How To Get Excellent Credit: 5 Expert Tips

1. Always pay on time. Always.

Payment history heavily influences your credit score. In fact, it is the most influential factor for FICO and VantageScore.1 To stay on top of your payments, set up a calendar reminder or enroll in automatic payments. The on-time payment goal applies to all your bills, including utilities, rent and cell phone service.

What if you were late on a payment a few years ago? While late or missed payments can stay on your credit report for seven years, the impact on your credit score decreases over time.; Most negative items have little impact on your score after two years2 so be patient, keep making timely payments, and youll soon be on your way to an excellent credit score.

2. Optimize your credit utilization ratio.

is another key piece of your credit score puzzle. Credit utilization measures the balances you owe on your credit cards relative to your cards credit limits. Its calculated on an overall basis .

The general rule of thumb with credit utilization is to stay below 30%.3 This applies to each individual card and your total credit utilization ratio. Strategies for improving your credit utilization ratio focus on reducing the numerator and managing the denominator .

Try one of these techniques to improve your credit utilization ratio:

3. Regularly monitor your credit scores for inaccuracies.

4. Be strategic about taking on new debt and closing accounts.

5. Consider your credit mix.

Apply For A Credit Builder Loan

Remember that credit mix is important to your credit score. That means you cant just have one type of creditsuch as a credit cardfor maximum impact. You may also want an installment loan on your account.

A credit builder loan is one way to get an installment account on your credit history. These work like a traditional loan in reverse: if youre approved, your funds get placed in a secured certificate of deposit and are given to you after youve paid off the loan.

As you pay the loan as agreed, youll enjoy the benefit of positive payment history building on your credit report. Once you pay off the loan, the savings account is unlocked and you gain access to the money.

What Is Business Credit

A business credit score works very similarly to a personal credit score. The score itself is a rating that lenders use to understand how likely you are to pay back a loan or money spent on a credit card. Businesses are rated from 0 to 100, 100 being the best score possible, 0 representing a very high risk of default on a loan. Your credit score is calculated by Credit Reference Agencies through the form of credit reports.

The main credit reference agencies in US and Canada are Equifax, TransUnion, and illion .

If youre a sole trader, lenders will use your personal credit score to determine your creditworthiness, but if you set up a limited company you can build your business credit rating independently .;

Don’t Miss: What Does Charge Off Mean On Credit Report

Dont Apply For Lots Of New Credit Cards

When you apply for a new credit card or loan, the issuing bank will check your credit, which is considered a hard inquiry. Hard inquiries will cause your credit score to dip temporarily. Itll bounce back as time passes and more positive behavior is reported. However, if you are already starting from scratch, even a slight dip of five to 10 points can be significant. Plus, credit bureaus keep tabs on how many times you apply for new lines of credit. Too many hard inquiries on your credit report can be a sign that you are desperately seeking credit and pose a risk to lenders.;

Ask The Experts: The Building Blocks Of Building Credit

In search of more insights into the credit-building process, we posed the following questions to a panel of personal finance experts. Check out their bios and responses below.

- What do you think is the biggest misconception that people have about building credit?

- What is the most common mistake that people make when trying to build credit?

- Do you think its easier or harder to build credit now than it was 10 years ago?

- What is the best tip you have for someone trying to build credit from scratch?

Also Check: How To Raise My Credit Score 100 Points

Why Building Credit Takes Time

One of the most important pieces of advice someone can give to someone whos learning how to establish credit is to not obsess over their credit score.

The worst thing you can do is focus so much on your credit score that you end up making decisions that are bad for your finances.

In fact, an important principle of building credit is to focus on things that are good for your credit and your money, such as:

- Using revolving credit but never letting it turn into debt.

- Paying on time.

- Not taking on any new loans unless you need them.

If the decisions youre making are good for your finances, theres a good chance theyll be good for your credit.

Dont forget: it takes time to learn how to start building credit and maintain the good habits youve learned. Stay focused, stay responsible and let time do its thing. Soon enough, youll have a good credit score and the tools to help you keep it that way.

Ways To Build Credit When You Have No Credit History

Its enough to drive someone applying for a car loan right over the edge of the steepest cliff of frustration. You dont have a credit history for the lender to evaluate, so you cant get a loan. But how are you supposed to start building payment and other credit history if no one will extend a loan or credit card to you in the first place?

Fortunately, youre not the first person with this credit quandary. Why is that good? Because banks, credit unions, and credit card companies still want your business, so theyve created products specifically designed for people with no or little credit history.

Click or swipe to find out how you can begin building a solid credit history even with no prior credit.

Click here to sign up for our free financial education email course.

Johan Swanepoel / shutterstock.com

Also Check: How To Get A Debt Collection Removed From Credit Report

Always Make Your Payments On Time

The biggest factor affecting your credit score is whether you make your payments on time. Just one missed payment can have a significant impact on your credit score. Even worse, the mark will stay on your credit report for seven years, although the negative effect will fade over time.;

The good news is that you can completely avoid missed payments by committing to make those payments on time, every time. One trick is to set up autopay on your credit card account for at least the minimum payment due each month.;;

Lower Your Credit Utilization Ratio By Asking For A Credit Increase

Another major factor contributing to your overall score is your credit utilization ratio, which is the amount of credit youre using relative to the total amount of credit you have available. Below 30 percent is often recommended by industry experts, although those with the best credit scores often keep their total credit utilization under 10 percent. ;

Looked at another way, if you have $20,000 in credit available on all of your credit cards combined and youve amassed $15,000 in charges, your credit utilization ratio is far too high, and that will negatively impact your score. But if youve charged just $2,000 of that $20,000, youre only using 10 percent, which is far better.

A quick hack for improving your utilization ratio is to simply ask one or more of your credit card companies for a credit limit increase, which will nudge up the overall amount of credit you have available.

But do not go out and immediately use that increased credit, as you will be right back where you started.

Increasing your available credit but not using it lowers your credit utilization, which can improve your credit score, says Wright, of Real Life Investor Couple.

Don’t Miss: Keyword

Open A Business Checking Account

Many young business owners feel they can get by using bank alternatives like PayPal and Venmo. Or worse, some business owners, like Sally, commingle all their business funds in their personal bank accounts. The problem is that these transactions dont go toward establishing your business credit with reporting agencies to build your credit.

To rectify this problem, sign up for an official bank account using the name of your business. You can still use services like PayPal and Venmo, but connect them to your business bank account so youll have an official record that credit bureaus can track.

Ways To Establish Credit With No Credit History

Its hard to imagine any consumer being invisible in the digital world of the 21st century, but there are 26 million credit invisibles in America, according to the Consumer Financial Protection Bureau .

Consumers with no credit history never used a credit card, havent had a car loan, never paid a mortgage are tagged as credit invisible by the three major reporting bureaus, Experian, Equifax and TransUnion.

If you have occasionally used some form of credit probably a credit card, but possibly paid off a loan of some sort years ago you are considered credit unscorable because there is not enough information to generate a credit score. The CFPB says 19 million consumers are in the unscorable category.

You dont want to be in either of those brackets, but to escape, youre going to need a credit history. The credit bureaus want to see how you use credit and whether you pay it back if you use a credit card or take out a loan.

Recommended Reading: Is 524 A Good Credit Score

Become An Authorized User On Someone Elses Card

While you might not be approved for a regular credit card, you could become an authorized user on someone elses account, like your parents or spouses account.;

If you go this route, the account needs to be in good standing, with a low balance and a history of on-time payments. If not, being an authorized user wont help you build a good credit score.;

Becoming an authorized user is a way to jump-start credit score growth and is not a long-term fix. Real credit score growth will come from building your credit history, not piggybacking on someone elses. Think of this option as a stepping-stone to get you to your next credit tool, whether thats your credit card or a small personal loan.;

Keep Your Accounts Open Unless Theyre Costing You

The length of your credit history also factors into your credit score, which is why it can be so challenging when youre learning how to start building credit for the first time. Once you have some accounts open, avoid closing them unless you have a good reason to do so.

Its fine to close an account if its charging you a big annual fee or if its a loan you want to pay off as fast as possible. But if the account isnt costing you, closing it could shorten your credit history and ding your score.

Don’t Miss: Will A Sim Only Contract Improve Credit Rating

How To Build Credit Fast

Building your credit in a short period of time can be challenging, but there are a couple actions you can take that can help speed up the process.

- Improve your credit utilization. Your credit utilization is one of the few aspects of your credit report that you can change quickly. is calculated by dividing the total of your credit card balances by the total of all your credit card limits. You can improve your utilization most quickly by paying down your credit card balances. Increasing your overall credit limit can also help if your lender agrees to it.

- Try using Experian Boost. As mentioned above, Experian Boost is a tool that gives you credit for past on-time payments. With your permission, it connects to the bank account you pay bills with and looks for qualifying on-time payments. Once found, a record of these on-time payments is added to your Experian credit report and could instantly raise your FICO® Score. The average Experian FICO® Score increase among Boost users who see a lift is 13 points.

Keep Your Balances Low Or Better Yet Nonexistent

The second-biggest factor affecting your credit score is how much debt you have, especially relative to your available credit. This figure is known as the , and its simply a measure of your combined credit card balances compared to your total credit available.;

For example, lets say you have two credit cards, each with a $5,000 limit. If you have a balance of $1,500 on one and $3,500 on the other, your credit utilization ratio is 50% because your combined balance is $5,000, and your combined limit is $10,000.;

Most credit experts advise keeping your credit utilization ratio below 30%. The lower, the betterand best of all, is if you can pay off your balances entirely, and not owe any credit card debt.;

You can do this by only charging what you can pay off every month. You can also make multiple, smaller payments each month to keep your spending under control and avoid any surprise, monster bills at the end of the month. Doing so will give a boost to your credit score, and you wont owe any interest if you pay your balance in full each month.

Instead of making a single monthly credit card payment, consider making two or several smaller payments. First, you will reduce the balance that the bank reports to the credit bureau, slightly improving your utilization ratio. Second, as finance charges are often calculated based on the average daily balance, you can shrink the interest you pay by reducing daily balances earlier in the billing period.;

You May Like: Which Credit Score Matters The Most

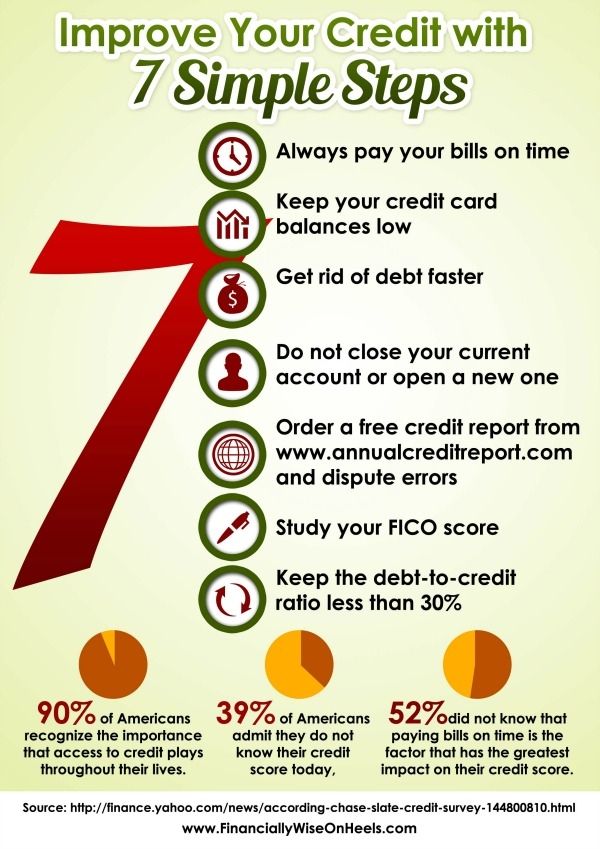

Tips To Increase Your Credit Score

If you are like many consumers and dont know your credit score, there are several free places you can find it. The Discover Card is one of several credit card sources that offer free credit scores. Discover provides your FICO score, the one used by 90% of businesses that do lending. Most other credit cards like Capital One and Chase give you a Vantage Score, which is similar, but not identical. Same goes for online sites like Credit Karma, Credit Sesame and Quizzle.

The Vantage Score comes from the same place that FICO gets its information the three major credit reporting bureaus, Experian, TransUnion and Equifax but it weighs elements differently and there could be a slight difference in the two scores.

Once you get your score, as Homonoff suggested, you might be surprised if its not as high as you expected. These are ways to improve the score.

Why You Should Build Your Credit

When you apply for financial products like credit cards and loans, those lenders will often review your credit reports and credit scores to help with their decision. Your credit history can help them determine how risky it is to lend to you.

If you have low credit or no credit at all you may receive less-generous borrowing terms, such as a lower credit limit or a higher interest rate. If you dont pay off your balance on time and in full every month, then a higher interest rate can end up costing you a lot more money over time on any money you borrow.

You could also have your credit application denied, which might force you to seek out other lenders with worse terms and interest rates.

You May Like: What Credit Score Do You Need For A Conventional Loan

Become An Authorized User

A family member or significant other may be willing to add you as an;;on his or her card.;Doing so adds that card’s payment history to your credit files, so you’ll want a primary user who has a long history of paying on time.;In addition, being added as an authorized user can reduce the amount of time it takes to generate a FICO score.

You;don’t have to use or even possess the credit card at all in order to benefit from being an authorized user.

Ask the primary cardholder to find out whether;the card issuer reports;authorized user activity to the credit bureaus. That activity generally;is reported, but youll want to make sure ;otherwise, your credit-building efforts may be wasted.

You should come to an agreement on;whether and how youll use the card before youre added as an authorized user, and be prepared to pay your share;if that’s the deal you strike.

How Does Portify Build My Credit Score

Instead of credit checks, Portify uses open banking to evaluate users financial situations.

The award-winning credit building app observes recurring expenses and sends smart alerts to encourage on-time payments.

Portify has partnered with all the big UK credit reference agencies to report on-time payments. Since positive repayment history makes up 35 per cent of your , this can help improve it.

If youre unlikely to have enough to pay upcoming bills, they open a credit line that can credit your bank account with enough balance to settle your recurring expenses on time.

Another way they help build your is by structuring your membership as a loan agreement. In other words, Portify can report your membership fee payments as credit repayments to Experian. All you need to do is to make timely membership fee payments.

Recommended Reading: Does Capital One Report Credit Limit