What Should Really Consist Of In How Accurate Is Credit Karma Credit Score

Perfectly, its the important areas you should mention inside of your how accurate is credit karma credit score. And, in this article the sections are:

Whats the Structure for the how accurate is credit karma credit score?

A how accurate is credit karma credit score is a proper letter which has the plain rule for people in all around the world. So thats why, youll want to listen with its structure and font. But again, Just about every Firm can have unique structure and magnificence for their Expert interaction. And we have been listed here to share the popular different types of the basic how accurate is credit karma credit score format. Here some facts over it:

- Block Format

- Modified Block

- Semi-Block

- Font

- Punctuation

More Credit Karma Services

But, besides this free service, Credit Karma has other related services, including a security monitoring service and alerts for new credit checks on you. Outside of Credit Karma, many of the best credit monitoring services provide similar alerts and services.

And, once it has your personal information, you can search for personalized offers for a credit card, a car loan, or a home loan, and your search won’t pop up in your credit report on Credit Karma or anywhere else. A standard section of credit reports is “inquiries,” which lists requests for your report from lenders you’ve applied to for a loan.

Does Credit Karma Offer Free Fico Scores

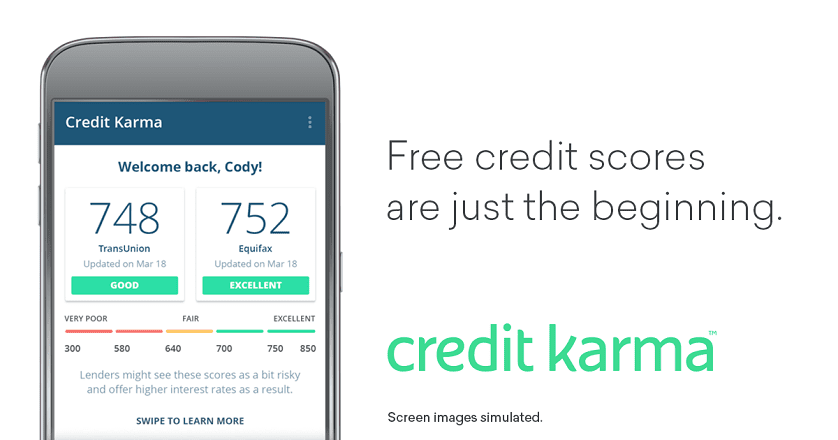

You may have read reviews that say the credit scores you see on Credit Karma are useless because theyre not FICO® scores. Though Credit Karma does not currently offer FICO® scores, the scores you see on Credit Karma provide valuable insight into your financial health.

Its important to keep in mind that no one credit score is the end-all, be-all. There are dozens of different FICO® scoring models alone. Even if youre confident in a specific FICO® score, it may not necessarily match the scores a lender pulls when you apply for a loan.

At Credit Karma, we believe that because you can have so many different scores, the exact number you get at a given time isnt of foremost importance. Whats more important are the changes you observe over time in a single score, and where that number puts you in relation to other consumers.

You May Like: Does Paypal Working Capital Report To Credit Bureaus

What Is Credit Karma

Credit Karma is a financial technology, or fintech, company that provides a wide range of free services to help consumers better manage money and improve their credit. Its parent company, Intuit, also owns QuickBooks personal finance and accounting software, TurboTax tax software, and the personal finance app Mint.com. Credit Karma earns money from ads on the site and when users buy products or services it recommends.

Its An Excellent Financial Tool

This tool for monitoring credit scores daily. But if youre checking your score to take up a loan/mortgage, its best to get more details by comparing your scores using both Vantage 3.0 and FICO models.

The difference between these two models is usually minor as they share some features. Their main similarity is they both aim to predict the possibilities that a client will default on a debt in the following two years.

You May Like: When Will Chapter 7 Bankruptcy Be Removed From Credit Report

How Can I Get My Credit Score For Free

It has a simple sign-up service that mimics most websites. There are three stages to creating your account: giving your email address, filling in your personal details, and confirming your identity. The whole process only takes a couple of minutes.

Without entering in your details or subscribing to a credit monitoring service, youll be able to get a free credit score and credit report.

To verify your identity, you must enter the last four digits of your social security number and answer some additional security questions. This prevents random people from being able to find out your credit score.

However, a huge benefit is that you dont need to give Credit Karma any of your sensitive details, like your card number or full social security number.

How Accurate Are Credit Karma Scores

- Banks Editorial Team

Curious about your credit score? Then you may be wondering about Credit Karma. The personal finance website promises to help you manage your finances and offers a free credit report and score to encourage you to register for a free account. But how accurate are Credit Karma scores? Keep reading to find out.;

Recommended Reading: How To Get A Bankruptcy Off Your Credit Report

Which Credit Report Is Most Accurate

The three major credit bureaus get their information from different sources. This means that your three credit reports from these bureaus may all be slightly different. Consider monitoring each of these reports on an annual basis to help make sure the information is correct.

If youre using Credit Karma to check your credit scores and monitor your credit reports, keep in mind that we update your TransUnion credit scores on a daily basis, so you can follow your progress closely.

But as we mentioned, the most important credit report is the one your lender reviews when you apply for a new credit card, loan or mortgage. Because you may not know which report your lender might use, its more important to focus on the general principles of building credit than on memorizing whats in a particular report.

Differences Between Fico And Vantagescore

In addition to the base FICO Score, of which the newest versions are FICO Score 9 and 10, FICO offers industry-specific credit scoring models designed for creditors such as auto and mortgage lenders. VantageScore does not have industry-specific credit scoring models.

There are also different FICO Score models for each of the three major consumer credit bureaus . Each of the four VantageScore models can be used by any credit bureau.

To have a FICO Score, your credit report must show at least one credit account at least six months old and activity on at least one credit account during the last six months. To have a VantageScore, all you need is one credit account on your credit report, no matter how new the account is.

The two credit scoring models weigh the data in your credit report somewhat differently. For instance, payment history is more important to your FICO Score than to your VantageScore; credit usage and credit mix are more important to your VantageScore than to your FICO Score.

Read Also: How To Get Charge Offs Off Of Your Credit Report

Should I Even Bother With The Credit Karma Score

Since most major lenders utilize the FICO model, you need to be very cautious about relying solely on your Credit Karma score. As I have shown, in some instances, this score can be really different from your FICO score like when you only have a couple of months of credit history or when you have closed a lot of credit card accounts.

Sometimes a lender might have a hard cut off for approvals or for certain interest rates. For example, if your score is below 700 your interest rate could go up another 1% or 2%. Or if your score is below 650 you might not be able to get approved for a certain loan or card.

In those cases, when you were dealing with hard cutoffs, it becomes very important that you get a truly accurate and up-to-date score. This is especially true if you are dealing with a large sum of money like in the case of a mortgage.

In those situations you would want to stray away from Credit Karma and do what you can to obtain an official FICO score. It will also benefit you to try to figure out exactly which credit score model your lender uses, since there are many different versions of FICO score.

And some point you might actually run into a lender that uses the Vantage score model . If they are pulling from Equifax for TransUnion then Credit Karma could be very useful for that lender.

Is Credit Karma Score Accurate Online Video Tutorial

For our Beautiful reader, we offer a useful video clip to give you a simple tutorial how to write down a very good is credit karma score accurate. The sample down below may a basically guideline if you are free of charge to alter it depending on your troubles. So, delight in viewing!

Very well, it is focused on is credit karma score accurate. We hope it might be practical for just about any business enterprise functions youve. Thanks for reading and see you shortly!

Recommended Reading: Which Business Credit Cards Do Not Report Personal Credit

Which Is Better: Fico Or Vantagescore

Both VantageScore and FICO are software ratings that evaluate the creditworthiness of a person based on their expense and payment history. Fair, The FICO model is the oldest and best recognized, created by Isaac Corp. in 1989. In 2006, the three leading consumer credit reporting companies Experian, Equifax, and TransUnion, began VantageScore.

How Accurate Is Credit Karma When Checking Your Scores

NASHVILLE, TN – Millions of people use Credit Karma to check their credit scores, but just how accurate are those scores?

A lot of people are getting a big surprise when they apply for a loan right now. Consumer reporter Lindsay Bramson found out why and where you can go for the most accurate credit scores.

Bramson put in her score, and voila! Her scores popped up from two of the three credit bureaus. The same scores lenders use right? Most likely not.

Instead of FICO, Credit Karma relies on another scoring agency called Vantage Score. Were not saying free services like Credit Karma are bad. Were just saying the scores are estimates.

Most lenders pull your FICO and there are several scores for mortgages and cars and credit cards.;

You really dont need a third party, said Liz Coyle, executive director of Georgia Watch a consumer advocacy group based in Georgia.

If you want accuracy, experts say use these sources: Experian, Transunion and Equifax. Because of the pandemic, theyve been offering more access than ever before. And its free.

Right now you can get your free credit report from all three reporting credit bureaus weekly, and if you want, you could stagger and get your report three times in one week, said Coyle.

To get your free reports, ;

WSMV.com;is now with you on the go! Get the latest news updates and video, 4WARN weather forecast, weather radar, special investigative reports, sports headlines and much more from News4 Nashville.

You May Like: What Is The Highest Credit Score You Can Get

Can I Use Credit Karma On Mobile

Credit Karma has its own mobile app, which is available for both Android and Apple devices. The reviews speak for themselves: on the Google Play store, the Credit Karma app has an average rating of 4.7/5 out of over 900,000 reviews. Its also the fifth most popular finance app on Apple.

The app is entirely free and allows you to access most of the online features.

Vantagescore Or Fico: Does It Matter

VantageScore is not FICO, for Fair Isaac Corp. They are the two biggest competitors in the business of creating scoring models that are used to rate the creditworthiness of consumers. To complicate matters, both update their models occasionally, and lenders use different versions with slightly different results.

You don’t have a credit score. You have many credit scores, each calculated by a lender based on one of many models or versions of models. The important thing is, they should all be in the same range, such as “good” or “very good.”

Your score should be roughly the same on either model. One model may put slightly more weight on unpaid medical debt. One may take longer to record a loan application. But if your credit is “good” or “very good” according to one system, it should be the same in the other.

Recommended Reading: Does Applying For A Loan Hurt Your Credit Score

How Accurate Are Credit Karma Credit Scores

A lot of people rely on Credit Karma to monitor their credit score to make sure everything stays up to par. Its a very easy and free to use tool so it is very understandable that it is one of the most popular ways to keep track of your credit score. But exactly how accurate is Credit Karma?

In this article, I will talk about whether or not Credit Karma is accurate and some of its potential shortcomings as well as its strengths. Ill also show you how to find a more accurate credit score that can better predict your credit approval odds.

Uses Information From Only Two Credit Bureaus

Usually, there are three major credit agencies; TransUnion, Equifax, and Experian. All these bureaus play a significant role in credit scores and reports. Credit Karma uses details from only two agencies; Equifax and TransUnion.

While the omission of Experian details isnt a big limitation, the little information it contains can sometimes put you at a disadvantage.

Don’t Miss: What Credit Score Does Carmax Use

How Does Credit Karma Work

When you sign up for , you will be asked to provide a variety of personal information. Although it will only take a few minutes to sign up for a free account, it will help to have your personal information ready. For example, you will need to provide the last four digits of your Social Security number so make sure to have that handy.

Once Credit Karma has your information, they will find your credit reports on TransUnion and Equifax. With the information from your credit reports, the company will provide your credit score for free. You can check back for your credit score whenever youd like. However, the company typically sends out emails to alert you if there is a major change that you should be aware of.

Huge Difference Between Credit Karma And Experian Score

Perhaps a more enlightened person can shed light on this discrepency: My Credit Karma TU and Eq scores have been holding steady at 605, while my Fico8 on Exprian’s site holds at 683! This seems like a huge gap. I’m currently at 95% util 15,000 total limit , no bads, 2 inquiries, 18 year oldest reporting…

What gives? Any thoughts would be appreciated

Thanks

Read Also: How Much Does A Hard Inquiry Affect Credit Score

Whats How Accurate Is Credit Karma Credit Score

Fellas! Are you presently Doing the job like a secretary in a business or Corporation? Guaranteed, you are going to acquire in charge in all letters concerns. And Sure, a how accurate is credit karma credit score challenge is one of a point you should be master in. Even Youre not an personnel, a how accurate is credit karma credit score is significant for virtually any needs if you want to deliver a proposal to other organization, enterprise and even your Instructor. Being aware of how vital how accurate is credit karma credit score reasons are, we are interested to debate it nowadays. Please stay tuned and revel in reading through!A how accurate is credit karma credit score is a formal and Experienced document that is composed by individual, Business or corporation to its purchasers, stakeholder, enterprise, Business and plenty of additional. This letter functions to deliver any info, request, permission and several far more skillfully with The fundamental and customary templates among people everywhere in the earth. Both a personal correspondent and firm require to create the Establish high quality by way of your how accurate is credit karma credit score in sake of displaying your Experienced small business. Then how to really make it? In this article we go.

What Should Involve In How Accurate Is Credit Karma Score

Very well, it is the vital elements you ought to mention inside of your how accurate is credit karma score. And, right here the pieces are:

What is the Structure for any how accurate is credit karma score?

A how accurate is credit karma score is a proper letter that has the plain rule for people in all around the entire world. To ensure thats why, you must listen with its structure and font. But yet again, each Group could have diverse structure and magnificence for their Qualified interaction. And we are right here to share the typical sorts of The fundamental how accurate is credit karma score format. Below some information over it:

- Block Structure

The most typical how accurate is credit karma score Format is using a block format. Through this format, The complete physique letter is remaining justified with the single Area apart from working with 2nd Place involving paragraphs.

- Modified Block

- Semi-Block

It is the modified block fashion. Even, it is the most not often Employed in how accurate is credit karma score Format. Making use of this format, the entire overall body letter is concaved of remaining justified.

- Font

- Punctuation

Also Check: Is 524 A Good Credit Score