too easy, but there is something you should be aware of. If you have received a concession in payment of your dues, your CIBIL report will reflect a settled account, even if the lawsuit is dropped. It will remain on your report for 7 years. This can cause issues for you in the future, as potential lenders will refrain from approving your loan or credit applications.

In case you cannot pay the amount you owe your lender, you can always justify your reasons in court. The bank may then offer a settlement amount, which you will have to pay, no questions asked.

Identify Any Credit Report Errors

Review your credit reports periodically for inaccurate or incomplete information. You can get one free credit report from each of the three major credit bureaus Equifax, Experian, and TransUnion once a year at annualcreditreport.com. You can also subscribe, usually at a cost, to a credit monitoring service and review your report monthly.

Some common credit report errors you might spot include:

- Identity mistakes such as an incorrect name, phone number or address.

- A so-called mixed file that contains account information belonging to another consumer. This may occur when you and another consumer have the same or similar names.

- An account incorrectly attributed to you due to identity theft.

- A closed account thats still being reported as open.

- An incorrect reporting of you as an account owner, when you are just an authorized user on an account.

- A remedied delinquency such as a collections account that you paid off yet still shows as unpaid.

- An account thats incorrectly labelled as late or delinquent, which could include outdated information such as a late payment thats over 7 years old or an incorrect date regarding your last payment.

- The same debt listed more than once.

- An account listed more than once with different creditors.

- Incorrect account balances.

- Inaccurate credit limits.

Read Also: 8773922016

How Can I Improve My Scores

If you are trying to improve your credit scores, a good first step is to order your free credit score from Experian. When you get your score, it will come with a list of the risk factors that are currently impacting you the most. Knowing these risk factors helps you know where you can improve to hopefully increase your credit scores.

Keep in mind that because your score is already relatively high, it may be difficult to increase your score very much in a short period of time.

If you’ve had late payments in the past, the first step to improving credit scores is to make sure all your accounts are current and that you are continuing to make all your payments on time.

The second step is often to lower your , which is an important credit score factor. This is especially true if one of your risk factors is that your revolving account balances are too high. Your credit utilization is calculated by taking the total of all your credit card balances and dividing that number by the total of all your credit card limits. By paying down your credit cards or paying them off completely, you will lower your utilization rate and potentially improve your scores. Those with the highest credit scores tend to have utilization rates below 10 percent.

Request The Sending Of Notices

You can also ask the credit bureau to send notices of corrections to your credit report to anyone who received your report in the past six months or the past two years for employers.

If your dispute was filed with a credit bureau and you disagree with how the issue was resolved, you can add information about your dispute to your credit report. For example, write a statement summarizing what happened if the dispute was not in your favor. This does not apply if you have filed your dispute through the creditor.

Recommended Reading: Can You Remove Hard Inquiries Off Your Credit Report

Can Debt Collectors Remove Negative Information From My Reports

Unfortunately, negative information that is accurate cannot be removed and will generally remain on your credit reports for around seven years. Lenders use your credit reports to scrutinize your past debt payment behavior and make informed decisions about whether to extend you credit and under what terms. Therefore, it’s just as important for them to see your negative credit history as your positive history.

If you discover, however, that negative information is still on your credit reports after seven years and you have paid off the amount as agreed, you should immediately file a dispute.

You can dispute the negative information sooner if it appears on your credit reports multiple times. You can also dispute the information if it’s a result of fraud or identity theft. It’s important to report the fraud or identity theft immediately to the three nationwide credit bureaus so that you can get your financial life back on track.

Be warned that there are many companies that claim they can have negative information removed from your credit reports for a fee. However, neither you nor a third party can get negative but accurate information removed.