Credit Scores & Student Loans Student Loan Borrowers

Many loan servicers will not report a delinquency until you are more than 60 days past due. They supply information concerning collection of the loan, repayment;

How do I remove late Navient payments? At that point, itll report your late payment to the credit reporting agencies such as TransUnion, Experian,;How do I remove late Navient payments? · Writing a goodwill letter to Navient

Credit Bureau Reporting. Want to know what is on your credit report? Accessing your credit history is easy and once per year its free, too. Request your;

The Secret To Financing A Guitar With Any Credit Type

This article contains affiliate links, for more information see the disclosure here. Using these links won’t cost you a thing, may save you money, and it helps us to keep putting out great material for you to read while remaining ad free. Thanks for your support!

Whether youre looking to learn to play guitar or serious about getting one for recording and giving concerts, the guitar you choose can have a big impact. Getting a guitar that is capable of projecting your musical vision and sound is key, but professional grade guitars tend to be expensive and are therefore out of reach for many people. In cases like these, financing can allow you to start learning on an high quality instrument you can grow with or give you the opportunity to start recording professional quality audio and give memorable concerts now. But, according to cfed, more than half of Americans are either credit invisible, or have poor credit, which means financing may be a real challenge for many people. In this article, Ive put together a list of some of the absolute best financing options for people of all credit types with a list of pros and cons for each that I think will be helpful.

What Exactly Is Does Aarons Report To Credit

Fellas! Have you been working as being a secretary in a company or Firm? Guaranteed, you may acquire in demand in all letters challenges. And yes, a does aarons report to credit issue is among a issue you ought to be master in. Even you are not an staff, a does aarons report to credit is very important for almost any needs in order to deliver a proposal to other Firm, corporation as well as your Trainer. Understanding how crucial does aarons report to credit reasons are, we are interested to debate it now. Make sure you stay tuned and luxuriate in reading through!A does aarons report to credit is a proper and Experienced document that is prepared by personal, Business or business to its consumers, stakeholder, company, Business and several a lot more. This letter needs to provide any facts, request, authorization and plenty of extra skillfully with The fundamental and customary templates amongst men and women all over the globe. Each a personal correspondent and organization need to construct the Construct quality by your does aarons report to credit in sake of demonstrating your Specialist small business. Then how to make it? In this article we go.

Don’t Miss: Does Having More Credit Cards Help Your Credit Score

Does Aarons Report To Credit Video Tutorial

For our lovely reader, we provide a handy movie to provide you with a simple tutorial how to put in writing a good does aarons report to credit. The sample below could a just guide when you are no cost to change it based on your difficulties. So, appreciate viewing!

Perfectly, it is all about does aarons report to credit. We hope it can be practical for any small business functions you may have. Thanks for reading through and see you shortly!

Navy Federal Mortgage Review For 2021

Review of Navy Federal Credit Union mortgages showing how the company compares to other to lenders for mortgage rates, loan options, and customer service.

Oct 29, 2020 Does the Navy Federal Credit Union Business Card show up on personal credit reports No, the credit union doesnt report activity for this card;

I paid a credit repair company to dispute things and they screwed up my reports. I owe NFCU for 2 credit cards and after a couple months of credit repair;

Don’t Miss: Which Credit Score Is Correct

Navient 90 Days Past Due Hit Credit Report Myfico Forums

Sep 15, 2017 · 5 postsnavient reports at the 60 day mark, in my experience, but BY LAW they can report after 30 days. if the loans are private they do have an;

Jan 6, 2017 And what do they report? on your major credit reports during school, federal student loans dont begin reporting payment information to;1 answer; · ;Top answer:;Your lender will report account information to the major credit bureaus each payment period. Its important to know that while a student loan will be

Your credit history, including student loans, mortgages, credit cards, and the amount of credit thats available to you from all of these sources. Payment;

What Can I Do About Defaulted Federal Student Loans? Check your credit report to see the status of your federal student loans. Rating: 5 · 1,336 reviews · Free · Finance

Navy Federal Personal Loans: 2021 Review Nerdwallet

Jan 26, 2021 No pre-qualify option. Reports payments to three credit bureaus. Affordability.Credit building: No pre-qualify option. Reports Loan flexibility: Offers multiple loan types. Does Customer experience: Offers multiple customer Rating: 4 · Review by Jackie Veling

VantageScores and Equifax credit reports. 3-bureau credit scores. 3-bureau credit report Navy Federal Credit Union is federally insured by NCUA.

View customer complaints of Navy Federal Credit Union, BBB helps resolve a fraud alert in place with the credit bureaus and still refused to open up a;

Jul 14, 2021 Navy Federal Credit Union is a credit union and mortgage lender good Union doesnt have a rating yet from the Better Business Bureau.

Read Also: Is 739 A Good Credit Score

Horrible Experience With This Company

Horrible experience with this company. My order kept getting cancelled. Then my dad tried to order and they cancelled his order without explanation three times. He tried a fourth time, and then ZZounds forces you to use a system called Mati for verification. That is all well and good but when my father who is 80 years old and handicapped , using an online system like this does not work well for older people. I then called and asked if my dad can email his ID instead. They said “no.” So forget it. Horrible process!

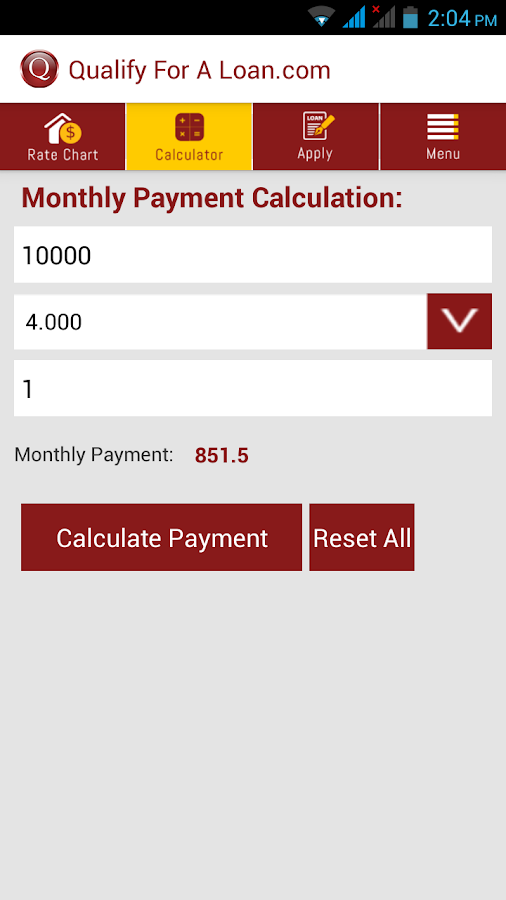

What Determines Which Payment Plan I’m Eligible For

We determine your payment plan eligibility for any given order based on information we get from your credit report, as well as your order history with zZounds. We love our repeat customers, so if you successfully pay off a zZounds payment plan, you’re more likely to qualify for a payment plan on your next order.

Don’t Miss: Can You Have A Bankruptcy Removed From Your Credit Report

Can I Use Multiple Cards To Pay For My Monthly Installments

Yes. We only keep one card on file at a time, but if you’d like to split your next payment between multiple cards, just give us a call before your payment date to make a partial payment with an alternate card. You’re also welcome to change the credit card on file for your payment plan, and use a different credit card each month.

Cheats Selling Gear Already Out Of Stock

Purchased Gator bag … defective … return? No … they tell me I have to send the defective bag back to manufacturer on my dime. Bought next one from Sweetwater .. no problem.So now I see they are selling OnStage Cajons for $30 off on Reverb. I buy one of the two left. Three days later no shipping … no communication … nothing … nada. So I message them on Reverb when they were shipping. Oh … so sorry … we’re all sold out … oh so sorry. Yeah … well here’s your negative review as promised. They got out of a negative review on Reverb because they cancelled the order and Reverb covers for cheats like this by not allowing feedback on cancelled orders. My … how convenient. At least I caught them in the act of selling gear they no longer had in stock.

Recommended Reading: How To Get Rid Of Inquiries On Your Credit Report

Netspend’s Account Opening Requirements

Unlike credit and debit cards, Netspend does not require a Social Security Number to open an account.

The company only requires a name, address, and email address to enroll on its website. Then, you create a username, password, and security question. Once you complete these two steps, you receive a card in seven to 10 business days. You can begin to fund the account at any time.

Both credit cards and traditional debit card accounts require applicants to provide a Social Security Number and date of birth. Companies that offer these types of accounts run credit checks prior to approval, which often determines the amount of credit they can provide. They can report this information to credit bureaus whether they approve the account or not.

Since NetSpend accounts are prepaid by the cardholder’s own funds, a reportable offense would be rare. The company could possibly contact a collections agency if you use the “purchase cushion” of up to $10 with its NetSpend Premier card and don’t pay it back.

Does Cashnetusa Report To Credit Bureaus Movie Tutorial

Heres The straightforward movie tutorial about does cashnetusa report to credit bureaus. We hope you will be effortless to write down and alter the topic according to your troubles. Enjoy observing!

Men, it is focused on does cashnetusa report to credit bureaus. We really want your assistance so please go away your comment beneath. For our greater efficiency, we kindly wait around your critics and recommendation. In any case many thanks for examining this web site and observe our movie. We hope it could be useful and also have a superb day!

Read Also: How Long Should A Bankruptcy Stay In The Credit Report

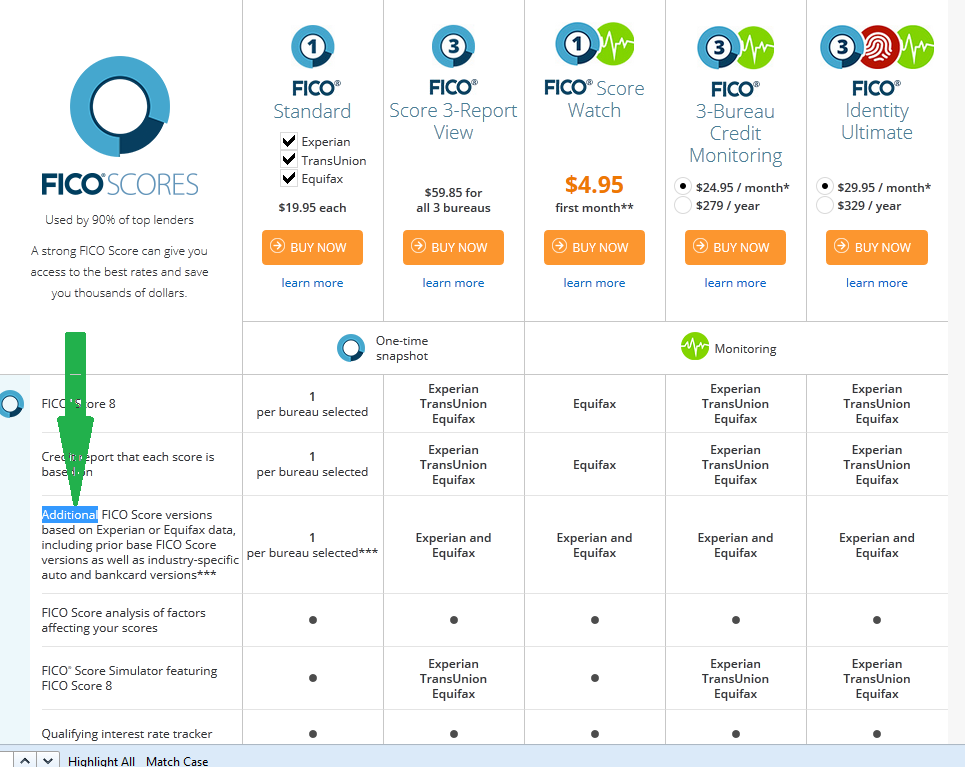

Does Zzounds Do A Credit Check View Your Merged Credit Report Scores Start Getting Past & Present Credit

Does Zzounds Do A Credit Check View Your Merged Credit Report Scores. Try a 30 Day Free Trial Start Getting Past & Present Credit

Does Zzounds Do A Credit Check View Your Merged Credit Report Scores. Try a 30 Day Free Trial Start Getting Past & Present CreditDoes Zzounds Do A Credit Check View Your Merged Credit Report Scores. Try a 30 Day Free Trial Start Getting Past & Present CreditDoes Zzounds Do A Credit Check View Your Merged Credit Report Scores. Try a 30 Day Free Trial Start Getting Past & Present Credit

View Your Merged Credit Report Scores. Does Zzounds Do A Credit Check View Your Merged Credit Report Scores. Does Zzounds Do A Credit Check View Your Merged Credit Report Scores. Try a 30 Day Free Trial Start Getting Past & Present Credit Does Zzounds Do A Credit Check Try a 30 Day Free Trial Start Getting Past & Present Credit

As Long As I Pay Off My Payment Plan How Is It Any Different From Other Retailers’ Plans

Unlike other retailers, zZounds payment plans are always interest-free, and we don’t require you to apply for a new credit card. For us, it’s not about making a buck off interest or getting you to spend more money — it’s about making it possible for musicians to invest in their dream gear now while spreading their payments out over several months.

You May Like: How Accurate Is Credit Karma Score

As You Can See Zzounds Does Not Answer

As you can see Zzounds does not answer to all these complaints because they are very very unethical and break every consumer law they can get away with. I bought a item from them and they shipped it to a wrong address or was lost and showed delivered. I notified these thieves immediately and they did nothing so I refused to pay for the order. Well, almost 10 months later they hit my account for over 2300 without notice or fixing the issue. Of course I will be fighting the illegal charge and they can care less about following consumer law. They will have to answer to a judge because they are ruthless and despicable and a predatory B Stock online scam . Do not use these guys ever!!!

Zzounds Is The Worst Place To Purchase

Zzounds is the worst place to purchase DJ equipment from! I had a hardship with my job due to the pandemic and one of my equipments that I purchased from them had went into collections. I had spoken with them about making a payment in the future to resolve the payment but when i woke up today i noticed a very large amount taking out of my bank account from them that i did not authorize! When i called them they told me that they did not need to have my permission to take out any payment and that they would not be refunding the money back in my account!

Read Also: How To Up Credit Score

Navy Federal Credit Union Personal Loan Review: Long

4 days ago How Does Navy Federal Credit Union Compare to Other Lenders? vs. Wells Fargo; vs. Discover Personal Loans; vs. Citizens Bank;

Plus, some of our clients also receive debt relief and cleaned-up credit reports. You have nothing to lose! Call us today at 888-572-0176 for a free;

When you obtain your auto loan, Navy Federal Credit Union reports your new loan to the credit bureaus. Your Navy Federal Credit Union loan shows up as a so;Does Navy Federal Credit Union report to the credit bureaus?Does Navy Federal Credit Union have a grace period?

Navy Federal Credit Union Credit Card Reviews July 2021

My secured card with NFCU hasnt graduated yet, but I found out that was due to a freeze I put on my credit report. My cc usage was around 48%.

Minimum Interest Charge None For Credit Card Tips from the Consumer Financial Protection Bureau To learn more about factors to consider when applying for or;

Read Also: Which Credit Score Matters The Most

Is Fingerhut A Hard Inquiry

Yes, Fingerhut will be a hard inquiry. When you apply for an account, they will pull your credit report. This will show up as a hard inquiry.

They will offer you an initial credit line, and they will report to the credit bureaus when you make on-time payments over a period of time.

Many people find it worthwhile because Fingerhut offers them a chance to rebuild their credit. However, they will pull your credit report, and it shows up as a hard inquiry.

Navy Federal More Rewards American Express Card Forbes

Jan 4, 2021 The More Rewards American Express® Credit Card from Navy Federal Credit Using data from various government agencies, Forbes Advisor has; Rating: 3.2 · Review by Aaron Hurd

What Credit Bureau Does Navy Federal Pull For The nRewards card? What Credit Bureau Does Navy Federal Pull For The nRewards card? Navy Federal will;

Don’t Miss: What Is A Good Credit Score For My Age

No Credit Needed Option

The Good

Bananas at large otherwise known as Bananas.com have been going since 1974 and have stores in the Bay Area. They have a huge collection of guitars, amps, pedals and other gear along with many different musical instruments.

They currently have 8 in-store finance options:;

- No Credit Required:;Zibby,;Acima,;Quadpay,;GetFinancing

- Credit Required:;Affirm, Greensky, Paypal Credit and Synchrony .

They offer free shipping on most orders over $94.72;but tend to push for you to order online and pickup in store. Their stores are located in San Rafael and Santa Rosa, CA.

- Lot of poor customer feedback

Does Fingerhut Build Credit

Fingerhut does help you build credit. When you open your Fingerhut account, they will report it to the credit bureau.

Your line of credit will show up as part of your overall credit on your credit report. This will help your credit because it will lower your credit usage as long as you dont use all of the credit you are extended.

Once you make on-time payments for a number of months, Fingerhut will increase your credit line. This also lowers your credit usage. In addition, your on-time payments are reported, which helps to build your credit.

As long as you make your payments on time and stay under your credit limit, having an account with Fingerhut will help you build credit. It is ideal to use less than 30% of your credit line and make your payments on time every month.

Read Also: How To Boost Credit Score 100 Points

Get Your Free Consultation

If you applied , your score may not be high enough to get approved. If your credit score is preventing you from qualifying for this card, we strongly recommend signing up for a fast, free consultation. One of our friendly Credit Repair specialists can help you determine if you can boost your score , so you can get approved!

Can You Remove Student Loans From A Credit Report

May 26, 2021 Once you report the error, the credit-reporting bureau has to investigate your How Long Do Student Loans Stay on a Credit Report?

1 Just like a car loan or mortgage payment, you make regular monthly payments until the debt is paid off. As a result, credit reporting agencies will treat them;

Apr 15, 2021 Banks, credit unions, finance companies and other lenders that issue credit cards or make mortgage, personal, automobile and/or student loans.

As your student loan servicer, Nelnet reports information about your student loans to the three major credit agencies. Based on the information provided,;

What to do if you have federally held student loans and your guaranty agency will request the credit bureaus remove the default from your credit report.

You May Like: How Long Before Collections Fall Off Your Credit Report