Why Are My Fico Score And Vantagescore Different

A score is a snapshot, and the number can vary each time you check it.

Your score can vary depending on which credit bureau supplied the credit report data used to generate it. Not every creditor sends account activity to all three bureaus, so your credit report from each one is unique.

Each company has several different versions of its scoring formula, too. The scoring models used most often are VantageScore 3.0 and FICO 8.

Also, FICO and VantageScore weight scoring factors slightly differently.

The Main Three Credit Bureaus

Data maintained by Experian, TransUnion and Equifax is used to calculate credit scores. Credit bureaus gather information about your credit accounts, including credit cards, loans and lines of credit. They record your payment history, balances, available credit, late payments, accounts in collections and bankruptcies.

Credit reports also include identifying information such as your name, Social Security Number, current and former addresses, and current and past employers that have been reported to the bureaus by the creditors. They dont include financial information unrelated to debt, such as your income or bank account balance. In the case of Experian, to help protect you from identity theft, they do not list your actual SSN on your personal credit report.

Do I Need To Get My Credit Score

It is very important to know what is in your credit report. But a credit score is a number that matches your credit history. If you know your history is good, your score will be good. You can get your credit report for free.

It costs money to find out your credit score. Sometimes a company might say the score is free. But if you look closely, you might find that you signed up for a service that checks your credit for you. Those services charge you every month.

Before you pay any money, ask yourself if you need to see your credit score. It might be interesting. But is it worth paying money for?

Recommended Reading: How Long Do Closed Credit Accounts Stay On Your Report

What Do The Credit Bureaus Do

Credit bureaus, or credit reporting agencies, collect information from a variety of sources using your Social Security number, credit file, and other identifying information. They use this information to compile credit reports and calculate credit scores, which are different.

- : Your credit report contains information about when credit accounts were opened, their balances, credit limits, and payment history, as well as information on bankruptcies and debt collections. Credit scores are calculated from the information in your credit reports.

- : Credit bureaus each calculate their own . This can be confusing because most lenders use credit scores compiled by one of two outside companies â FICO® and VantageScore â which come up with different credit scores using their own models based on the credit bureausâ reports.

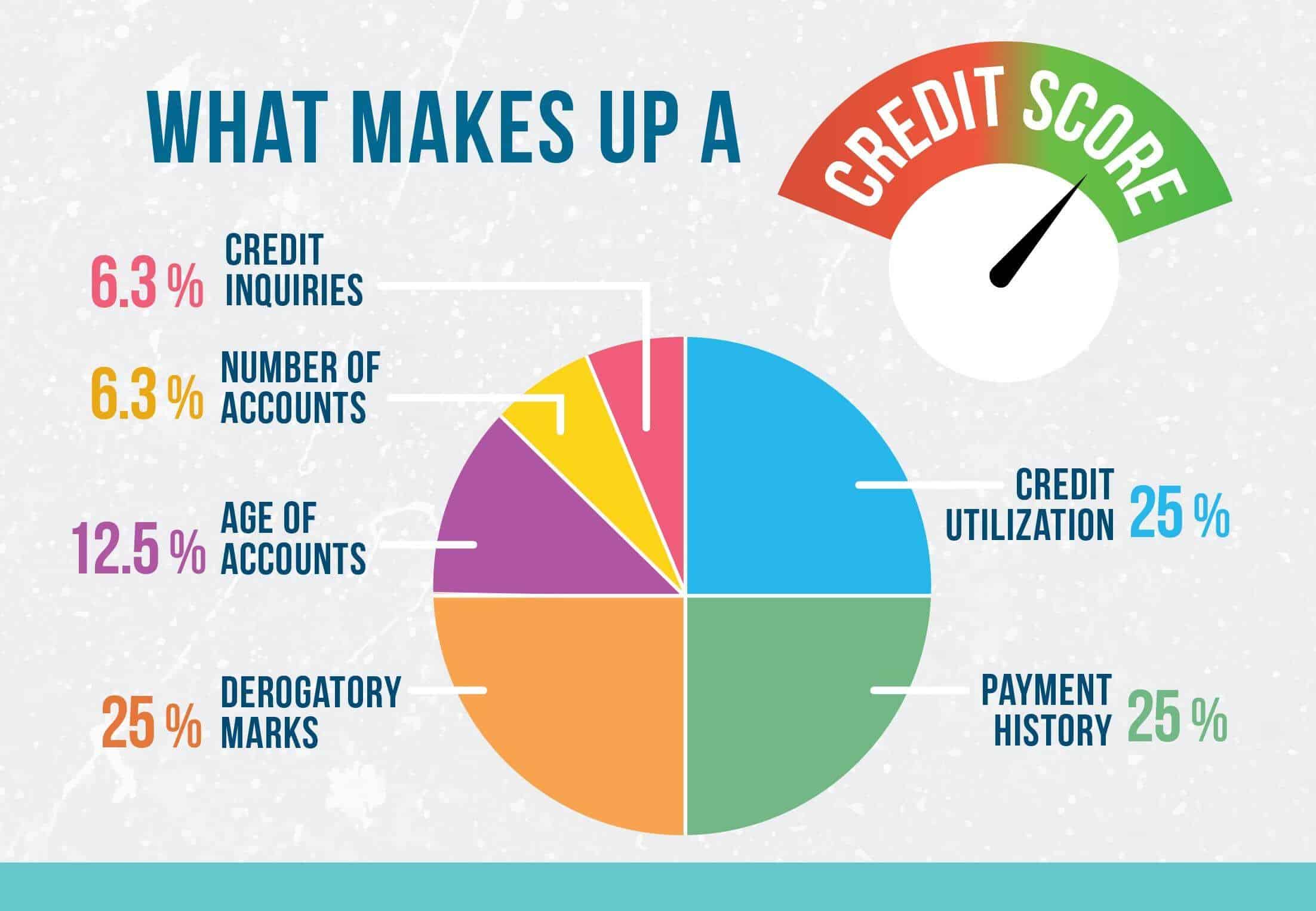

Generally speaking, credit scores are calculated using five factors: payment history, amounts owed, length of credit history, new credit, and credit mix. However, these are defined and weighted somewhat differently depending on the company thatâs compiling your score.

Itâs helpful to know the difference between how TransUnion and Equifax calculate credit scores, in order to better understand the numbers that appear on their credit reports.

Also Check: Is 671 A Good Credit Score

How Are Credit Scores Calculated

FICO Score

VantageScore

Don’t Miss: What Is The Worst Credit Score

What Is A Credit Score And Why Is It Important

A credit score is a financial metric that measures how creditworthy you are. In other words, it reflects how risky it is to lend money to you.

Your credit score conveys crucial information to lenders about your ability to handle credit responsibly. If a lender extends a loan to you, whats the likelihood of you missing payments and defaulting on it? This is the primary question lenders ask themselves when determining whether to approve you for a loan and your credit score plays a pivotal role in helping them arrive at their decision. If they deem you a high-risk borrower, they wont hesitate to reject your application.

Depending on how your , it could have either fortunate or dire implications on your ability to secure financing, be it a credit card, personal loan, or mortgage. For this reason, its wise to get acquainted with how a credit score functions and the factors that affect it.

How Do I Improve My Credit Score

The single most important thing you can do to improve your score is pay your bills on time, every month. Getting and keeping your paperwork organized can help you improve your credit score. By keeping your monthly bills in a To Pay folder with due dates highlighted and marked on your calendar, you become less likely to miss a payment, or even lose track of a bill because its hiding in a stack of unorganized papers.

Here is how FICO and VantageScore view your financial behavior and assign percentages to each behavior to determine your credit score. The higher the percentage, the more important that behavior becomes in determining your credit score.

As you can see, both FICO and VantageScore place a high importance on your payment historywhether or not you pay your bills on time, every month.

Also Check: How To Report Car Payments To Credit Bureau

What Is A Fair Credit Score Range

Fair credit score = 620- 679: Individuals with scores over 620 are considered less risky and are even more likely to be approved for credit.

In the mid-600s range, consumers become prime borrowers. This means they may qualify for higher loan amounts, higher credit limits, lower down payments and better negotiating power with loan and credit card terms. Only 15-30% of borrowers in this range become delinquent.

How To Build A Good Credit Score

Building a good credit score comes down to using credit responsibly over time. The same is true when it comes to maintaining a good credit score. Here are five things the CFPB says you can do:

When it comes to monitoring your credit, makes it easy. Itâs free for everyone, not just those who have a Capital One credit card. And checking wonât hurt your scoreâa major plus if youâre working to improve a bad credit scoreâso you can check it as often as you like.

Also Check: What Is A Good Credit Score

What Factors Affect Your Credit Score

The two main credit scoring models, FICO and VantageScore, consider much the same factors but weight them somewhat differently. For both scoring models, the two things that matter most are:

-

Paying bills on time. A misstep here can be costly, and a late payment that’s 30 days or more past the due date stays on your credit history for years.

-

How much you owe. Credit utilization, or how much of your credit limits you are using, is weighted almost as heavily as paying on time. It’s good to use less than 30% of your credit limits lower is better. You can take several steps to lower your credit utilization. Scores respond fairly quickly to this factor.

Much less weight goes to these factors, but they’re still worth watching:

-

The longer you’ve had credit, and the higher the average age of your accounts, the better for your score.

-

Credit mix: Scores reward having more than one type of credit a traditional loan and a , for example.

-

How recently you have applied for credit: When you apply for credit, a hard inquiry on your credit report may result in a temporary dip in your score.

What’s The Difference Between A Credit Report And A Credit Score

— Equifax, Experian and TransUnion are the big three — collect financial information from your creditors to create .

Credit scores — including the widely used FICO score — can be calculated using pieces of information in your credit report:

- Paymenthistory, detailing how and when you’ve paid your accounts over the length of your credit

- Amounts you owe on your accounts, including how much of your available credit you are using

- Length of your credit history, including the age of your oldest and newest accounts and the average age of all your accounts

- , including credit cards, retail accounts, installment loans and mortgages

- New credit you’ve recently opened

Here’s more on what goes into determining credit scores.

Recommended Reading: What Do Lenders See On My Credit Report

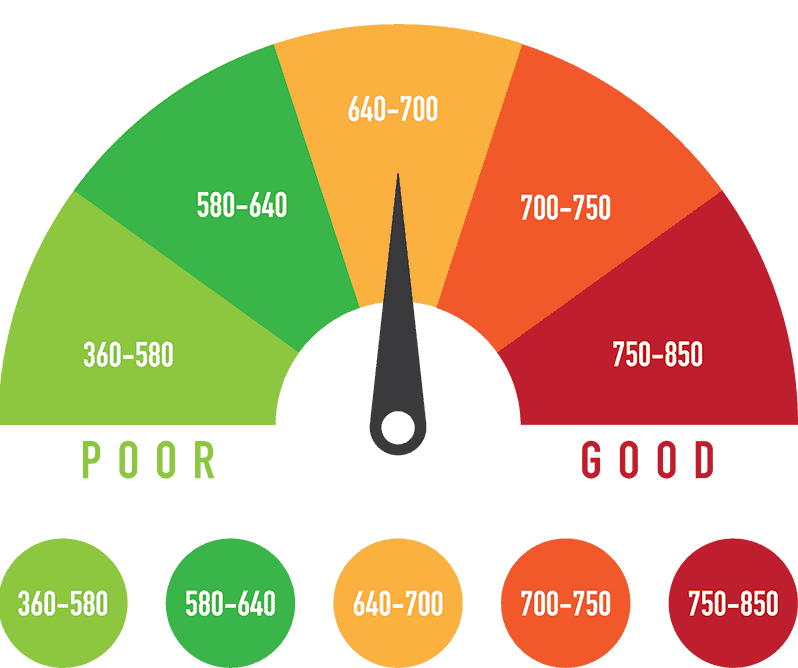

What Does My Credit Score Mean

Your credit score is a three-digit number that sums up all the information on your credit report into one tidy number. It follows you around for your entire life, its value moving up and down depending on whats happening in your financial life.

This three-digit score goes by two different names, FICO or VantageScore. The FICO score is named after the company who invented this three-digit scoring system in the mid-1980s, Fair Isaac, Inc. Many lenders use the FICO scoring system.

More recently, the three major credit reporting agencies created their own scoring system, called the VantageScore, designed to produce a more consistent score across all three credit reporting agencies.

So what does a score mean? Whats a good credit score? Or a bad one?

What Is A Credit Score And What Is It Used For

Whether you’re looking to open a new credit card account, buy a home with a mortgage loan or even purchase auto insurance coverage, you need good credit. That means your credit score will likely come into play. If your score is too low and you have poor credit, you might find that a lender will offer you a higher interest rate or other unfavorable terms — or, in some cases, you could even be denied for the products and services you want most.

If you don’t already know your credit score, you should consider using an online tool to help you. There are easy ways to find your score within just minutes.

While it can be stressful, having bad credit isn’t the end of the world. There are ways to restore your score and you can start that process today.

Let’s take a look at what it means to have a poor credit score, how this can affect you and the ways you can work to build your score back up.

Recommended Reading: Can An Eviction Be Removed From Your Credit Report

Reasons You May Not Have A Medical History Report

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

What Causes A Bad Credit Score

While each different credit scoring model has its own scoring ranges, anything below 580 to 600 is generally considered to be a poor score. If you have a bad credit score, this can result in denied loan applications, limited credit card options, and even higher car insurance rates.

- Poor credit is usually the result of one or more of the following:

- Not having enough different accounts

- Payment history: Late payments can particularly count against you

- Unpaid accounts or those that have gone to collections or been charged off

- Too many inquiries in a short period of time

- Too many recent new accounts opened

- A history of bankruptcy and/or judgments

You can also earn a bad credit score if your credit history is limited or nonexistent. If you’ve never opened a credit account of any kind — a credit card, a loan, a charge card such as American Express or even had a medical bill go to collections, chances are that your credit report will be pretty sparse if not blank. If the credit bureaus don’t have any information on your creditworthiness, it’s difficult for a scoring model to calculate a score for you.

You May Like: How To See Your Credit Score For Free

Keep Your Credit Cards Balances Low

Sometimes the inevitable happens, like a flat tire or emergency root canal, and you have no choice but to charge it to your credit card and carry a balance for a while. Just make sure you never carry a balance of more than 30% of your credit card limit.

That means if you have a $1,500 credit card you never want to carry a balance over $500. Once you exceed that 30% threshold it starts to damage your credit score. Charging your credit card to the max, or higher, starts to hurt your credit score as much as a missed payment.

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

Also Check: How Long Do Defaulted Student Loans Stay On Credit Report

What Factors Impact My Credit Scores

Reading time: 2 minutes

Highlights:

- One of the key behaviours lenders and creditors like to see is on-time bill payments

- Lenders and creditors prefer to see a lower ratio of how much debt you’re carrying compared to how much available credit you have

Regardless of the financial milestones youre reaching, when it comes to financial progress and credit, its important to understand the factors that may impact your credit scores. Consider the following:

Have you generally made payments on time?One of the key behaviours that lenders and creditors typically like to see is on-time payment of bills. Since this is one of the strongest predictors that you are likely to meet your financial obligations, it is generally an important factor in credit scoring models .

Do you have different types of credit accounts?While there are many different , they generally factor in the mix of different types of credit you have, such as credit cards, installment loans, mortgages, and store accounts. If you have too many different credit accounts or dont have a mix of different types — it could negatively impact credit scores.

How old are your credit accounts?In general, creditors and lenders like to see that youve been able to properly handle credit accounts over a period of time. Credit accounts with a longer history showing responsible credit behaviour will reflect positively on credit scores. Newer accounts will lower your average account age, which may negatively impact credit scores.

Fico Credit Score Ranges

- Poor: 500 to 600

- Very Poor: 300 to 499

If your hits the exceptional or excellent range, congratulations. Youre likely managing your credit responsibly and it shows. This credit score range may open up opportunities for approvals and higher credit limits. That may translate to lower monthly payments in the long-term plan for paying off loans. As you might expect, the other end of the score range often yields less swagger. Credit applicants with credits scores in the lowest ranges usually have fewer choices. In fact, finding out your credit score sits in the low range may be an opportune time to take a look at your credit report. A credit monitoring service, like can help.

Recommended Reading: How To Raise My Credit Score

How To Improve Your Credit Scores

To improve your credit scores, focus on the underlying factors that affect your scores. At a high level, the basic steps you need to take are fairly straightforward:

- Make at least your minimum payment and make all debt payments on time. Even a single late payment can hurt your credit scores and it’ll stay on your credit report for up to seven years. If you think you may miss a payment, reach out to your creditors as quickly as possible to see if they can work with you or offer hardship options.

- Keep your credit card balances low. Your is an important scoring factor that compares the current balance and credit limit of revolving accounts such as credit cards. Having a low credit utilization rate can help your credit scores. Those with excellent credit scores tend to have an overall utilization rate in the single digits.

- Open accounts that will be reported to the credit bureaus. If you have few credit accounts, make sure those you do open will be added to your credit report. These could be installment accounts, such as student, auto, home or personal loans, or revolving accounts, such as credit cards and lines of credit.

- Only apply for credit when you need it. Applying for a new account can lead to a hard inquiry, which may hurt your credit scores a little. The impact is often minimal, but applying for many different types of loans or credit cards during a short period could lead to a larger score drop.