Your Credit Scores Are An Important Aspect Of Your Financial Profile

They may be used to determine some of the most important financial factors in your life, such as whether or not youll be able to lease a vehicle, qualify for a mortgage or even land that cool new job.

And considering 71 percent of Canadian families carry debt in some form , good credit health should be a part of your current and future plans.

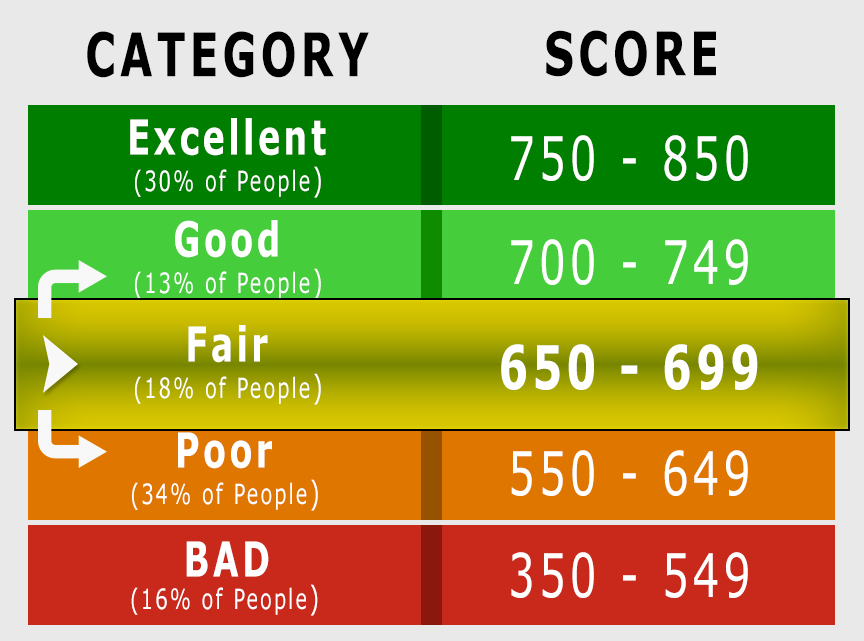

High, low, positive, negative theres more to your scores than you might think. And depending on where your numbers fall, your lending and credit options will vary. So what is a good credit score? What about a great one? Lets take a look at the numbers.

Learn More About Your Credit Score

A 680 FICO® Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to check your credit score to find out the specific factors that impact your score the most and get your free credit report from Experian. Read more about score ranges and what a good credit score is.

A Good Credit Score Is In The Eye Of The Beholder

Although the FICO and VantageScore charts above display a general idea of how lenders may interpret different credit score ranges, lenders and other companies can, and often do, differ in their opinions of creditworthiness.

For example, just because youre considered to have a good credit score to an auto dealer doesnt mean a mortgage lender would consider that same score to be a good credit risk. Each lender has their own criteria for credit scoring as well as their own thresholds for a good score vs. a bad score.

Read Also: Does Titlemax Check Your Credit

Is 680 Credit Score Good Enough For Mortgage

680Good creditgood680mortgage

A 680 FICO®Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to check your to find out the specific factors that impact your score the most and get your free report from Experian.

Furthermore, can I get a house with a 670 credit score? FHA Loan with 670 Credit ScoreFHA loans only require that you have a 580 , so with a 670 FICO, you can definitely meet the requirements. With a 670 credit score, you should also be offered a better interest rate than with a 580-619 FICO score.

Moreover, is 689 a good credit score to buy a house?

rating affects monthly paymentsFICO scores range from 300 to 850. An average or fair rating generally is between 630 and 689. Your score affects not only whether you can get a mortgage, but the monthly rate you’ll be offered.

How much of a home loan can I get with a 650 credit score?

For many conventional loans, the lowest you can have and still be approved is 620. The minimum for VA loan is also 620, however, some banks can allow consumers with 580 to be approved. The Federal Housing Administration allows for at least a 580 with a 3.5% down payment.

How To Turn A 680 Credit Score Into An 850 Credit Score

There are two types of 680 credit score. On the one hand, theres a 680 credit score on the way up, in which case 650 will be just one pit stop on your way to good credit, excellent credit and, ultimately, top WalletFitness®. On the other hand, theres a 680 credit score going down, in which case your current score could be one of many new lows yet to come.

Everyone obviously wants his or her credit score to be on an upward trajectory. So whether you need to turn things around or increase the pace of your improvement, youd better get to work. You can find personalized advice on your WalletHub credit analysis page, and well cover the strategies that everyone can use below.

Don’t Miss: Remove Repossession From Credit Report

Improving Your 780 Credit Score

A FICO® Score of 780 is well above the average credit score of 704, but there’s still some room for improvement.

Among consumers with FICO® credit scores of 780, the average utilization rate is 17.0%.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll also find some good general score-improvement tips here.

How Long Does It Take To Get A 680 Credit Score

It depends where you started out.

If you had fair credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

Recommended Reading: Itin Credit Report

Credit Score Credit Cards

Unfortunately, one with fair 680 credit score will not qualify for just any credit card, such as ones that offer big initial bonuses. The general approval process will also be more difficult for those with less than good credit. However, individuals within this credit range typically qualify for the following cards: ones with zero financing, no foreign fee, or no annual fees airline/hotel cards and store cards. Based on this, there are several credit card options available for those with average credit to turn to, but most come with annual fees and only allow a low credit limit.

Is 680 A Good Credit Score For A House Or Apartment

Related Articles

Your credit score can have a big impact on your ability to rent a property, qualify for a mortgage and secure a favorable interest rate. However, just because your credit score isn’t perfect doesn’t mean you won’t be able to buy a new house or find a new apartment. With a credit score in the high 600s, you should be able to do both. However, you may have to pay a little more.

Read Also: What Is Syncb Ntwk On Credit Report

Is 690 A Good Credit Score

- Standard Definition: Yes A lot of people think good credit starts at a score of 660 and ends at a score of 719.

- WalletHubs Rating: No Based on the rate at which people with 690 credit scores get approved for credit cards that require “good credit” or better, we believe you actually need a credit score of 700-749 to have good credit.

Of course, lenders always have the last word. And they neither define good credit the same way, nor disclose exactly what they consider it to be. So even if your 690 credit score does count as good credit by in some cases, it wont in others. And thats reason enough to improve your credit score so as to erase all doubt.

Below, you can learn more about what your 690 credit score means as well as what you can do to take it to the next level.

How To Earn A Good Credit Score:

If you currently have a credit score below the “good” rating, you may be labeled as a subprime borrower, which can significantly limit your ability to find attractive loans or lines of credit. If you want to get into the “good” range, start by requesting your credit report to see if there are any errors. Going over your report will reveal what’s hurting your score, and guide you on what you need to do to build it.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

A Quick Guide Explaining Credit Scores Including How They Work What Range Is Considered Good And Why Theyre Valuable

- FICO says good credit scores fall between 670 and 739. Thatâs on a scoring range from 300 to 850.

- VantageScoreâs good scores are reported to fall between 661 and 780, also on a 300â850 range.

But thereâs a lot more to it than that. So keep reading to take a closer look at credit scores, including how theyâre determined, whoâs looking at them and what you can do to monitor and improve yours.

What Is A Bad Credit Score Range

Bad credit score = 300 549: It is generally accepted that credit scores below 550 are going to result in a rejection of credit every time. If your score has fallen into this range, improving your score is going to take some work.

Filing for bankruptcy can bring a score down to this level. Statistically, borrowers with scores this low are delinquent approximately 75% of the time. But if you continue to make your payments on time, your score should improve. There are certain types of loans, like home loans, that are hard to get with a score in this range, but there are still options for getting a mortgage with bad credit.

Read Also: Reporting Death To Credit Bureaus

Why Your Credit Score Matters

There are real benefits to staying on top of your credit score.

Thats because a strong credit score can translate into real perks, like access to a wider range of products and services including loans, credit cards and mortgages. You could also enjoy better interest rates and more generous credit limits. Meanwhile, if your credit score isnt quite where you want it to be, knowing the score is the first step to improving it.

Either way, it pays to know your credit score. Its your financial footprint the way companies decide how financially reliable you are. A higher credit score means lenders see you as lower risk.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: What Is Syncb Ntwk On Credit Report

Details You Need To Make A Smart Decision

FICO and myFICO® service are trademarks and/or registered trademarks of Fair Isaac Corporation. Experian is a registered trademark of Experian Information Solutions, Inc. Transunion is a registered trademark of TransUnion, LLC. Equifax is a registered trademark of Equifax, Inc.

The content provided is for informational purposes only and is not considered or intended to be legal, tax, or investment advice. You should consult your legal, tax or financial consultant about your personal situation. Third party site links are provided for your convenience. BBVA is not responsible for, and does not guarantee the products, services, content, privacy, security or accessibility standards of third party sites. Information contained in this webpage was obtained from EVERFI, annualcreditreport.com, consumer.ftc.gov, myfico.com, consumerfinance.gov, experian.com, transunion.com, and equifax.com. BBVA does not guarantee that using this information will improve your credit score or overall credit standing.

1annualcreditreport.com is the only source for your free annual credit reports as authorized by federal law and is a registered trademark of Central Source LLC.

What Affects A Credit Score

While every credit scoring model is different, there are a number of common factors that affect your score. These factors include:

- Payment history

- Balances on your active credit

- Available credit

- Number of accounts

Each factor has its own value in a credit score. If you want to keep your number at the higher end of the credit score scale, its important to stay on top of paying your bills, using your approved credit, and limiting inquiries.

However, if you are in the market to purchase a house or loan, there is an annual 45-day grace period in which all credit inquiries are considered one cumulative inquiry. In other words, if you go to two or three lenders within a 45-day period to get find the best rate and terms available for a loan, this only counts as one inquiry. This means that they are not all counted against you and will not affect your credit score.

Recommended Reading: How To Remove Repossession From Credit Report

How To Keep On Track With A Very Good Credit Score

To achieve a 780 credit score, you’re probably disciplined in your financial habits, with solid debt-management skills. You can still increase your score, however, and of course you’ll want to avoid losing ground. To those ends, it’s a good idea to keep an eye on your score, and avoid behaviors that can bring it down.

Factors that affect credit scores include:

. To determine your on a credit card, divide the outstanding balance by the card’s credit limit, and then multiply by 100 to get a percentage. Calculate the utilization for all your cards, and then figure out your total utilization rate by dividing the sum of all your balances by the sum of all your borrowing limits . You probably know credit scores will slip downward if you max out your credit limit on one or more cards by pushing utilization toward 100%. You may not know that most experts recommend keeping your utilization rate below 30% for each of your cards and for all your revolving accounts overall. Credit usage is responsible for about 30% of your FICO® Score.

Timely bill payments. This may seem obvious, but there’s no greater influence on your FICO® Score: Late and missed payments hurt your credit score, and on-time payments benefit your score. Payment history accounts for as much as 35% of your FICO® Score.

. The FICO® scoring system generally favors borrowers with a variety of credit, including both installment loans and revolving credit . Credit mix can influence up to 10% of your FICO® Score.

Is A Credit Score Of 680 Good Or Bad

With a 680 credit score, you have reached the good range of credit score. This means you can qualify for a car loan or mortgage, youll be less likely incur more charges than people with a lower credit score.

Certain lenders might consider people with good credit scores are preferred applications however Ability Mortgage Group treats all our clients with the same level of service good or bad credit. Others in the subprime lender category have no problem working with people whose scores place them in the Fair category, but they have fairly high rates of interest.

About 27 percent of individuals with whose credit scores fall under the fair category may become negligent at some point.

Recommended Reading: How To Unlock My Experian Credit Report

How To Improve Your 680 Credit Score

A FICO® Score of 680 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 680 FICO® Score is on the lower end of the Good range, you’ll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range .

35% of consumers have FICO® Scores lower than 680.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll find some good general score-improvement tips here.

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- Cleaning up your credit report

- Paying down your balance

- Negotiating outstanding balance

- Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

You May Like: Does Paypal Credit Report To Credit Bureaus

What Is A Good Credit Score Range

Good credit score = 680 739: Credit scores around 700 are considered the threshold to good credit. Lenders are comfortable with this FICO score range, and the decision to extend credit is much easier. Borrowers in this range will almost always be approved for a loan and will be offered lower interest rates. If you have a 680 credit score and its moving up, youre definitely on the right track.

According to FICO, the median credit score in the U.S. is in this range, at 723. Borrowers with this good credit score are only delinquent 5% of the time.

Is Your Credit Score Average For Your Age

Given that younger borrowers may not have a long history of credit to drive their credit score up, it shouldn’t be surprising that average credit scores for American borrowers improve throughout their lifetime. As borrowers mature, they also become more aware of the factors that drive credit score improvement and are motivated to increase their scores to allow home purchases and other large investments that require loans or lines of credit.

Read Also: How To Remove Repossession From Credit Report

What Is A Good Credit Score To Buy A House

If only it were that simple. When trying to answer the question, What credit score is needed to buy a house? there is no hard-and-fast-rule. Heres what we can say: if your score is good, lets say higher than a 660, then youll probably qualify. Of course, that assumes youre buying a house you can afford and applying for a mortgage that makes sense for you. Assuming thats all true, and youre within the realm of financial reason, a 660 should be enough to get you a loan.

Anything lower than 660 and all bets are off. Thats not to say that you definitely wont qualify, but the situation will be decidedly murkier. In fact, the term subprime mortgage refers to mortgages made to borrowers with credit scores below 660 . In these cases, lenders rely on other criteria reliable source of income, solid assets to override the low credit score.

If we had to name the absolute lowest credit score to buy a house, it would likely be somewhere around a 500 FICO score. It is very rare for borrowers with that kind of credit history to receive mortgages. So, while it may be technically possible for you to get a loan with a score of, say, 470, you would probably be better off focusing your financial energy on shoring up your credit report first, and then trying to get your loan. In fact, when using SmartAsset tools to answer the question, What credit score is needed to buy a house?, we will tell anyone who has a score below 620 to wait to get a home loan.